Answered step by step

Verified Expert Solution

Question

1 Approved Answer

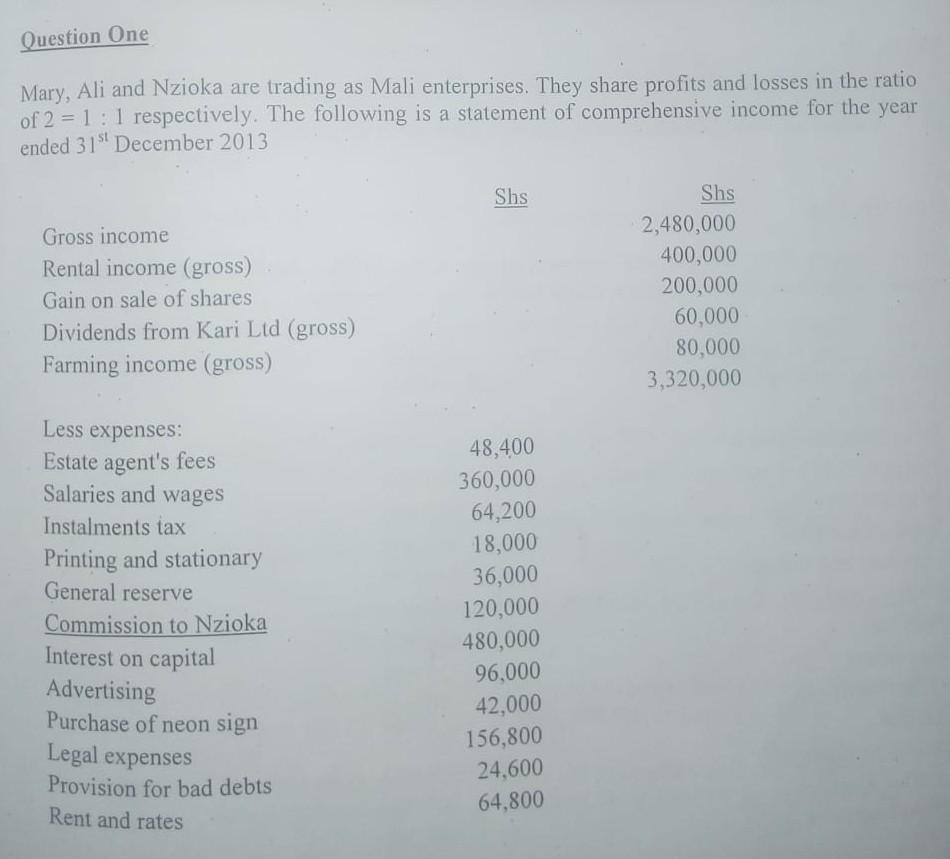

Question One Mary, Ali and Nzioka are trading as Mali enterprises. They share profits and losses in the ratio of 2 = 1 : 1

