Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question One (18 Marks) Assume that ABC International Bank plc (based in London) quotes the GBP: EUR Ask rate at 1,1695. Assume further that the

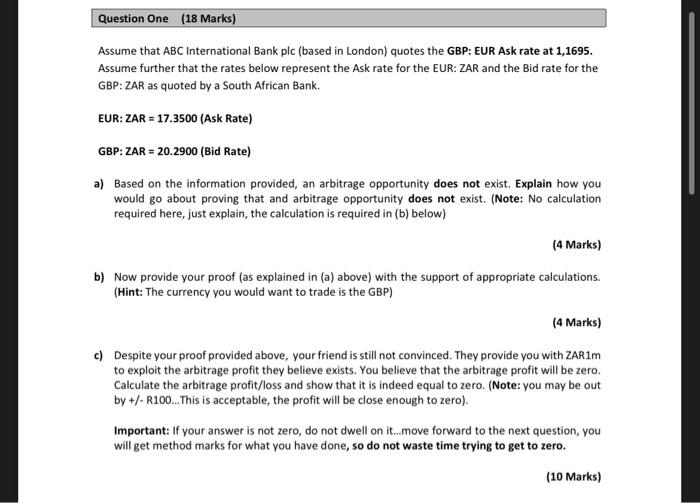

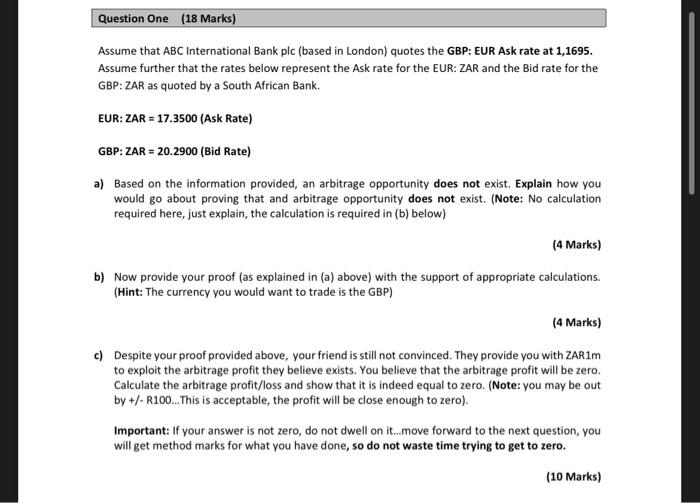

Question One (18 Marks) Assume that ABC International Bank plc (based in London) quotes the GBP: EUR Ask rate at 1,1695. Assume further that the rates below represent the Ask rate for the EUR: ZAR and the Bid rate for the GBP: ZAR as quoted by a South African Bank. EUR: ZAR = 17.3500 (Ask Rate) GBP: ZAR = 20.2900 (Bid Rate) a) Based on the information provided, an arbitrage opportunity does not exist. Explain how you would go about proving that and arbitrage opportunity does not exist. (Note: No calculation required here, just explain the calculation is required in (b) below) (4 Marks) b) Now provide your proof (as explained in (a) above) with the support of appropriate calculations. (Hint: The currency you would want to trade is the GBP) (4 Marks) c) Despite your proof provided above, your friend is still not convinced. They provide you with ZARIM to exploit the arbitrage profit they believe exists. You believe that the arbitrage profit will be zero. Calculate the arbitrage profit/loss and show that it is indeed equal to zero. (Note: you may be out by +/- R100... This is acceptable, the profit will be close enough to zero). Important: If your answer is not zero, do not dwell on it..move forward to the next question, you will get method marks for what you have done, so do not waste time trying to get to zero. (10 Marks) Question One (18 Marks) Assume that ABC International Bank plc (based in London) quotes the GBP: EUR Ask rate at 1,1695. Assume further that the rates below represent the Ask rate for the EUR: ZAR and the Bid rate for the GBP: ZAR as quoted by a South African Bank. EUR: ZAR = 17.3500 (Ask Rate) GBP: ZAR = 20.2900 (Bid Rate) a) Based on the information provided, an arbitrage opportunity does not exist. Explain how you would go about proving that and arbitrage opportunity does not exist. (Note: No calculation required here, just explain the calculation is required in (b) below) (4 Marks) b) Now provide your proof (as explained in (a) above) with the support of appropriate calculations. (Hint: The currency you would want to trade is the GBP) (4 Marks) c) Despite your proof provided above, your friend is still not convinced. They provide you with ZARIM to exploit the arbitrage profit they believe exists. You believe that the arbitrage profit will be zero. Calculate the arbitrage profit/loss and show that it is indeed equal to zero. (Note: you may be out by +/- R100... This is acceptable, the profit will be close enough to zero). Important: If your answer is not zero, do not dwell on it..move forward to the next question, you will get method marks for what you have done, so do not waste time trying to get to zero. (10 Marks)

Question One (18 Marks) Assume that ABC International Bank plc (based in London) quotes the GBP: EUR Ask rate at 1,1695. Assume further that the rates below represent the Ask rate for the EUR: ZAR and the Bid rate for the GBP: ZAR as quoted by a South African Bank. EUR: ZAR = 17.3500 (Ask Rate) GBP: ZAR = 20.2900 (Bid Rate) a) Based on the information provided, an arbitrage opportunity does not exist. Explain how you would go about proving that and arbitrage opportunity does not exist. (Note: No calculation required here, just explain the calculation is required in (b) below) (4 Marks) b) Now provide your proof (as explained in (a) above) with the support of appropriate calculations. (Hint: The currency you would want to trade is the GBP) (4 Marks) c) Despite your proof provided above, your friend is still not convinced. They provide you with ZARIM to exploit the arbitrage profit they believe exists. You believe that the arbitrage profit will be zero. Calculate the arbitrage profit/loss and show that it is indeed equal to zero. (Note: you may be out by +/- R100... This is acceptable, the profit will be close enough to zero). Important: If your answer is not zero, do not dwell on it..move forward to the next question, you will get method marks for what you have done, so do not waste time trying to get to zero. (10 Marks) Question One (18 Marks) Assume that ABC International Bank plc (based in London) quotes the GBP: EUR Ask rate at 1,1695. Assume further that the rates below represent the Ask rate for the EUR: ZAR and the Bid rate for the GBP: ZAR as quoted by a South African Bank. EUR: ZAR = 17.3500 (Ask Rate) GBP: ZAR = 20.2900 (Bid Rate) a) Based on the information provided, an arbitrage opportunity does not exist. Explain how you would go about proving that and arbitrage opportunity does not exist. (Note: No calculation required here, just explain the calculation is required in (b) below) (4 Marks) b) Now provide your proof (as explained in (a) above) with the support of appropriate calculations. (Hint: The currency you would want to trade is the GBP) (4 Marks) c) Despite your proof provided above, your friend is still not convinced. They provide you with ZARIM to exploit the arbitrage profit they believe exists. You believe that the arbitrage profit will be zero. Calculate the arbitrage profit/loss and show that it is indeed equal to zero. (Note: you may be out by +/- R100... This is acceptable, the profit will be close enough to zero). Important: If your answer is not zero, do not dwell on it..move forward to the next question, you will get method marks for what you have done, so do not waste time trying to get to zero. (10 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started