Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION ONE: [25] Keep Trying Inc. has grown tremendously in the past few years, with most clients requesting/requiring an audit of their annual financial statements.

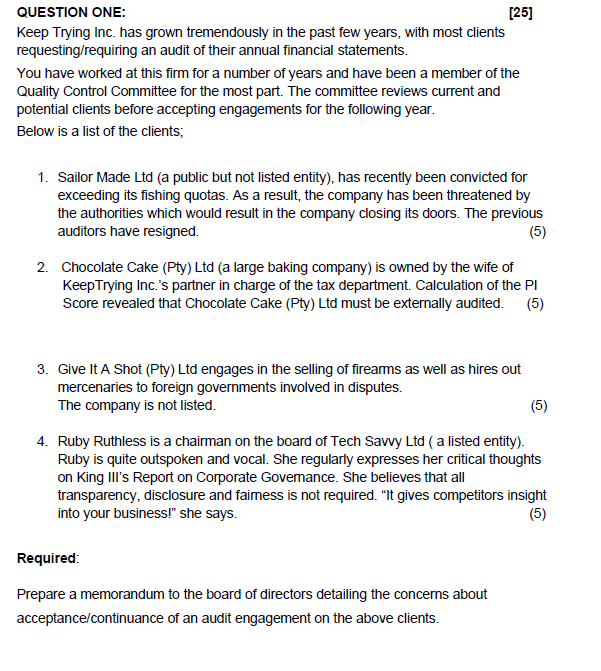

QUESTION ONE: [25] Keep Trying Inc. has grown tremendously in the past few years, with most clients requesting/requiring an audit of their annual financial statements. You have worked at this firm for a number of years and have been a member of the Quality Control Committee for the most part. The committee reviews current and potential clients before accepting engagements for the following year. Below is a list of the clients; 1. Sailor Made Ltd (a public but not listed entity), has recently been convicted for exceeding its fishing quotas. As a result, the company has been threatened by the authorities which would result in the company closing its doors. The previous auditors have resigned. 2. Chocolate Cake (Pty) Ltd (a large baking company) is owned by the wife of KeepTrying Inc.'s partner in charge of the tax department. Calculation of the PI Score revealed that Chocolate Cake (Pty) Ltd must be externally audited. (5) 3. Give It A Shot (Pty) Ltd engages in the selling of firearms as well as hires out mercenaries to foreign governments involved in disputes. The company is not listed. 4. Ruby Ruthless is a chairman on the board of Tech Savvy Ltd ( a listed entity). Ruby is quite outspoken and vocal. She regularly expresses her critical thoughts on King III's Report on Corporate Governance. She believes that all transparency, disclosure and faimess is not required. "It gives competitors insight into your business!" she says. Required: Prepare a memorandum to the board of directors detailing the concerns about acceptance/continuance of an audit engagement on the above clients

QUESTION ONE: [25] Keep Trying Inc. has grown tremendously in the past few years, with most clients requesting/requiring an audit of their annual financial statements. You have worked at this firm for a number of years and have been a member of the Quality Control Committee for the most part. The committee reviews current and potential clients before accepting engagements for the following year. Below is a list of the clients; 1. Sailor Made Ltd (a public but not listed entity), has recently been convicted for exceeding its fishing quotas. As a result, the company has been threatened by the authorities which would result in the company closing its doors. The previous auditors have resigned. 2. Chocolate Cake (Pty) Ltd (a large baking company) is owned by the wife of KeepTrying Inc.'s partner in charge of the tax department. Calculation of the PI Score revealed that Chocolate Cake (Pty) Ltd must be externally audited. (5) 3. Give It A Shot (Pty) Ltd engages in the selling of firearms as well as hires out mercenaries to foreign governments involved in disputes. The company is not listed. 4. Ruby Ruthless is a chairman on the board of Tech Savvy Ltd ( a listed entity). Ruby is quite outspoken and vocal. She regularly expresses her critical thoughts on King III's Report on Corporate Governance. She believes that all transparency, disclosure and faimess is not required. "It gives competitors insight into your business!" she says. Required: Prepare a memorandum to the board of directors detailing the concerns about acceptance/continuance of an audit engagement on the above clients Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started