Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION NUMBER ONE (Answer 1 a up to 1e) Dr. and Mrs. Nzala have arrived in Zambia from their studies in Europe and are wondering

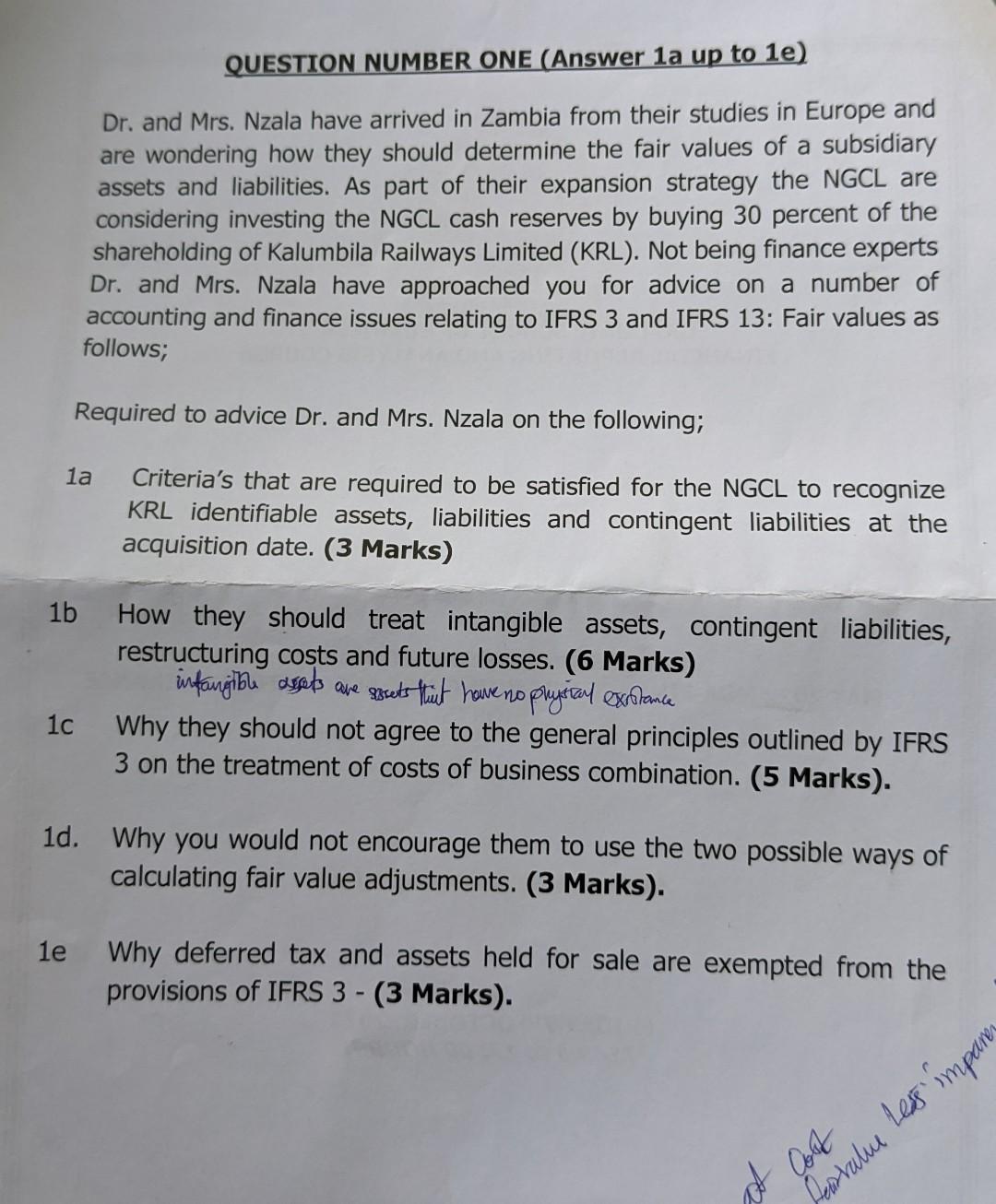

QUESTION NUMBER ONE (Answer 1 a up to 1e) Dr. and Mrs. Nzala have arrived in Zambia from their studies in Europe and are wondering how they should determine the fair values of a subsidiary assets and liabilities. As part of their expansion strategy the NGCL are considering investing the NGCL cash reserves by buying 30 percent of the shareholding of Kalumbila Railways Limited (KRL). Not being finance experts Dr. and Mrs. Nzala have approached you for advice on a number of accounting and finance issues relating to IFRS 3 and IFRS 13: Fair values as follows; Required to advice Dr. and Mrs. Nzala on the following; 1a Criteria's that are required to be satisfied for the NGCL to recognize KRL identifiable assets, liabilities and contingent liabilities at the acquisition date. (3 Marks) 1b How they should treat intangible assets, contingent liabilities, restructuring costs and future losses. (6 Marks) intangible assobs ave assets thut have no plysical exrotance 1c Why they should not agree to the general principles outlined by IFRS 3 on the treatment of costs of business combination. (5 Marks). 1d. Why you would not encourage them to use the two possible ways of calculating fair value adjustments. (3 Marks). 1e Why deferred tax and assets held for sale are exempted from the provisions of IFRS 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started