QUESTION: PLEASE ANSWER 1 2 AND 3

CHAPTER 11 1. Is the company organized as a sole proprietorship, a partnership, or a corporation? How do you know? 2. What classes of stock does the company report? How many shares are authorized, issued, and outstanding of each class? 3. Did the company pay any dividends this year? If so, how much per share was paid to each class of stock? Did dividends for this year increase or decrease over last year? What comments did management provide about dividends?

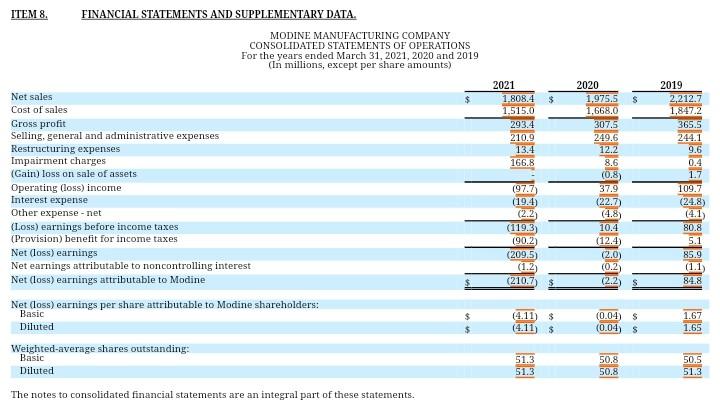

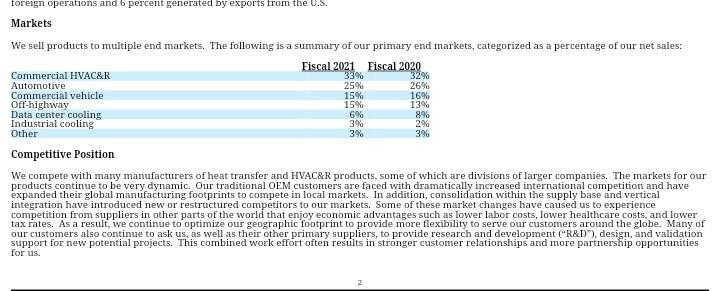

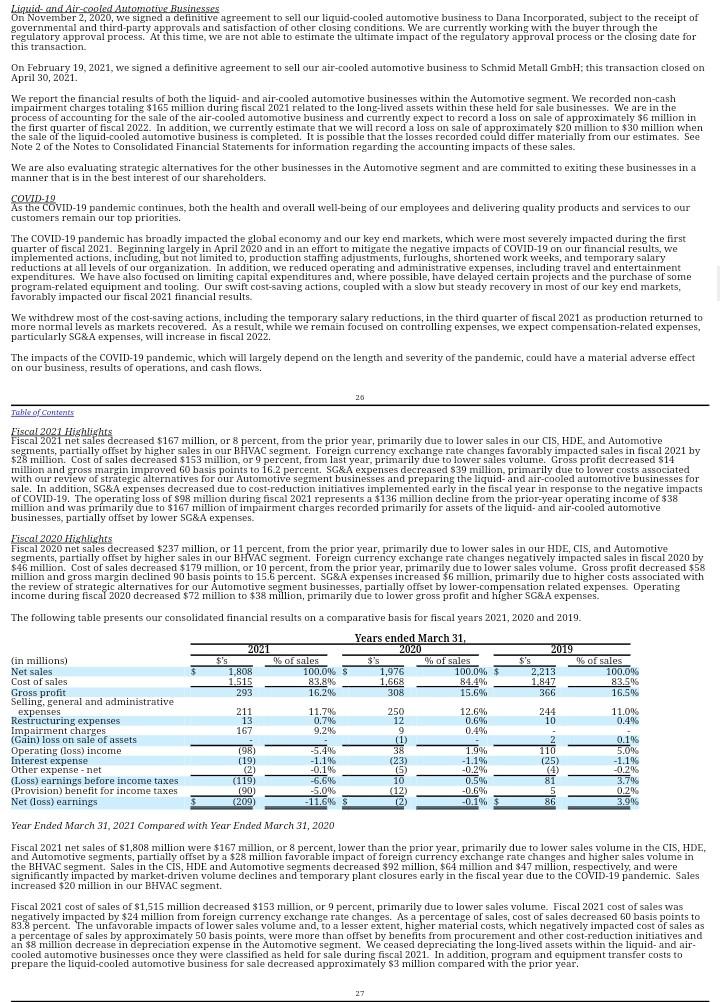

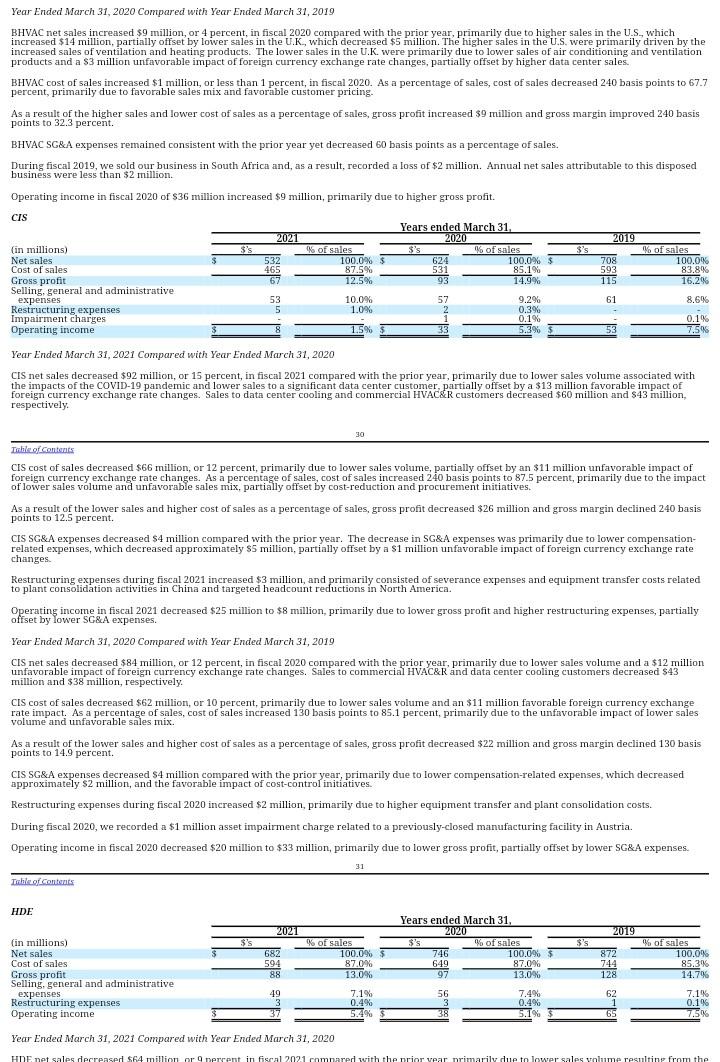

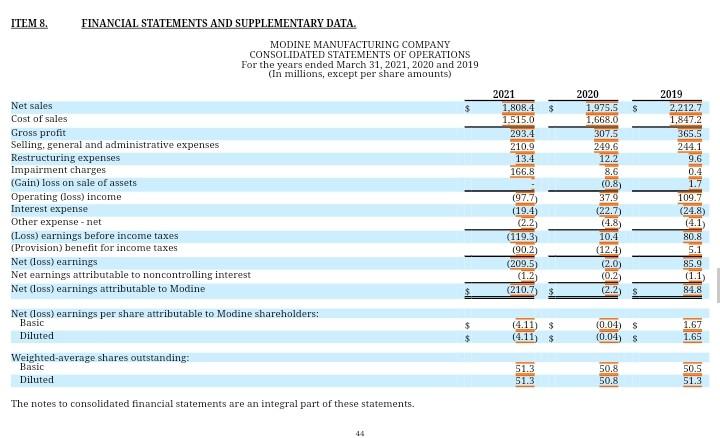

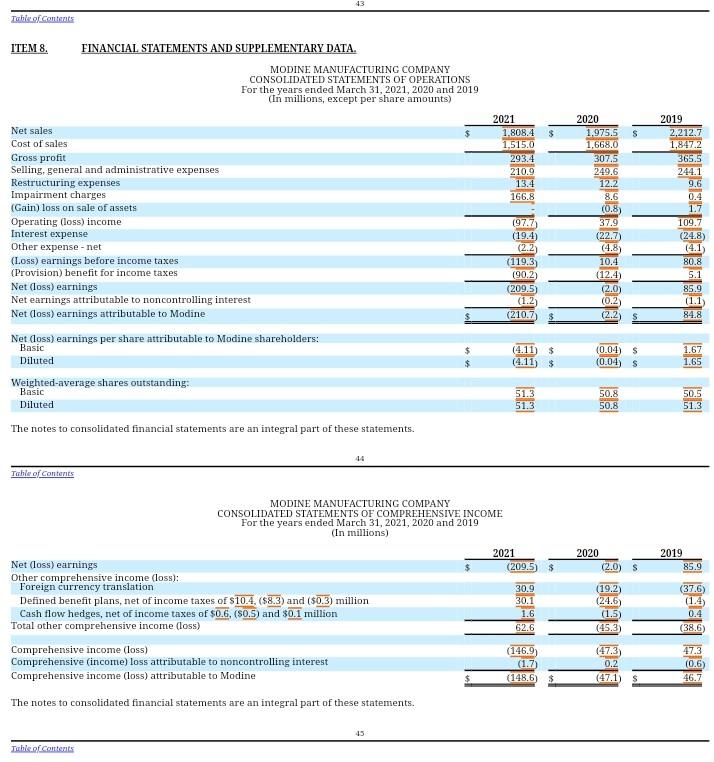

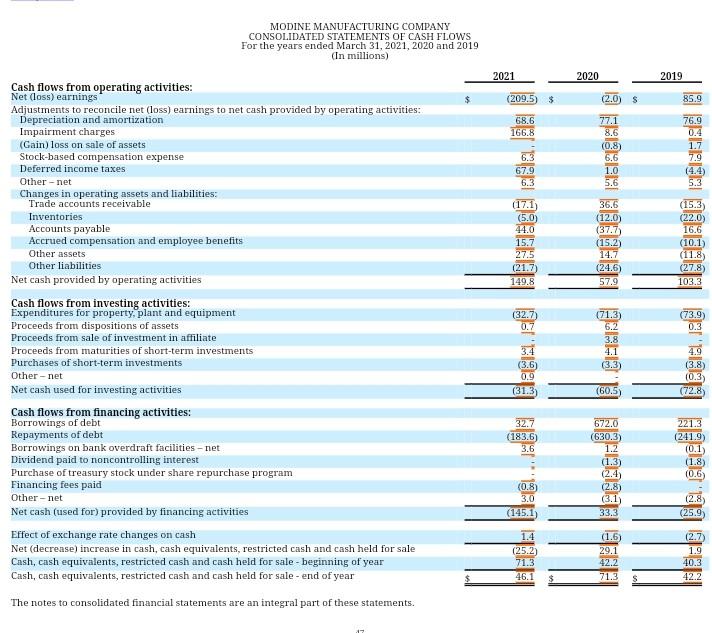

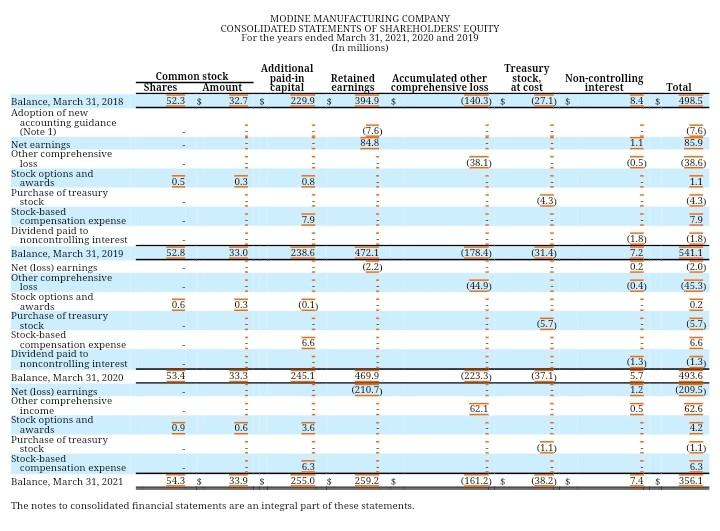

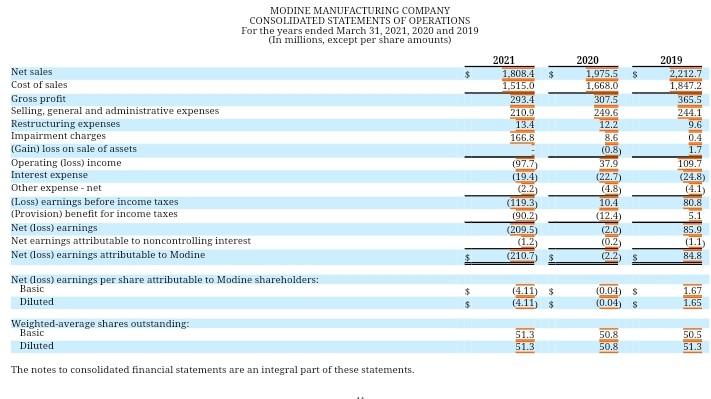

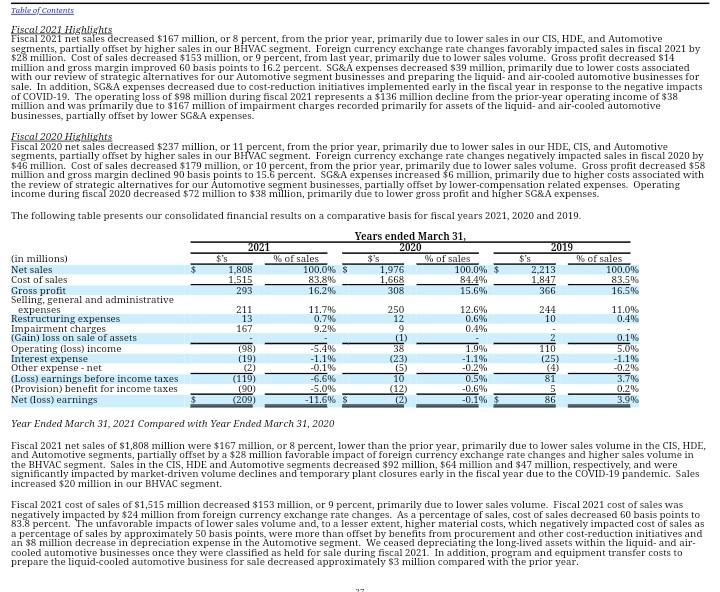

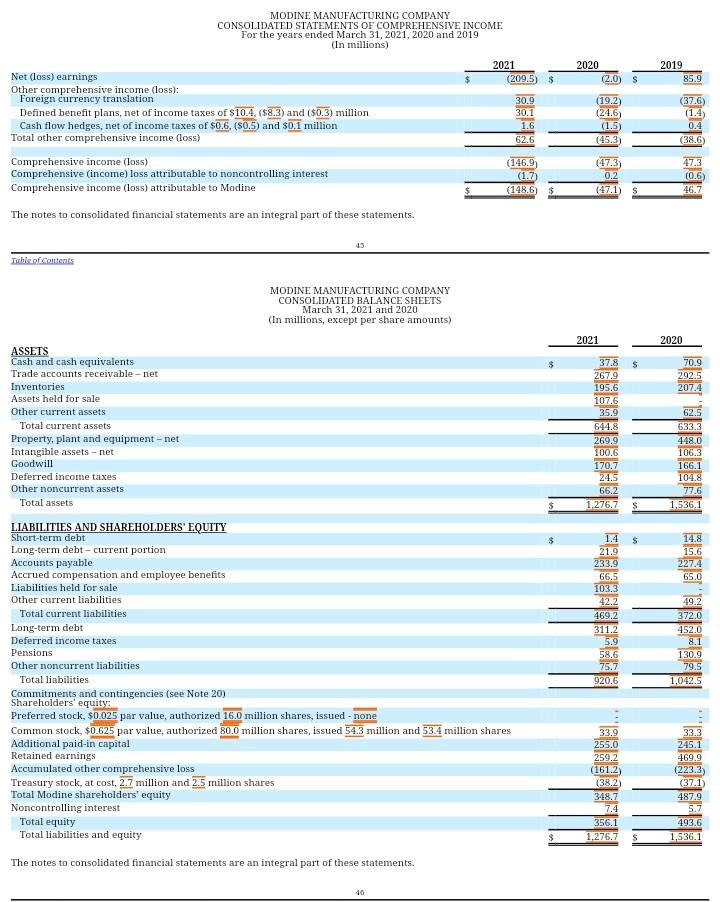

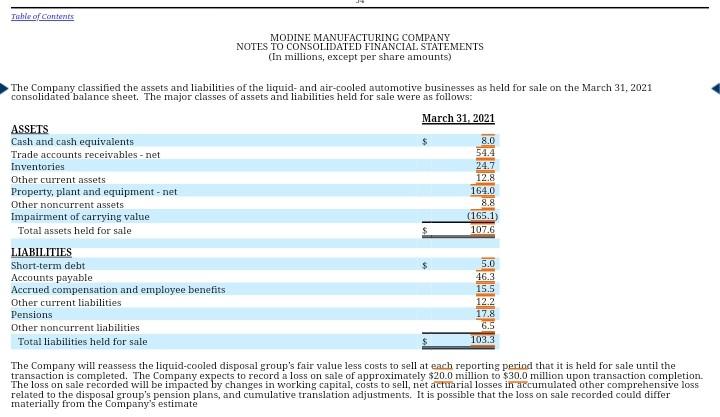

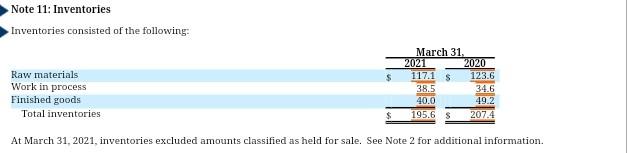

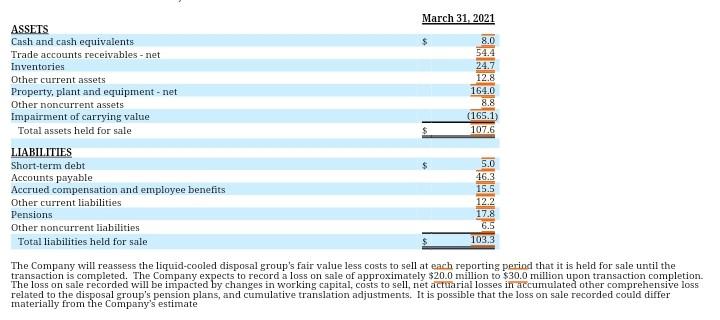

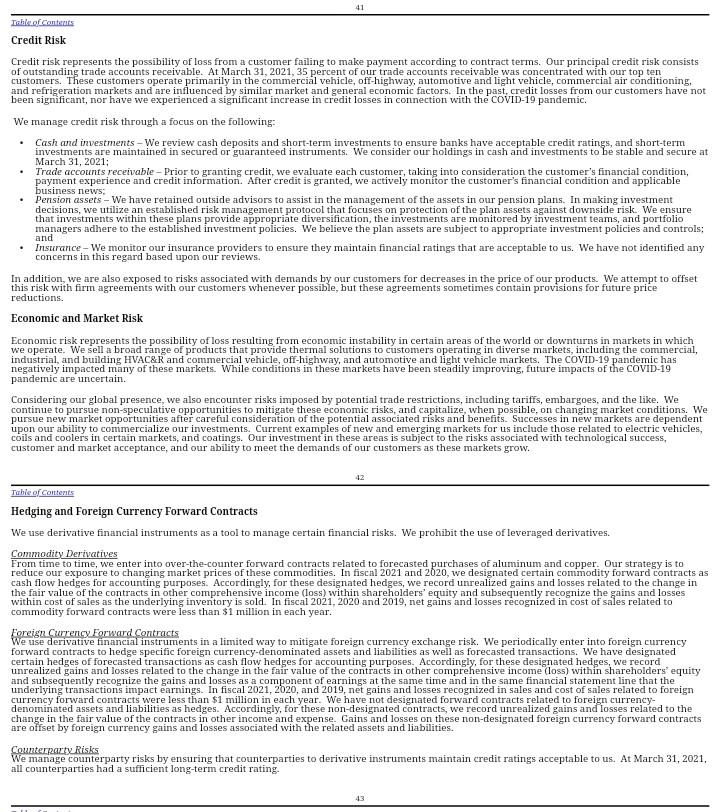

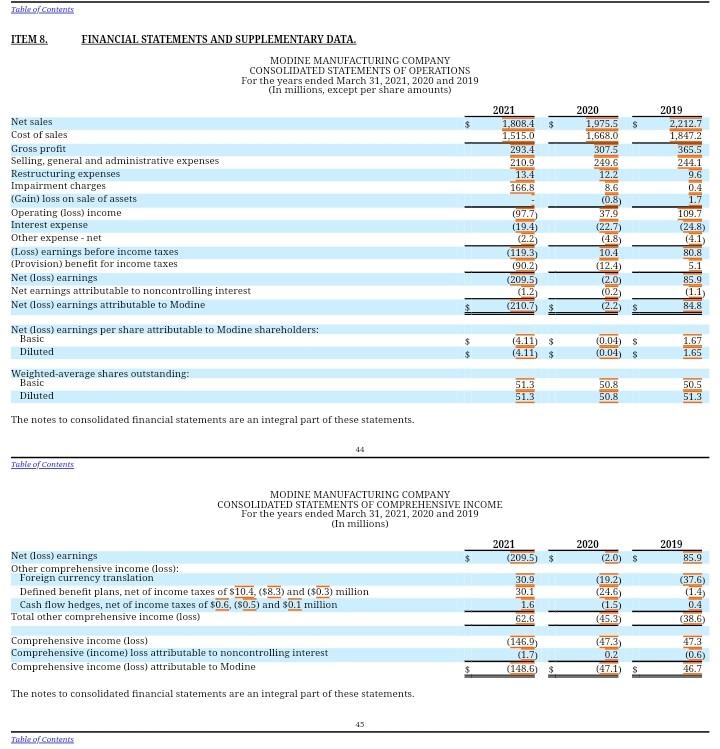

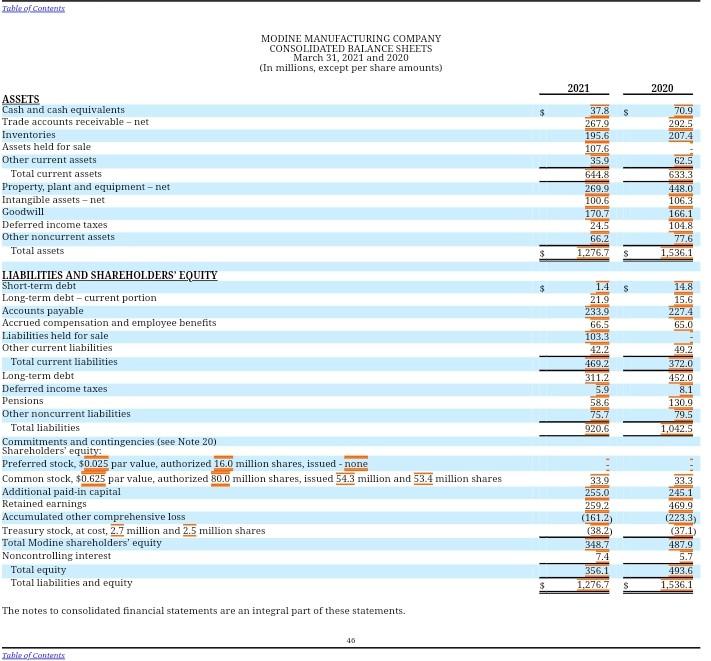

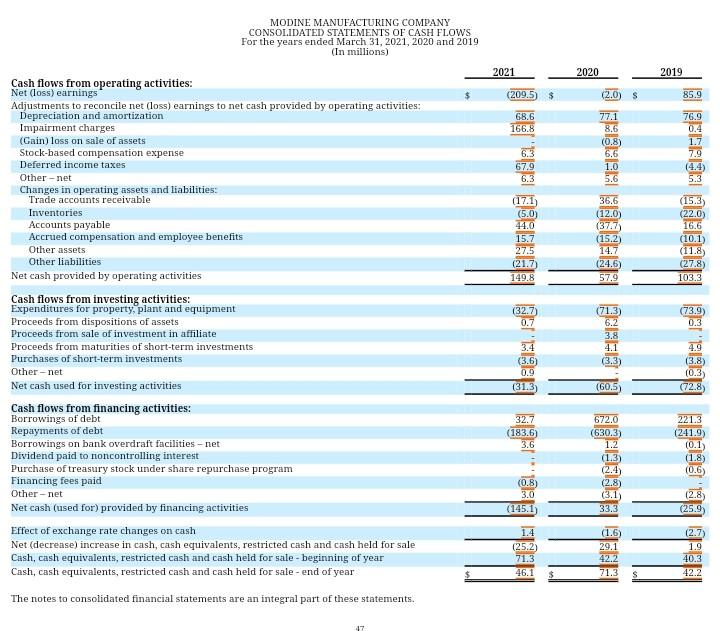

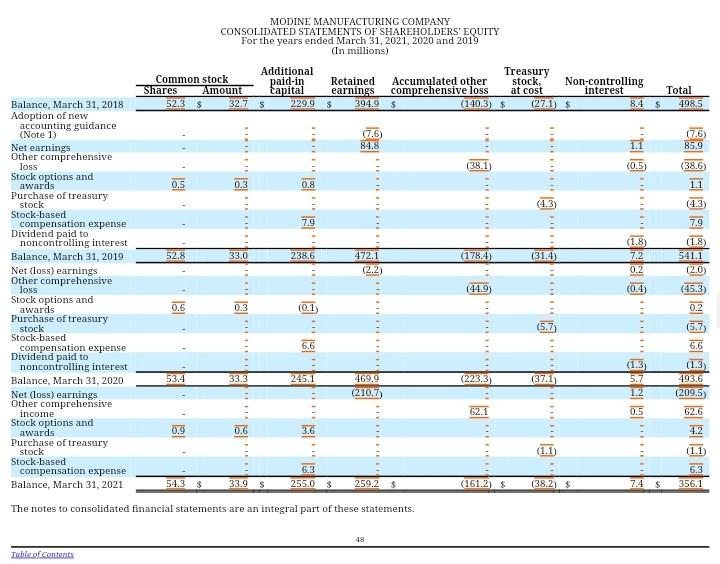

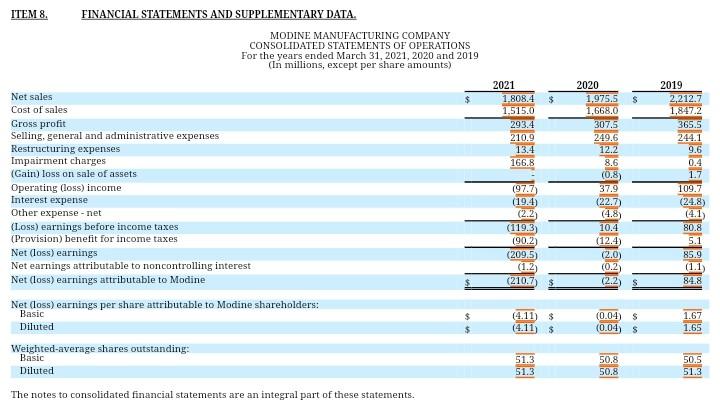

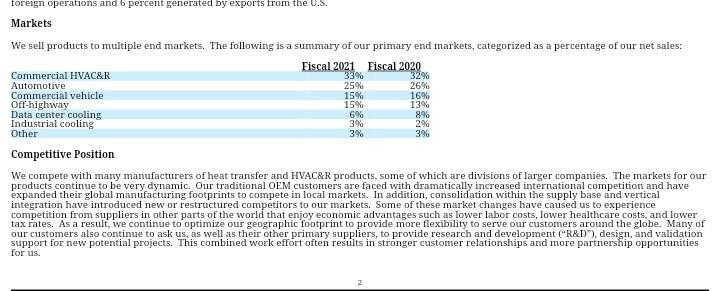

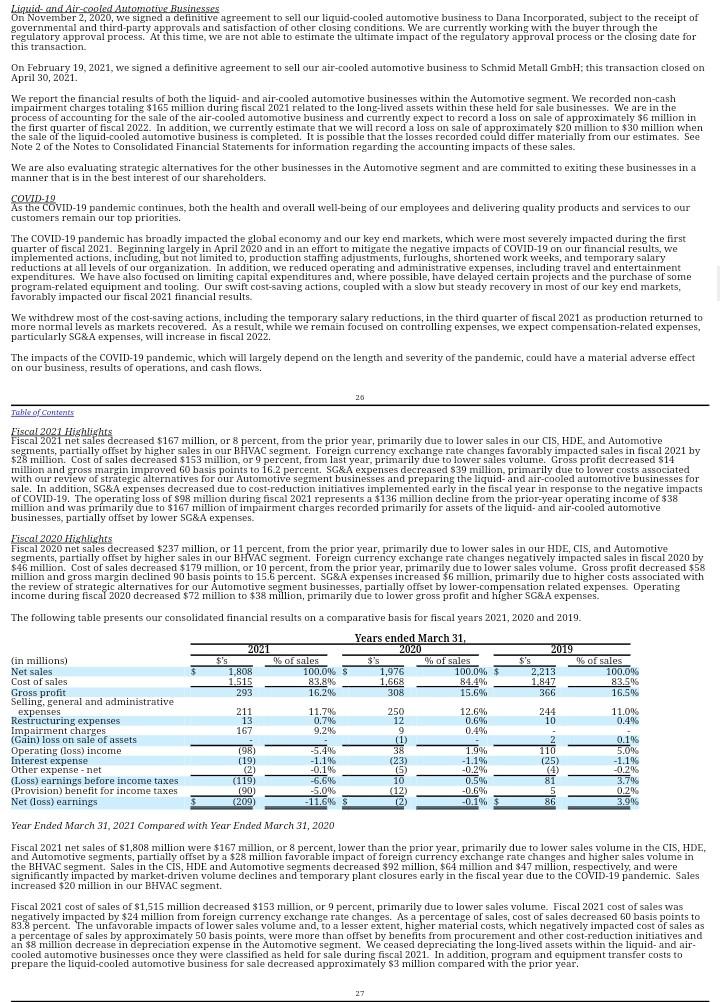

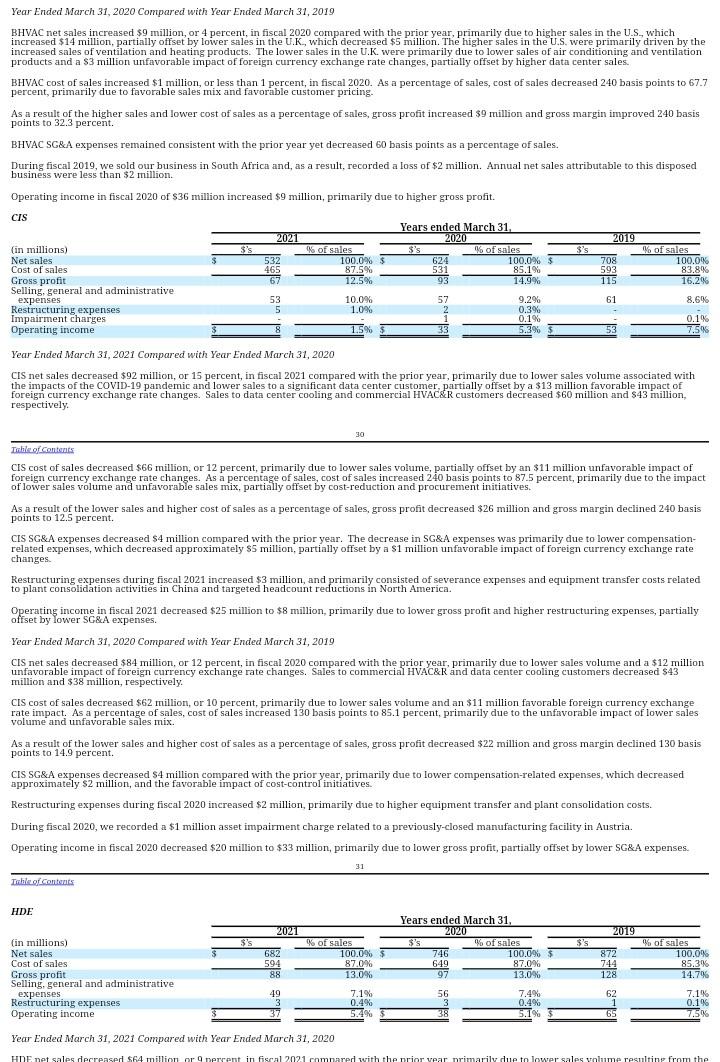

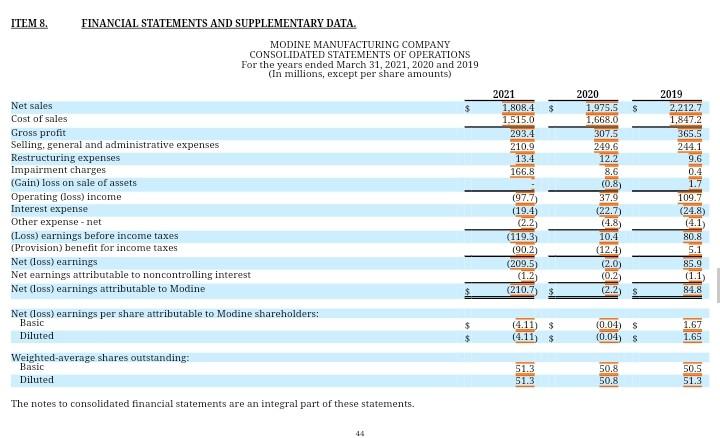

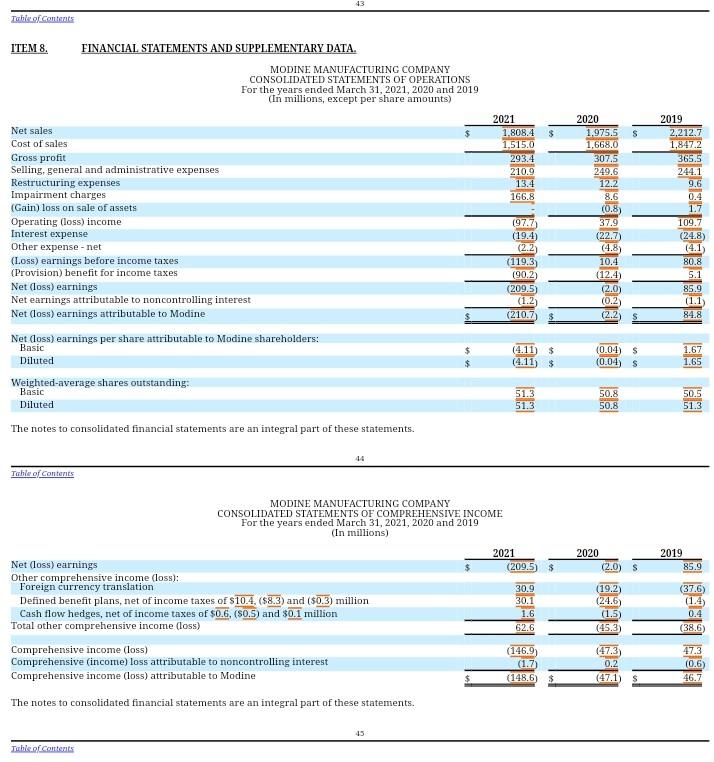

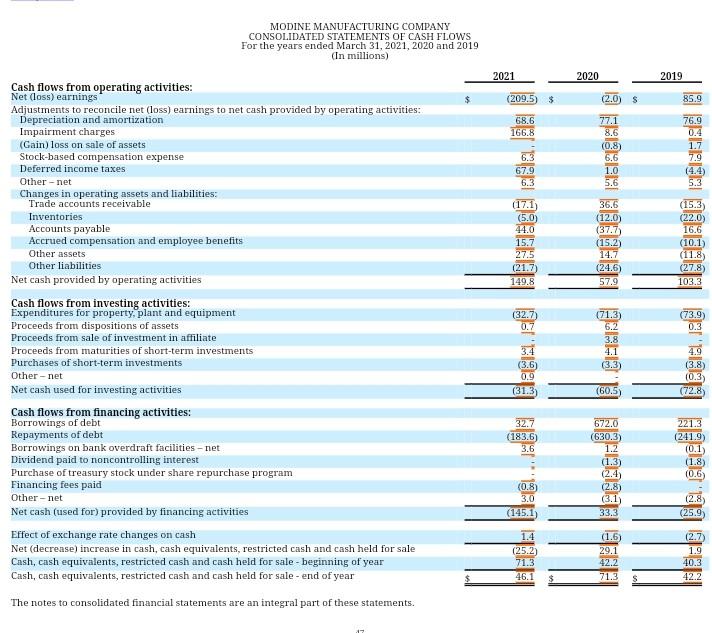

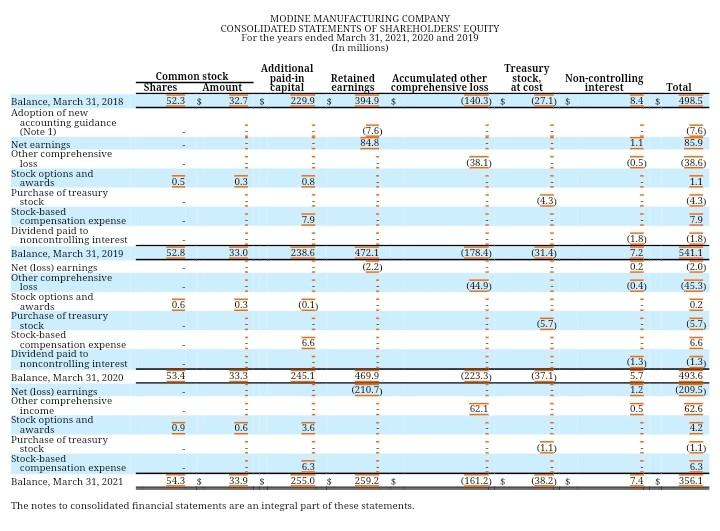

