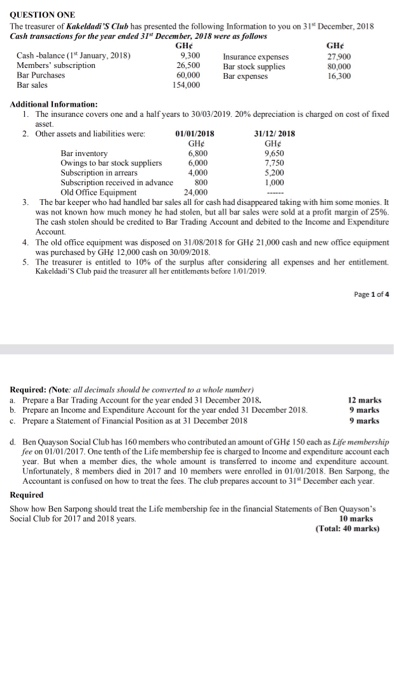

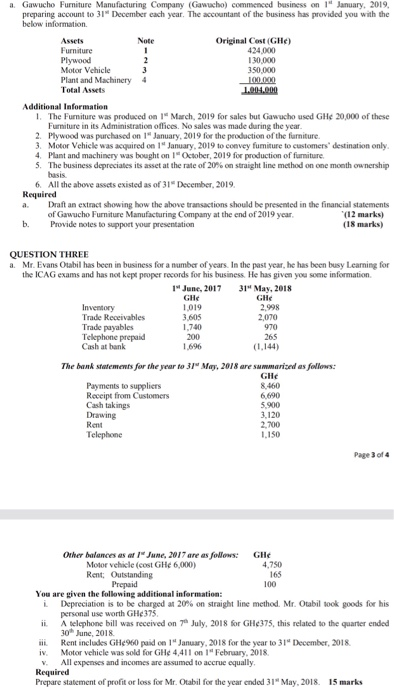

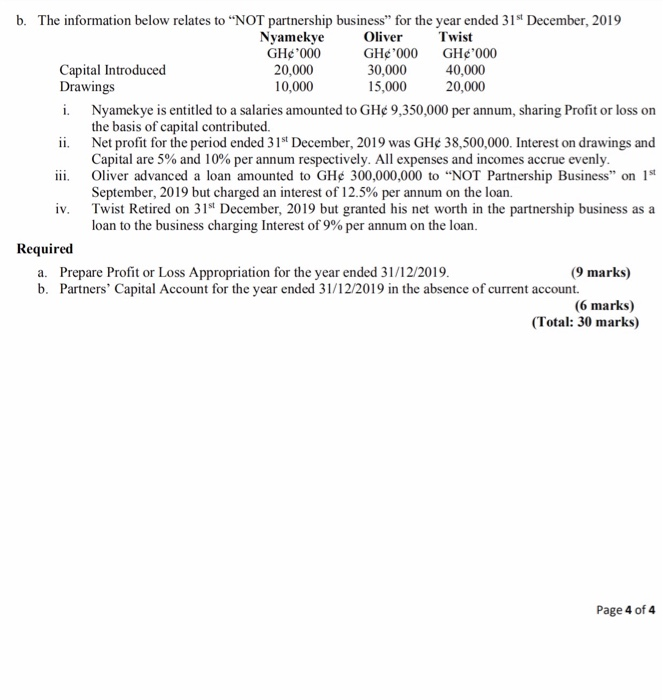

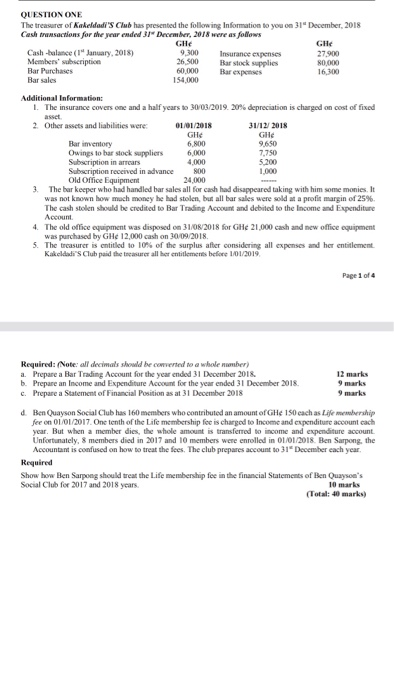

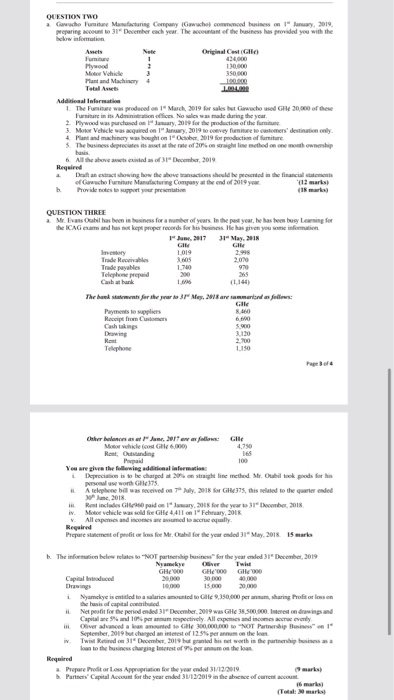

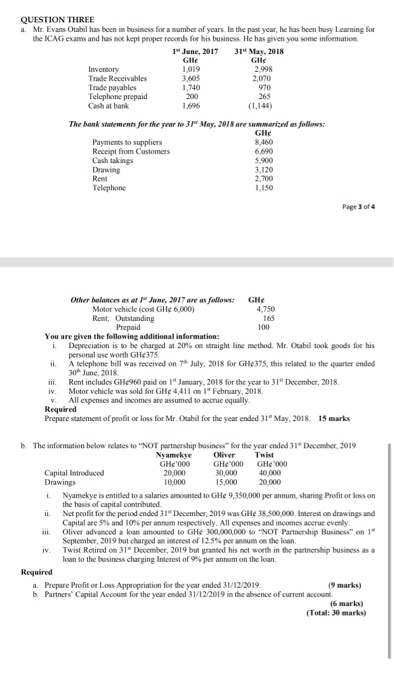

QUESTION ONE The treasurer of Kakeldadi's Club has presented the following Information to you on 31 December, 2018 Cash transactions for the year ended 31 December, 2018 were as follows GHE GHE Cash-balance (1 January, 2018) 9,300 Insurance expenses 27.900 Members' subscription 26.500 Bar stock supplies 80,000 Bar Purchases 60,000 Bar expenses 16,300 Bar sales 154,000 Additional Information: 1. The insurance covers one and a half years to 30/03/2019. 20% depreciation is charged on cost of fixed asset 2. Other assets and liabilities were: 01/01/2018 31/12/2018 Gle GHC Bar inventory 6,800 9.650 Owings to bar stock suppliers 6,000 7.750 Subscription in arrears 4,000 3,200 Subscription received in advance 800 1,000 Old Office Equipment 24,000 3. The bar keeper who had handled bar sales all for cash had disappeared taking with him some monies. It was not known how much money he had stolen, but all bar sales were sold at a profit margin of 25%. The cash stolen should be credited to Bar Trading Account and debited to the Income and Expenditure Account 4. The old office equipment was disposed on 31/08/2018 for GH 21.000 cash and new office equipment was purchased by GH 12,000 cash on 30/09/2018 5. The treasurer is entitled to 10% of the surplus after considering all expenses and her entitlement Kakeldadi's Club paid the treasurer all her entitlements before 1/01/2019. Page 1 of 4 Required: (Note: all decimals should be comverted to a whole number) a. Prepare a Bar Trading Account for the year ended 31 December 2018 12 marks b. Prepare an Income and Expenditure Account for the year ended 31 December 2018 9 marks c. Prepare a Statement of Financial Position as at 31 December 2018 9 marks Ben Quayson Social Club has 160 members who contributed an amount of GH 150 each as Life membership fee on 01/01/2017. One tenth of the Life membership fee is charged to Income and expenditure account each year. But when a member dies, the whole amount is transferred to income and expenditure account Unfortunately, 8 members died in 2017 and 10 members were enrolled in 01/01/2018. Ben Sarpong, the Accountant is confused on how to treat the foes. The club prepares account to 31 December cachycar. Required Show how Ben Sarpong should treat the Life membership fee in the financial Statements of Ben Quayson's Social Club for 2017 and 2018 years. 10 marks (Total: 40 marks) Assets a. Gawucho Furniture Manufacturing Company (Gawucho) commenced business on 1" January, 2019, preparing account to 31 December each year. The accountant of the business has provided you with the below information Note Original Cost (GHC) Furniture 1 424,000 Plywood 2 130,000 Motor Vehicle 3 350.000 Plant and Machinery 4 100.000 Total Assets 1.000.000 Additional Information 1. The Furniture was produced on 1 March, 2019 for sales but Gawucho used GH 20,000 of these Furniture in its Administration offices. No sales was made during the year. 2. Plywood was purchased on 1 January, 2019 for the production of the furniture. 