Answered step by step

Verified Expert Solution

Question

1 Approved Answer

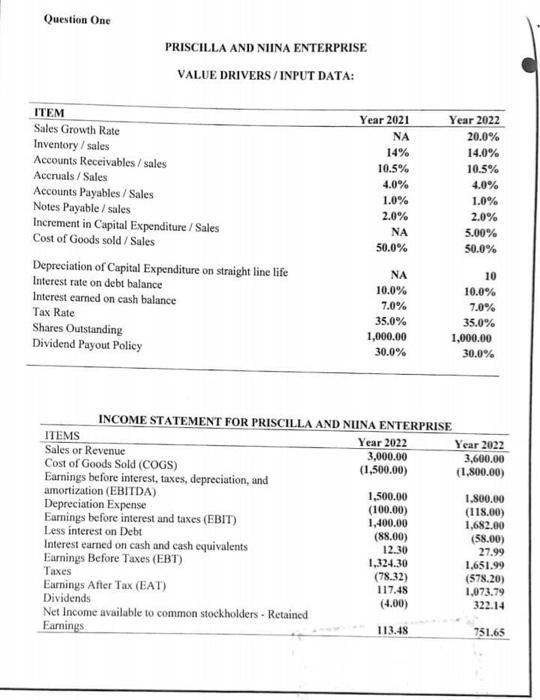

Question One PRISCILLA AND NIINA ENTERPRISE VALUE DRIVERS/INPUT DATA: ITEM Sales Growth Rate Inventory / sales Accounts Receivables/ sales Accruals/Sales Accounts Payables/ Sales Notes

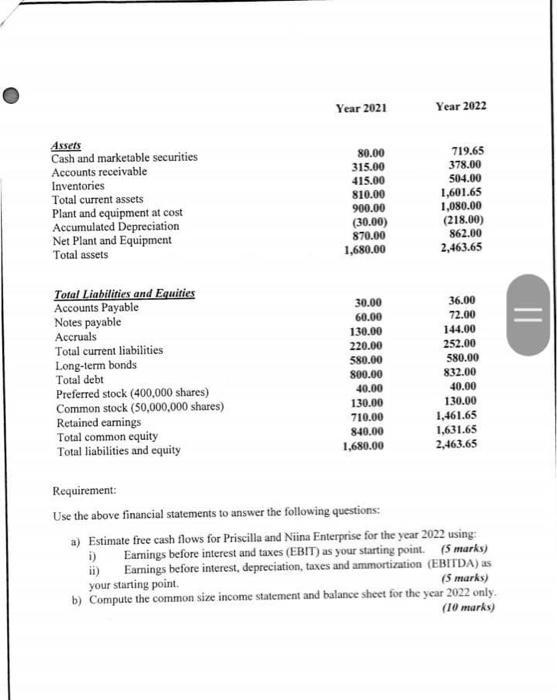

Question One PRISCILLA AND NIINA ENTERPRISE VALUE DRIVERS/INPUT DATA: ITEM Sales Growth Rate Inventory / sales Accounts Receivables/ sales Accruals/Sales Accounts Payables/ Sales Notes Payable/ sales Increment in Capital Expenditure / Sales Cost of Goods sold/Sales Depreciation of Capital Expenditure on straight line life Interest rate on debt balance Interest earned on cash balance Tax Rate Shares Outstanding Dividend Payout Policy ITEMS Sales or Revenue Cost of Goods Sold (COGS) Earnings before interest, taxes, depreciation, and amortization (EBITDA) Depreciation Expense Earnings before interest and taxes (EBIT) Less interest on Debt Interest earned on cash and cash equivalents Earnings Before Taxes (EBT) Taxes Year 2021 14% 10.5% 4.0% 1.0% 2.0% NA 50.0% INCOME STATEMENT FOR PRISCILLA AND NIINA ENTERPRISE Year 2022 3,000.00 (1,500.00) Earnings After Tax (EAT) Dividends Net Income available to common stockholders - Retained Earnings 10.0% 7.0% 35.0% 1,000.00 30.0% 1,500.00 (100.00) 1,400.00 (88.00) 12.30 1,324.30 (78.32) 117.48 (4.00) Year 2022 20.0% 14.0% 10.5% 4.0% 1.0% 2.0% 113.48 5.00% 50.0% 10 10.0% 7.0% 35.0% 1,000.00 30.0% Year 2022 3,600.00 (1,800.00) 1,800.00 (118.00) 1,682,00 (58.00) 27.99 1,651.99 (578.20) 1,073.79 322.14 751.65 Assets Cash and marketable securities Accounts receivable Inventories Total current assets Plant and equipment at cost Accumulated Depreciation Net Plant and Equipment Total assets Total Liabilities and Equities Accounts Payable Notes payable Accruals Total current liabilities Long-term bonds Total debt Preferred stock (400,000 shares) Common stock (50,000,000 shares) Retained earnings Tot common equity Total liabilities and equity Year 2021 80.00 315.00 415.00 810.00 900.00 (30.00) 870.00 1,680.00 30.00 60.00 130.00 220.00 580.00 800.00 40.00 130.00 710.00 840.00 1,680.00 Year 2022 719.65 378.00 504.00 1,601.65 1,080.00 (218.00) 862.00 2,463.65 36.00 72.00 144.00 252.00 580.00 832.00 40.00 130.00 1,461.65 1,631.65 2,463.65 Requirement: Use the above financial statements to answer the following questions: a) Estimate free cash flows for Priscilla and Niina Enterprise for the year 2022 using: Earnings before interest and taxes (EBIT) as your starting point. (5 marks) i) ii) Earnings before interest, depreciation, taxes and ammortization (EBITDA) as (5 marks) your starting point. b) Compute the common size income statement and balance sheet for the year 2022 only. (10 marks) ||

Step by Step Solution

★★★★★

3.39 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

a i Free Cash Flow FCF using EBIT EBIT 140000 Depreciation 11800 Taxes 7832 Capital Expenditures 220...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started