Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION NO. 2 (20 MARKS) a. Star Animators, Inc. currently makes all sales on credit and offers no cash discount. The firm is considering a

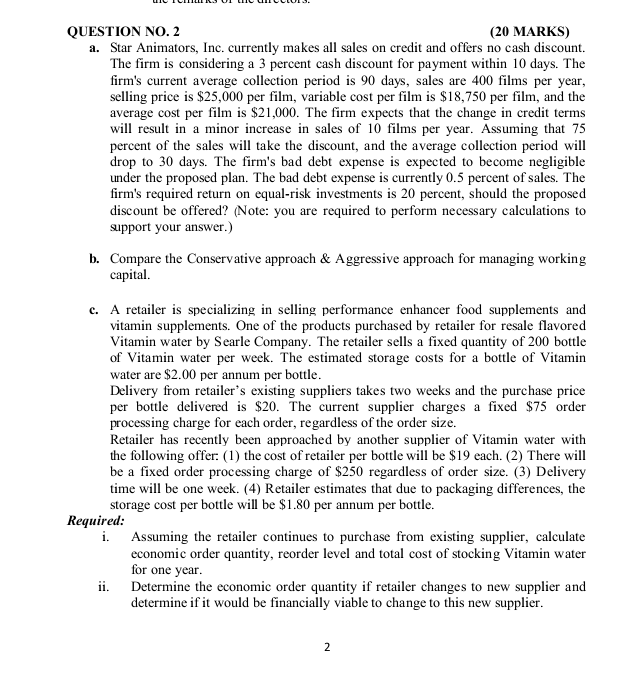

QUESTION NO. 2 (20 MARKS) a. Star Animators, Inc. currently makes all sales on credit and offers no cash discount. The firm is considering a 3 percent cash discount for payment within 10 days. The firm's current average collection period is 90 days, sales are 400 films per year, selling price is $25,000 per film, variable cost per film is $18,750 per film, and the average cost per film is $21,000. The firm expects that the change in credit terms will result in a minor increase in sales of 10 films per year. Assuming that 75 percent of the sales will take the discount, and the average collection period will drop to 30 days. The firm's bad debt expense is expected to become negligible under the proposed plan. The bad debt expense is currently 0.5 percent of sales. The firm's required return on equal-risk investments is 20 percent, should the proposed discount be offered? (Note: you are required to perform necessary calculations to support your answer.) b. Compare the Conservative approach & Aggressive approach for managing working capital. c. A retailer is specializing in selling performance enhancer food supplements and vitamin supplements. One of the products purchased by retailer for resale flavored Vitamin water by Searle Company. The retailer sells a fixed quantity of 200 bottle of Vitamin water per week. The estimated storage costs for a bottle of Vitamin water are $2.00 per annum per bottle. Delivery from retailer's existing suppliers takes two weeks and the purchase price per bottle delivered is $20. The current supplier charges a fixed $75 order processing charge for each order, regardless of the order size. Retailer has recently been approached by another supplier of Vitamin water with the following offer: (1) the cost of retailer per bottle will be $19 each. (2) There will be a fixed order processing charge of $250 regardless of order size. (3) Delivery time will be one week. (4) Retailer estimates that due to packaging differences, the storage cost per bottle will be $1.80 per annum per bottle. Required: i. Assuming the retailer continues to purchase from existing supplier, calculate economic order quantity, reorder level and total cost of stocking Vitamin water for one year. ii. Determine the economic order quantity if retailer changes to new supplier and determine if it would be financially viable to change to this new supplier. 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started