Question

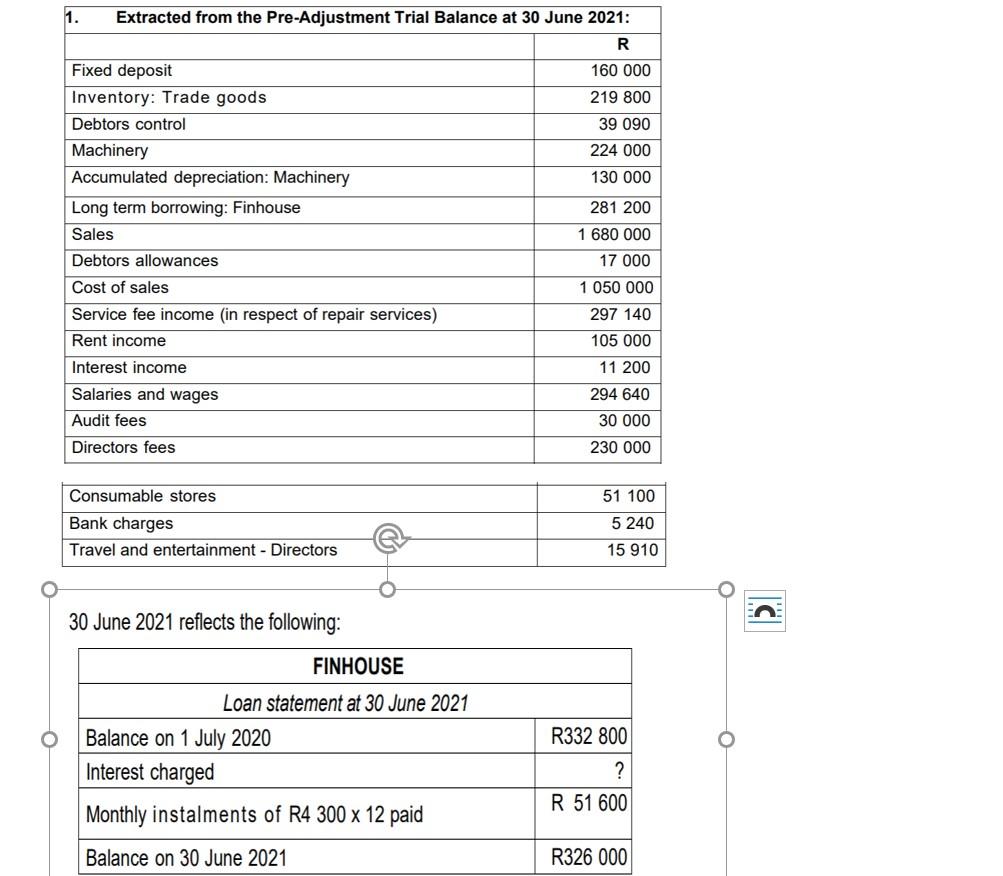

QUESTION ONE [20] Samke Limited sells new equipment and repairs equipment for their regular customers. The following information was extracted from the accounting records for

QUESTION ONE [20]

Samke Limited sells new equipment and repairs equipment for their regular customers.

The following information was extracted from the accounting records for the financial

year ended 30 June 2021

. Adjustments and additional information:

The internal auditors have identified the following errors or omissions:

2.1 auditors are owed a further R28 000 in audit fees.

2.2 Bank charges of R310 reflected on the June 2021 bank statement have not yet been entered in the books.

2.3 The stock count on 30 June 2021 revealed the following on hand:

Inventory: Trade goods; R202 000

Consumable stores; R900

2.4 The tenant paid the July and August rent in June 2021. The rent was

increased by R700 per month on 1 January 2021.

2.5 Provide for depreciation on machinery at 10% p.a. on the diminishing-balance

method. Note that new machinery costing R30 000 was purchased on 31

December 2020, (this was recorded correctly).

2.6 Interest on the loan was capitalised. The loan statement from Finhouse on

The interest expense for the year has not yet been entered in the books.

2.7 A credit note issued to a debtor, S Moon, dated 28 June 2021 was not recorded

in the books. The credit note was for price reduction on unsatisfactory repair of a

piece of equipment, R540.