3. Motor Vehicle was acquired on 1 January, 2019 to convey fumiture to customers' destination only 4. Plant and machinery was bought on 1 October, 2019 for production of furniture 5. The business depreciates its asset at the rate of 20% on straight line method on one month ownership basis 6. All the above assets existed as of 31 December, 2019. Required Draft an extract showing how the above transactions should be presented in the financial statements of Gawucho Furniture Manufacturing Company at the end of 2019 year. (12 marks) b. Provide notes to support your presentation (18 marks) QUESTION THREE a. Mr. Evans Otabil has been in business for a number of years. In the past year, he has been busy Learning for the ICAG exams and has not kept proper records for his business. He has given you some information 19 June, 2017 31 May, 2018 GHE GHC Inventory 1.019 2,998 Trade Receivables 3.605 2,070 Trade payables 1.700 970 Telephone prepaid 200 265 Cash at bank (1.144) The bank statements for the year to 3/" May, 2018 are summarised as follows: Gle Payments to suppliers 8.460 Receipt from Customers 6.690 Cash takings 5.900 Drawing Rent 2.700 Telephone 1.150 2120 Page 3 of 4 Other balances as ar 1" June, 2017 are as follows: GH Motor vehicle (cost GH 6,000) 4,750 Rent: Outstanding 165 Prepaid 100 You are given the following additional information: i Depreciation is to be charged at 20% on straight line method. Mr. Otabil took goods for his personal use worth GH4375 ii. A telephone bill was received on 7" July, 2018 for GH375, this related to the quarter ended 30 June, 2018 Rent includes GH 960 paid on 1 January, 2018 for the year to 31 December, 2018 Motor vehicle was sold for GH 4,411 on 1 February, 2018 All expenses and incomes are assumed to accrue equally Required Prepare statement of profit or loss for Mr. Otabil for the year ended 31" May, 2018. 15 marks iv b. The information below relates to "NOT partnership business for the year ended 31" December, 2019 Nyamekye Oliver Twist GH '000 GH000 GH'000 Capital Introduced 20,000 30,000 40,000 Drawings 10,000 15,000 20,000 i Nyamekye is entitled to a salaries amounted to GH 9,350,000 per annum, sharing Profit or loss on the basis of capital contributed. ii. Net profit for the period ended 31st December, 2019 was GH 38,500,000. Interest on drawings and Capital are 5% and 10% per annum respectively. All expenses and incomes accrue evenly. iii. Oliver advanced a loan amounted to GH 300,000,000 to "NOT Partnership Business" on 1st September, 2019 but charged an interest of 12.5% per annum on the loan. iv. Twist Retired on 31st December, 2019 but granted his net worth in the partnership business as a loan to the business charging Interest of 9% per annum on the loan. Required a. Prepare Profit or Loss Appropriation for the year ended 31/12/2019. (9 marks) b. Partners' Capital Account for the year ended 31/12/2019 in the absence of current account. (6 marks) (Total: 30 marks) Page 4 of 4 QUESTION ONE The treasure of Kakeldade's Club has presented the following Information to you on 31 December, 2018 Cash transactions for the year ended 31 December, 2018 were as follows GHE GH Cash-balance (1 January, 2018) 9,300 Insurance expenses 27.900 Members' scription 26,500 Bar stock supplies 80,000 Bar Purchases 60.000 Bar expenses 16,300 Bar sales 154.000 Additional Information: 1. The insurance covers one and a half years to 30/03/2019. 