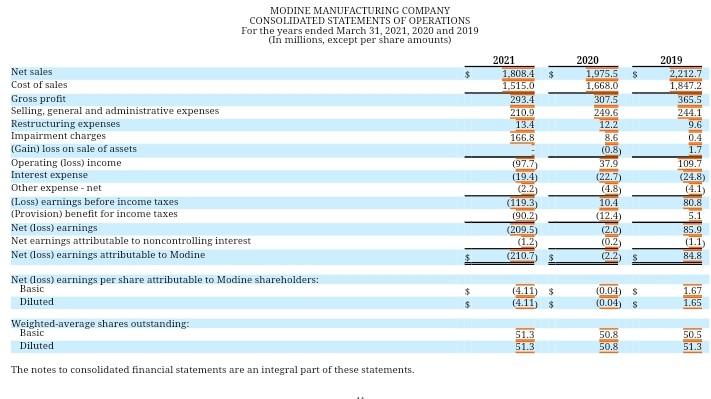

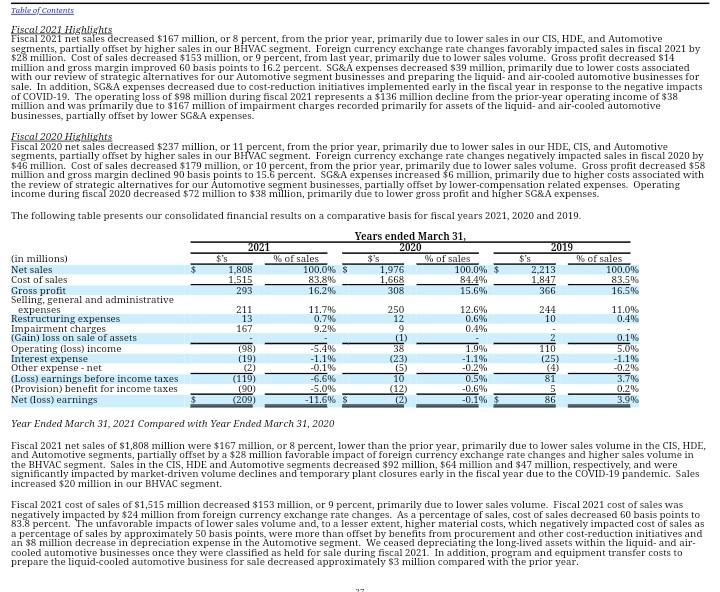

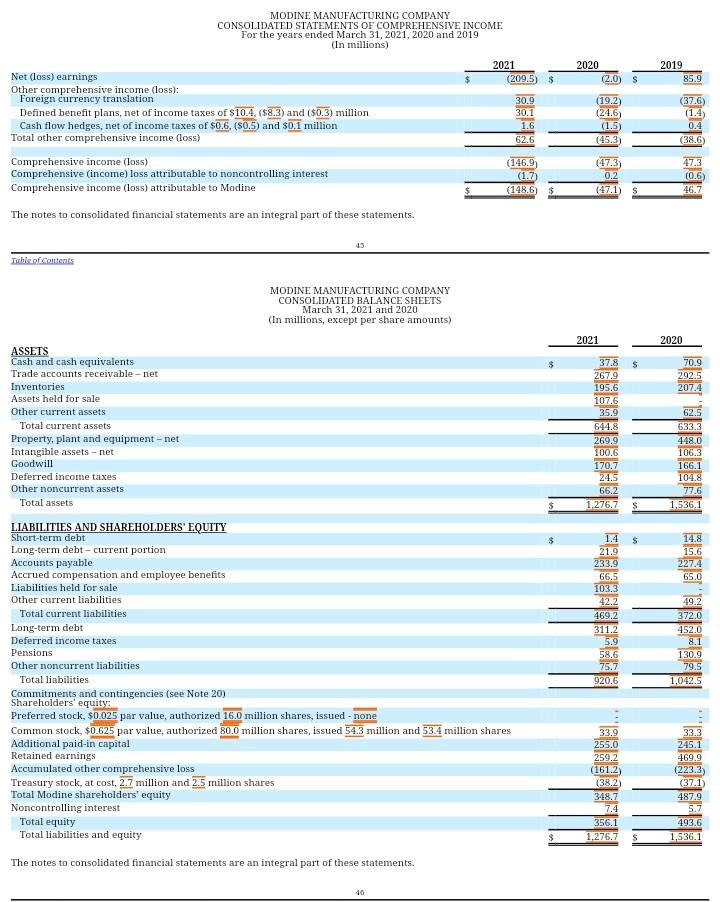

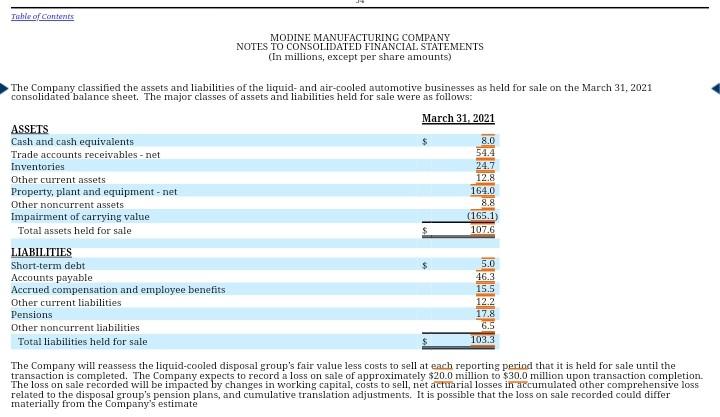

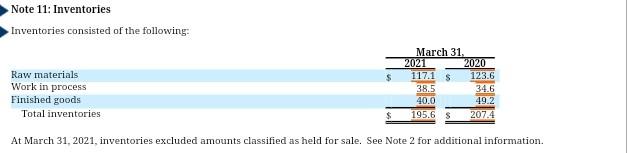

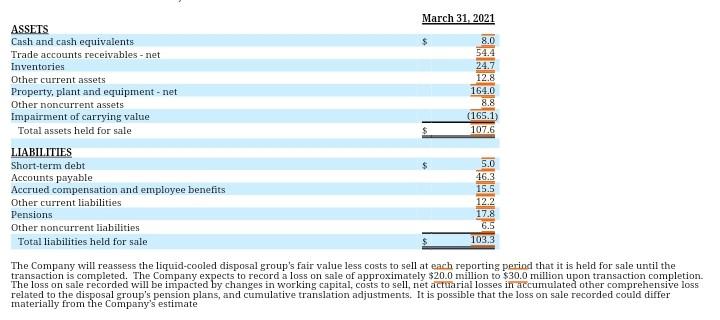

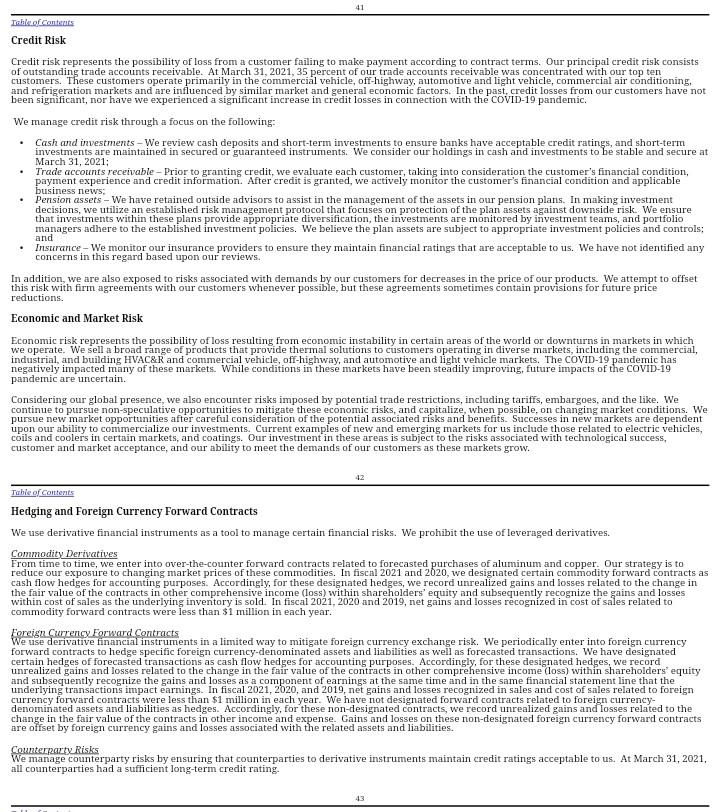

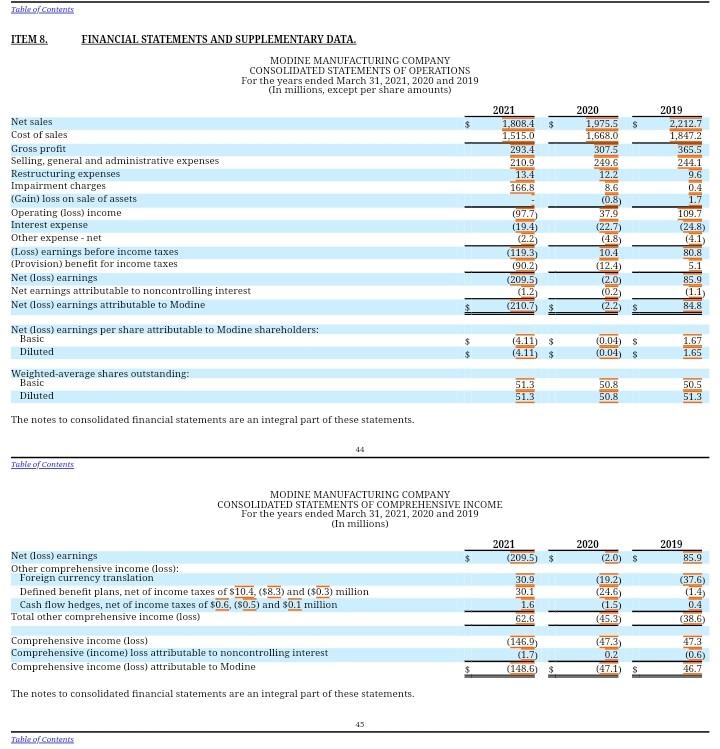

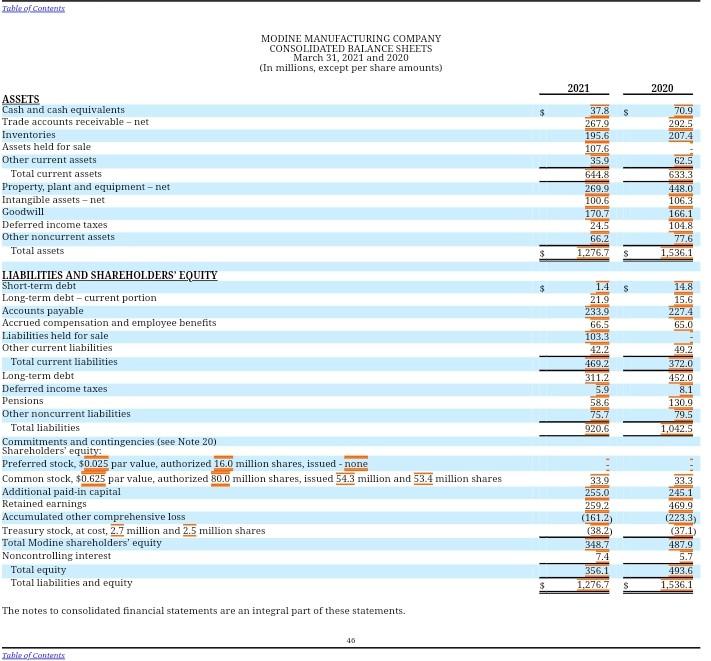

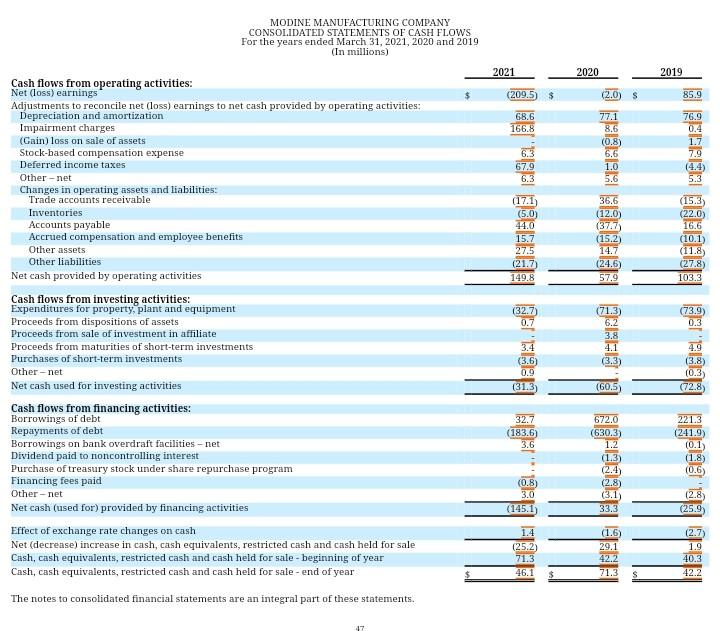

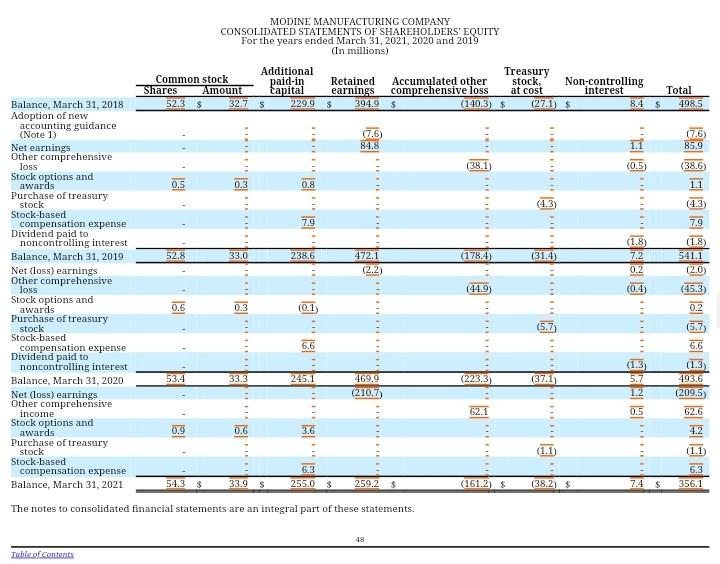

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA. MODINE MANUFACTURING COMPANY CONSOLIDATED STATEMENTS OF OPERATIONS For the years ended March 31, 2021, 2020 and 2019 (In millions, except per share amounts) $ 2021 1.808.4 1.515.0 293.4 210,9 13.4 166.8 Net sales Cost of sales Gross profit Selling, general and administrative expenses Restructuring expenses Impairment charges (Gain) loss on sale of assets Operating (loss) income Interest expense Other expense - net (Loss) earnings before income taxes (Provision) benefit for income taxes Net (loss) earnings Net earnings attributable to noncontrolling interest Net (loss) earnings attributable to Modine Net (loss) earnings per share attributable to Modine shareholders: Basic Diluted Weighted-average shares outstanding: Basic Diluted 2020 1,975.5 1.668.0 307,5 249.6 12.2 8.6 (0.8) 37.9 (22.7 (4.8 10.4 (12.4) (2.0) (0.2 (2.2 2019 2,212.7 1,847.2 365.5 244.1 9.6 0.4 1.7 109.7 (24.8 (4.1 80.8 5.1 85. (1.1 84.8 (97.7) (19.4) (2.2) (119.3) (90.2) (209.5) (1.2 (210.7 $ $ (4.11) $ (4.11) $ (0.04) (0.04 1.67 1.65 $ S 51.3 51.3 50.8 50.8 50.5 51.3 The notes to consolidated financial statements