Question

QUESTION ONE The draft financial statements of Makeni Plc., Roads Co and Kuku Co as at 31 December 2022 are as follows: [Check table in

QUESTION ONE

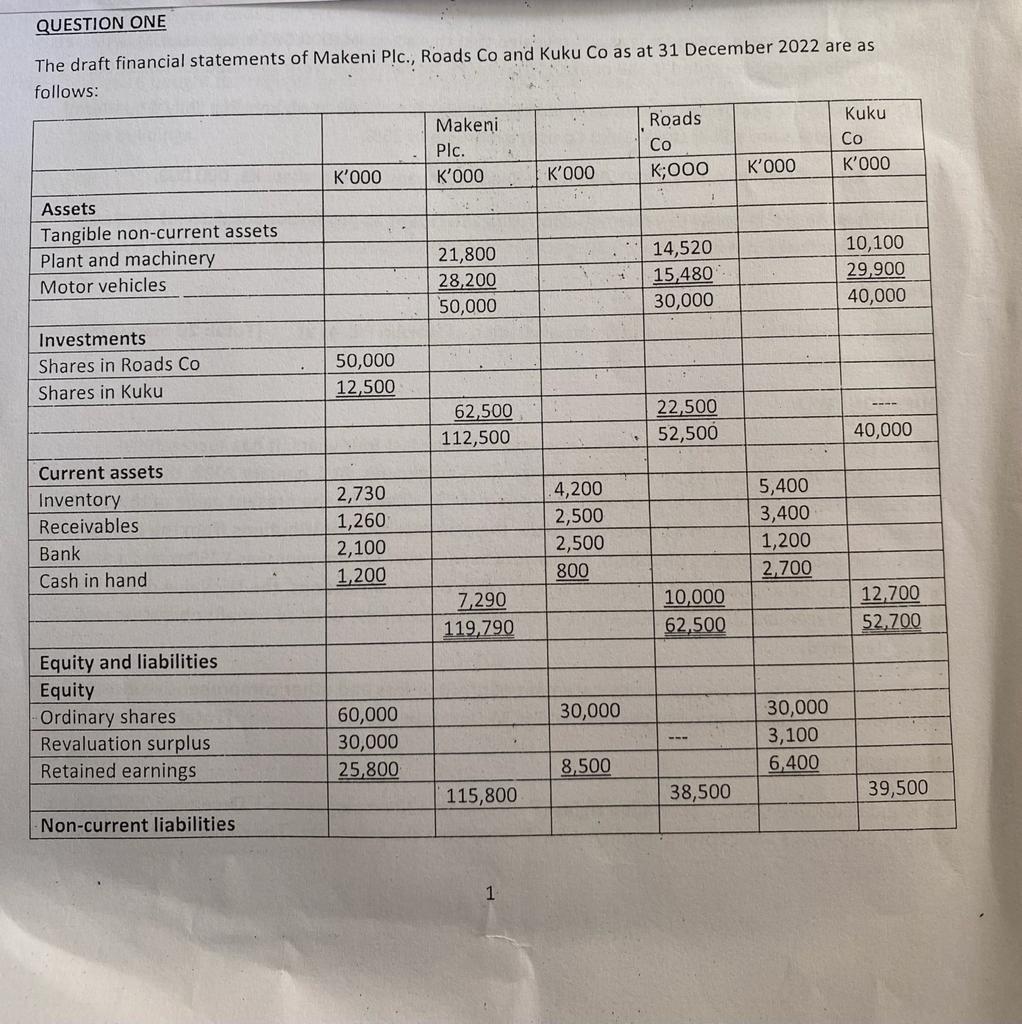

The draft financial statements of Makeni Plc., Roads Co and Kuku Co as at 31 December 2022 are as follows:

[Check table in image]

Notes:

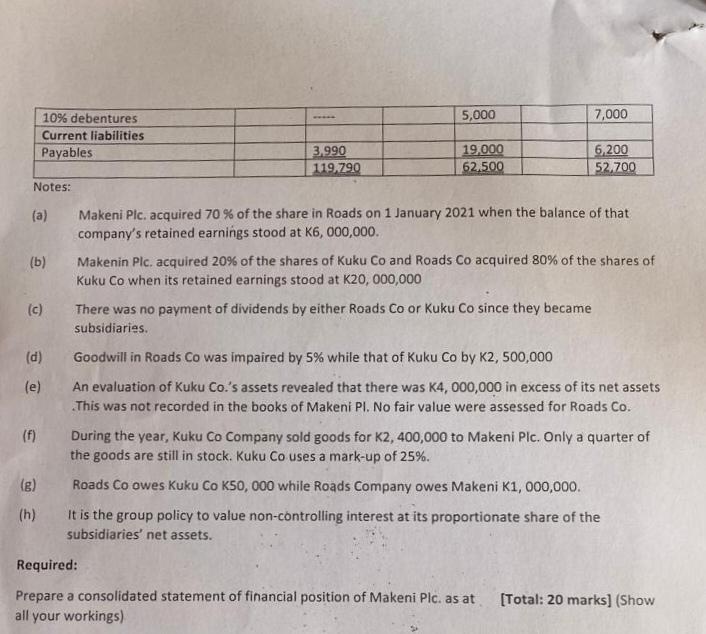

(a) Makeni Plc. acquired 70 % of the share in Roads on 1 January 2021 when the balance of that company's retained earnings stood at K6,000,000.

(b)There was no payment of dividends by either Roads Co or Kuku Co since they became subsidiaries.

