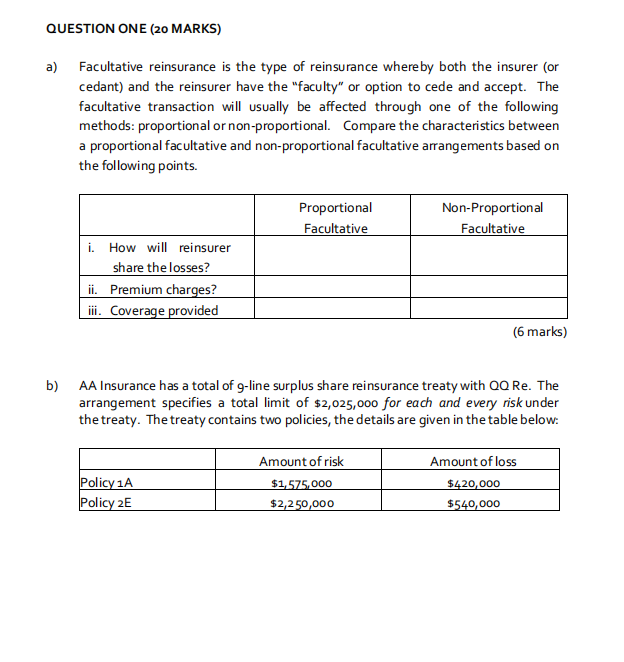

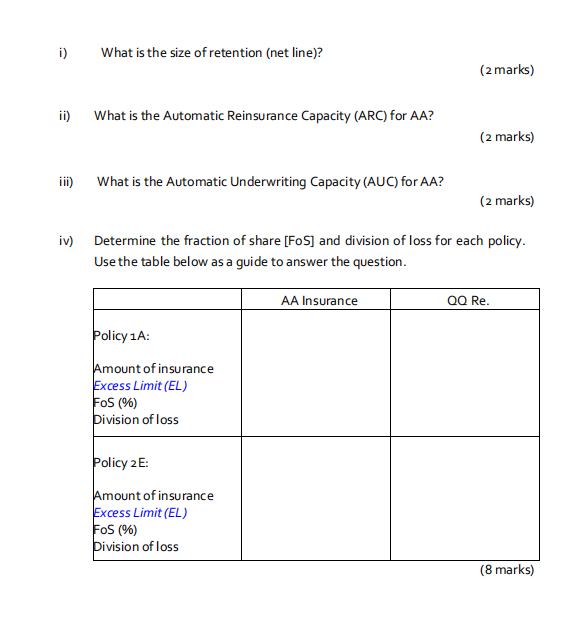

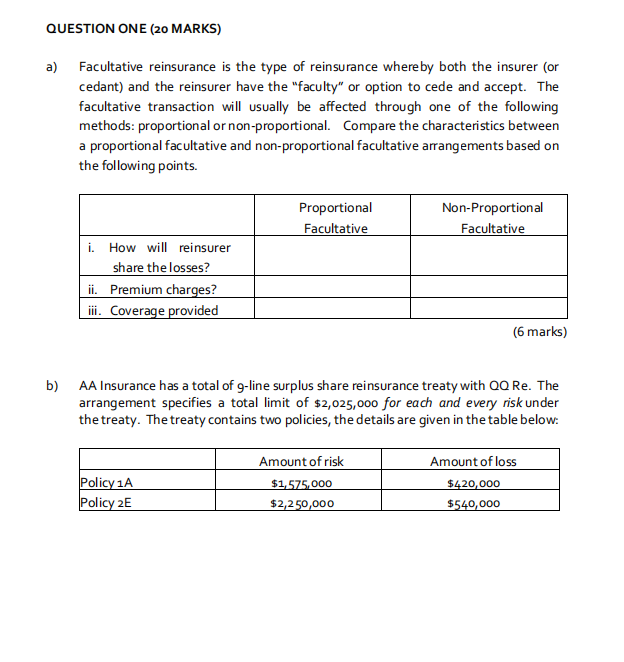

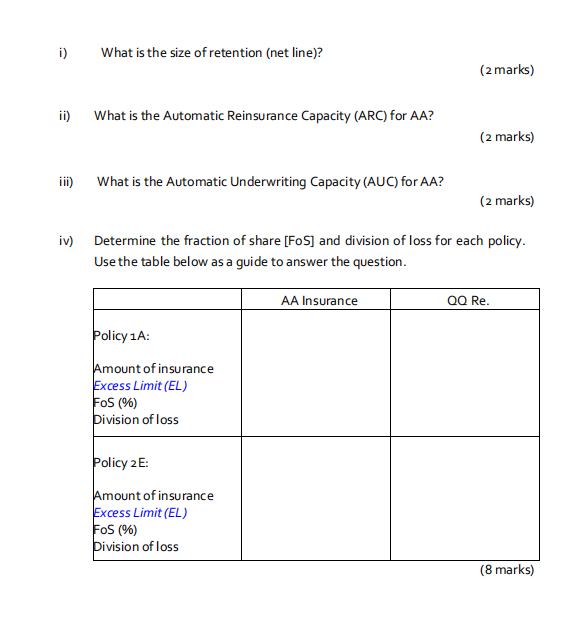

QUESTION ONE (20 MARKS) a) Facultative reinsurance is the type of reinsurance where by both the insurer (or cedant) and the reinsurer have the "faculty" or option to cede and accept. The facultative transaction will usually be affected through one of the following methods: proportional or non-proportional. Compare the characteristics between a proportional facultative and non-proportional facultative arrangements based on the following points. Proportional Facultative Non-Proportional Facultative i. How will reinsurer share the losses? ii. Premium charges? iii. Coverage provided (6 marks) b) AA Insurance has a total of 9-line surplus share reinsurance treaty with QQ Re. The arrangement specifies a total limit of $2,025,000 for each and every risk under the treaty. The treaty contains two policies, the details are given in the table below: Policy 1A Policy 2E Amount of risk $1,575,000 $2,250,000 Amount of loss $420,000 $540,000 i) What is the size of retention (net line)? (2 marks) ii) What is the Automatic Reinsurance Capacity (ARC) for AA? (2 marks) iii) What is the Automatic Underwriting Capacity (AUC) for AA? (2 marks) iv) Determine the fraction of share [FoS] and division of loss for each policy. Use the table below as a guide to answer the question. AA Insurance QQ Re. Policy 1A: Amount of insurance Excess Limit (EL) FoS (96) Division of loss