Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question No 2: (a) The production department of Priston Company has submitted the following forecast of units to be produced by quarter for the upcoming

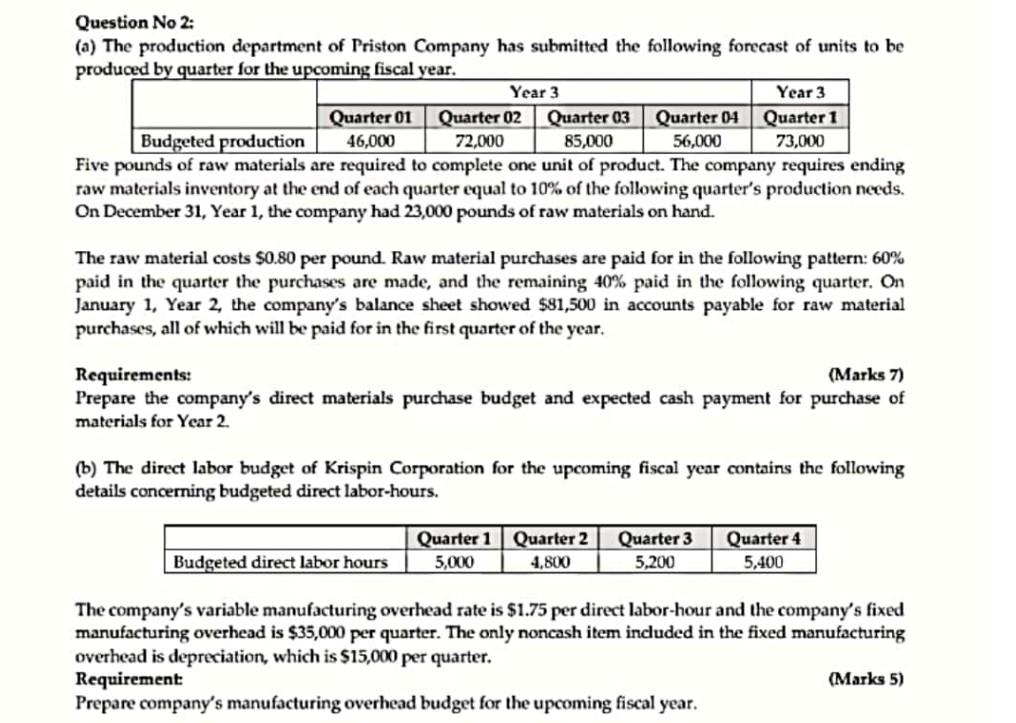

Question No 2: (a) The production department of Priston Company has submitted the following forecast of units to be produced by quarter for the upcoming fiscal year. Year 3 Year 3 Quarter 01 Quarter 02 Quarter 03 Quarter 04 Quarter 1 Budgeted production 46,000 72,000 85,000 56,000 73,000 Five pounds of raw materials are required to complete one unit of product. The company requires ending raw materials inventory at the end of each quarter equal to 10% of the following quarter's production needs. On December 31, Year 1, the company had 23,000 pounds of raw materials on hand. The raw material costs $0.80 per pound. Raw material purchases are paid for in the following pattern: 60% paid in the quarter the purchases are made, and the remaining 40% paid in the following quarter. On January 1, Year 2, the company's balance sheet showed $81,500 in accounts payable for raw material purchases, all of which will be paid for in the first quarter of the year. Requirements: (Marks 7) Prepare the company's direct materials purchase budget and expected cash payment for purchase of materials for Year 2. (b) The direct labor budget of Krispin Corporation for the upcoming fiscal year contains the following details concerning budgeted direct labor-hours. Quarter 1 5,000 Quarter 2 4,800 Quarter 3 5,200 Quarter 4 5,400 Budgeted direct labor hours The company's variable manufacturing overhead rate is $1.75 per direct labor-hour and the company's fixed manufacturing overhead is $35,000 per quarter. The only noncash item included in the fixed manufacturing overhead is depreciation, which is $15,000 per quarter. Requirement (Marks 5) Prepare company's manufacturing overhead budget for the upcoming fiscal year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started