20% depreciation is charged on cost of fixed 2. Other assets and liabilities were: 01/01/2018 31/12/2018 Gle Ghe Bar inventory 6,800 9.650 Owings to bar stock suppliers 6,000 7.750 Subscription in arrears 4.000 5.200 Subscription received in advance 800 1.000 Old Office Equipment 24,000 3. The bar keeper who had handled bar sales all for cash had disappeared taking with him some monies. It was not known how much money he had stolen, but all bar sales were sold at a profit margin of 25% The cash stolen should be credited to Bar Trading Account and debited to the Income and Expenditure Account 4. The old office equipment was disposed on 31/08/2018 for GH 21,000 cash and new office equipment was purchased by GH 12,000 cash on 10/09/2018 5. The treasurer is entitled to 10% of the surplus after considering all expenses and her entitlement. Kakeldadi's Club paid the treasurer all her entitlements before 1/01/2019 Page 1 of 4 Required: (Note: all decimals should be converted to a whole number) a. Prepare a Bar Trading Account for the year ended 31 December 2018 12 marks b. Prepare an Income and Expenditure Account for the year ended 31 December 2018 9 marks c. Prepare a Statement of Financial Position as at 31 December 2018 9 marks d. Ben Quayson Social Club has 160 members who contributed an amount of GHe 150 each as Life membership fee on 01/01/2017. One tenth of the Life membership fee is charged to Income and expenditure account cach year. But when a member dies, the whole amount is transferred to income and expenditure account. Unfortunately, 8 members died in 2017 and 10 members were enrolled in 01/01/2018 Ben Sarpong, the Accountant is confused on how to treat the fees. The club prepares account to 31 December each year. Required Show how Ben Sarpong should treat the Life membership fee in the financial Statements of Ben Quayson's Social Club for 2017 and 2018 years 10 marks (Total: 40 marks) cevedo Mly 2017 this to the ended QUESTION TWO Gaucho Pumite Manufacturing Company Gawach commoed teasiness on 1 January 2019, preparing account to 31" December each year. The content of the business has provided you with the Amets Original Castle Plywood 130.000 350.000 Plant and Machinery 100 L.COM Additional information The Faniture was produced on March, 2019 for sales but who used GH 20,000 of these Furniture in its Administration office. No ale was made during the year 3. Motor Vehicle was acquired on January, 2019 veyfume te cestomers' destination only word purchased on my 2018 for the production of the A Mantand machinery was behin Ober, 2019 for pedactie of furniture The business deprecates its set at the rate of 20% on straight line method cene month ownership 6 All the above weed of 31 December, 2019 Required Dat an extract showing how the above actions should be posted in the financial statements of Gawacho Furniture Manufacturing Company at the end of 2019 year 12 marks QUESTION THREE a Me Evans Oil has been in business for a number of years. In the past year, he has been busy Learning for the ICAG am and has kept proper records for his bus. He has given you some indicatie June, 2017 31 May, 2018 1019 Trade Reis 3. Trade payables 110 970 Telephone prepaid 200 Cash thank The band was for the year is 3P" Mey 2018 are samarind as follows: Payments to suppliers 100 Recipe from Customers 600 Cashtaking 5200 3.130 Rom 200 Telephone LISO Page 3 of 4 Other belone" Jan. 2017 was follows: Gile Motor vehicle cos 6.000 4,20 Rent Outstanding 165 You are given the following additional information Deprecia