2.8 Assume a company tax rate of 30%

Required:

Prepare a Statement of profit or loss and other comprehensive income for the year

ended 30 June 2021 in compliance with International Financial Reporting Standards

appropriate to Samke Ltds business activties. (20)

Question 2

QUESTION TWO [20]

The following information relating to property plant and equipment was extracted from

the accounting records of Freds Transport for year ended 28 February 2022;

1. Balances at 28 February 2021:

- Equipment at cost R 56 000

- Accumulated depreciation: equipment R 10 860

- Vehicles at cost R560 000

- Accumulated depreciation: vehicles R285 360

2. The following transactions in respect of property, plant and equipment took place

during the current financial year:

2.1 An old vehicle was sold on 31 August 2021 for R144 000 cash. The cost price

of the vehicle sold was R240 000, and its accumulated depreciation amounted

to R120 100 on 1 March 2021. The proceeds from the sale of the vehicle was

used to partially finance the purchase of another vehicle for R440 000 bought

on 1 September 2021.

2.2 On 28 February 2022 sold used equipment for R14 400 cash. The accumulated

depreciation on this equipment was R3 280 at 1 March 2021. The cost price of

the equipment was R18 000.

3. Depreciation must still be provided for as follows:

Equipment at 10% per year on the diminishing balance method, and

Vehicles at 20% per year on the straight line method.

4. The financial year ends on the last day of February.

Required:

Prepare the property, plant and equipment note to be attached to the financial

statements for Freds Transport for the year ended 28 February 2022.

Show the cost, accumulated depreciation and the carrying amount of the disposed

assets in the property, plant and equipment note. You may omit the total column.

Show all workings. Round off all calculations to the nearest whole number.

