Question on image

Question on image

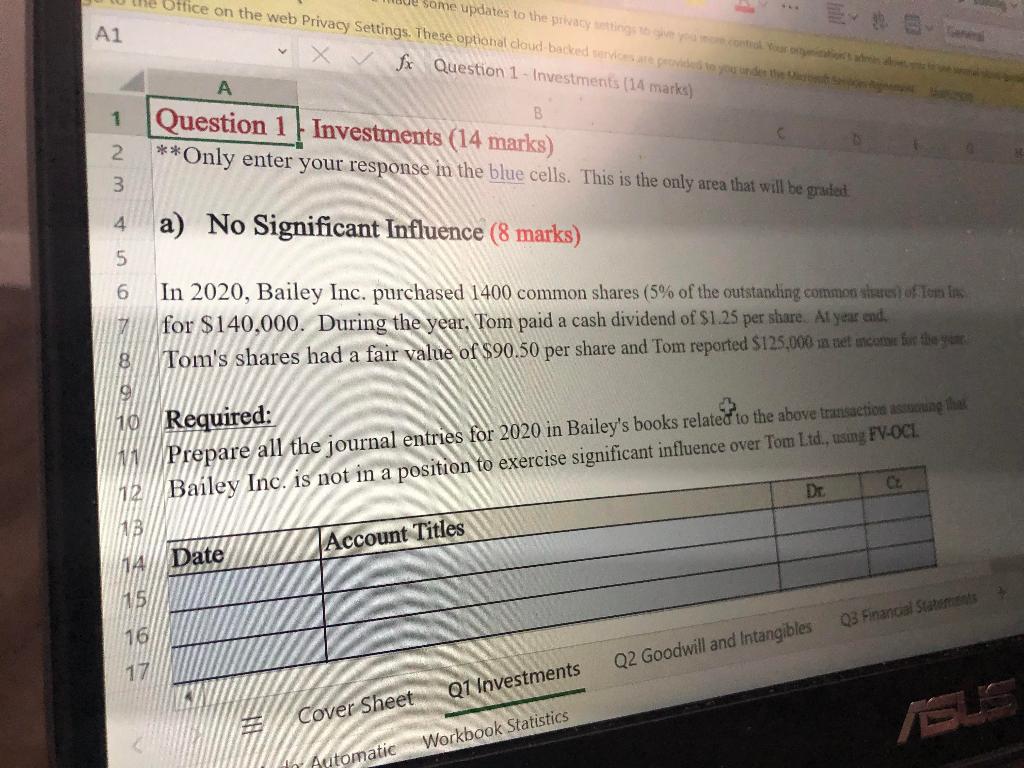

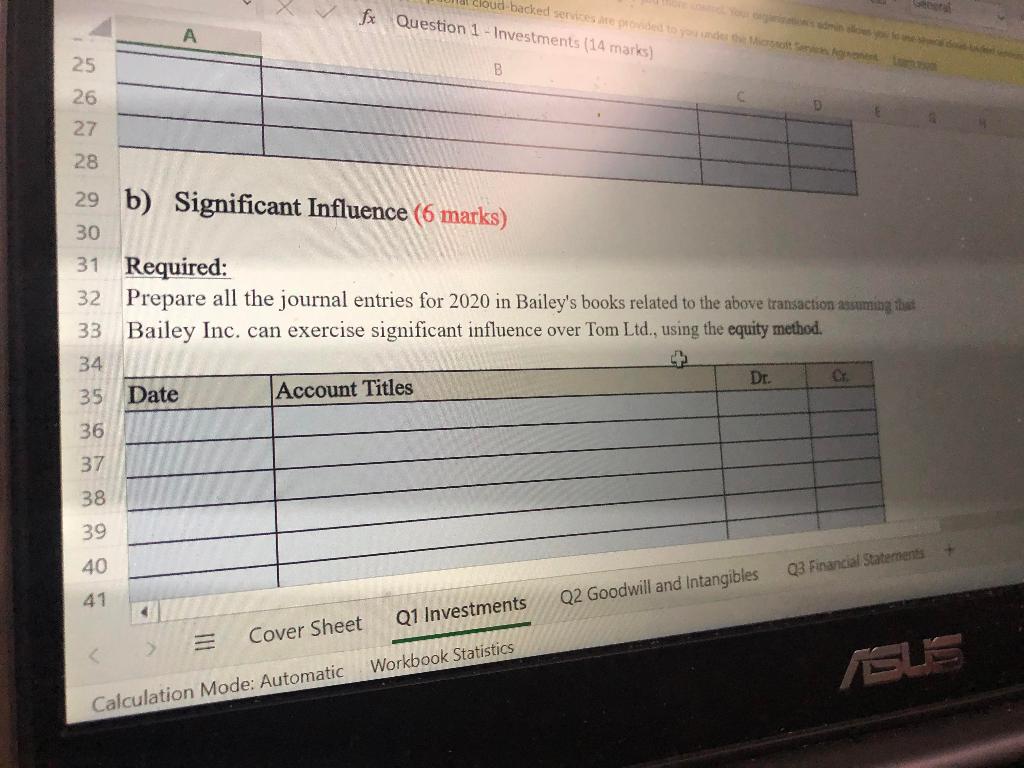

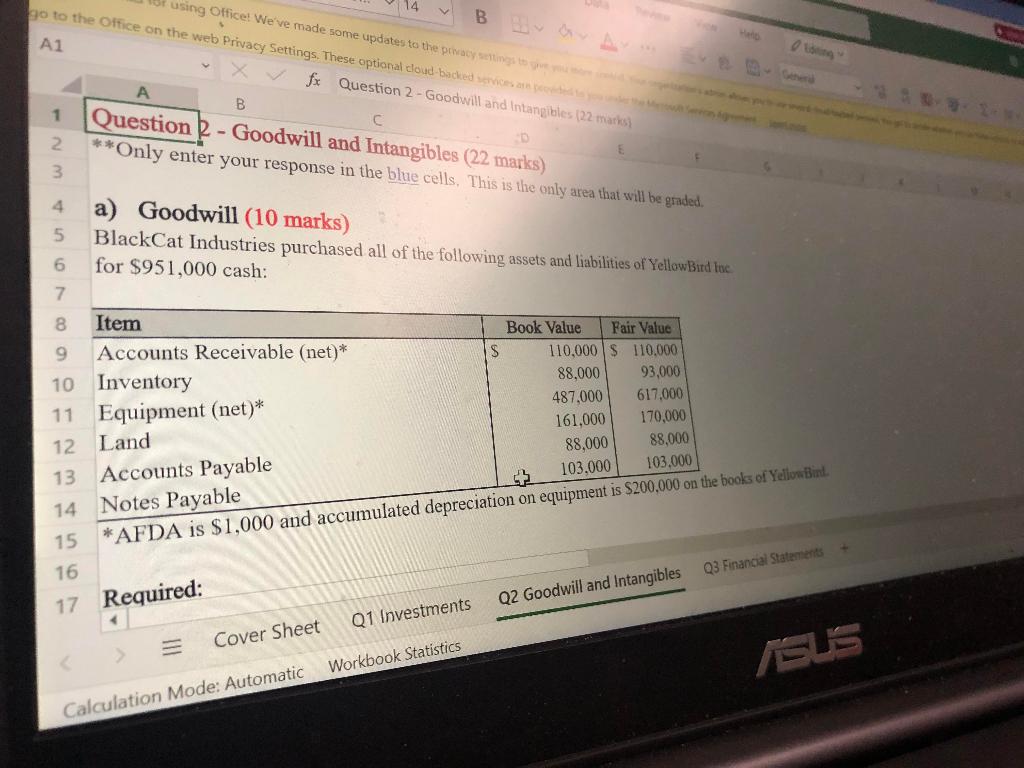

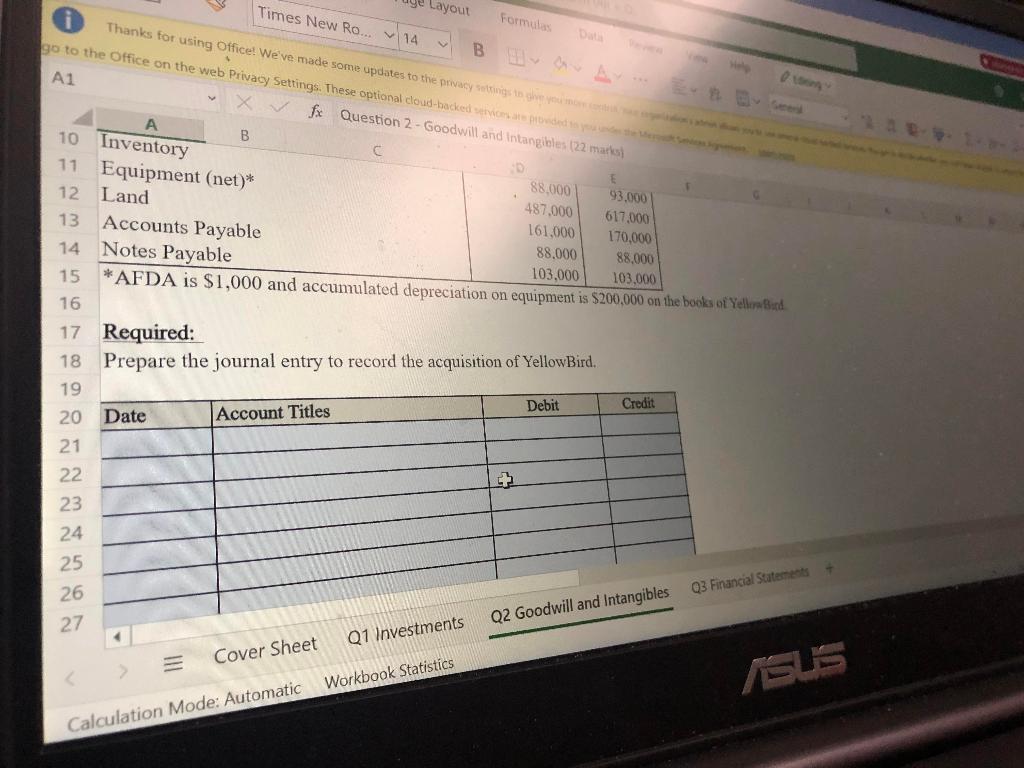

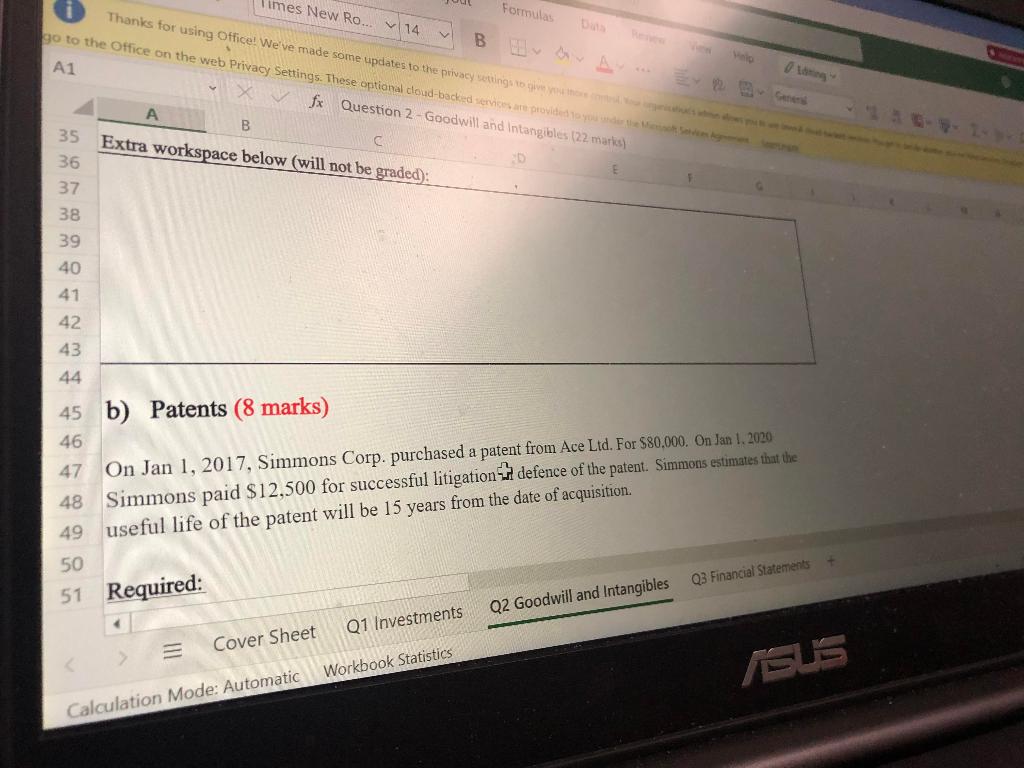

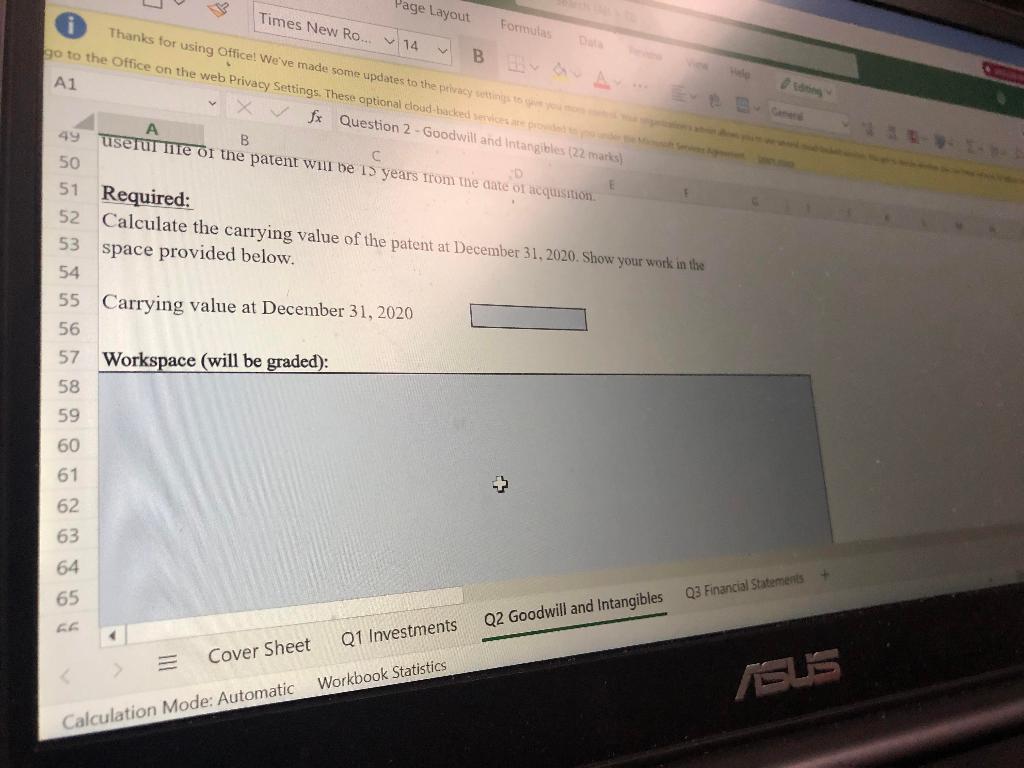

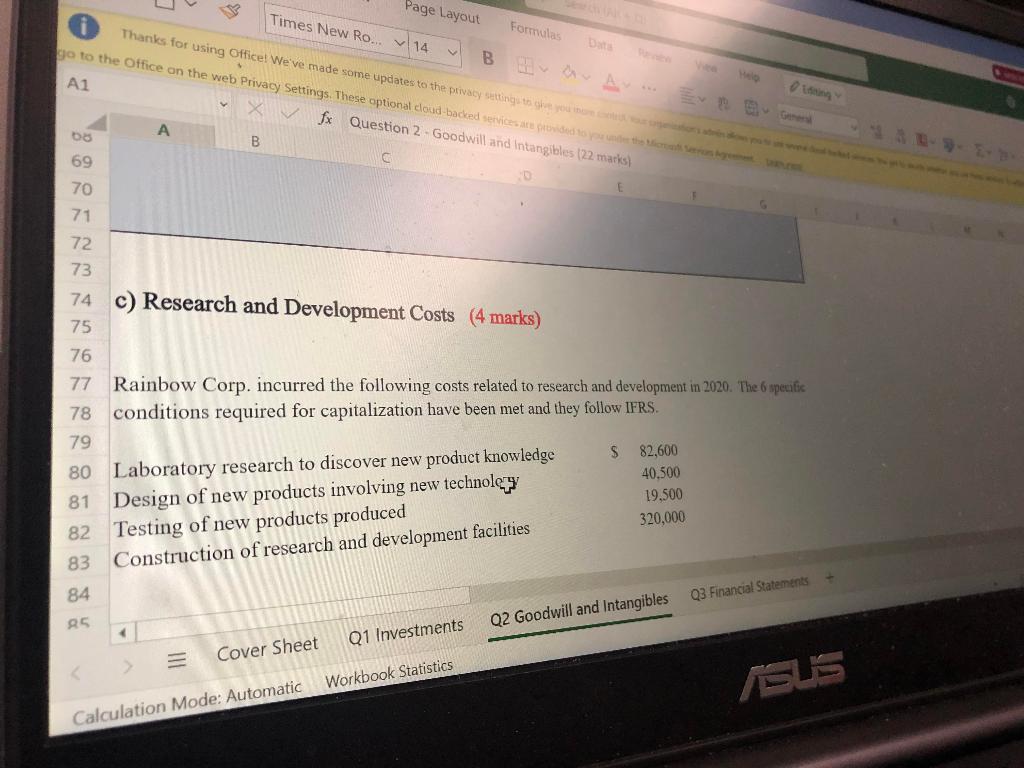

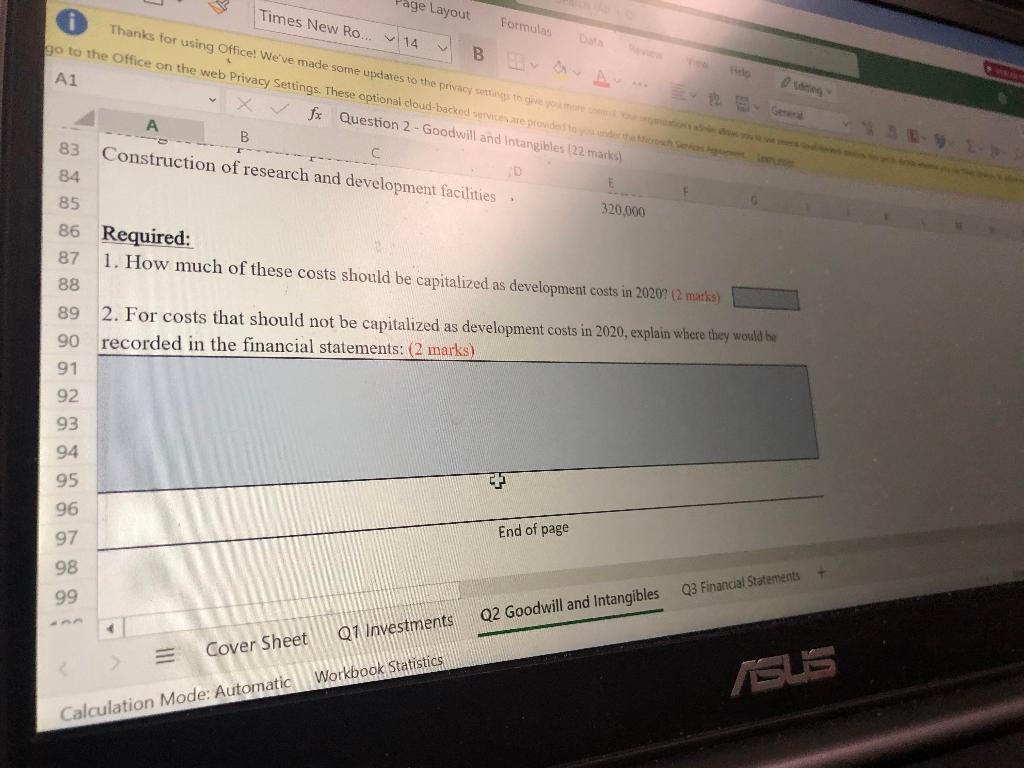

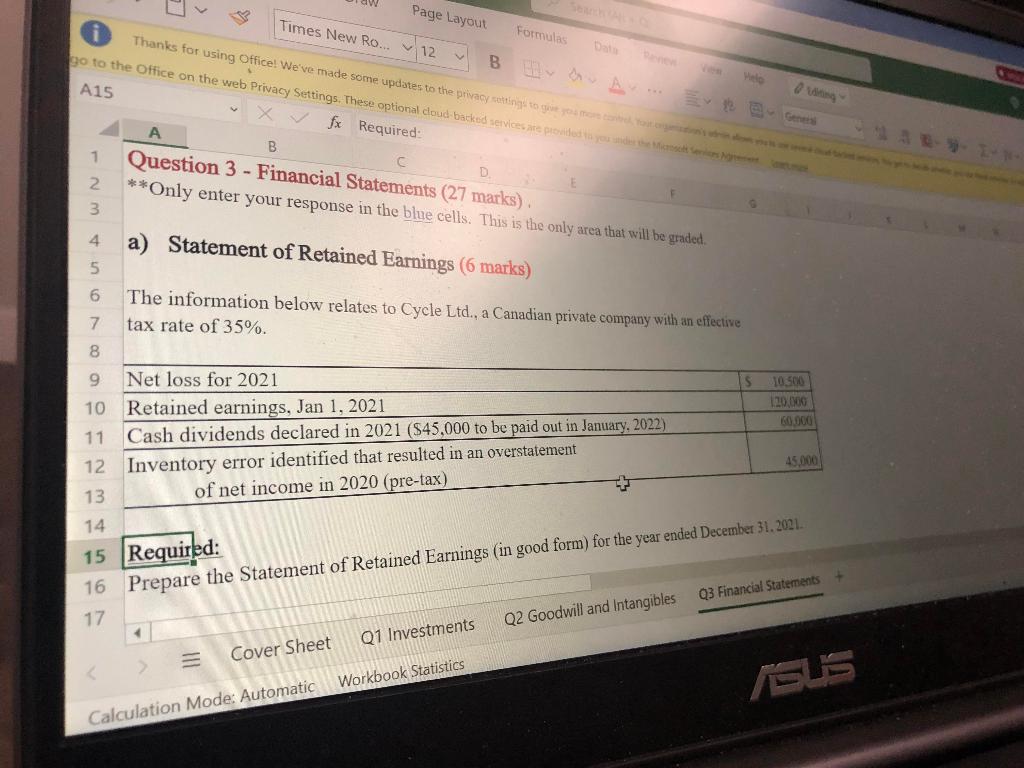

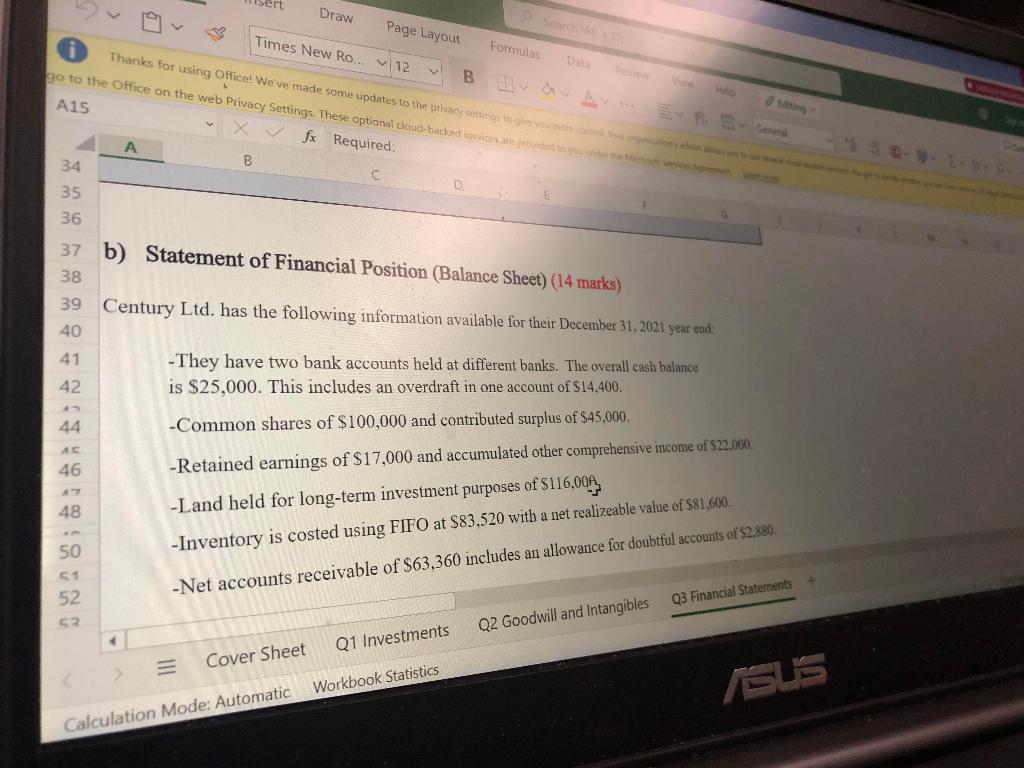

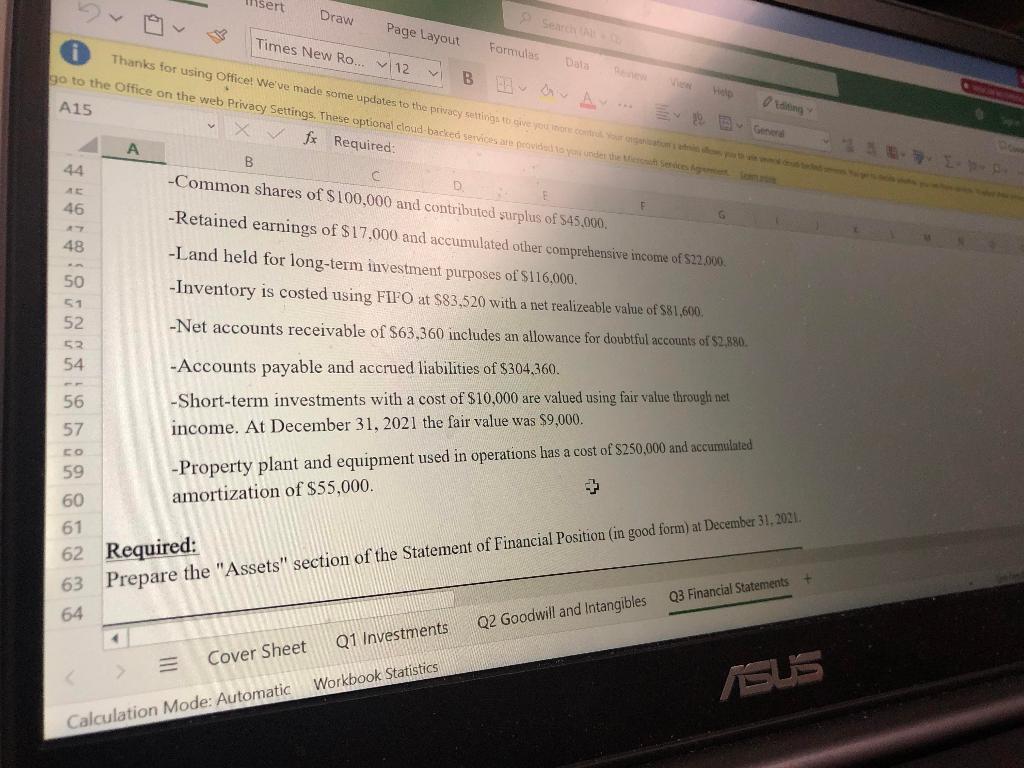

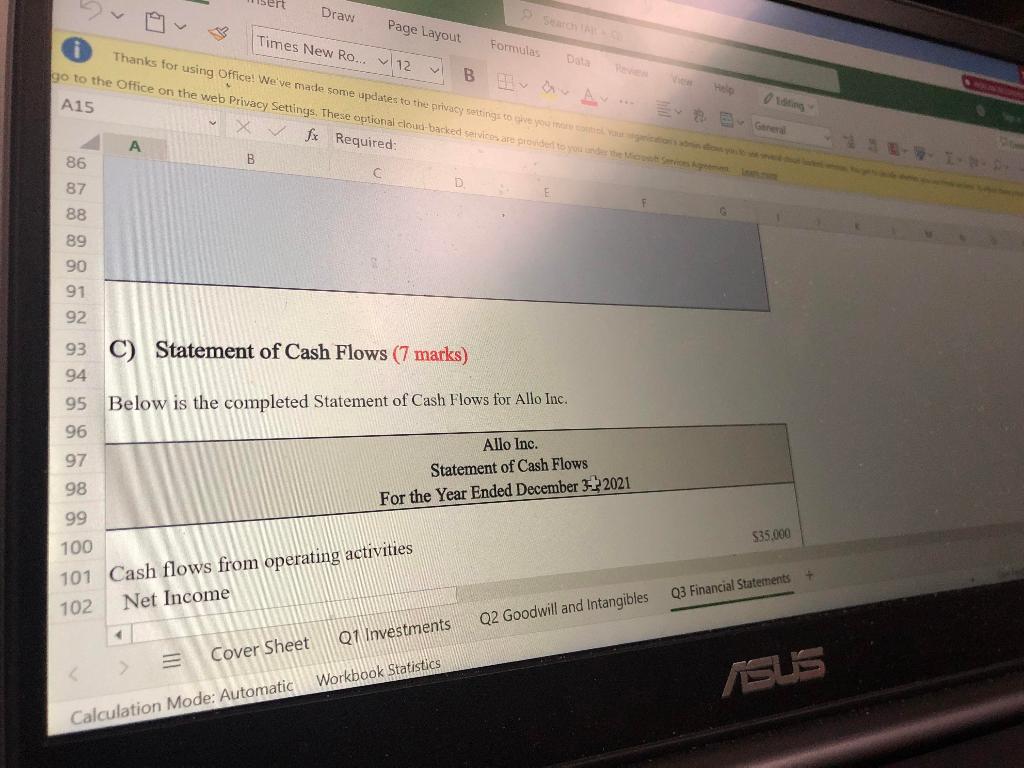

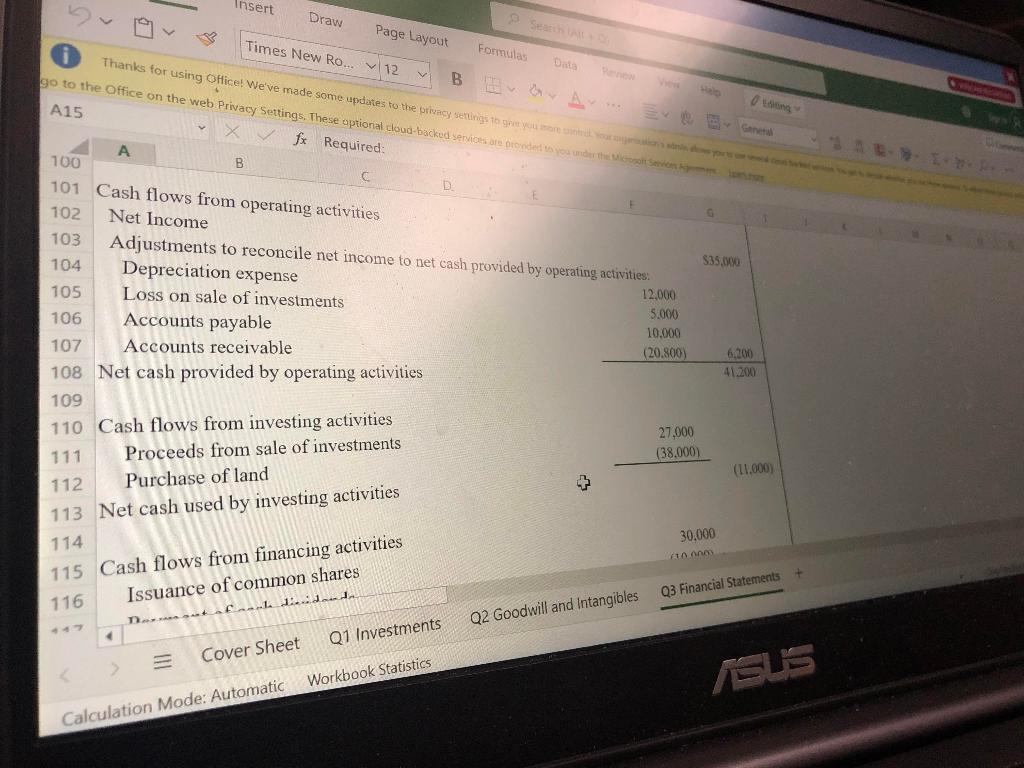

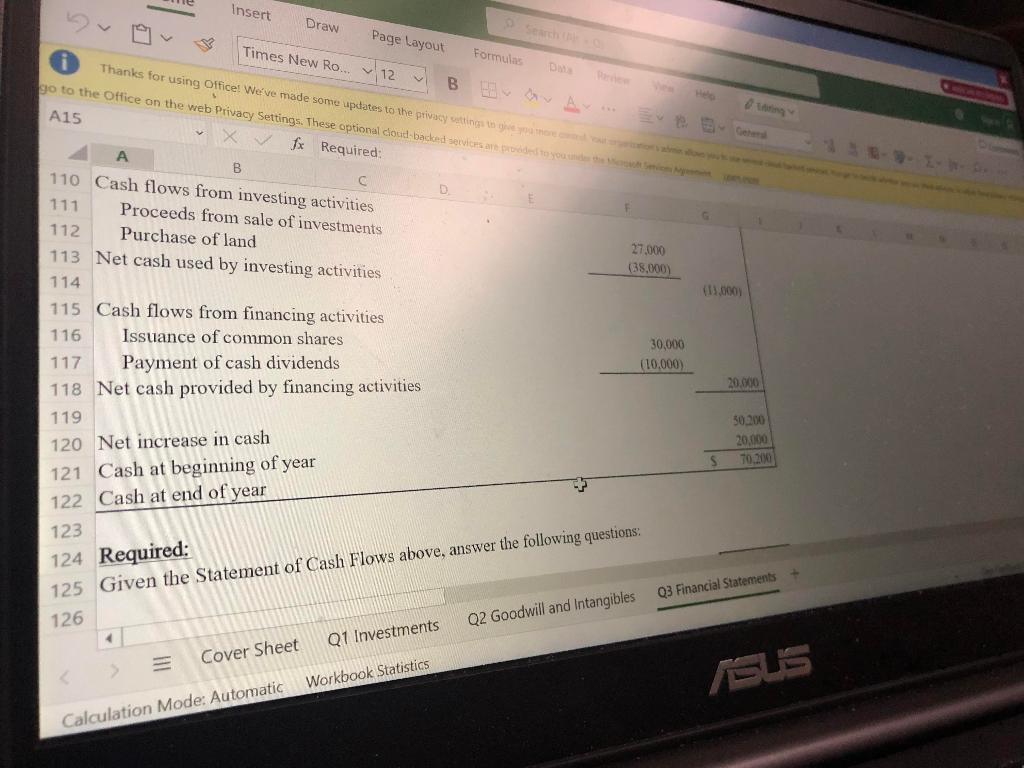

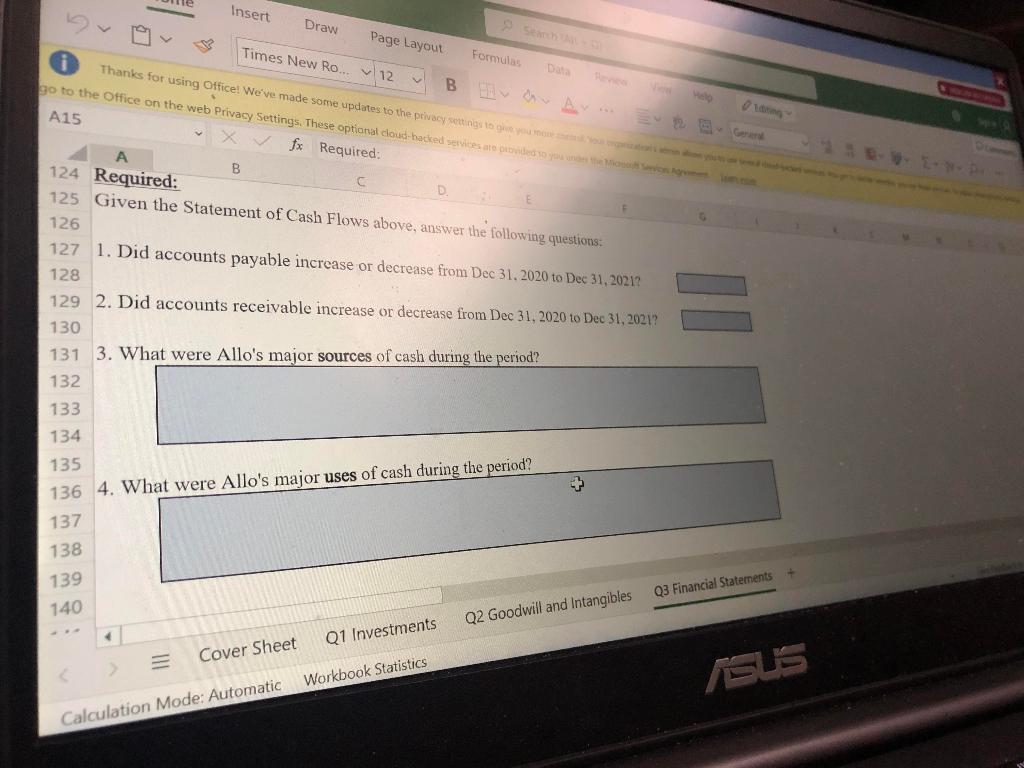

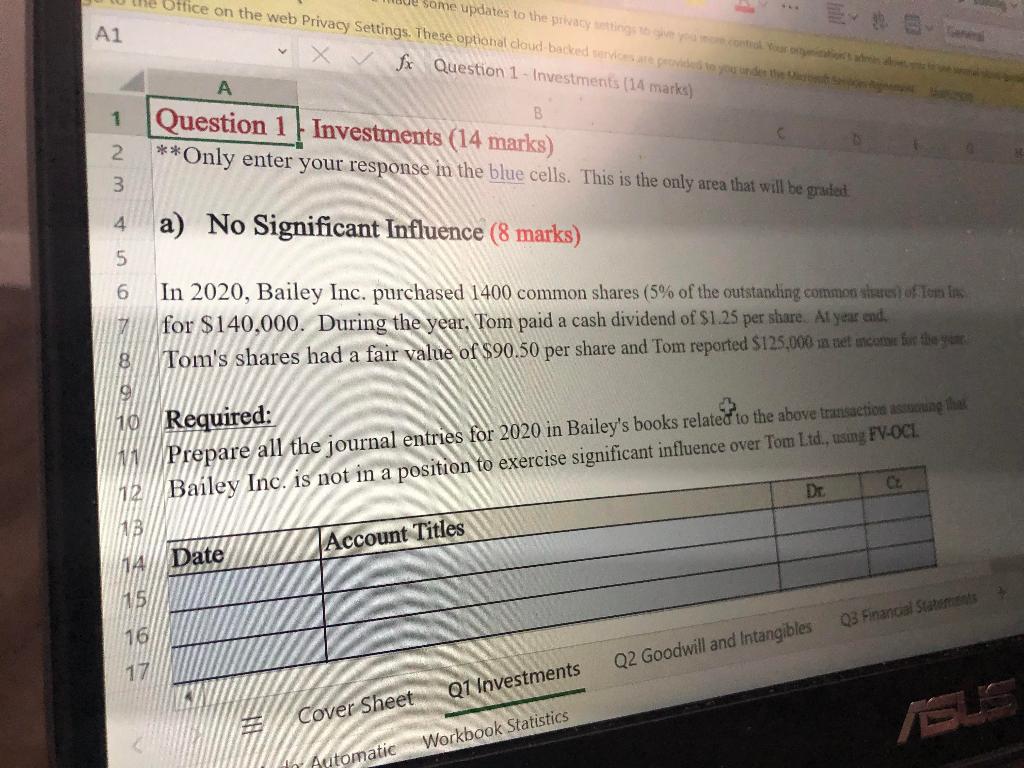