is to be charpedot 206 straight line method. Mr. Oubil ook goods for his w worth G4375 Rent includes GHe paid on January 2018 for the year to 31 December, 2018 iv. Me vehicle was sold for GH 4.411 on 1 February 2018 All pomes and come to an equally Required Prepare statement of profit or loss for Mt. Obill for the year ended 31 May, 2018 15 marks The information below relates to "NOT partnership busines" or the year ended 31 December, 2019 Nyamky GH000 GHEGH000 Capital 10.000 15.000 30.000 i Nyamckye in titled to a les amounted to GHC 2,350,000 per annum, sharing Profit or lossen the basis of capital cod iL Net profit for the period ended 31 December 2019 was GHe 38.500.000. Interest on drawings and Capital and per annan respectively. All apmies and incomes evenly il Oliver advanced a lan amounted to Gate 300.000.000 to "NOT Partnership Business September, 2019 but charged an interest of 12.5% per annum on the Twist Retired 31 December, 2019 urte is worth is the principles koon to the business charging Interest of per annum the loan. Required a Prepare Proditor Loss Appropriation for the year ended 31/12/2019 Paris Capital Account for the year ended 31122019 in the abschee of current account. 6 marka QUESTION THREE a. Mr. Evans Otabil has been in business for a number of years. In the past year, he has been busy Learning for the ICAG exams and has not kept proper records for his business. He has given you some information 1 June, 2017 31 May, 2018 GHE Inventory 1019 2.998 Trade Receivables 3.05 2,070 Trade payables 1,740 970 Telephone prepaid 263 Cash at bank The bank statements for the year to 31" May, 2018 are summarized as follows: GHE Payments to suppliers 8,460 Recipt from Customers 6690 Cash takings 5.900 Drawing 3.120 Rent 2.700 Telephone 1,150 Page 3 of 4 166 Other balances as ar "June, 2017 are as follows: GH Motor vehicle cost GH 6,000) 4.750 Rent: Outstanding Prepaid 100 You are given the following additional information: i Depreciation is to be charged at 20% ce straight line method. Mr. Otabil took goods for his personal use worth GH375. A telephone bill was received on 7 July, 2018 for GH375, this related to the quarter ended 30 June, 2018 ili. Rent includes GH960 paid on 1 January 2018 for the year to 31" December, 2018 iv. Motor vehicle was sold for GH 4,411 on 1 February, 2018 v. All expenses and incomes are assumed to accrue equally. Required Prepare statement of profit or loss for Mr. Otabil for the year ended 31 May, 2018, 15 marks i b. The information below relates to "NOT partnership business for the year ended 31 December, 2019 Nyamekye Oliver Twist GH000 GH 000 GH000 Capital Introduced 20,000 40,000 Drawings 10,000 15,000 20,000 Nyamekye is entitled to a salaries amounted to GH 9,350,000 per annum, sharing Profit or loss on the basis of capital contributed Net profit for the period ended 31 December, 2019 was GH 38.500,000. Interest ce drawings and Capital are 5% and 10% per annum respectively. All expenses and incomes accrue evenly Oliver advanced a loan amounted to GH 300,000,000 to "NOT Partnership Business" on 1" September, 2019 but charged an interest of 12.5% per annum on the loan. iv. Twist Retired on 31 December, 2019 but granted his net worth in the partnership business as a Town to the business charging Interest of 9% per annum on the loan. Required a. Prepare Profit or Loss Appropriation for the year ended 31/12/2019. (9 