question p6-7A, Thanks!

question p6-7A, Thanks!

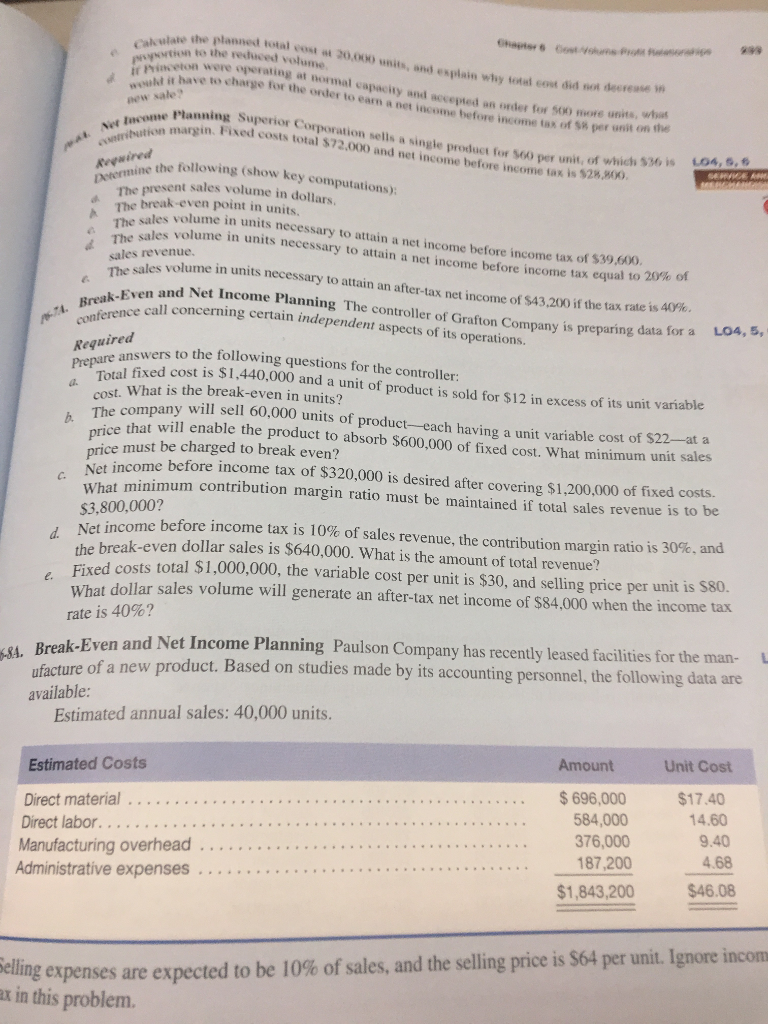

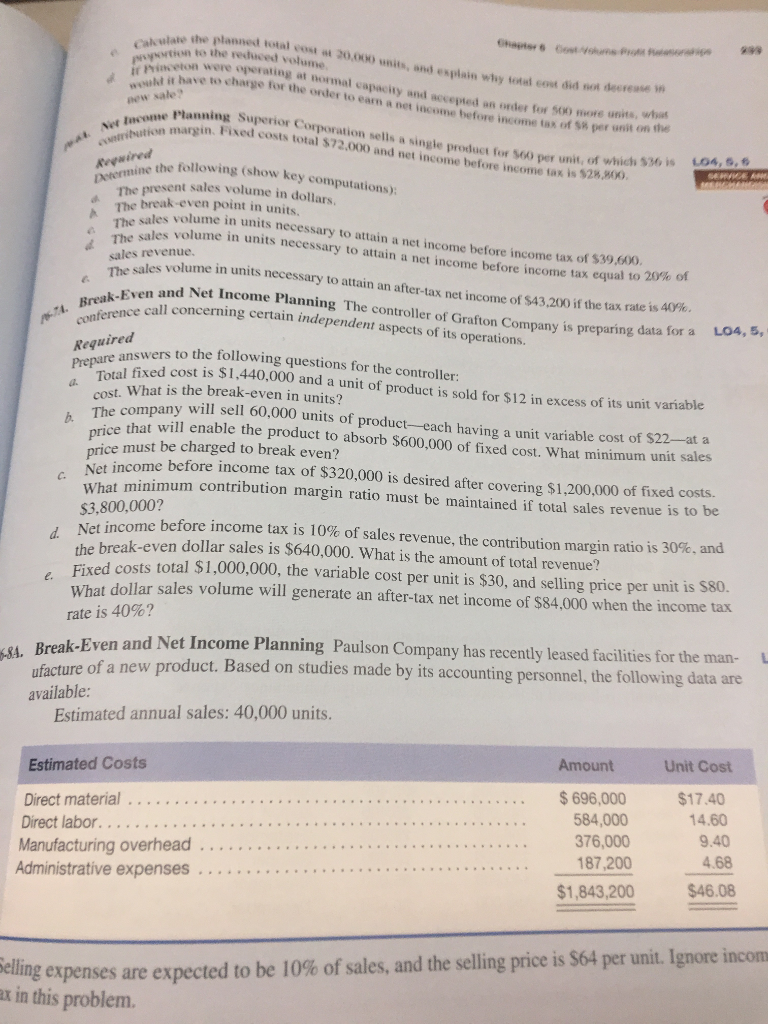

k ulate the planned total cost at 20,000 nits, o the reduced volun n were operating at normal capacity and accepted ito charge for the order to earn a net income before income ta and esplain why total cost did not decrease an order for 500 more units, whet x of 58 per unit on the new sale? Planning Superior Corporation sells Net lihation margin. Fixed costs total $72 tncome Plannin 2.000 and net income before income tax is $28, product for 560 per unit, of which 536 is LA csatmibution L04, 5, 6 ne the following (show key computations) trn resent sales volume in dollars The break-even point in units. sales volume in units necessary to attain a net income before income tax of $39,60X les volume in units necessary to attain a net income before income tax equal to 20% ot sales volume in units necessary to attain an after-tax net income of $43,200 if the tax rate is 40%. Even and Net Income Planning The controller of Grafton Company is preparing data for a e The sales revenue The . Break-Eve call concerning certain independent aspects of its operations. 4. LO4, Required Pre fixed cost is $1.,440,000 and a unit of product is sold for $12 in excess of its unit v eu svers to the following questions for the controller What is the break-even in units? of its unit variable will sell 60,000 units of product-each having a unit variable cost of at will enable the product to absorb 5600,000 of fixed cost. What minimum uni b The company $22-at a price income tax of $320,000 is desired after covering $1,200,000 of fix Net income before What minimum contribution margin ratio must be maintained if total sales revenue is to be $3,800,000? Net income before income tax is 10% of sales revenue, the contribution margin ratio is 30%. and ed costs. the break-even dollar sales is $640,000. What is the amount of total revenue? ed costs total $1,000,000, the variable cost per unit is $30, and selling price per unit is S80 hat dollar sales volume will generate an after-tax net income of $84,000 when the income tax e. Fix rate is 40%? Even and Net Income Planning Paulson Company has recently leased facilities for the man reak- ufacture of a new product. Based on studies made by its accounting personnel, the following data are available Estimated annual sales: 40,000 units. Unit Cost Estimated Costs Direct material. Manufacturing overhead... $17.40 14.60 $ 696,000 584,000 376,000 187,200 Administrative expenses . . $1.843 200 $46.08 elling expenses are expected to be 10% of sales and the selling price is S64 per unit. Ignore incon x in this

question p6-7A, Thanks!

question p6-7A, Thanks!