(c) Goodwill in Roads Co was impaired by 5% while that of Kuku Co by K2, 500,000

(d) Makenin Plc. acquired 20% of the shares of Kuku Co and Roads Co acquired 80% of the shares of Kuku Co when its retained earnings stood at K20,000,000

(e) An evaluation of Kuku Co.'s assets revealed that there was K4, 000,000 in excess of its net assets .This was not recorded in the books of Makeni Pl. No fair value were assessed for Roads Co.

(f) During the year, Kuku Co Company sold goods for K2, 400,000 to Makeni Plc. Only a quarter of the goods are still in stock. Kuku Co uses a mark-up of 25%.

(g) Roads Co owes Kuku Co K50, 000 while Roads Company owes Makeni K1, 000,000.

(h) It is the group policy to value non-controlling interest at its proportionate share of these subsidiaries' net assets.

Required:

Prepare a consolidated statement of financial position of Makeni Plc. as at 31st December 2022

QUESTION ONE The draft financial statements of Makeni Plc., Roads Co and Kuku Co as at 31 December 2022 are as follows: Makeni Plc. Roads Co Kuku Co K'000 K'000 K'000 K'000 K;000 K'000 Assets Tangible non-current assets 10,100 Plant and machinery 21,800 14,520 29,900 Motor vehicles 15,480 28,200 50,000 30,000 40,000 Investments Shares in Roads Co Shares in Kuku 22,500 ---- 52,500 40,000 Current assets Inventory Receivables Bank Cash in hand 12,700 52,700 Equity and liabilities Equity Ordinary shares Revaluation surplus Retained earnings 39,500 Non-current liabilities 50,000 12,500 2,730 1,260 2,100 1,200 60,000 30,000 25,800 62,500 112,500 7,290 119,790 115,800 1 4,200 2,500 2,500 800 30,000 8,500 10,000 62,500 www 38,500 5,400 3,400 1,200 2,700 30,000 3,100 6,400 10% debentures 5,000 7,000 Current liabilities Payables 19,000 6,200 3,990 119,790 62.500 52,700 Notes: (a) Makeni Plc. acquired 70 % of the share in Roads on 1 January 2021 when the balance of that company's retained earnings stood at K6, 000,000. (b) Makenin Plc. acquired 20% of the shares of Kuku Co and Roads Co acquired 80% of the shares of Kuku Co when its retained earnings stood at K20,000,000 (c) There was no payment of dividends by either Roads Co or Kuku Co since they became subsidiaries. (d) Goodwill in Roads Co was impaired by 5% while that of Kuku Co by K2, 500,000 (e) An evaluation of Kuku Co.'s assets revealed that there was K4, 000,000 in excess of its net assets This was not recorded in the books of Makeni Pl. No fair value were assessed for Roads Co. (f) During the year, Kuku Co Company sold goods for K2, 400,000 to Makeni Plc. Only a quarter of the goods are still in stock. Kuku Co uses a mark-up of 25%. (g) Roads Co owes Kuku Co K50, 000 while Roads Company owes Makeni K1, 000,000. (h) It is the group policy to value non-controlling interest at its proportionate share of the subsidiaries' net assets. Required: Prepare a consolidated statement of financial position of Makeni Plc. as at all your workings) [Total: 20 marks] (Show QUESTION ONE The draft financial statements of Makeni Plc., Roads Co and Kuku Co as at 31 December 2022 are as follows: Makeni Plc. Roads Co Kuku Co K'000 K'000 K'000 K'000 K;000 K'000 Assets Tangible non-current assets 10,100 Plant and machinery 21,800 14,520 29,900 Motor vehicles 15,480 28,200 50,000 30,000 40,000 Investments Shares in Roads Co Shares in Kuku 22,500 ---- 52,500 40,000 Current assets Inventory Receivables Bank Cash in hand 12,700 52,700 Equity and liabilities Equity Ordinary shares Revaluation surplus Retained earnings 39,500 Non-current liabilities 50,000 12,500 2,730 1,260 2,100 1,200 60,000 30,000 25,800 62,500 112,500 7,290 119,790 115,800 1 4,200 2,500 2,500 800 30,000 8,500 10,000 62,500 www 38,500 5,400 3,400 1,200 2,700 30,000 3,100 6,400 10% debentures 5,000 7,000 Current liabilities Payables 19,000 6,200 3,990 119,790 62.500 52,700 Notes: (a) Makeni Plc. acquired 70 % of the share in Roads on 1 January 2021 when the balance of that company's retained earnings stood at K6, 000,000. (b) Makenin Plc. acquired 20% of the shares of Kuku Co and Roads Co acquired 80% of the shares of Kuku Co when its retained earnings stood at K20,000,000 (c) There was no payment of dividends by either Roads Co or Kuku Co since they became subsidiaries. (d) Goodwill in Roads Co was impaired by 5% while that of Kuku Co by K2, 500,000 (e) An evaluation of Kuku Co.'s assets revealed that there was K4, 000,000 in excess of its net assets This was not recorded in the books of Makeni Pl. No fair value were assessed for Roads Co. (f) During the year, Kuku Co Company sold goods for K2, 400,000 to Makeni Plc. Only a quarter of the goods are still in stock. Kuku Co uses a mark-up of 25%. (g) Roads Co owes Kuku Co K50, 000 while Roads Company owes Makeni K1, 000,000. (h) It is the group policy to value non-controlling interest at its proportionate share of the subsidiaries' net assets. Required: Prepare a consolidated statement of financial position of Makeni Plc. as at all your workings) [Total: 20 marks] (ShowStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started