marks) b. Partners' Capital Account for the year ended 31/12/2019 in the absence of current account (6 marks) (Total: 30 marks) QUESTION ONE The treasurer of Kakeldadi's Club has presented the following Information to you on 31 December, 2018 Cash transactions for the year ended 31 December, 2018 were as follows GHE GHE Cash-balance (1 January, 2018) 9,300 Insurance expenses 27.900 Members' subscription 26.500 Bar stock supplies 80,000 Bar Purchases 60,000 Bar expenses 16,300 Bar sales 154,000 Additional Information: 1. The insurance covers one and a half years to 30/03/2019. 20% depreciation is charged on cost of fixed asset 2. Other assets and liabilities were: 01/01/2018 31/12/2018 Gle GHC Bar inventory 6,800 9.650 Owings to bar stock suppliers 6,000 7.750 Subscription in arrears 4,000 3,200 Subscription received in advance 800 1,000 Old Office Equipment 24,000 3. The bar keeper who had handled bar sales all for cash had disappeared taking with him some monies. It was not known how much money he had stolen, but all bar sales were sold at a profit margin of 25%. The cash stolen should be credited to Bar Trading Account and debited to the Income and Expenditure Account 4. The old office equipment was disposed on 31/08/2018 for GH 21.000 cash and new office equipment was purchased by GH 12,000 cash on 30/09/2018 5. The treasurer is entitled to 10% of the surplus after considering all expenses and her entitlement Kakeldadi's Club paid the treasurer all her entitlements before 1/01/2019. Page 1 of 4 Required: (Note: all decimals should be comverted to a whole number) a. Prepare a Bar Trading Account for the year ended 31 December 2018 12 marks b. Prepare an Income and Expenditure Account for the year ended 31 December 2018 9 marks c. Prepare a Statement of Financial Position as at 31 December 2018 9 marks Ben Quayson Social Club has 160 members who contributed an amount of GH 150 each as Life membership fee on 01/01/2017. One tenth of the Life membership fee is charged to Income and expenditure account each year. But when a member dies, the whole amount is transferred to income and expenditure account Unfortunately, 8 members died in 2017 and 10 members were enrolled in 01/01/2018. Ben Sarpong, the Accountant is confused on how to treat the foes. The club prepares account to 31 December cachycar. Required Show how Ben Sarpong should treat the Life membership fee in the financial Statements of Ben Quayson's Social Club for 2017 and 2018 years. 10 marks (Total: 40 marks) Assets a. Gawucho Furniture Manufacturing Company (Gawucho) commenced business on 1" January, 2019, preparing account to 31 December each year. The accountant of the business has provided you with the below information Note Original Cost (GHC) Furniture 1 424,000 Plywood 2 130,000 Motor Vehicle 3 350.000 Plant and Machinery 4 100.000 Total Assets 1.000.000 Additional Information 1. The Furniture was produced on 1 March, 2019 for sales but Gawucho used GH 20,000 of these Furniture in its Administration offices. No sales was made during the year. 2. Plywood was purchased on 1 January, 2019 for the production of the furniture. 