Question one

1.2

Question two

2.2

Question 3

Question 4

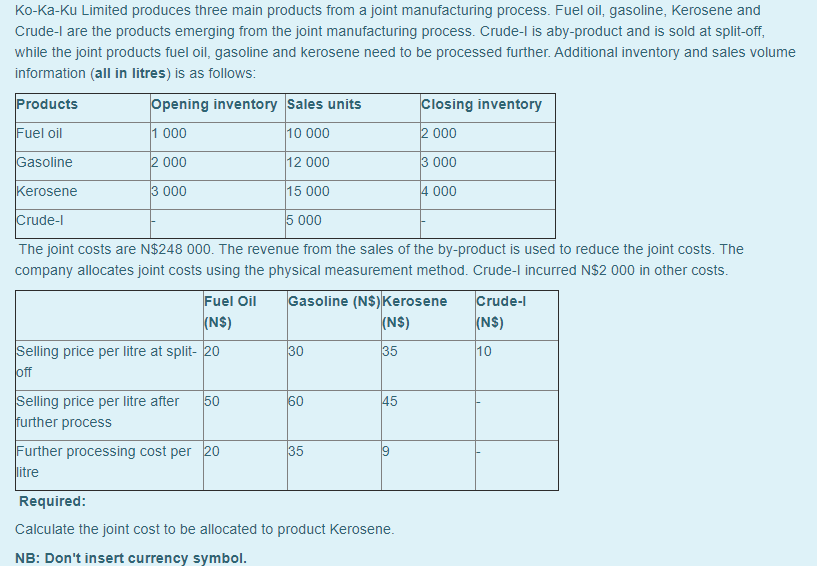

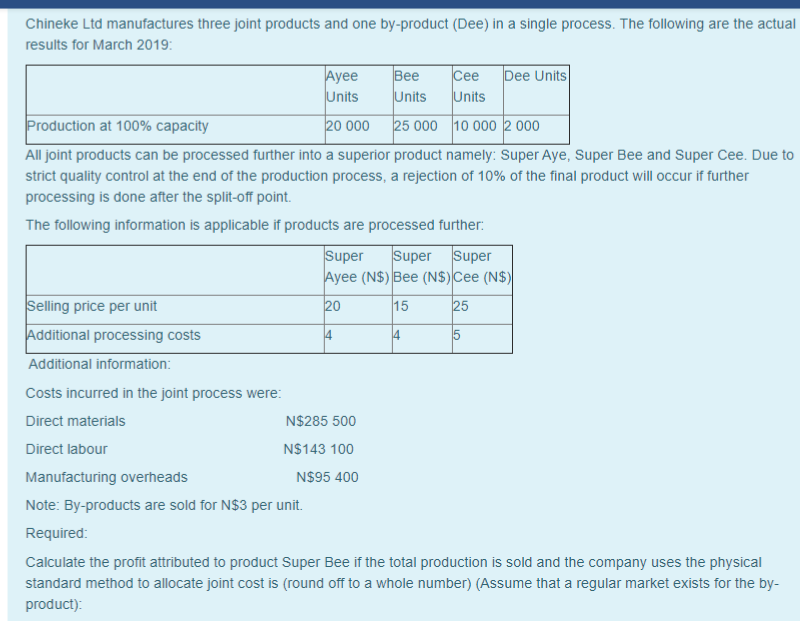

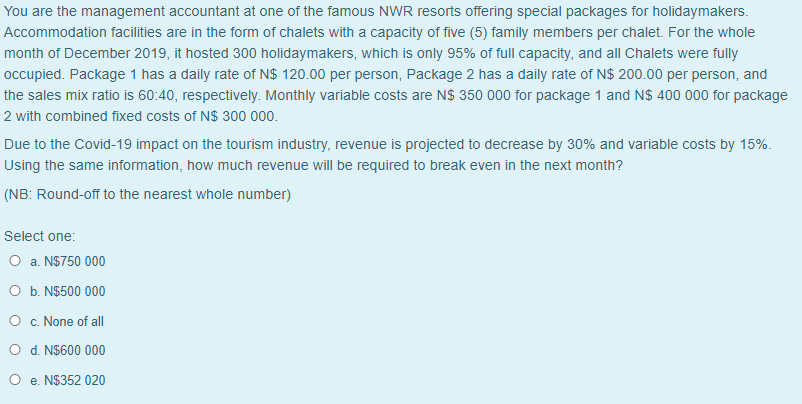

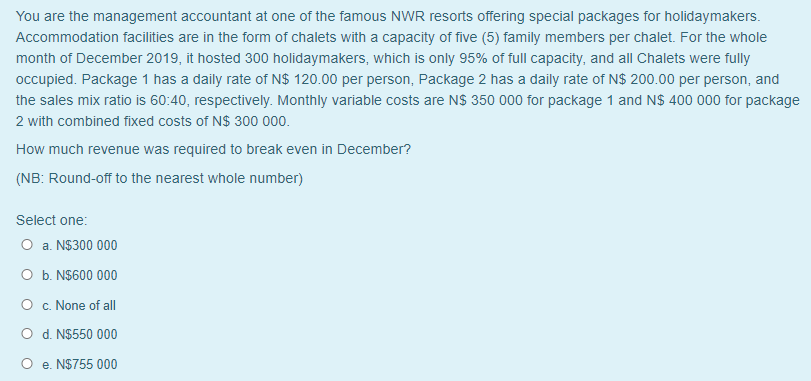

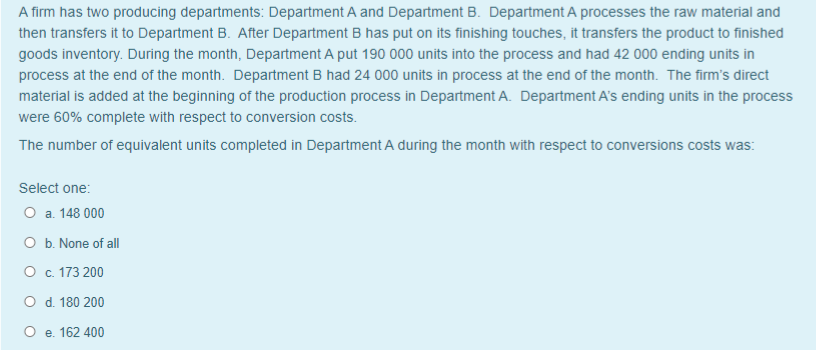

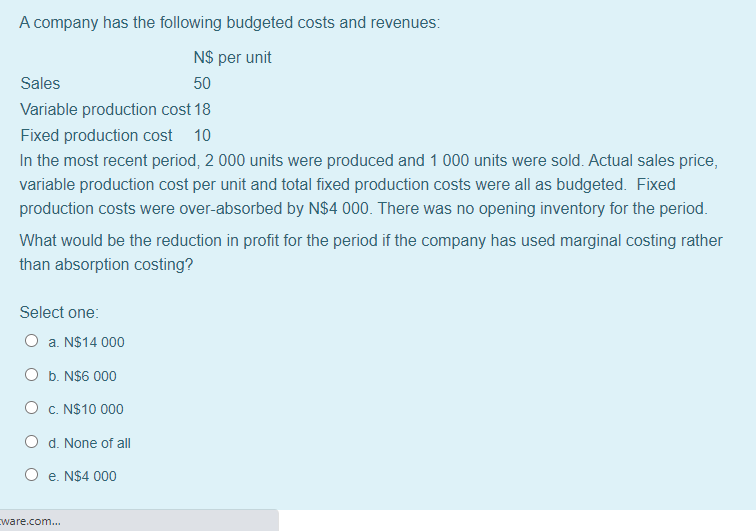

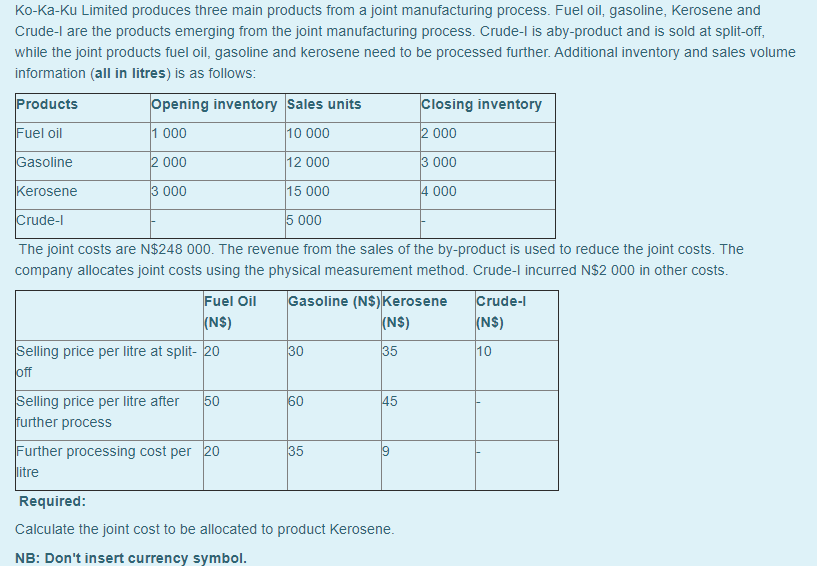

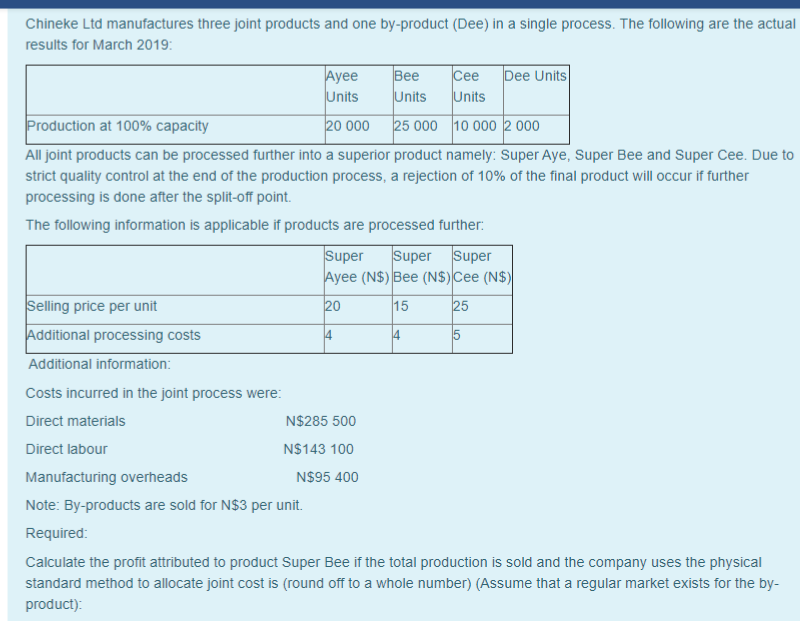

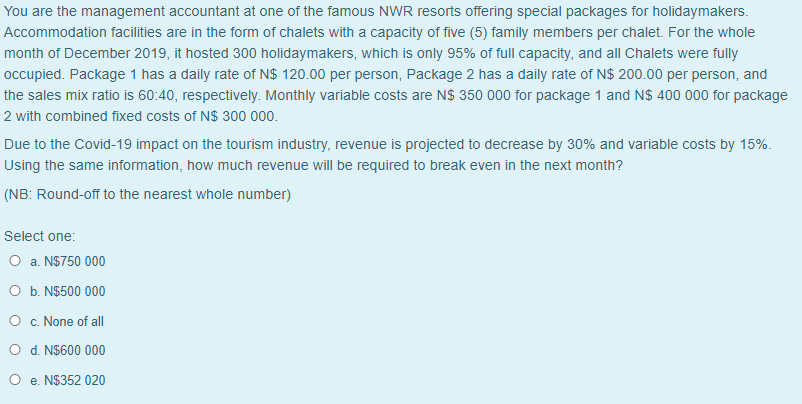

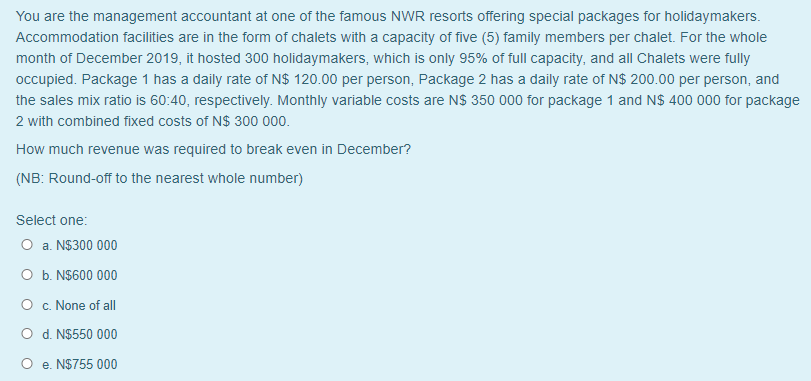

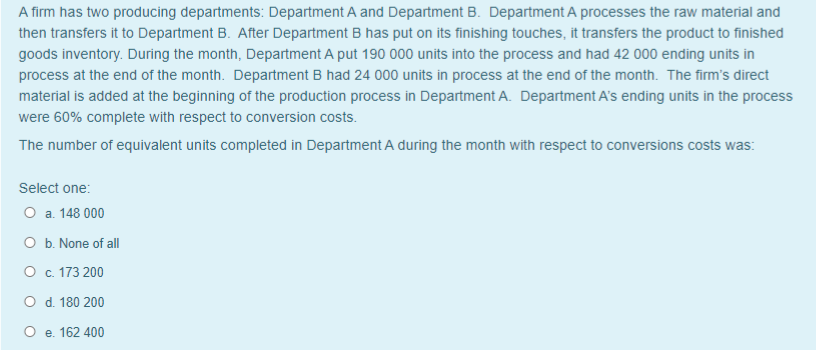

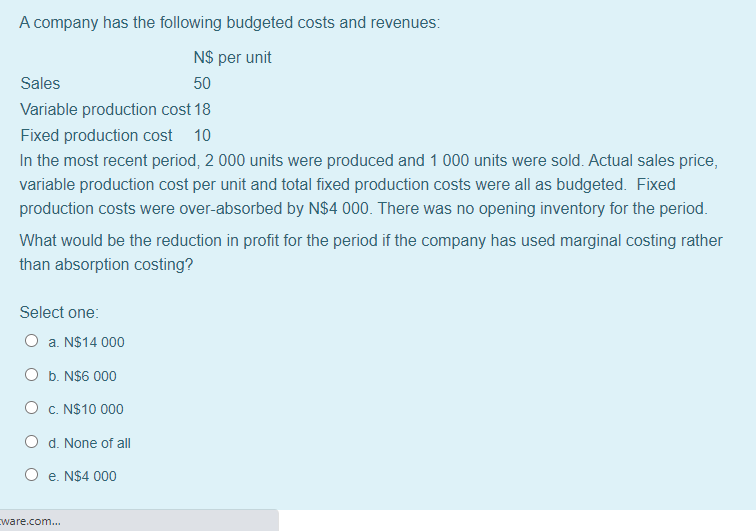

Ko-Ka-Ku Limited produces three main products from a joint manufacturing process. Fuel oil, gasoline, Kerosene and Crude-l are the products emerging from the joint manufacturing process. Crude-l is aby-product and is sold at split-off, while the joint products fuel oil, gasoline and kerosene need to be processed further. Additional inventory and sales volume information (all in litres) is as follows: Products Opening inventory Sales units Closing inventory Fuel oil 1 000 10 000 2 000 Gasoline 2 000 12 000 3 000 Kerosene 3 000 15 000 4 000 Crude- 5 000 The joint costs are N$248 000. The revenue from the sales of the by-product is used to reduce the