Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION ONE a. Gidimadjor Ltd, a Hotel Business realized 15% gain on sales of its Land. The accountant approached you for explanation on the treatment

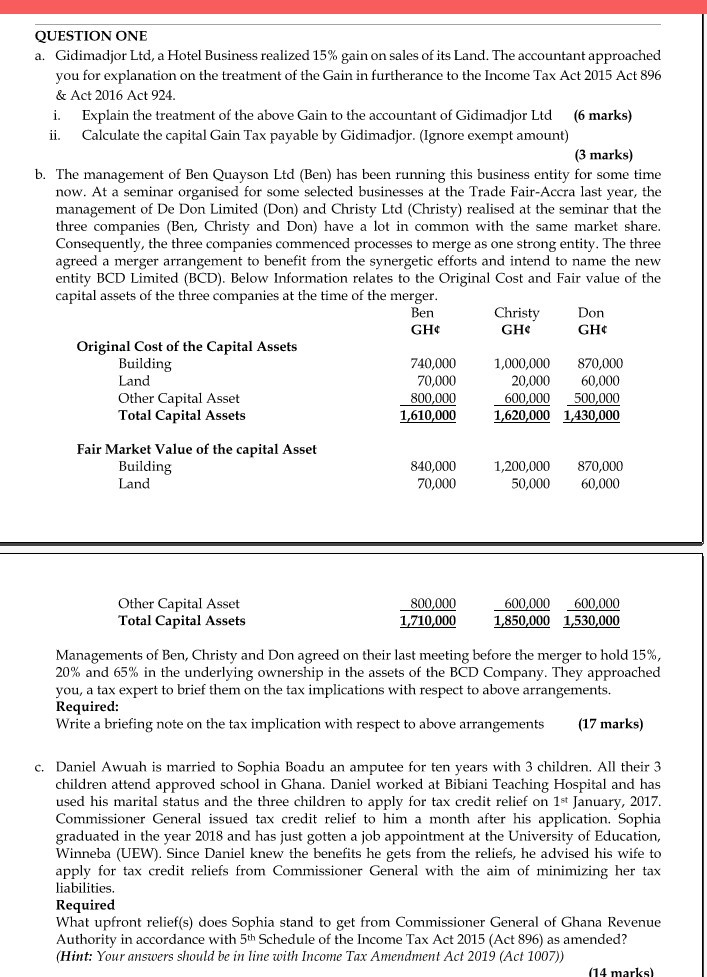

QUESTION ONE a. Gidimadjor Ltd, a Hotel Business realized 15% gain on sales of its Land. The accountant approached you for explanation on the treatment of the Gain in furtherance to the Income Tax Act 2015 Act 896 & Act 2016 Act 924. i. Explain the treatment of the above Gain to the accountant of Gidimadjor Ltd (6 marks) ii. Calculate the capital Gain Tax payable by Gidimadjor. (Ignore exempt amount) (3 marks) b. The management of Ben Quayson Ltd (Ben) has been running this business entity for some time now. At a seminar organised for some selected businesses at the Trade Fair-Accra last year, the management of De Don Limited (Don) and Christy Ltd (Christy) realised at the seminar that the three companies (Ben, Christy and Don) have a lot in common with the same market share. Consequently, the three companies commenced processes to merge as one strong entity. The three agreed a merger arrangement to benefit from the synergetic efforts and intend to name the new entity BCD Limited (BCD). Below Information relates to the Original Cost and Fair value of the capital assets of the three companies at the time of the merger. Ben Christy Don GH GHC GH Original Cost of the Capital Assets Building 740,000 1,000,000 870,000 Land 70,000 20,000 60,000 Other Capital Asset 800,000 600,000 500,000 Total Capital Assets 1,610,000 1,620,000 1,430,000 Fair Market Value of the capital Asset Building Land 840,000 70,000 1,200,000 50,000 870,000 60,000 800,000 Other Capital Asset Total Capital Assets 600,000 600,000 1,850,000 1,530,000 1,710,000 Managements of Ben, Christy and Don agreed on their last meeting before the merger to hold 15%, 20% and 65% in the underlying ownership in the assets of the BCD Company. They approached you, a tax expert to brief them on the tax implications with respect to above arrangements. Required: Write a briefing note on the tax implication with respect to above arrangements (17 marks) c. Daniel Awuah is married to Sophia Boadu an amputee for ten years with 3 children. All their 3 children attend approved school in Ghana. Daniel worked at Bibiani Teaching Hospital and has used his marital status and the three children to apply for tax credit relief on 1st January, 2017 Commissioner General issued tax credit relief to him a month after his application. Sophia graduated in the year 2018 and has just gotten a job appointment at the University of Education, Winneba (UEW). Since Daniel knew the benefits he gets from the reliefs, he advised his wife to apply for tax credit reliefs from Commissioner General with the aim of minimizing her tax liabilities. Required What upfront relief(s) does Sophia stand to get from Commissioner General of Ghana Revenue Authority in accordance with 5th Schedule of the Income Tax Act 2015 (Act 896) as amended? (Hint: Your answers should be in line with Income Tax Amendment Act 2019 (Act 1007)) (14 marks) QUESTION ONE a. Gidimadjor Ltd, a Hotel Business realized 15% gain on sales of its Land. The accountant approached you for explanation on the treatment of the Gain in furtherance to the Income Tax Act 2015 Act 896 & Act 2016 Act 924. i. Explain the treatment of the above Gain to the accountant of Gidimadjor Ltd (6 marks) ii. Calculate the capital Gain Tax payable by Gidimadjor. (Ignore exempt amount) (3 marks) b. The management of Ben Quayson Ltd (Ben) has been running this business entity for some time now. At a seminar organised for some selected businesses at the Trade Fair-Accra last year, the management of De Don Limited (Don) and Christy Ltd (Christy) realised at the seminar that the three companies (Ben, Christy and Don) have a lot in common with the same market share. Consequently, the three companies commenced processes to merge as one strong entity. The three agreed a merger arrangement to benefit from the synergetic efforts and intend to name the new entity BCD Limited (BCD). Below Information relates to the Original Cost and Fair value of the capital assets of the three companies at the time of the merger. Ben Christy Don GH GHC GH Original Cost of the Capital Assets Building 740,000 1,000,000 870,000 Land 70,000 20,000 60,000 Other Capital Asset 800,000 600,000 500,000 Total Capital Assets 1,610,000 1,620,000 1,430,000 Fair Market Value of the capital Asset Building Land 840,000 70,000 1,200,000 50,000 870,000 60,000 800,000 Other Capital Asset Total Capital Assets 600,000 600,000 1,850,000 1,530,000 1,710,000 Managements of Ben, Christy and Don agreed on their last meeting before the merger to hold 15%, 20% and 65% in the underlying ownership in the assets of the BCD Company. They approached you, a tax expert to brief them on the tax implications with respect to above arrangements. Required: Write a briefing note on the tax implication with respect to above arrangements (17 marks) c. Daniel Awuah is married to Sophia Boadu an amputee for ten years with 3 children. All their 3 children attend approved school in Ghana. Daniel worked at Bibiani Teaching Hospital and has used his marital status and the three children to apply for tax credit relief on 1st January, 2017 Commissioner General issued tax credit relief to him a month after his application. Sophia graduated in the year 2018 and has just gotten a job appointment at the University of Education, Winneba (UEW). Since Daniel knew the benefits he gets from the reliefs, he advised his wife to apply for tax credit reliefs from Commissioner General with the aim of minimizing her tax liabilities. Required What upfront relief(s) does Sophia stand to get from Commissioner General of Ghana Revenue Authority in accordance with 5th Schedule of the Income Tax Act 2015 (Act 896) as amended? (Hint: Your answers should be in line with Income Tax Amendment Act 2019 (Act 1007)) (14 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started