are an integral part of these statements. foreign operations and 6 percent generated by exports from the U.S. Markets We sell products to multiple end markets. The following is a summary of our primary end markets, categorized as a percentage of our net sales: Fiscal 2021 Fiscal 2020 Commercial HVAC&R 33% 32% Automotive 25% 26% Commercial vehicle 15% 16% Off-highway 15% 13% Data center cooling 6% 8% Industrial cooling 3% 2% Other 3% 3% Competitive Position We compete with many manufacturers of heat transfer and HVAC&R products, some of which are divisions of larger companies. The markets for our products continue to be very dynamic. Our traditional OEM customers are faced with dramatically increased international competition and have expanded their global manufacturing footprints to compete in local markets. In addition, consolidation within the supply base and vertical integration have introduced new or restructured competitors to our markets. Some of these market changes have caused us to experience competition from suppliers in other parts of the world that enjoy economic advantages such as lower labor costs, lower healthcare costs, and lower tax rates. As a result, we continue to optimize our geographic footprint to provide more flexibility to serve our customers around the globe. Many of our customers also continue to ask us, as well as their other primary suppliers, to provide research and development (R&D), design, and validation support for new potential projects. This combined work effort often results in stronger customer relationships and more partnership opportunities for us. Liquid- and Air-cooled Automotive Businesses On November 2, 2020, we signed a definitive agreement to sell our liquid-cooled automotive business to Dana Incorporated, subject to the receipt of governmental and third-party approvals and satisfaction of other closing conditions. We are currently working with the buyer through the regulatory approval process. At this time, we are not able to estimate the ultimate impact of the regulatory approval process or the closing date for this transaction. On February 19, 2021, we signed a definitive agreement to sell our air-cooled automotive business to Schmid Metall GmbH; this transaction closed on April 30, 2021 We report the financial results of both the liquid- and air-cooled automotive businesses within the Automotive segment. We recorded non-cash impairment charges totaling $165 million during fiscal 2021 related to the long-lived assets within these held for sale businesses. We are in the process of accounting for the sale of the air-cooled automotive business and currently expect to record a loss on sale of approximately $6 million in the first quarter of fiscal 2022. In addition, we currently estimate that we will record a loss on sale of approximately $20 million to $30 million when the sale of the liquid-cooled automotive business is completed. It is possible that the losses recorded could differ materially from our estimates. See Note 2 of the Notes to Consolidated Financial Statements for information regarding the accounting impacts of these sales. We are also evaluating strategic alternatives for the other businesses in the Automotive segment and are