joint costs. The company allocates joint costs using the physical measurement method. Crude-I incurred N$2 000 in other costs. Fuel Oil Gasoline (NS)Kerosene Crude- (NS) (NS) (NS) Selling price per litre at split- 20 30 35 10 off Selling price per litre after 50 60 45 further process Further processing cost per 20 35 litre 19 Required: Calculate the joint cost to be allocated to product Kerosene. NB: Don't insert currency symbol. Chineke Ltd manufactures three joint products and one by-product (Dee) in a single process. The following are the actual results for March 2019: Ayee Bee Dee Units Units Units Units Production at 100% capacity 20 000 25 000 10 000 2 000 All joint products can be processed further into a superior product namely: Super Aye, Super Bee and Super Cee. Due to strict quality control at the end of the production process, a rejection of 10% of the final product will occur if further processing is done after the split-off point. The following information is applicable if products are processed further: Super Super Super Ayee (N$) Bee (N$) Cee (N$) Selling price per unit 20 15 25 Additional processing costs 4 Additional information: Costs incurred in the joint process were: Direct materials N$285 500 Direct labour N$143 100 Manufacturing overheads N$95 400 Note: By-products are sold for N$3 per unit. Required: Calculate the profit attributed to product Super Bee if the total production is sold and the company uses the physical standard method to allocate joint cost is (round off to a whole number) (Assume that a regular market exists for the by- product): 4 15 You are the management accountant at one of the famous NWR resorts offering special packages for holidaymakers. Accommodation facilities are in the form of chalets with a capacity of five (5) family members per chalet. For the whole month of December 2019, it hosted 300 holidaymakers, which is only 95% of full capacity, and all Chalets were fully occupied. Package 1 has a daily rate of N$ 120.00 per person, Package 2 has a daily rate of N$ 200.00 per person, and the sales mix ratio is 60:40, respectively. Monthly variable costs are N$ 350 000 for package 1 and N$ 400 000 for package 2 with combined fixed costs of N$ 300 000. Due to the Covid-19 impact on the tourism industry, revenue is projected to decrease by 30% and variable costs by 15%. Using the same information, how much revenue will be required to break even in the