Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Phil is a calendar year taxpayer and a lender. He also runs a dry-cleaning business. Customers have the option to pay $100 per month

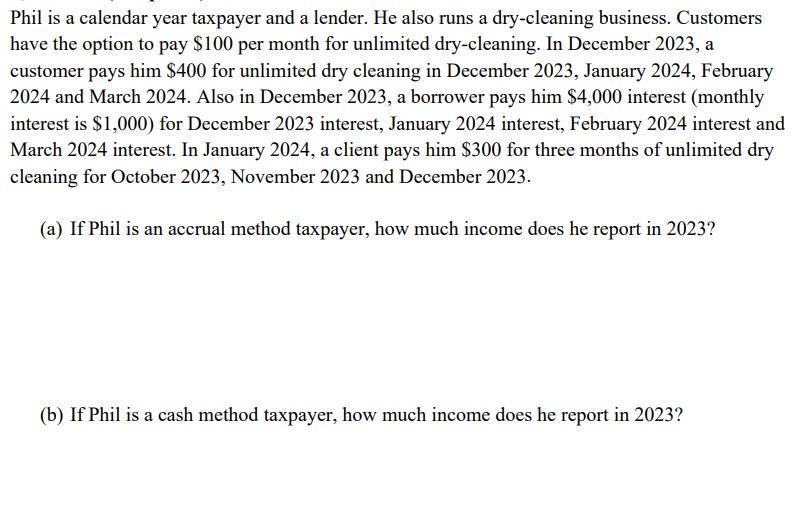

Phil is a calendar year taxpayer and a lender. He also runs a dry-cleaning business. Customers have the option to pay $100 per month for unlimited dry-cleaning. In December 2023, a customer pays him $400 for unlimited dry cleaning in December 2023, January 2024, February 2024 and March 2024. Also in December 2023, a borrower pays him $4,000 interest (monthly interest is $1,000) for December 2023 interest, January 2024 interest, February 2024 interest and March 2024 interest. In January 2024, a client pays him $300 for three months of unlimited dry cleaning for October 2023, November 2023 and December 2023. (a) If Phil is an accrual method taxpayer, how much income does he report in 2023? (b) If Phil is a cash method taxpayer, how much income does he report in 2023?

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

In this case we need to consider how Phils income is recognized based on the accounting method he us...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started