Answered step by step

Verified Expert Solution

Question

1 Approved Answer

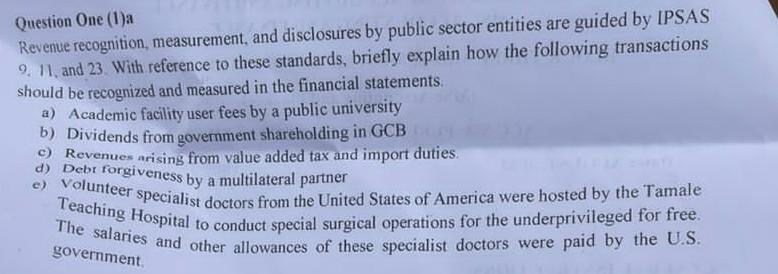

Question One (1)a Revenue recognition, measurement, and disclosures by public sector entities are guided by IPSAS 9. 11, and 23. With reference to these standards,

Question One (1)a Revenue recognition, measurement, and disclosures by public sector entities are guided by IPSAS 9. 11, and 23. With reference to these standards, briefly explain how the following transactions should be recognized and measured in the financial statements a) Academic facility user fees by a public university b) Dividends from government shareholding in GCB c) Revenues arising from value added tax and import duties. d) Debr forgiveness by a multilateral partner e) Volunteer specialist doctors from the United States of America were hosted by the Tamale Teaching Hospital to conduct special surgical operations for the underprivileged for free. The salaries and other allowances of these specialist doctors were paid by the U.S. government

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started