next month? (NB: Round-off to the nearest whole number) Select one: O a. N$750 000 O b. N$500 000 O c. None of all 0 d. N$600 000 O e. N$352 020 You are the management accountant at one of the famous NWR resorts offering special packages for holidaymakers. Accommodation facilities are in the form of chalets with a capacity of five (5) family members per chalet. For the whole month of December 2019, it hosted 300 holidaymakers, which is only 95% of full capacity, and all Chalets were fully occupied. Package 1 has a daily rate of N$ 120.00 per person, Package 2 has a daily rate of N$ 200.00 per person, and the sales mix ratio is 60:40, respectively. Monthly variable costs are N$ 350 000 for package 1 and N$ 400 000 for package 2 with combined fixed costs of N$ 300 000. How much revenue was required to break even in December? (NB: Round-off to the nearest whole number) Select one: O a. N$300 000 O b. N$600 000 O c. None of all 0 d. N$550 000 O e. N$755 000 A firm has two producing departments: Department A and Department B. Department A processes the raw material and then transfers it to Department B. After Department B has put on its finishing touches, it transfers the product to finished goods inventory. During the month, Department A put 190 000 units into the process and had 42 000 ending units in process at the end of the month. Department B had 24 000 units in process at the end of the month. The firm's direct material is added at the beginning of the production process in Department A. Department A's ending units in the process were 60% complete with respect to conversion costs. The number of equivalent units completed in Department A during the month with respect to conversions costs was: Select one: O a. 148 000 O b. None of all O c. 173 200 O d. 180 200 O e. 162 400 A company has the following budgeted costs and revenues: N$ per unit Sales 50 Variable production cost 18 Fixed production cost 10 In the most recent period, 2 000 units were produced and 1 000 units were sold. Actual sales price, variable production cost per unit and total fixed production costs were all as budgeted. Fixed production costs were over-absorbed by N$4 000. There was no opening inventory for the period. What would be the reduction in profit for the period if the company has used marginal costing rather than absorption costing? Select one: O a. N$14 000 O b. N$6 000 0 C. N$10 000 O d. None of all O e. N$4 000 ware.com