3. Motor Vehicle was acquired on 1 January, 2019 to convey fumiture to customers' destination only 4. Plant and machinery was bought on 1 October, 2019 for production of furniture 5. The business depreciates its asset at the rate of 20% on straight line method on one month ownership basis 6. All the above assets existed as of 31 December, 2019. Required Draft an extract showing how the above transactions should be presented in the financial statements of Gawucho Furniture Manufacturing Company at the end of 2019 year. (12 marks) b. Provide notes to support your presentation (18 marks) QUESTION THREE a. Mr. Evans Otabil has been in business for a number of years. In the past year, he has been busy Learning for the ICAG exams and has not kept proper records for his business. He has given you some information 19 June, 2017 31 May, 2018 GHE GHC Inventory 1.019 2,998 Trade Receivables 3.605 2,070 Trade payables 1.700 970 Telephone prepaid 200 265 Cash at bank (1.144) The bank statements for the year to 3/" May, 2018 are summarised as follows: Gle Payments to suppliers 8.460 Receipt from Customers 6.690 Cash takings 5.900 Drawing Rent 2.700 Telephone 1.150 2120 Page 3 of 4 Other balances as ar 1" June, 2017 are as follows: GH Motor vehicle (cost GH 6,000) 4,750 Rent: Outstanding 165 Prepaid 100 You are given the following additional information: i Depreciation is to be charged at 20% on straight line method. Mr. Otabil took goods for his personal use worth GH4375 ii. A telephone bill was received on 7" July, 2018 for GH375, this related to the quarter ended 30 June, 2018 Rent includes GH 960 paid on 1 January, 2018 for the year to 31 December, 2018 Motor vehicle was sold for GH 4,411 on 1 February, 2018 All expenses and incomes are assumed to accrue equally Required Prepare statement of profit or loss for Mr. Otabil for the year ended 31" May, 2018. 15 marks iv b. The information below relates to "NOT partnership business for the year ended 31" December, 2019 Nyamekye Oliver Twist GH '000 GH000 GH'000 Capital Introduced 20,000 30,000 40,000 Drawings 10,000 15,000 20,000 i Nyamekye is entitled to a salaries amounted to GH 9,350,000 per annum, sharing Profit or loss on the basis of capital contributed. ii. Net profit for the period ended 31st December, 2019 was GH 38,500,000. Interest on drawings and Capital are 5% and 10% per annum respectively. All expenses and incomes accrue evenly. iii. Oliver advanced a loan amounted to GH 300,000,000 to "NOT Partnership Business" on 1st September, 2019 but charged an interest of 12.5% per annum on the loan. iv. Twist Retired on 31st December, 2019 but granted his net worth in the partnership business as a loan to the business charging Interest of 9% per annum on the loan. Required a. Prepare Profit or Loss Appropriation for the year ended 31/12/2019. (9 marks) b. Partners' Capital Account for the year ended 31/12/2019 in the absence of current account. (6 marks) (Total: 30 marks) Page 4 of 4 QUESTION ONE The treasure of Kakeldade's Club has presented the following Information to you on 31 December, 2018 Cash transactions for the year ended 31 December, 2018 were as follows GHE GH Cash-balance (1 January, 2018) 9,300 Insurance expenses 27.900 Members' scription 26,500 Bar stock supplies 80,000 Bar Purchases 60.000 Bar expenses 16,300 Bar sales 154.000 Additional Information: 1. The insurance covers one and a half years to 30/03/2019. 