Answered step by step

Verified Expert Solution

Question

1 Approved Answer

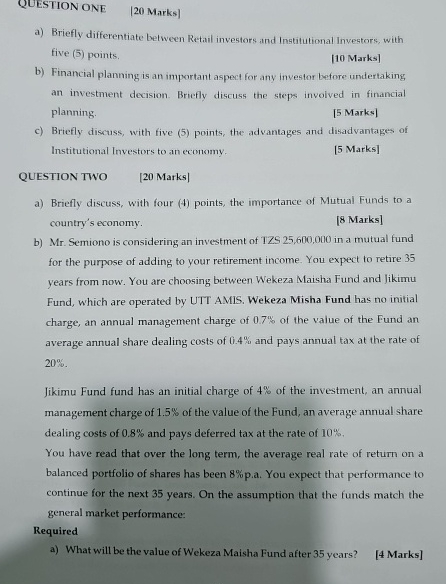

QUESTION ONE [ 2 0 Marks ] a ) Briefly differentiate between Retail investors and Institutional Investors, with five ( 5 ) points. [ 1

QUESTION ONE

Marks

a Briefly differentiate between Retail investors and Institutional Investors, with five points.

Marks

b Financial planning is an important aspect for any investor before undertaking an investment decision. Bricfly discuss the steps involved in financial planning.

Marks

c Briefly discuss, with five points, the advantages and disadvantages of Institutional Investors to an economy.

Marks

QUESTION TWO

Marks

a Briefly discuss, with four points, the importance of Mutual Funds to a country's economy.

Marks

b Mr Semiono is considering an investment of in a mutual fund for the purpose of adding to your retirement income. You expect to retire years from now. You are choosing between Wekeza Maisha Fund and Jikimu Fund, which are operated by UTT AMIS. Wekeza Misha Fund has no initial charge, an annual management charge of of the value of the Fund an average annual share dealing costs of and pays annual tax at the rate of

Jikimu Fund fund has an initial charge of of the investment, an annual management charge of of the value of the Fund, an average annual share dealing costs of and pays deferred tax at the rate of

You have read that over the long term, the average real rate of retum on a balanced portfolio of shares has been pa You expect that performance to continue for the next years. On the assumption that the funds match the general market performance:

Required

a What will be the value of Wekeza Maisha Fund after years?

Marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started