committed to exiting these businesses in a manner that is in the best interest of our shareholders. COVID.19 As the COVID-19 pandemic continues, both the health and overall well-being of our employees and delivering quality products and services to our customers remain our top priorities. The COVID-19 pandemic has broadly impacted the global economy and our key end markets, which were most severely impacted during the first quarter of fiscal 2021. Beginning largely in April 2020 and in an effort to mitigate the negative impacts of COVID-19 on our financial results, we implemented actions, including, but not limited to, production staffing adjustments, furloughs, shortened work weeks, and temporary salary reductions at all levels of our organization. In addition, we reduced operating and administrative expenses, including travel and entertainment expenditures. We have also focused on limiting capital expenditures and, where possible, have delayed certain projects and the purchase of some program-related equipment and tooling. Our swift cost-saving actions, coupled with a slow but steady recovery in most of our key end markets, favorably impacted our fiscal 2021 financial results. We withdrew most of the cost-saving actions, including the temporary salary reductions, in the third quarter of fiscal 2021 as production returned to more normal levels as markets recovered. As a result, while we remain focused on controlling expenses, we expect compensation-related expenses, particularly SC&A expenses, will increase in fiscal 2022. The impacts of the COVID-19 pandemic, which will largely depend on the length and severity of the pandemic, could have a material adverse effect on our business, results of operations, and cash flows. 