20% depreciation is charged on cost of fixed 2. Other assets and liabilities were: 01/01/2018 31/12/2018 Gle Ghe Bar inventory 6,800 9.650 Owings to bar stock suppliers 6,000 7.750 Subscription in arrears 4.000 5.200 Subscription received in advance 800 1.000 Old Office Equipment 24,000 3. The bar keeper who had handled bar sales all for cash had disappeared taking with him some monies. It was not known how much money he had stolen, but all bar sales were sold at a profit margin of 25% The cash stolen should be credited to Bar Trading Account and debited to the Income and Expenditure Account 4. The old office equipment was disposed on 31/08/2018 for GH 21,000 cash and new office equipment was purchased by GH 12,000 cash on 10/09/2018 5. The treasurer is entitled to 10% of the surplus after considering all expenses and her entitlement. Kakeldadi's Club paid the treasurer all her entitlements before 1/01/2019 Page 1 of 4 Required: (Note: all decimals should be converted to a whole number) a. Prepare a Bar Trading Account for the year ended 31 December 2018 12 marks b. Prepare an Income and Expenditure Account for the year ended 31 December 2018 9 marks c. Prepare a Statement of Financial Position as at 31 December 2018 9 marks d. Ben Quayson Social Club has 160 members who contributed an amount of GHe 150 each as Life membership fee on 01/01/2017. One tenth of the Life membership fee is charged to Income and expenditure account cach year. But when a member dies, the whole amount is transferred to income and expenditure account. Unfortunately, 8 members died in 2017 and 10 members were enrolled in 01/01/2018 Ben Sarpong, the Accountant is confused on how to treat the fees. The club prepares account to 31 December each year. Required Show how Ben Sarpong should treat the Life membership fee in the financial Statements of Ben Quayson's Social Club for 2017 and 2018 years 10 marks (Total: 40 marks) cevedo Mly 2017 this to the ended QUESTION TWO Gaucho Pumite Manufacturing Company Gawach commoed teasiness on 1 January 2019, preparing account to 31" December each year. The content of the business has provided you with the Amets Original Castle Plywood 130.000 350.000 Plant and Machinery 100 L.COM Additional information The Faniture was produced on March, 2019 for sales but who used GH 20,000 of these Furniture in its Administration office. No ale was made during the year 3. Motor Vehicle was acquired on January, 2019 veyfume te cestomers' destination only word purchased on my 2018 for the production of the A Mantand machinery was behin Ober, 2019 for pedactie of furniture The business deprecates its set at the rate of 20% on straight line method cene month ownership 6 All the above weed of 31 December, 2019 Required Dat an extract showing how the above actions should be posted in the financial statements of Gawacho Furniture Manufacturing Company at the end of 2019 year 12 marks QUESTION THREE a Me Evans Oil has been in business for a number of years. In the past year, he has been busy Learning for the ICAG am and has kept proper records for his bus. He has given you some indicatie June, 2017 31 May, 2018 1019 Trade Reis 3. Trade payables 110 970 Telephone prepaid 200 Cash thank The band was for the year is 3P" Mey 2018 are samarind as follows: Payments to suppliers 100 Recipe from Customers 600 Cashtaking 5200 3.130 Rom 200 Telephone LISO Page 3 of 4 Other belone" Jan. 2017 was follows: Gile Motor vehicle cos 6.000 4,20 Rent Outstanding 165 You are given the following additional information Deprecia is to be charpedot 206 straight line method. Mr. Oubil ook goods for his w worth G4375 Rent includes GHe paid on January 2018 