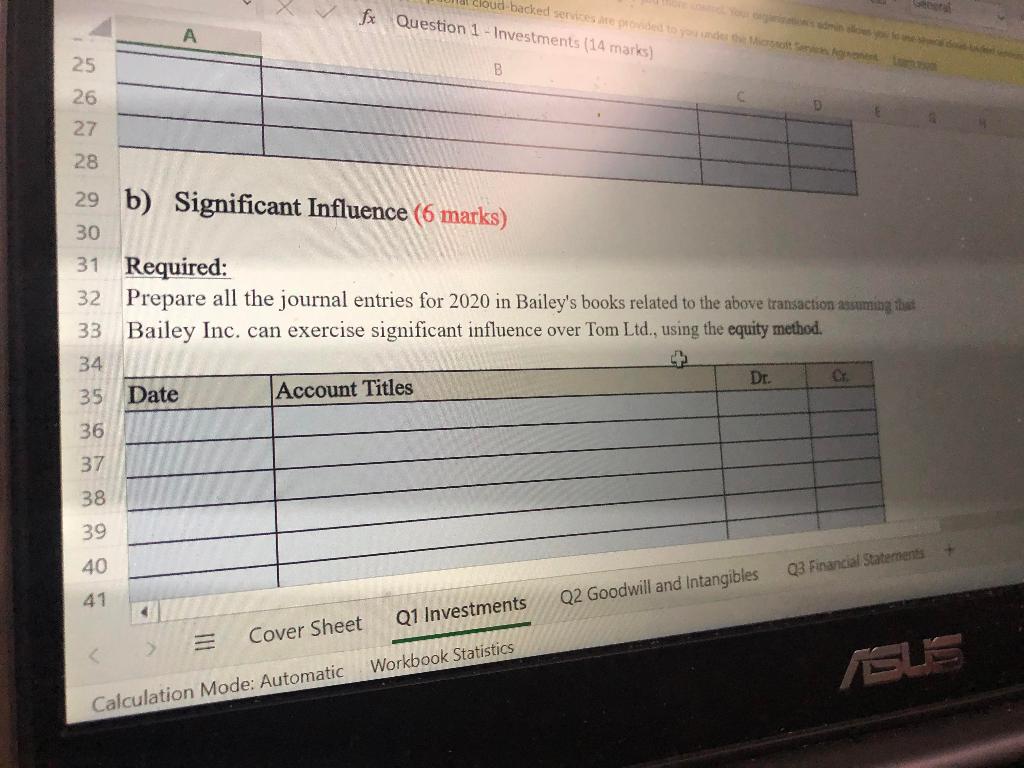

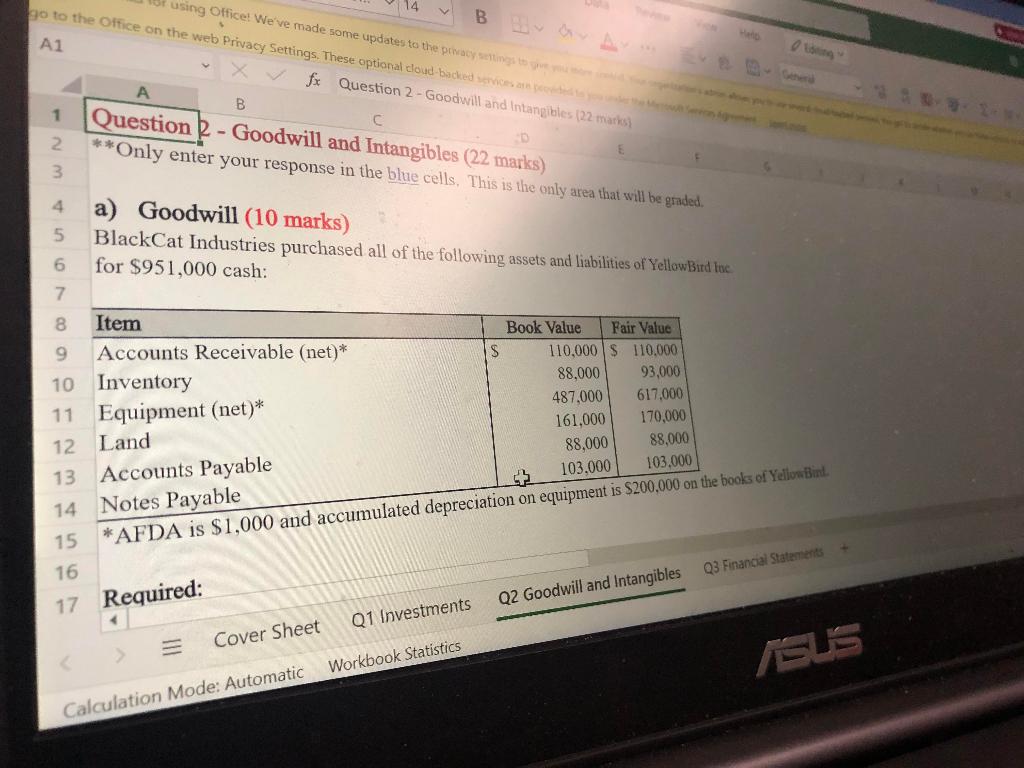

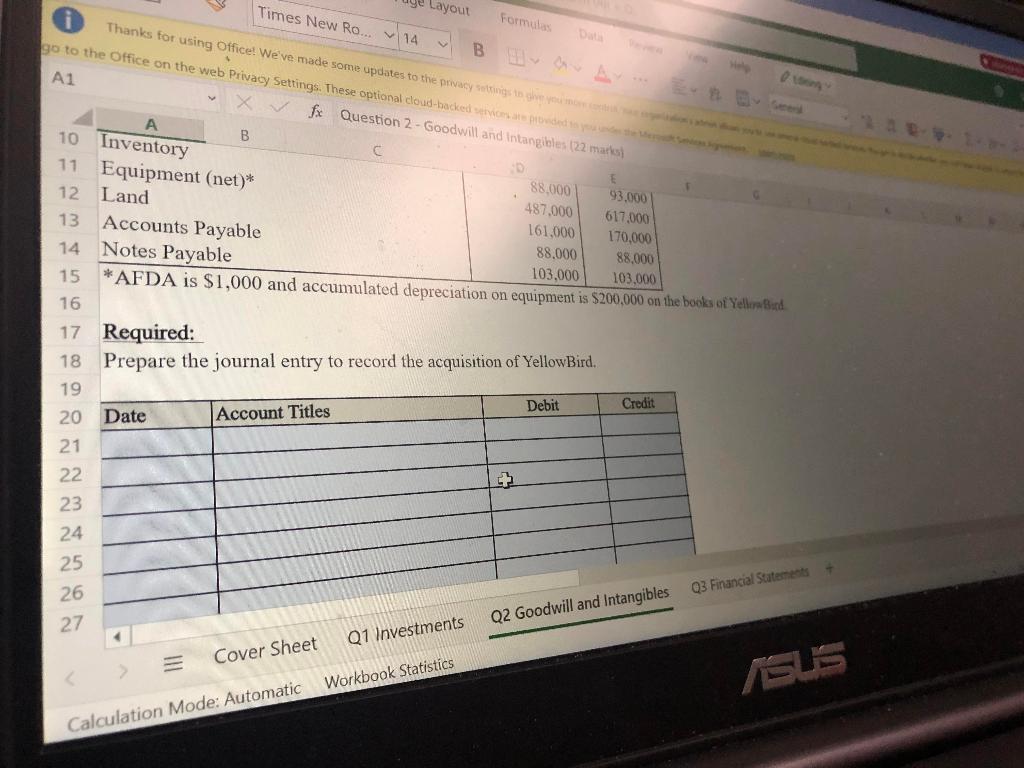

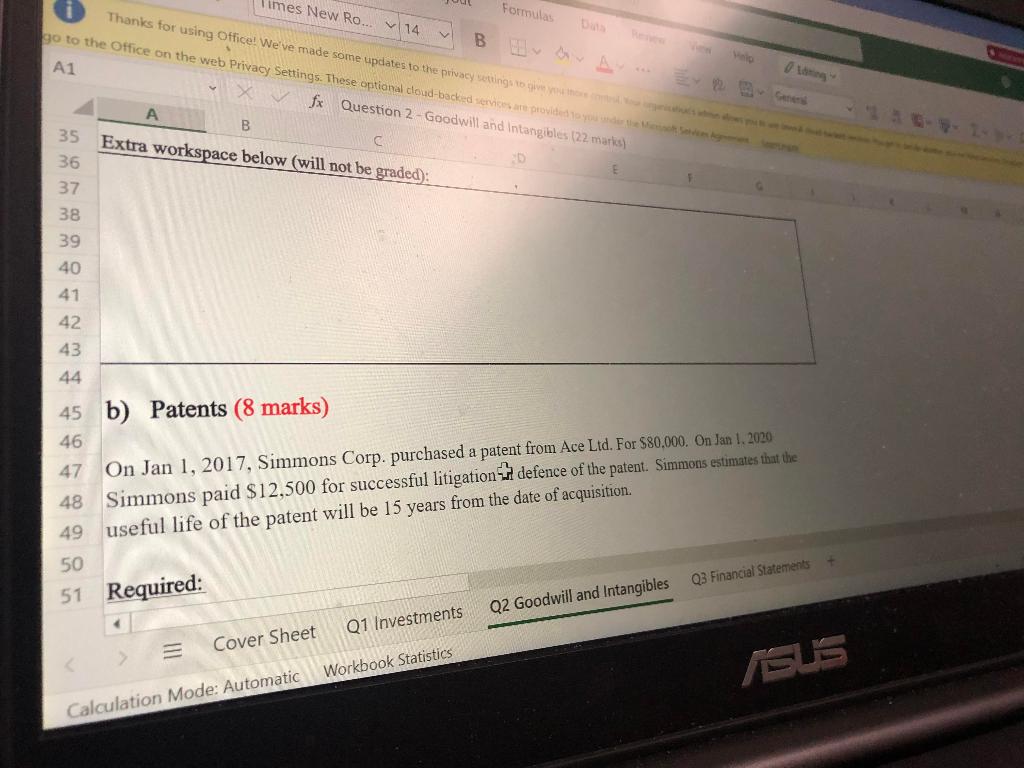

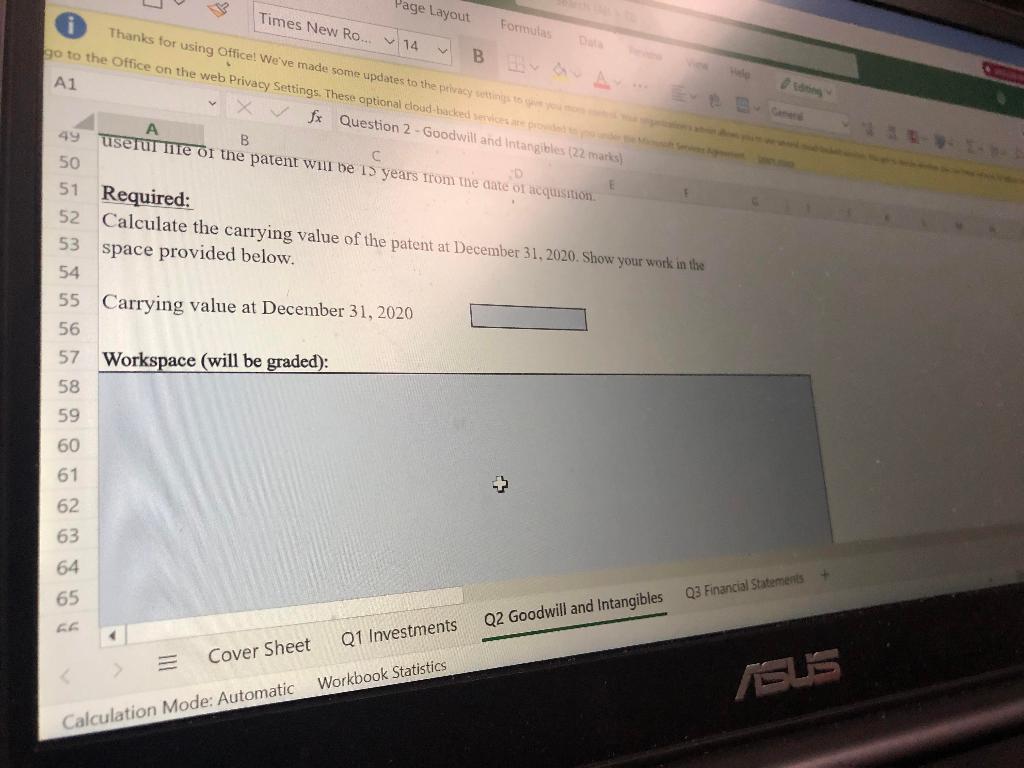

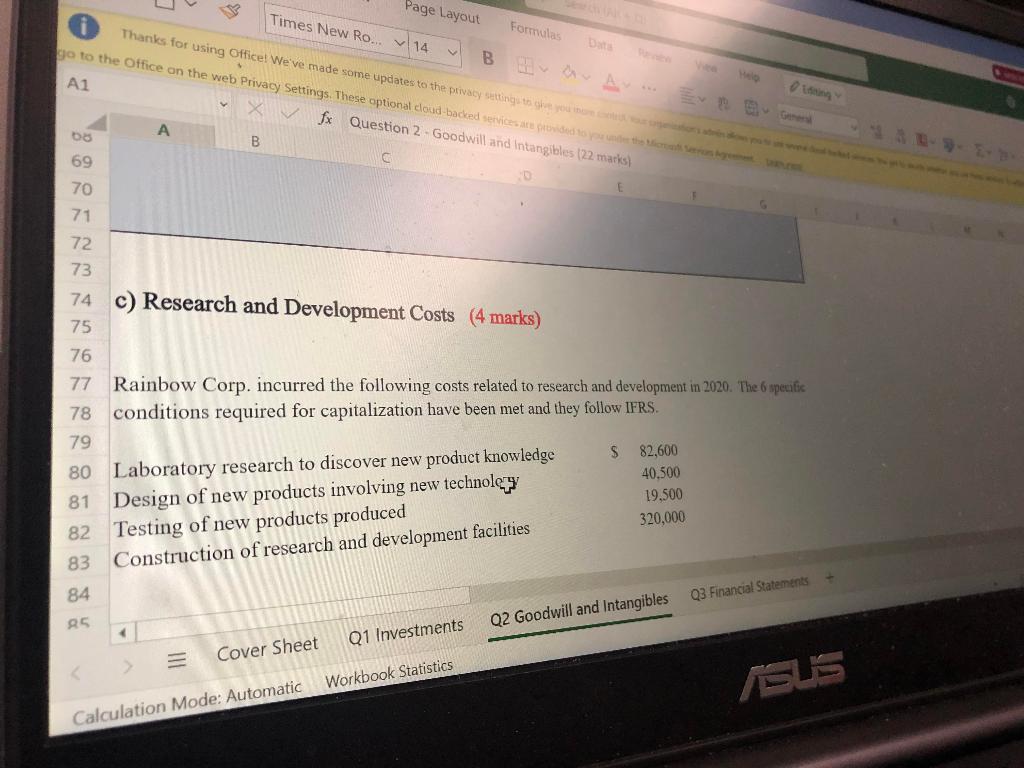

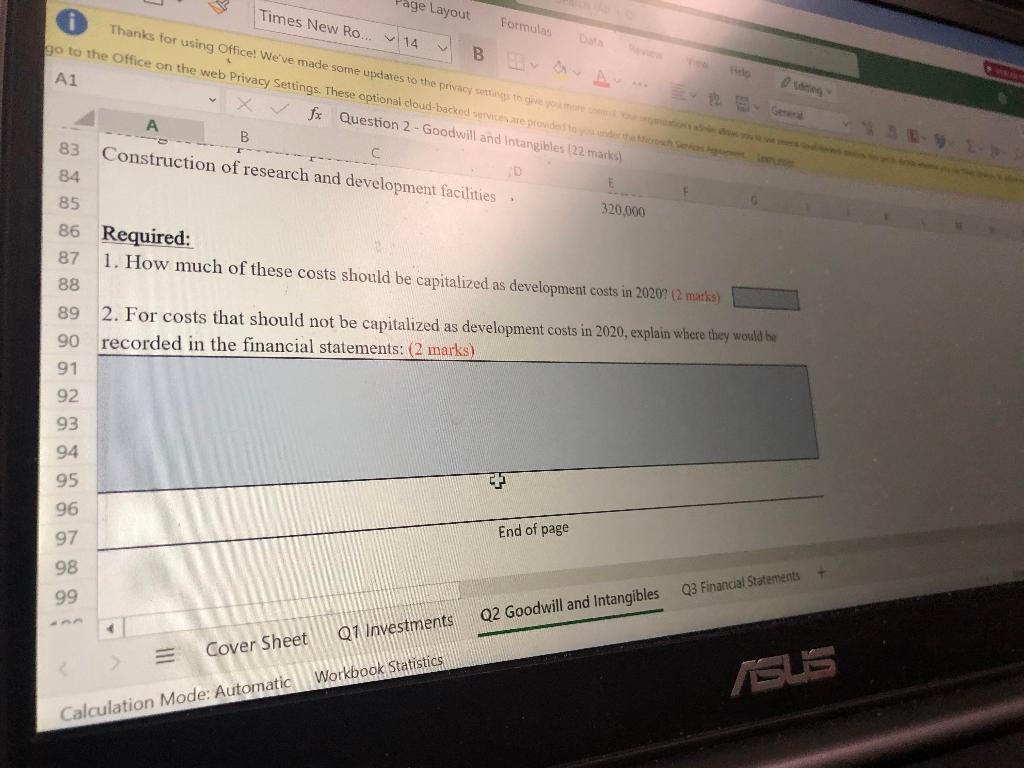

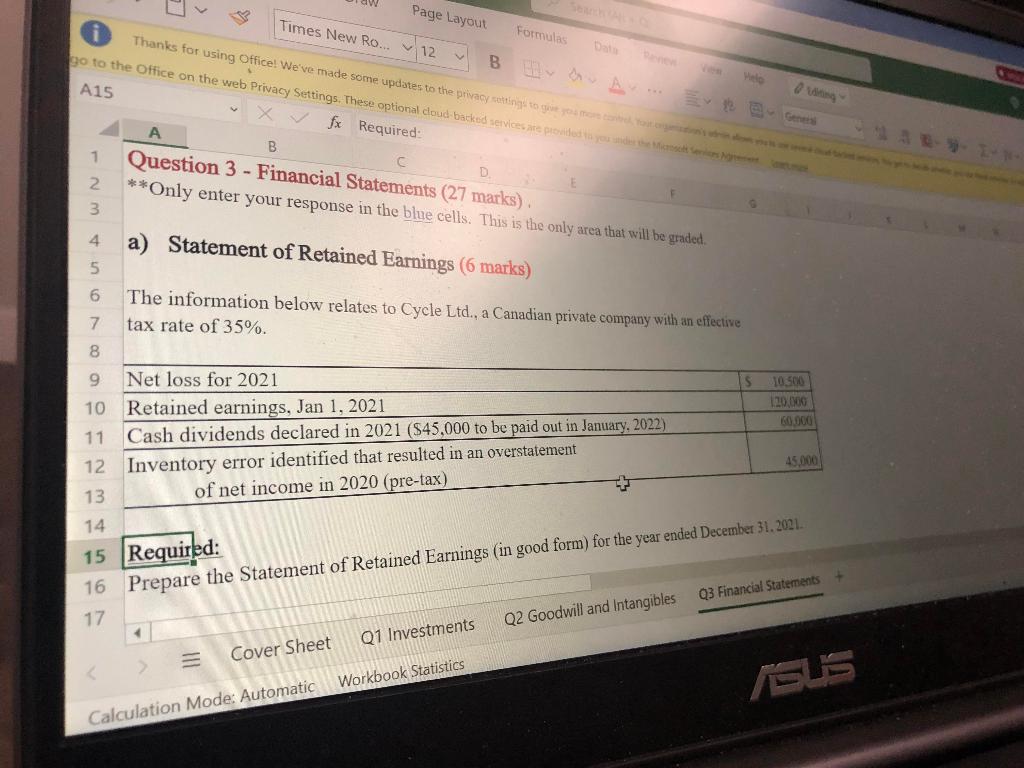

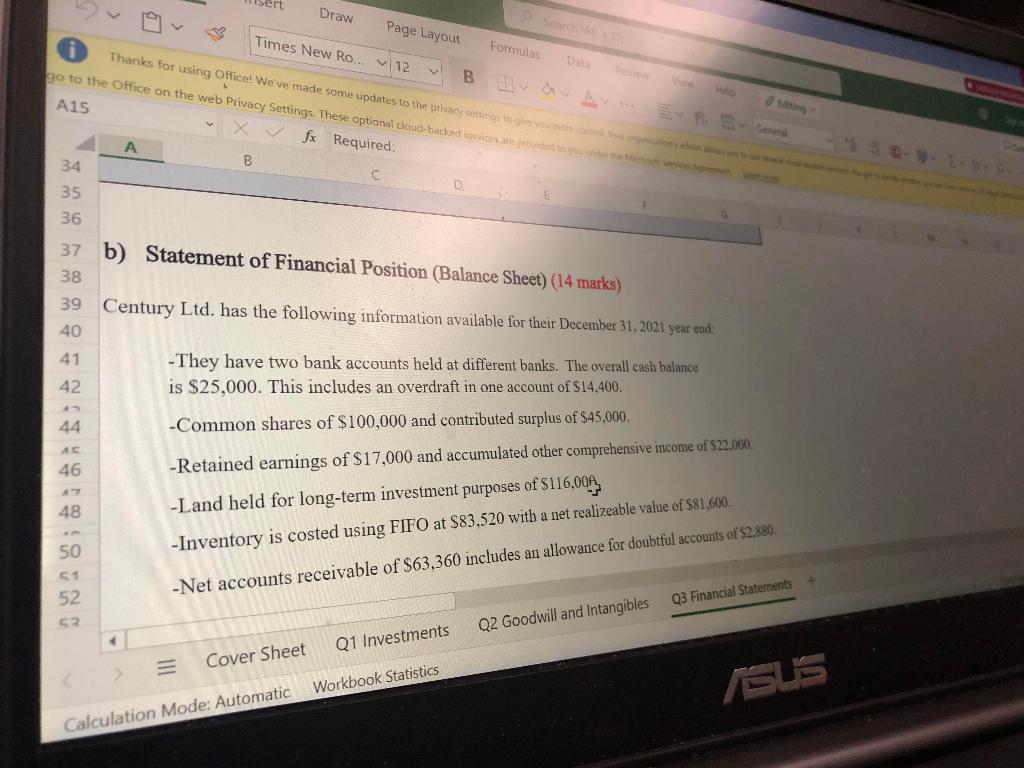

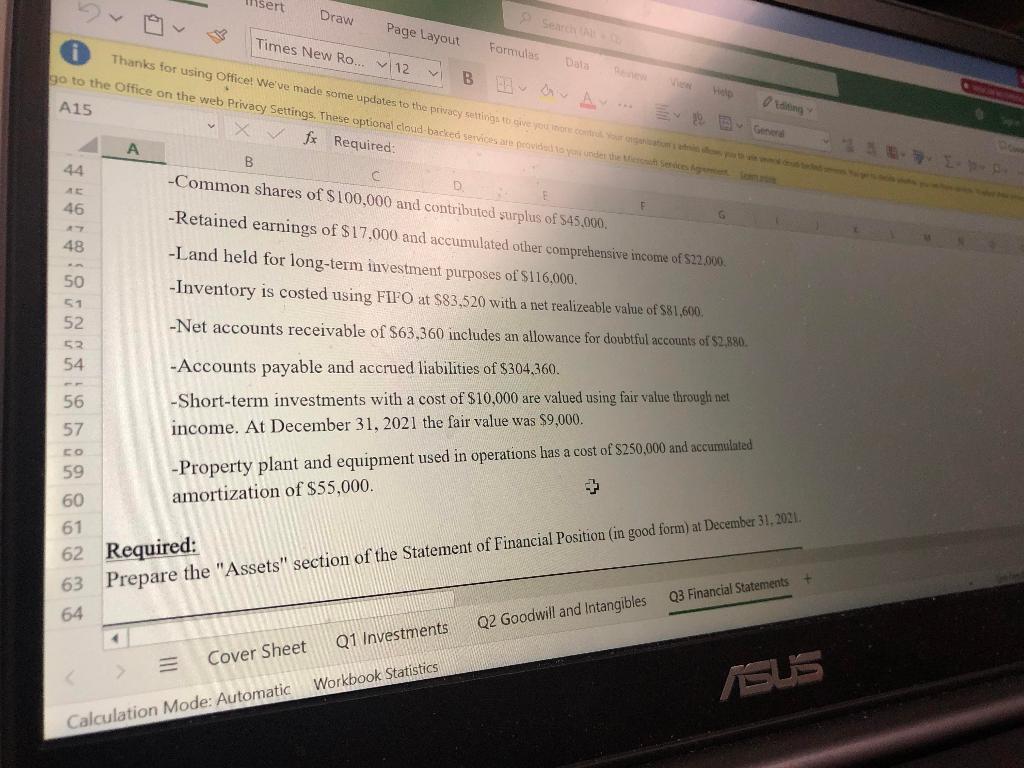

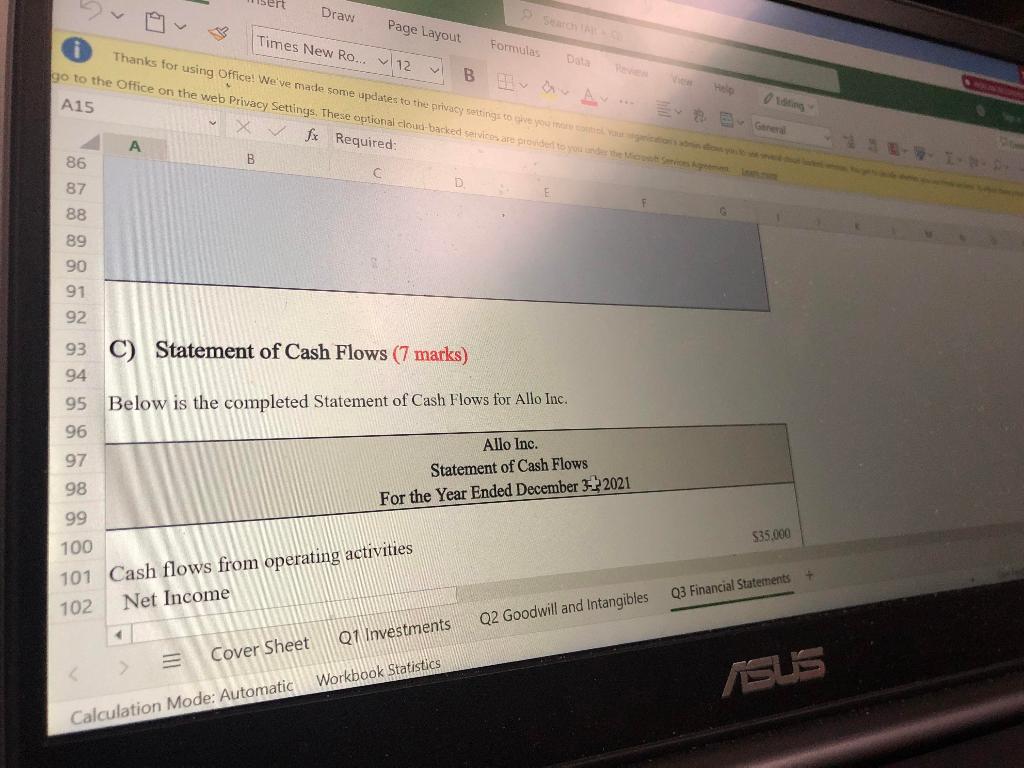

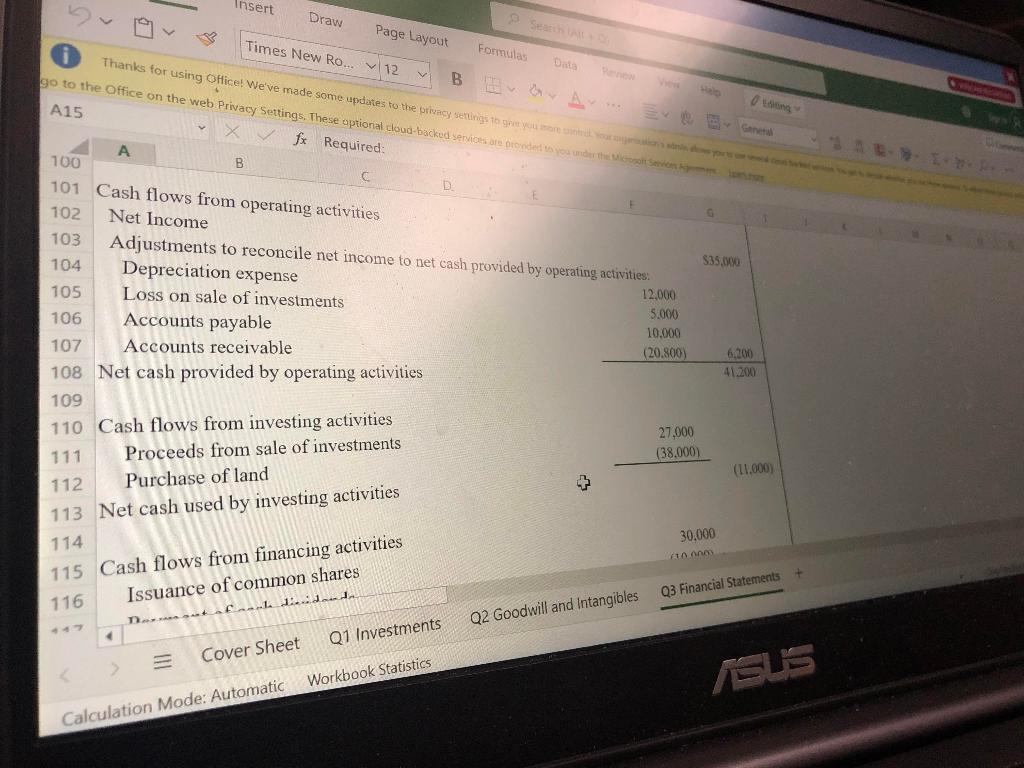

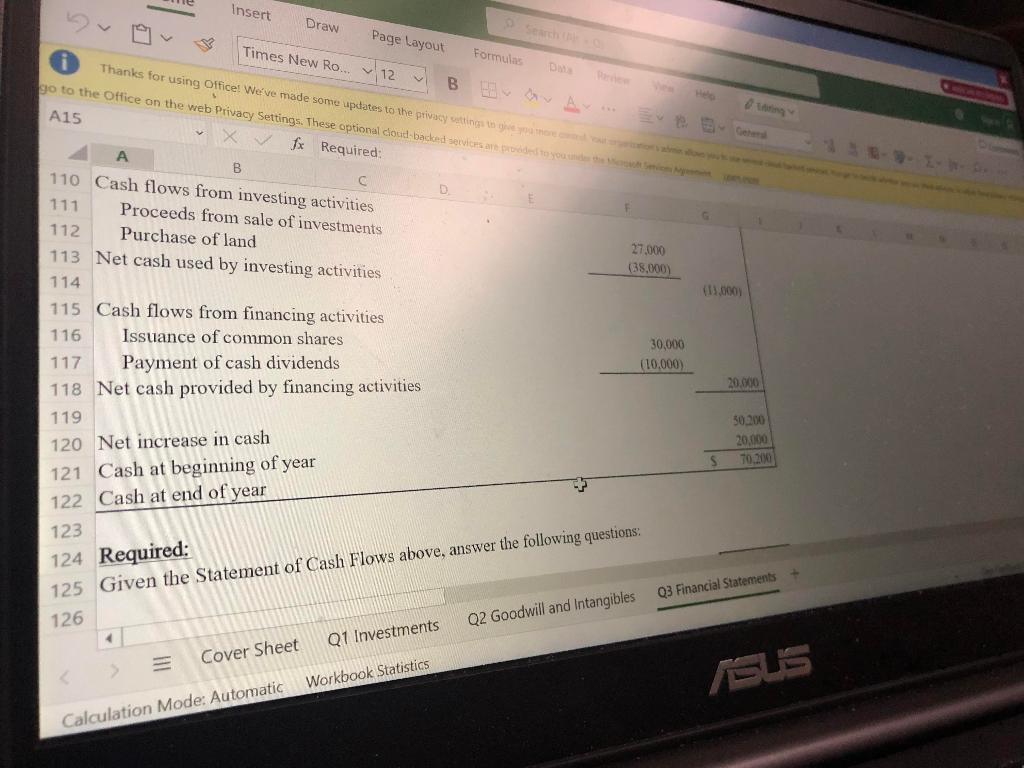

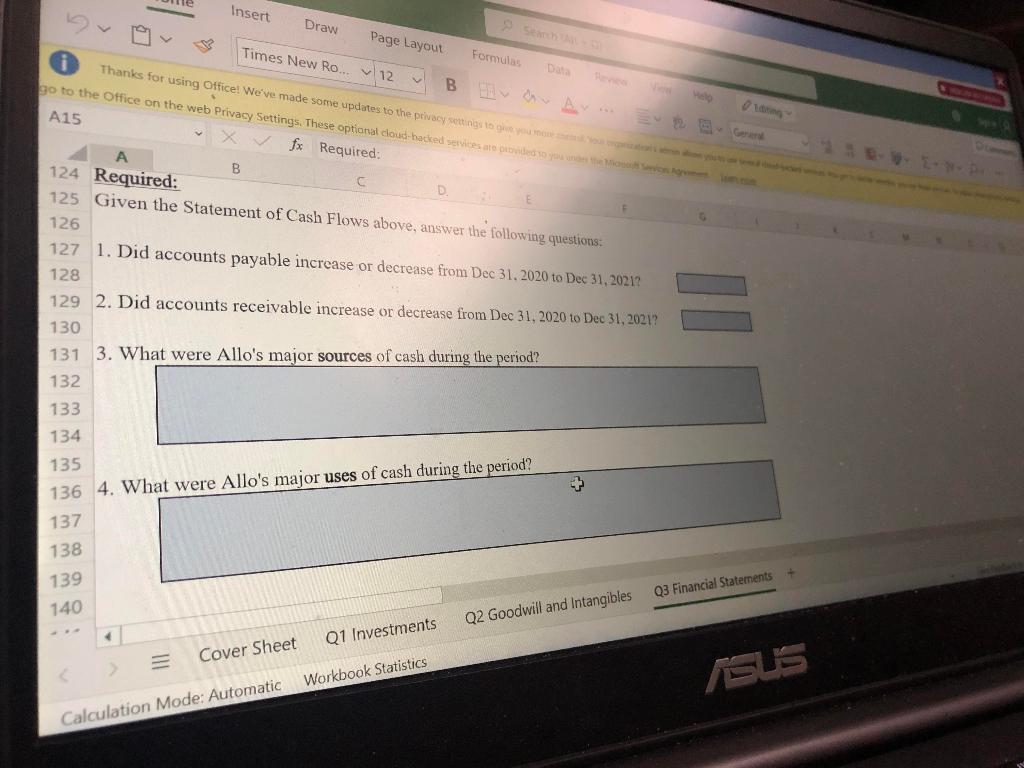