Policy 2E: Amount of insurance Excess Limit (EL) FoS (96) Division of loss (8 marks) QUESTION ONE (20 MARKS) a) Facultative reinsurance is the type of reinsurance where by both the insurer (or cedant) and the reinsurer have the "faculty" or option to cede and accept. The facultative transaction will usually be affected through one of the following methods: proportional or non-proportional. Compare the characteristics between a proportional facultative and non-proportional facultative arrangements based on the following points. Proportional Facultative Non-Proportional Facultative i. How will reinsurer share the losses? ii. Premium charges? iii. Coverage provided (6 marks) b) AA Insurance has a total of 9-line surplus share reinsurance treaty with QQ Re. The arrangement specifies a total limit of $2,025,000 for each and every risk under the treaty. The treaty contains two policies, the details are given in the table below: Policy 1A Policy 2E Amount of risk $1,575,000 $2,250,000 Amount of loss $420,000 $540,000 i) What is the size of retention (net line)? (2 marks) ii) What is the Automatic Reinsurance Capacity (ARC) for AA? (2 marks) iii) What is the Automatic Underwriting Capacity (AUC) for AA? (2 marks) iv) Determine the fraction of share [FoS] and division of loss for each policy. Use the table below as a guide to answer the question. AA Insurance QQ Re. Policy 1A: Amount of insurance Excess Limit (EL) FoS (96) Division of loss Policy 2E: Amount of insurance Excess Limit (EL) FoS (96) Division of loss (8 marks)