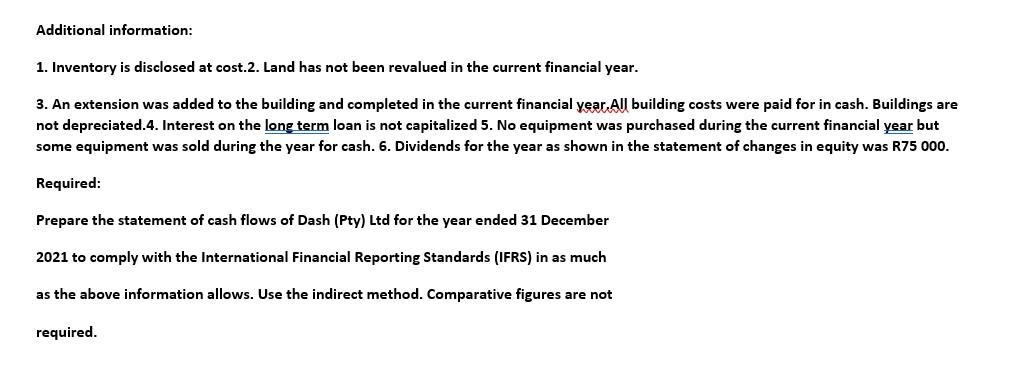

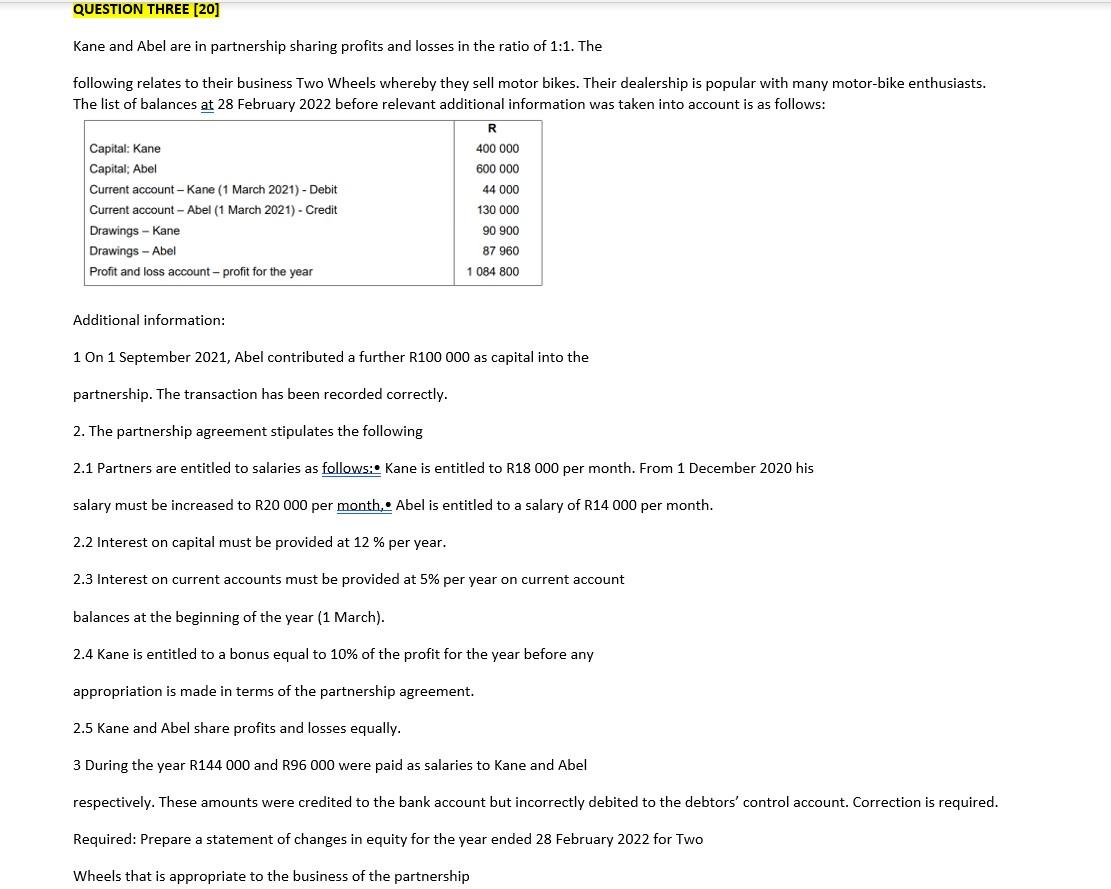

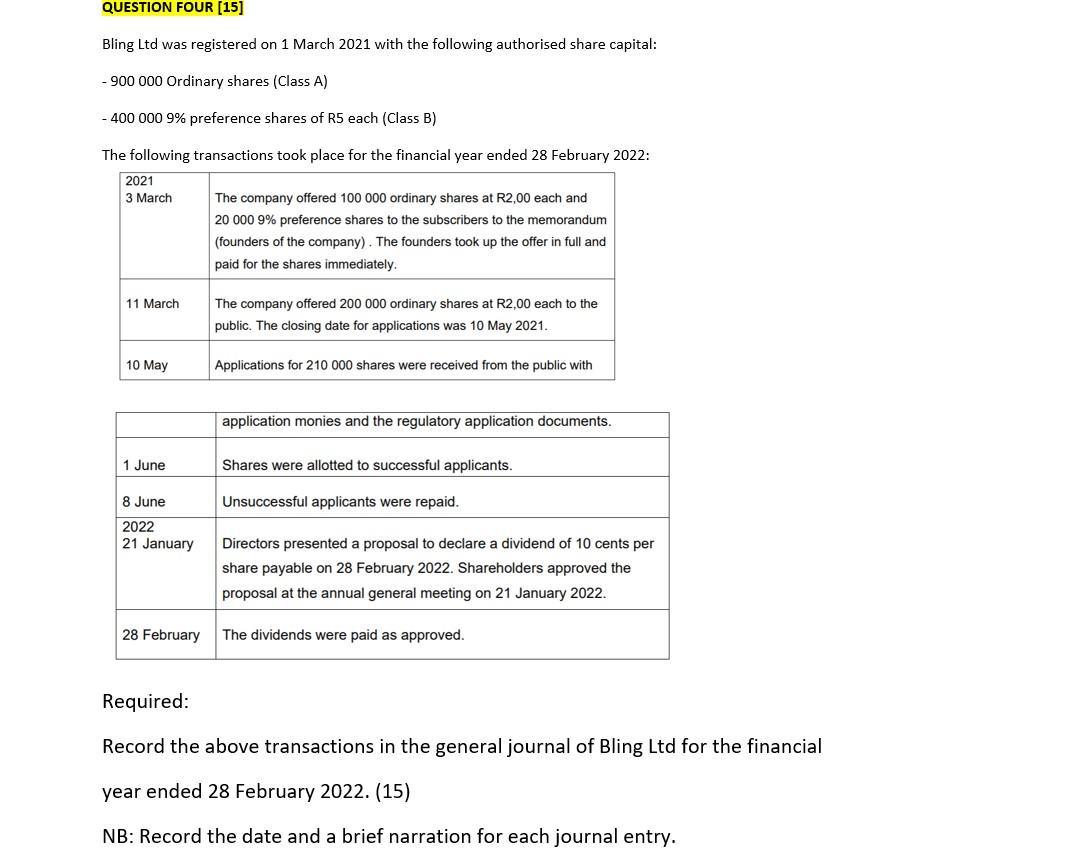

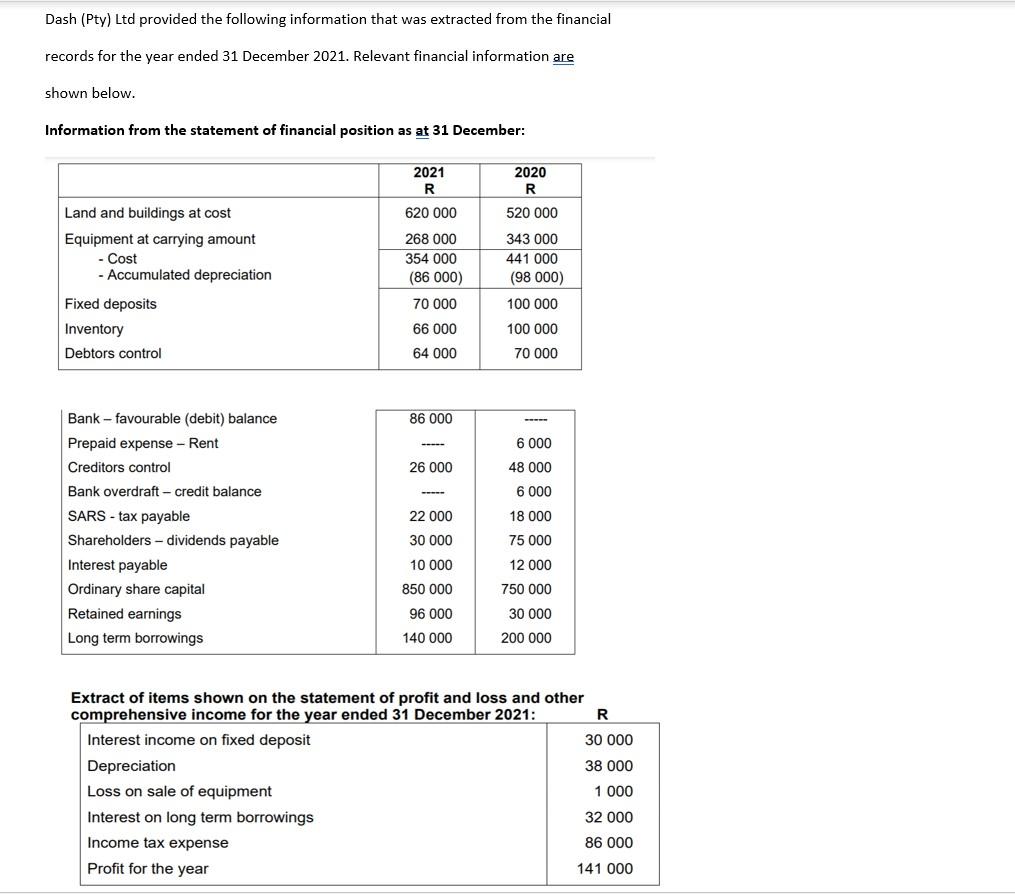

Additional information: 1. Inventory is disclosed at cost.2. Land has not been revalued in the current financial year. 3. An extension was added to the building and completed in the current financial year All building costs were paid for in cash. Buildings are not depreciated.4. Interest on the long term loan is not capitalized 5. No equipment was purchased during the current financial year but some equipment was sold during the year for cash. 6. Dividends for the year as shown in the statement of changes in equity was R75 000. Required: Prepare the statement of cash flows of Dash (Pty) Ltd for the year ended 31 December 2021 to comply with the International Financial Reporting Standards (IFRS) in as much as the above information allows. Use the indirect method. Comparative figures are not required. QUESTION THREE [20] Kane and Abel are in partnership sharing profits and losses in the ratio of 1:1. The following relates to their business Two Wheels whereby they sell motor bikes. Their dealership is popular with many motor-bike enthusiasts. The list of balances at 28 February 2022 before relevant additional information was taken into account is as follows: Capital: Kane 400 000 600 000 Capital; Abel Current account - Kane (1 March 2021) - Debit 44 000 130 000 Current account - Abel (1 March 2021) - Credit Drawings - Kane 90 900 Drawings - Abel 87 960 Profit and loss account - profit for the year 1 084 800 Additional information: 1 On 1 September 2021, Abel contributed a further R100 000 as capital into the partnership. The transaction has been recorded correctly. 2. The partnership agreement stipulates the following 2.1 Partners are entitled to salaries as follows: Kane is entitled to R18 000 per month. From 1 December 2020 his salary must be increased to R20 000 per month, Abel is entitled to a salary of R14 000 per month. 