1 Question 1 Investments ( 14 marks) ** Only enter your response in the blue cells. This is the only area that will be gatad. a) No Significant Influence (8 marks) In 2020 , Bailey Inc. purchased 1400 common shares (5\% of the outstanding common stares) of tom ifios for $140,000. During the year, Tom paid a cash dividend of $1.25 per share Atyar and. Required: D) Signiticant Influence ( 6 marks) Required: Prepare all the journal entries for 2020 in Bailey's books related to the above transaction asuming isat Bailey Inc. can exercise significant influence over Tom Ltd., using the equity method. a) Goodwill (10 marks) BlackCat Industries purchased all of the following assets and liabilities of YellowBird toc for $951,000 cash: Required: 17 Required: 18 Prepare the journal entry to record the acquisition of YellowBird. 35 45 b) Patents ( 8 marks) 46 47 On Jan 1, 2017, Simmons Corp. purchased a patent from Ace Ltd. For $80,000. On Jan 1.2020 48 Simmons paid $12,500 for successful litigation $ defence of the patent. Simmons estimates inat tie 49 useful life of the patent will be 15 years from the date of acquisition. 50 51 Required: 52 Calculate the carrying value of the patent at December 31,2020 . Show your work in the 53 space provided below. 54 55 Carrying value at December 31, 2020 56 57 Workspace (will be graded): 58 59 60 61 62 63 64 65 Cover Sheet Q1 Investments Q2 Goodwill and Intangibles Calculation Mode: Automatic Workbook Statistics