for the year to 31 December, 2018 iv. Me vehicle was sold for GH 4.411 on 1 February 2018 All pomes and come to an equally Required Prepare statement of profit or loss for Mt. Obill for the year ended 31 May, 2018 15 marks The information below relates to "NOT partnership busines" or the year ended 31 December, 2019 Nyamky GH000 GHEGH000 Capital 10.000 15.000 30.000 i Nyamckye in titled to a les amounted to GHC 2,350,000 per annum, sharing Profit or lossen the basis of capital cod iL Net profit for the period ended 31 December 2019 was GHe 38.500.000. Interest on drawings and Capital and per annan respectively. All apmies and incomes evenly il Oliver advanced a lan amounted to Gate 300.000.000 to "NOT Partnership Business September, 2019 but charged an interest of 12.5% per annum on the Twist Retired 31 December, 2019 urte is worth is the principles koon to the business charging Interest of per annum the loan. Required a Prepare Proditor Loss Appropriation for the year ended 31/12/2019 Paris Capital Account for the year ended 31122019 in the abschee of current account. 6 marka QUESTION THREE a. Mr. Evans Otabil has been in business for a number of years. In the past year, he has been busy Learning for the ICAG exams and has not kept proper records for his business. He has given you some information 1 June, 2017 31 May, 2018 GHE Inventory 1019 2.998 Trade Receivables 3.05 2,070 Trade payables 1,740 970 Telephone prepaid 263 Cash at bank The bank statements for the year to 31" May, 2018 are summarized as follows: GHE Payments to suppliers 8,460 Recipt from Customers 6690 Cash takings 5.900 Drawing 3.120 Rent 2.700 Telephone 1,150 Page 3 of 4 166 Other balances as ar "June, 2017 are as follows: GH Motor vehicle cost GH 6,000) 4.750 Rent: Outstanding Prepaid 100 You are given the following additional information: i Depreciation is to be charged at 20% ce straight line method. Mr. Otabil took goods for his personal use worth GH375. A telephone bill was received on 7 July, 2018 for GH375, this related to the quarter ended 30 June, 2018 ili. Rent includes GH960 paid on 1 January 2018 for the year to 31" December, 2018 iv. Motor vehicle was sold for GH 4,411 on 1 February, 2018 v. All expenses and incomes are assumed to accrue equally. Required Prepare statement of profit or loss for Mr. Otabil for the year ended 31 May, 2018, 15 marks i b. The information below relates to "NOT partnership business for the year ended 31 December, 2019 Nyamekye Oliver Twist GH000 GH 000 GH000 Capital Introduced 20,000 40,000 Drawings 10,000 15,000 20,000 Nyamekye is entitled to a salaries amounted to GH 9,350,000 per annum, sharing Profit or loss on the basis of capital contributed Net profit for the period ended 31 December, 2019 was GH 38.500,000. Interest ce drawings and Capital are 5% and 10% per annum respectively. All expenses and incomes accrue evenly Oliver advanced a loan amounted to GH 300,000,000 to "NOT Partnership Business" on 1" September, 2019 but charged an interest of 12.5% per annum on the loan. iv. Twist Retired on 31 December, 2019 but granted his net worth in the partnership business as a Town to the business charging Interest of 9% per annum on the loan. Required a. Prepare Profit or Loss Appropriation for the year ended 31/12/2019. (9 marks) b. Partners' Capital Account for the year ended 31/12/2019 in the absence of current account (6 marks) (Total: 30 marks)