20 Table of Contents Fiscal 2021 Highlights Fiscal 2021 net sales decreased $167 million, or 8 percent, from the prior year, primarily due to lower sales in our CIS, HDE, and Automotive segments, partially offset by higher sales in our BHVAC segment. Foreign currency exchange rate changes favorably impacted sales in fiscal 2021 by $28 million. Cost of sales decreased $153 million, or 9 percent, from last year, primarily due to lower sales volume. Gross profit decreased $14 million and gross margin improved 60 basis points to 16.2 percent. SG&A expenses decreased $39 million, primarily due to lower costs associated with our review of strategic alternatives for our Automotive segment businesses and preparing the liquid- and air-cooled automotive businesses for sale. In addition, SG&A expenses decreased due to cost-reduction initiatives implemented early in the fiscal year in response to the negative impacts of COVID-19. The operating loss of S98 million during fiscal 2021 represents a $136 million decline from the prior-year operating income of $38 businesses, partially offset 0 Cordion of impairment charges recorded primarily for assets of the liquid- and air-cooled automotive $ by % Eiscal 2020 Highlights Fiscal 2020 net sales decreased $237 million, or 11 percent, from the prior year, primarily due to lower sales in our HDE, CIS, and Automotive segments, partially offset by higher sales in our BHVAC segment. Foreign currency exchange rate changes negatively impacted sales