Rainbow Corp. incurred the following costs related to research and development in 2020 . The 6 speatic conditions required for capitalization have been met and they follow IFRS. A1 87 1. How much of these costs should be capitalized as development costs in 2020(2 manks) 88 89 2. For costs that should not be capitalized as development costs in 2020 , explain where they would be 90 recorded in the financial statements: (2 marks ) 91 92 93 94 95 96 97 End of page Calculation Mode: Automatic Required: Prepare the Statement of Retained Earnings (in good form) for the year ended December 31.2021. a3. Financial Statements Required: B Prepare the Statement of Retained Fion. tir b) Statement of Financial Position (Balance Sheet) (14 marks) Century Ltd. has the following information available for their December 31,2021 year end: - They have two bank accounts held at different banks. The overall cash balance is $25,000. This includes an overdraft in one account of $14,400. -Common shares of $100,000 and contributed surplus of $45,000. -Retained earnings of $17,000 and accumulated other comprehensive income of $22,000 -Land held for long-term investment purposes of $116,00A3 -Inventory is costed using FIFO at $83,520 with a net realizeable value of $81,600. -Net accounts receivable of $63,360 includes an allowance for doubtful accounts of $2,850. Q) Goodwill and Intangibles - Common shares of $100,000 and contributed surplus of $45,000. - Retained earnings of $17,000 and accumulated other comprehensive income of $22,000. -Land held for long-term investment purposes of $116,000. -Inventory is costed using FIFO at $83,520 with a net realizeable value of $81,600. - Net accounts receivable of $63,360 includes an allowance for doubtful accounts of $2,880. -Accounts payable and accrued liabilities of $304,360. - Short-term investments with a cost of $10,000 are valued using fair value through net income. At December 31,2021 the fair value was $9,000. -Property plant and equipment used in operations has a cost of $250,000 and accumulated amortization of $55,000. C) Statement of Cash Flows ( 7 marks) Below is the completed Statement of Cash Flows for Allo Inc. 116 Issuance of common shares 123 124 Required: 125 Given the Statement of Cash Flows above, answer the following questions: Calculation Mode: Automatic Workbook Statistics 127 1. Did accounts payable increase or decrease from Dec 31,2020 to Dec 31,2021 ? 128 129 2. Did accounts receivable increase or decrease from Dec 31, 2020 to Dec 31, 2021? 130 131 3. What were Allo's major sources of cash during the period? 132 133 134 135 136 4. What were Allo's major uses of cash during the period? Calculation Mode: Automatic Workbook Statistics

Question on image

Question on image