2.2 Interest on capital must be provided at 12% per year. 2.3 Interest on current accounts must be provided at 5% per year on current account balances at the beginning of the year (1 March). 2.4 Kane is entitled to a bonus equal to 10% of the profit for the year before any appropriation is made in terms of the partnership agreement. 2.5 Kane and Abel share profits and losses equally. 3 During the year R144 000 and R96 000 were paid as salaries to Kane and Abel respectively. These amounts were credited to the bank account but incorrectly debited to the debtors' control account. Correction is required. Required: Prepare a statement of changes in equity for the year ended 28 February 2022 for Two Wheels that is appropriate to the business of the partnership QUESTION FOUR [15] Bling Ltd was registered on 1 March 2021 with the following authorised share capital: - 900 000 Ordinary shares (Class A) - 400 000 9% preference shares of R5 each (Class B) The following transactions took place for the financial year ended 28 February 2022: 2021 3 March The company offered 100 000 ordinary shares at R2,00 each and 20 000 9% preference shares to the subscribers to the memorandum (founders of the company). The founders took up the offer in full and paid for the shares immediately. 11 March The company offered 200 000 ordinary shares at R2,00 each to the public. The closing date for applications was 10 May 2021. 10 May Applications for 210 000 shares were received from the public with application monies and the regulatory application documents. 1 June Shares were allotted to successful applicants. Unsuccessful applicants were repaid. 8 June 2022 21 January Directors presented a proposal to declare a dividend of 10 cents per share payable on 28 February 2022. Shareholders approved the proposal at the annual general meeting on 21 January 2022. 