Question

Question: Peter started a business Parc Design on 1 January 2019. During the first month of operations, the business completed five transactions which resulted

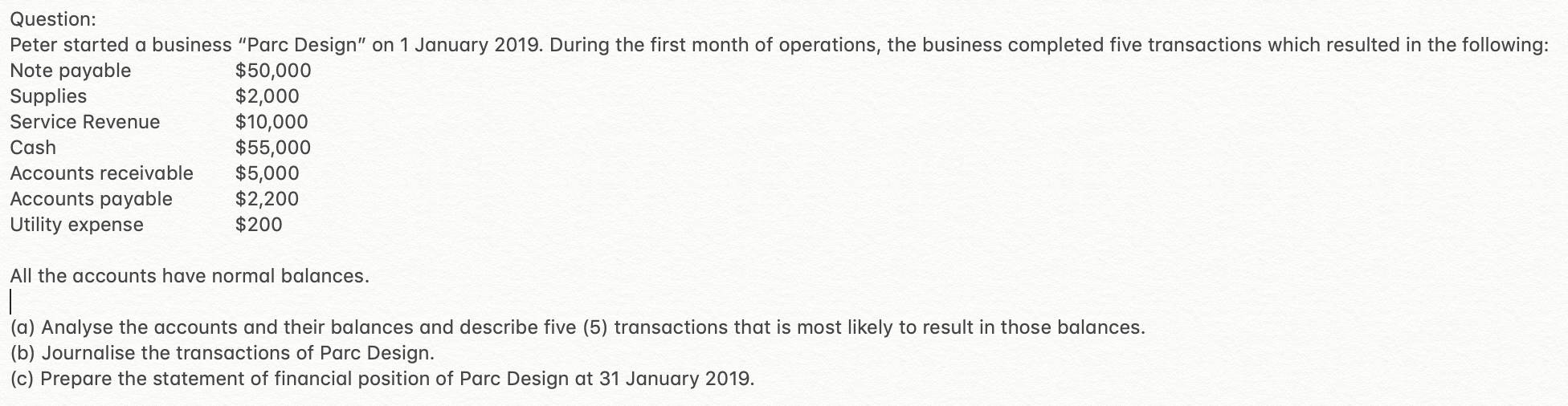

Question: Peter started a business "Parc Design" on 1 January 2019. During the first month of operations, the business completed five transactions which resulted in the following: Note payable $50,000 $2,000 $10,000 $55,000 Supplies Service Revenue Cash Accounts receivable Accounts payable Utility expense $5,000 $2,200 $200 All the accounts have normal balances. | (a) Analyse the accounts and their balances and describe five (5) transactions that is most likely to result in those balances. (b) Journalise the transactions of Parc Design. (c) Prepare the statement of financial position of Parc Design at 31 January 2019.

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial accounting

Authors: Walter T. Harrison Jr., Charles T. Horngren, C. William Thom

9th edition

978-0132751216, 132751127, 132751216, 978-0132751124

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App