in fiscal 2020 by $46 million. Cost of sales decreased $179 million, or 10 percent, from the prior year, primarily due to lower sales volume. Gross profit decreased $58 million and gross margin declined 90 basis points to 15.6 percent. SG&A expenses increased $6 million, primarily due to higher costs associated with the review of strategic alternatives for our Automotive segment businesses, partially offset by lower-compensation related expenses. Operating income during fiscal 2020 decreased $72 million to $38 million, primarily due to lower gross profit and higher SG&A expenses. The following table presents our consolidated financial results on a comparative basis for fiscal years 2021, 2020 and 2019. Years ended March 31, 2021 2020 2019 (in millions) $'s % of sales $'s % of sales % of sales Net sales 1,805 100.0% S 1,976 100.0% 2.213 100,00 Cost of sales 1,515 83.8% 1,668 84.4% 1.847 83.5% Gross profit 293 16.25 308 15.6% 366 16.5% Selling, general and administrative expenses 211 11.7% 250 12.6% 244 11.0% Restructuring expenses 13 0.7% 0.6% 10 0.4% % Impairment charges 167 9.2% 9 0.4% (Gain) loss on sale of assets (1) 0.16 Operating (loss) income 198) -5.4% 38 1.994 110 5.0% Interest expense ( (19) -1.16 (23) -1.1% (25) -1.1% Other expense - net (2) -0.1% (5) -0.2% (4) -0.2% (Loss) earnings before income taxes (119) -6.6% 10 0.5% 81 3.7% (Provision) benefit for income taxes (90) -5.0% (12 -0.6% 0.2% Net (Loss) earnings (209) ( - 11.6% S (2 -0.1% 86 3.9% 12 Year Ended March 31, 2021 Compared with Year Ended March 31, 2020 Fiscal 2021 net sales of $1,808 million were $167 million, or 8 percent, lower