question number is 6-35.

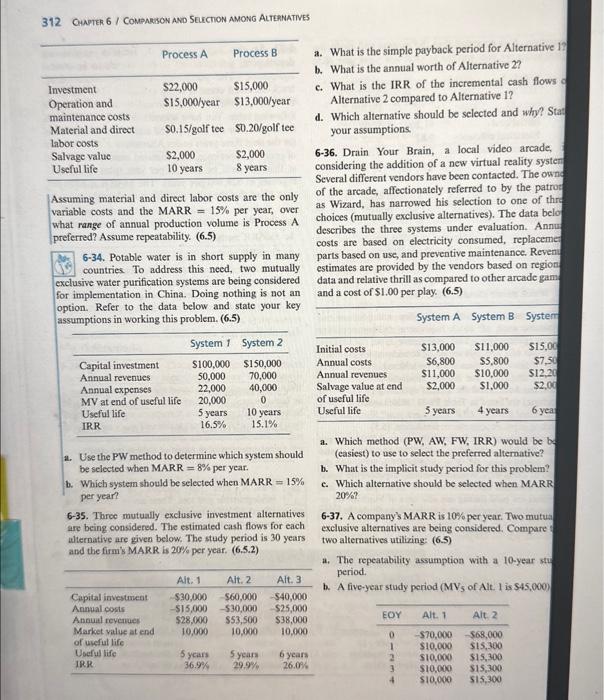

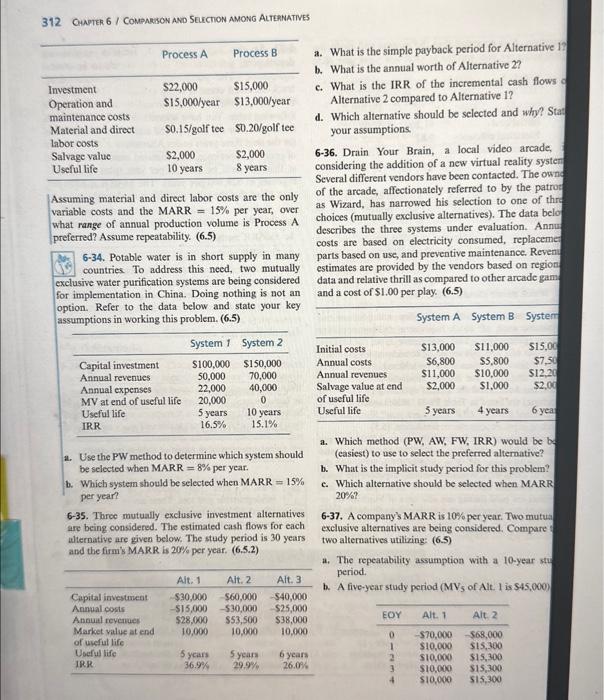

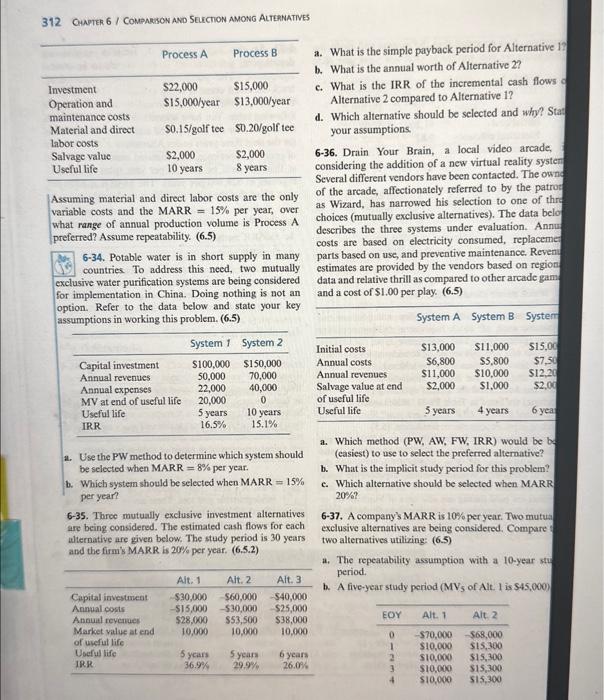

312 ONPTER 6 / COMEARBON AND SELCTION AMONG ALTEANATIVES a. What is the simple payback period for Alternative 13 b. What is the annual worth of Alternative 2 ? c. What is the IRR of the incremental cash flows Alternative 2 compared to Alternative 1 ? d. Which alternative should be selected and why? Stat your assumptions. 6-36. Drain Your Brain, a local video arcade, considering the addition of a new virtual reality systen Several different vendors have been contacted. The owne Assuming material and direct labor costs are the only of the arcade, affectionately referred to by the patros variable costs and the MARR =15% per year, over as Wizard, has narrowed his selection to one of thre what range of annual production volume is Process A choices (mutually exclusive alternatives). The data belo preferred? Assume repeatability. (6.5) describes the three systems under evaluation. Annus 6-34. Potable water is in short supply in many costs are based on electricity consumed, replaceme: countries To address this need, two mutually parts based on use, and preventive maintenance. Reveni Q. countries Io address this need, two mutually estimates are provided by the vendors based on region exclusive water purification systems are being considered data and relative thrill as compared to other arcade gam assumptions in working this problem. (6.5) a. Which method (PW, AW, FW, IRR) would be be a. Use the PW method to determine which system should (easiest) to use to select the preferred alternative? be selected when MARR =8% per year. b. What is the implicit study period for this problem? b. Which system should be selected when MARR=15% c. Which alternative should be selected when MARR per year? 6-35. Three mutually exclusive investment alternatives 6-37. A company's MARR is 10\% per year. Two mutua are being considered. The estimated cash flows for each exclusive alternatives are being considered. Compare : uliernative are given below. The study period is 30 years two alternatives utilizing: (6.5) and the firm's MARR is 20% per year. (6.5.2) a. The repeatability assumption with a 