28 February The dividends were paid as approved. Required: Record the above transactions in the general journal of Bling Ltd for the financial year ended 28 February 2022. (15) NB: Record the date and a brief narration for each journal entry. Dash (Pty) Ltd provided the following information that was extracted from the financial records for the year ended 31 December 2021. Relevant financial information are shown below. Information from the statement of financial position as at 31 December: 2021 2020 R R Land and buildings at cost 620 000 520 000 Equipment at carrying amount 268 000 343 000 - Cost 354 000 441 000 - Accumulated depreciation (86 000) (98 000) Fixed deposits 70 000 100 000 Inventory 66 000 100 000 Debtors control 64 000 70 000 Bank - favourable (debit) balance 86 000 ---- Prepaid expense - Rent 6 000 Creditors control 26 000 48 000 Bank overdraft - credit balance 6 000 SARS-tax payable 22 000 18 000 Shareholders dividends payable 30 000 75 000 Interest payable 10 000 12 000 Ordinary share capital 850 000 750 000 Retained earnings 96 000 30 000 Long term borrowings 140 000 200 000 Extract of items shown on the statement of profit and loss and other comprehensive income for the year ended 31 December 2021: R Interest income on fixed deposit 30 000 Depreciation 38 000 Loss on sale of equipment 1 000 Interest on long term borrowings 32 000 Income tax expense 86 000 Profit for the year 141 000 1. Extracted from the Pre-Adjustment Trial Balance at 30 June 2021: R Fixed deposit 160 000 Inventory: Trade goods 219 800 Debtors control 39 090 Machinery 224 000 Accumulated depreciation: Machinery 130 000 Long term borrowing: Finhouse 281 200 Sales 1 680 000 Debtors allowances 17 000 Cost of sales 1 050 000 Service fee income (in respect of repair services) 297 140 Rent income 105 000 11 200 Interest income Salaries and wages 294 640 Audit fees 30 000 Directors fees 230 000 Consumable stores 51 100 Bank charges 5 240 Travel and entertainment - Directors 15 910 30 June 2021 reflects the following: Balance on 1 July 2020 Interest charged Monthly instalments of R4 300 x 12 paid Balance on 30 June 2021 FINHOUSE Loan statement at 30 June 2021 R332 800 ? R 51 600 R326 000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started