Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION ONE The cost price of the opening stock was R 9 5 0 0 0 0 and the market value was R 9 2

QUESTION ONE The cost price of the opening stock was R and the market value was R as on

March The cost price of the closing stock was R and the market value was

R on February

The following bad debts were written off during the current year of assessment:

Trade debtors R

Loan to a supplier R

The company entered into registered learnership agreements that fulfil all the section H

criteria with Kimmy Vokes and Luya Kabada.

Kimmy Vokes was employed on September as a 'learner' on a fulltime basis, with a level

NQF qualification. This qualification will be required to be completed at the end of two years.

Luya Kabada a disabled person was registered as a 'learner' on a parttime basis on March

with a level NQF qualification. In terms of the registered learnership agreement, the

learnership will be completed at the end of months. also contributed R towards the provident fund on behalf of the company's employees.

Legal expenses were incurred as follows:

Drafting of a restraint of trade agreement amounting to R for an employee who had

resigned to start his own business.

The balance of the expenses relate to collection of outstanding trade debtors.

The company paid an annuity of R to an exemployee who retired at years of age

during the current year of assessment.

Included in repairs and maintenance expenditure is an amount of R paid to the night guard

for repairing the electrical fencing that was damaged in a severe thunderstorm.

On January the company granted shares to of its permanent staff at no

consideration. The market value per share was R on the date that the shares were offered and

they carry no restrictions. The plan in terms of which the shares were issued by the company

qualifies as a broadbased employee share plan in terms of section B

The full payment was made to the former operations manager on December for agreeing

not to start a business in South Africa within a period of five years. On April a new manufacturing machine was acquired which was brought into use on

June The company elects the Section C writeoff allowance.

Required:

Calculate in detail Turden Pty Ltds taxable income for the year ended February

Show all workings and full explanations where applicable.

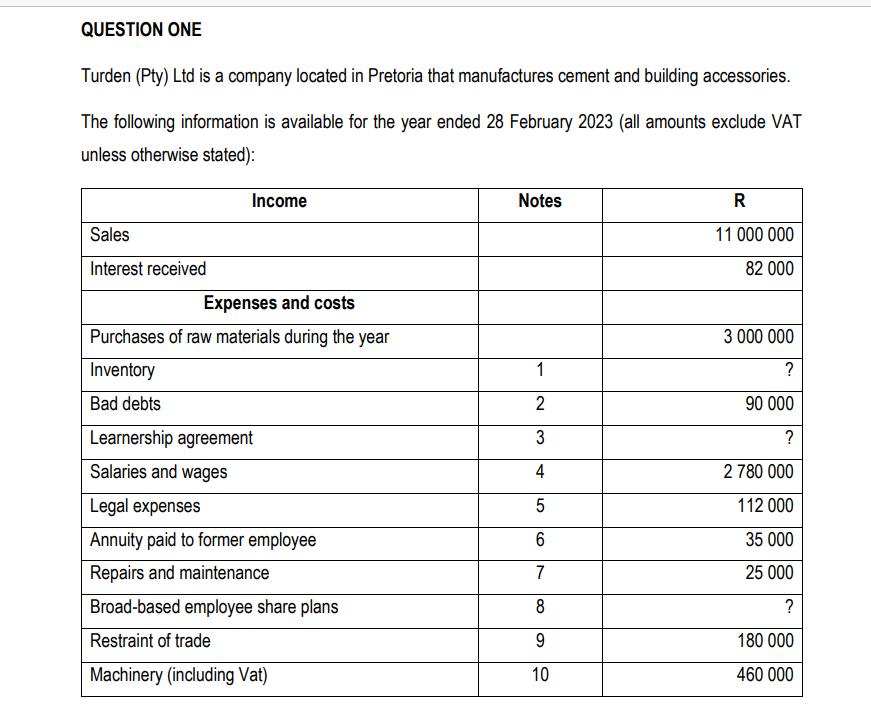

Turden Pty Ltd is a company located in Pretoria that manufactures cement and building accessories.

The following information is available for the year ended February all amounts exclude VAT

unless otherwise stated:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started