10-year stu period. b. A five-year study period ( MV5 of Ait. 1 is $45,000) 312 ONPTER 6 / COMEARBON AND SELCTION AMONG ALTEANATIVES a. What is the simple payback period for Alternative 13 b. What is the annual worth of Alternative 2 ? c. What is the IRR of the incremental cash flows Alternative 2 compared to Alternative 1 ? d. Which alternative should be selected and why? Stat your assumptions. 6-36. Drain Your Brain, a local video arcade, considering the addition of a new virtual reality systen Several different vendors have been contacted. The owne Assuming material and direct labor costs are the only of the arcade, affectionately referred to by the patros variable costs and the MARR =15% per year, over as Wizard, has narrowed his selection to one of thre what range of annual production volume is Process A choices (mutually exclusive alternatives). The data belo preferred? Assume repeatability. (6.5) describes the three systems under evaluation. Annus 6-34. Potable water is in short supply in many costs are based on electricity consumed, replaceme: countries To address this need, two mutually parts based on use, and preventive maintenance. Reveni Q. countries Io address this need, two mutually estimates are provided by the vendors based on region exclusive water purification systems are being considered data and relative thrill as compared to other arcade gam assumptions in working this problem. (6.5) a. Which method (PW, AW, FW, IRR) would be be a. Use the PW method to determine which system should (easiest) to use to select the preferred alternative? be selected when MARR =8% per year. b. What is the implicit study period for this problem? b. Which system should be selected when MARR=15% c. Which alternative should be selected when MARR per year? 6-35. Three mutually exclusive investment alternatives 6-37. A company's MARR is 10\% per year. Two mutua are being considered. The estimated cash flows for each exclusive alternatives are being considered. Compare : uliernative are given below. The study period is 30 years two alternatives utilizing: (6.5) and the firm's MARR is 20% per year. (6.5.2) a. The repeatability assumption with a 10-year stu period. b. A five-year study period ( MV5 of Ait. 1 is $45,000)