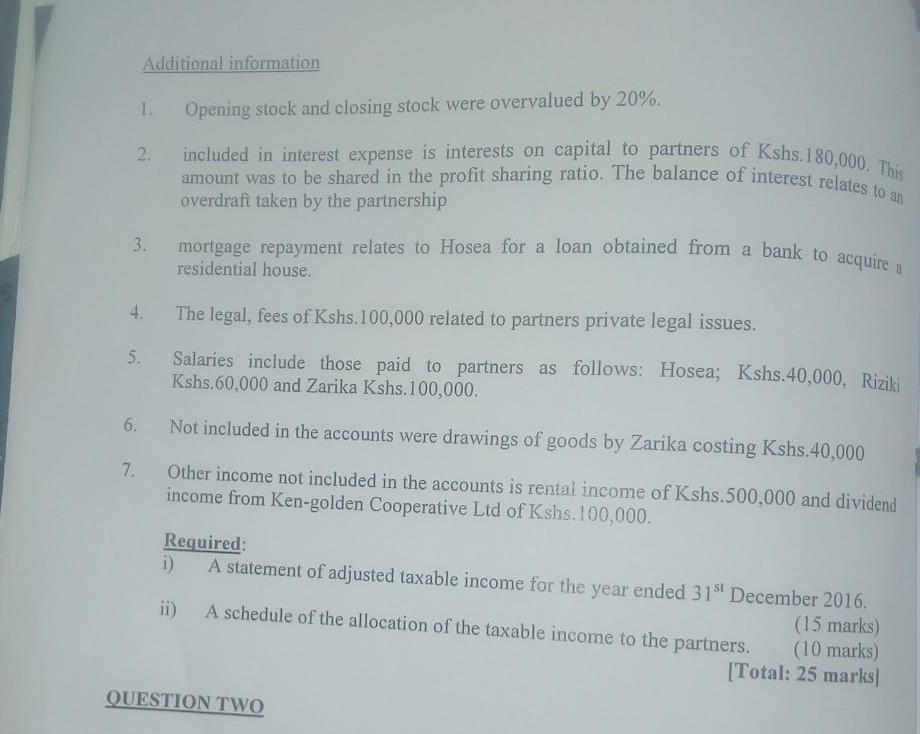

Question One Mary, Ali and Nzioka are trading as Mali enterprises. They share profits and losses in the ratio of 2 = 1 : 1 respectively. The following is a statement of comprehensive income for the year ended 31 December 2013 Shs Gross income Rental income (gross) Gain on sale of shares Dividends from Kari Ltd (gross) Farming income (gross) Shs 2,480,000 400,000 200,000 60,000 80,000 3,320,000 Less expenses: Estate agent's fees Salaries and wages Instalments tax Printing and stationary General reserve Commission to Nzioka Interest on capital Advertising Purchase of neon sign Legal expenses Provision for bad debts Rent and rates 48,400 360,000 64,200 18,000 36,000 120,000 480,000 96,000 42,000 156,800 24,600 64,800 Additional information 1. Opening stock and closing stock were overvalued by 20%. 2. amount was to be shared in the profit sharing ratio. The balance of interest relates to an included in interest expense is interests on capital to partners of Kshs. 180,000. This overdraft taken by the partnership 3. mortense , repayment relates to Hosea for a loan obtained from a bank to acquire a 4. The legal, fees of Kshs. 100,000 related to partners private legal issues. 5. Salaries include those paid to partners as follows: Hosea; Kshs.40,000, Riziki Kshs.60,000 and Zarika Kshs. 100,000, 6. Not included in the accounts were drawings of goods by Zarika costing Kshs.40,000 7. Other income not included in the accounts is rental income of Kshs.500,000 and dividend income from Ken-golden Cooperative Ltd of Kshs. 100,000. Required: i) A statement of adjusted taxable income for the year ended 31st December 2016. ii) A schedule of the allocation of the taxable income to the partners. (15 marks) (10 marks) [Total: 25 marks] QUESTION TWO Question One Mary, Ali and Nzioka are trading as Mali enterprises. They share profits and losses in the ratio of 2 = 1 : 1 respectively. The following is a statement of comprehensive income for the year ended 31 December 2013 Shs Gross income Rental income (gross) Gain on sale of shares Dividends from Kari Ltd (gross) Farming income (gross) Shs 2,480,000 400,000 200,000 60,000 80,000 3,320,000 Less expenses: Estate agent's fees Salaries and wages Instalments tax Printing and stationary General reserve Commission to Nzioka Interest on capital Advertising Purchase of neon sign Legal expenses Provision for bad debts Rent and rates 48,400 360,000 64,200 18,000 36,000 120,000 480,000 96,000 42,000 156,800 24,600 64,800 Additional information 1. Opening stock and closing stock were overvalued by 20%. 2. amount was to be shared in the profit sharing ratio. The balance of interest relates to an included in interest expense is interests on capital to partners of Kshs. 180,000. This overdraft taken by the partnership 3. mortense , repayment relates to Hosea for a loan obtained from a bank to acquire a 4. The legal, fees of Kshs. 100,000 related to partners private legal issues. 5. Salaries include those paid to partners as follows: Hosea; Kshs.40,000, Riziki Kshs.60,000 and Zarika Kshs. 100,000, 6. Not included in the accounts were drawings of goods by Zarika costing Kshs.40,000 7. Other income not included in the accounts is rental income of Kshs.500,000 and dividend income from Ken-golden Cooperative Ltd of Kshs. 100,000. Required: i) A statement of adjusted taxable income for the year ended 31st December 2016. ii) A schedule of the allocation of the taxable income to the partners. (15 marks) (10 marks) [Total: 25 marks] QUESTION TWO

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started