Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question One ( 2 0 marks a ) Clearly distinguish between a short hedge and a long hedge ( 5 marks ) b ) PenPenny

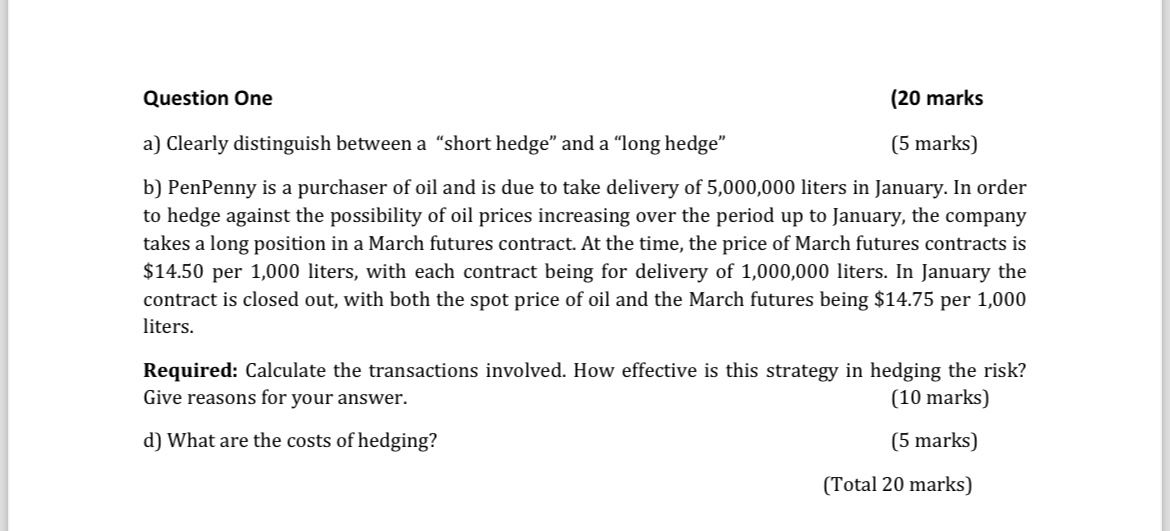

Question One

marks

a Clearly distinguish between a "short hedge" and a "long hedge"

marks

b PenPenny is a purchaser of oil and is due to take delivery of liters in January. In order to hedge against the possibility of oil prices increasing over the period up to January, the company takes a long position in a March futures contract. At the time, the price of March futures contracts is $ per liters, with each contract being for delivery of liters. In January the contract is closed out, with both the spot price of oil and the March futures being $ per liters.

Required: Calculate the transactions involved. How effective is this strategy in hedging the risk? Give reasons for your answer.

marks

d What are the costs of hedging?

marks

Total marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started