Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION ONE [30] Harambee manufacturing (PTY) Limited is a company that produces industrial paints. Since the beginning of 2019, the products have been marketed

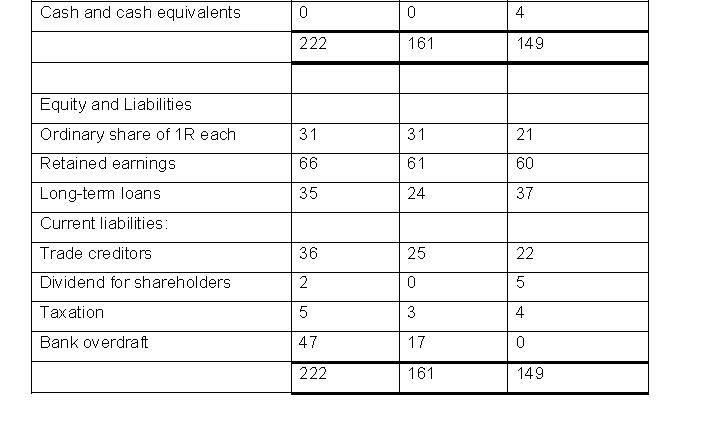

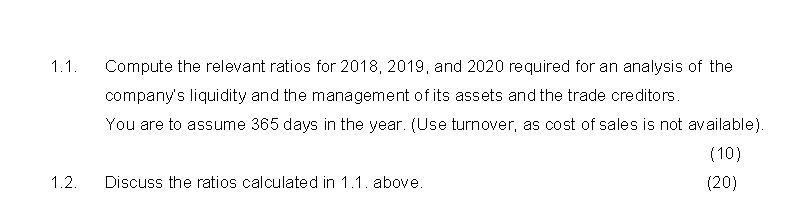

QUESTION ONE [30] Harambee manufacturing (PTY) Limited is a company that produces industrial paints. Since the beginning of 2019, the products have been marketed mainly through Independent regional distributors instead of directly to completed product users, which was the previous policy. Your own company, which has substantial resources, is the major user of this products. We have recently been asked by the financial director of Harambee Limited whether your company will be willing to provide short-term loan finance at current market rates. You have been given access to the account of Harambee for the past three years extract those accounts are shown below. 2020 Rm Turnover 200 Statement of financial position as at 31 December 2020 Rm Assets Property, plant, and equipment 83 Current assets: Inventory Trade debtors Other receivables 2019 Rm 176 82 55 2 2019 Rm 63 55 42 1 2018 Rm 175 2018 Rm 60 50 33 2 Cash and cash equivalents Equity and Liabilities Ordinary share of 1R each Retained earnings Long-term loans Current liabilities: Trade creditors Dividend for shareholders Taxation Bank overdraft 0 222 31 66 35 36 2 5 47 222 0 161 31 61 24 25 0 3 17 161 + 149 21 60 37 22 5 4 0 149 1.1. 1.2. Compute the relevant ratios for 2018, 2019, and 2020 required for an analysis of the company's liquidity and the management of its assets and the trade creditors. You are to assume 365 days in the year. (Use turnover, as cost of sales is not available). (10) (20) Discuss the ratios calculated in 1.1. above.

Step by Step Solution

★★★★★

3.58 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Liquidty ratios Current Ratio 2020 386 2019 392 2018 386 AVERAGE ACC Rec Turnover ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started