question p-20, please. I hope the solution is more detail, so I can fully understand it

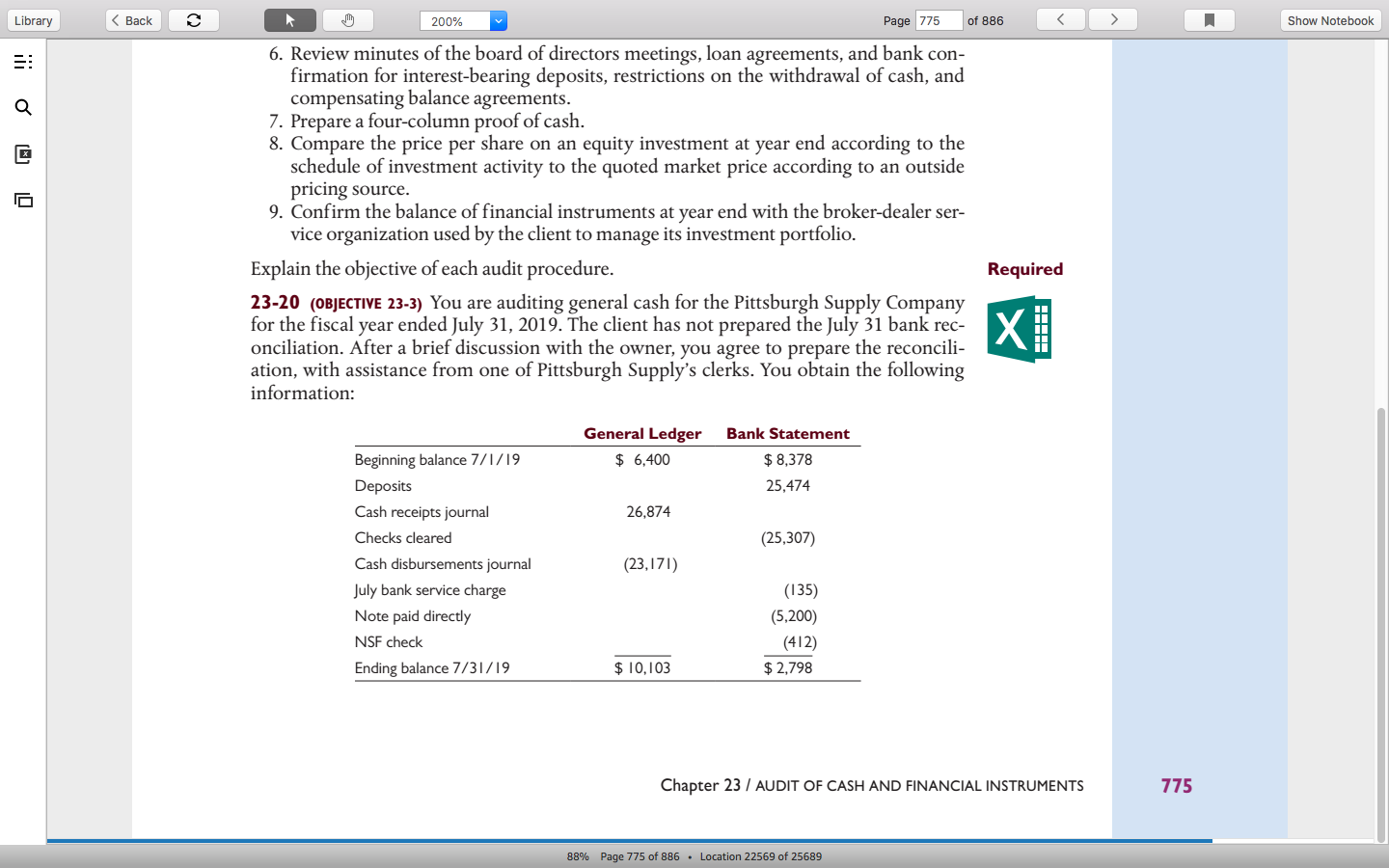

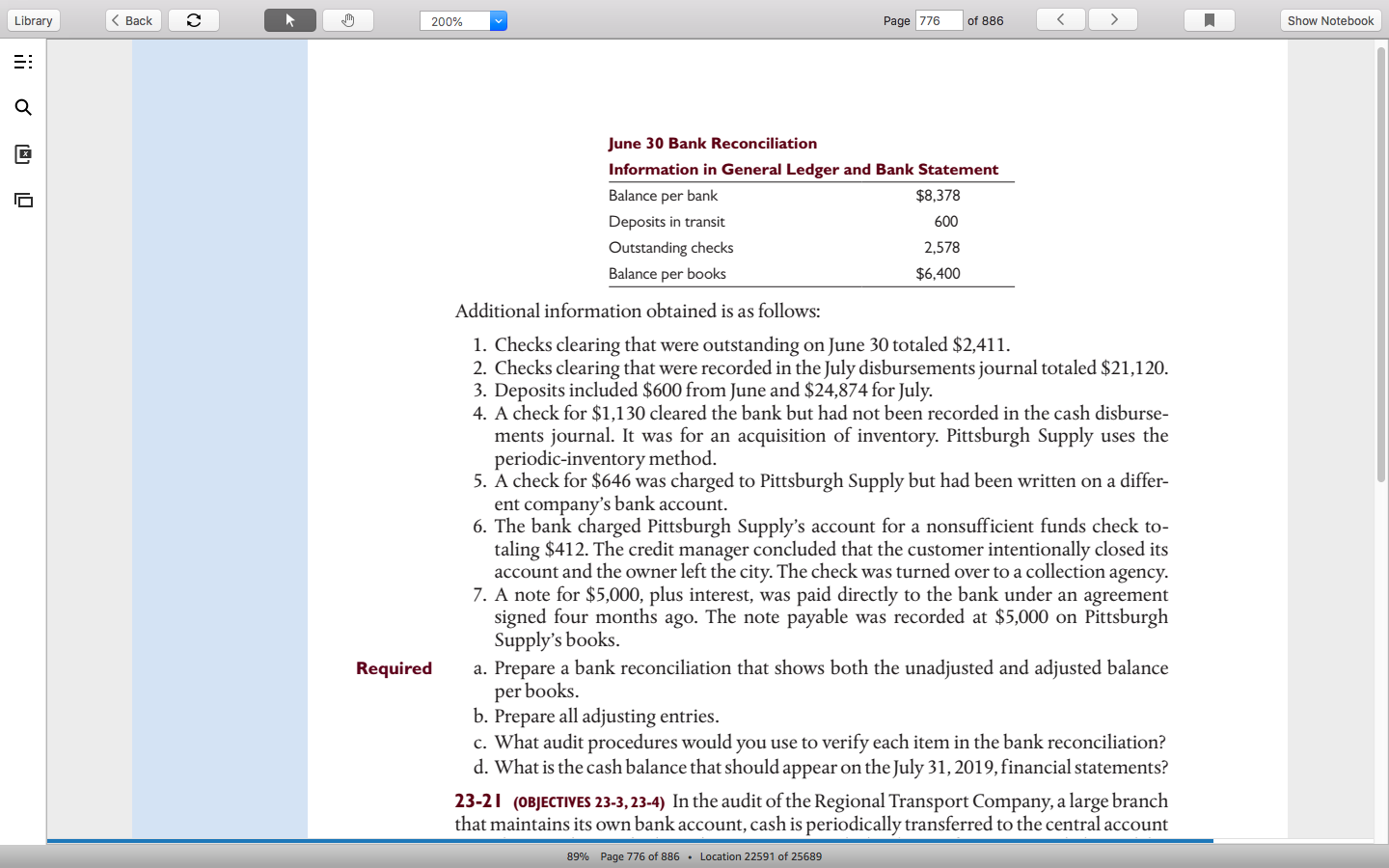

~ mil - - 5mm 6. Review minutes of the board of directors meetings, loan agreements, and bank can- firmation for interest-bearing deposits, restrictions on the withdrawal of cash, and compensating balance agreements. . Prepare a four-column proof of cash. . Compare the price per share on an equity investment at year end according to the schedule of investment activity to the quoted market price according to an outside pricing source. 9. Confirm the balance of financial instruments at year end with the broker-dealer ser- vice organization used by the client to manage its investment portfolio. iii}? new l Explain the objective of each audit procedure. Required 23-20 (OBJECTIVE am) You are auditing general cash for the Pittsburgh Supply Company for the fiscal year ended July 3], 2019. The client has not prepared the July 31 bank rec- onciliation. After a brief discussion with the owner, you agree to prepare the reconcili- ation, with assistance from one of Pittsburgh Supply's clerks. You obtain the following information: General Ledger Bank Statement Beginning balance 7/I/l9 $ 6,400 $ 8,373 Deposits 25.474 Cash reeeipls journal 26,874 Chedcs cleared (25.307) Cash disbursements journal (23,l7|) july hank service charge (I 35) Note paid directly (5.200) NSF check (4 I 2) Ending balance 7/3 | I l 9 $ IO, |03 $ 2,793 Chapter 23 I AUDIT OF CASH AND FINANCIAL INSTRUMENTS 115 ~ mil - , - mm Q E": june 30 Bank Reconciliation Information in General Ledger and Bank Statement El Balance per bank $3.378 Deposits in transit 500 Outstanding chedcs 2,578 Balance per books $6,400 Additional information obtained is as follows: 1. Checks clearing that were outstanding on june 30 totaled $2,411. 2. Checks clearing that were recorded in the July disbursements journal totaled $21,120. 3. Deposits included $600 from June and $24,874 for july. 4. A check for $1,130 cleared the bank but had not been recorded in the cash disburse- ments journal. It was for an acquisition of inventory. Pittsburgh Supply uses the periodic-inventory method. 5. A check for $646 was charged to Pittsburgh Supply but had been written on a differ- ent company's bank account. 6. The bank charged Pittsburgh Supply's account for a nonsufficient funds check to- taling $412. The credit manager concluded that the customer intentionally closed its account and the owner left the city. The check was turned over to a collection agency. 7. A note for $5,000, plus interest, was paid directly to the bank under an agreement signed four months ago. The note payable was recorded at $5,000 on Pittsburgh Supply's books. Required 3. Prepare a bank reconciliation that shows both the unadjusted and adjusted balance per books. b. Prepare all adjusting entries. c. What audit procedures would you use to verify each item in the bank reconciliation? d. What is the cash balance that should appear on thejuly 31, 2019, financial statements? 23-2 I (OBJECTIVE 23-3. 13-4) In the audit of the Regional Transport Company, a large branch that maintains its ownrbank account, cash is periodically transferred to the central account