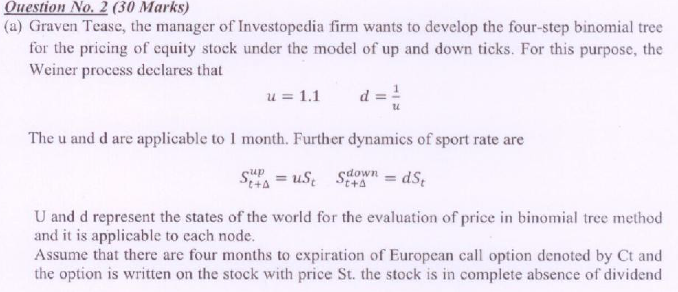

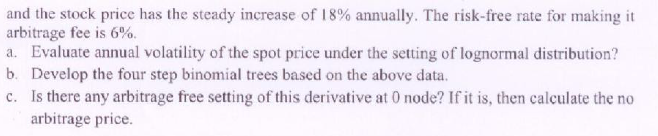

Question No. 2 (30 Marks) (a) Graven Tease, the manager of Investopedia firm wants to develop the four-step binomial tree for the pricing of equity stock under the model of up and down ticks. For this purpose, the Weiner process declares that u = 1.1 d The u and d are applicable to 1 month. Further dynamics of sport rate are St=ust St=dSt t+A U and d represent the states of the world for the evaluation of price in binomial tree method and it is applicable to each node. Assume that there are four months to expiration of European call option denoted by Ct and the option is written on the stock with price St. the stock is in complete absence of dividend and the stock price has the steady increase of 18% annually. The risk-free rate for making it arbitrage fee is 6%. a. Evaluate annual volatility of the spot price under the setting of lognormal distribution? b. Develop the four step binomial trees based on the above data. c. Is there any arbitrage free setting of this derivative at 0 node? If it is, then calculate the no arbitrage price. Question No. 2 (30 Marks) (a) Graven Tease, the manager of Investopedia firm wants to develop the four-step binomial tree for the pricing of equity stock under the model of up and down ticks. For this purpose, the Weiner process declares that u = 1.1 d The u and d are applicable to 1 month. Further dynamics of sport rate are St=ust St=dSt t+A U and d represent the states of the world for the evaluation of price in binomial tree method and it is applicable to each node. Assume that there are four months to expiration of European call option denoted by Ct and the option is written on the stock with price St. the stock is in complete absence of dividend and the stock price has the steady increase of 18% annually. The risk-free rate for making it arbitrage fee is 6%. a. Evaluate annual volatility of the spot price under the setting of lognormal distribution? b. Develop the four step binomial trees based on the above data. c. Is there any arbitrage free setting of this derivative at 0 node? If it is, then calculate the no arbitrage price