than the prior year, primarily due to lower sales volume in the CIS, HDE, and Automotive segments, partially offset by a $28 million favorable impact of foreign currency exchange rate changes and higher sales volume in the BHVAC segment. Sales in the CIS, HDE and Automotive segments decreased $92 million, $64 million and $47 million, respectively, and were significantly impacted by market-driven volume declines and temporary plant closures early in the fiscal year due to the COVID-19 pandemic. Sales increased $20 million in our BHVAC segment. Fiscal 2021 cost of sales of $1,515 million decreased $153 million, or 9 percent, primarily due to lower sales volume. Fiscal 2021 cost of sales was negatively impacted by $24 million from foreign currency exchange rate changes. As a percentage of sales, cost of sales decreased 60 basis points to 83.8 percent. The unfavorable impacts of lower sales volume and, to a lesser extent, higher material costs, which negatively impacted cost of sales as a percentage of sales by approximately 50 basis points were more than offset by benefits from procurement and other cost-reduction initiatives and an $8 million decrease in depreciation expense in the Automotive segment. We ceased depreciating the long-lived assets within the liquid- and air- cooled automotive businesses once they were classified as held for sale during fiscal 2021. In addition, program and equipment transfer costs to prepare the liquid-cooled automotive business for sale decreased approximately $3 million compared with the prior year 27 Year Ended March 31, 2020 Compared with Year Ended March 31, 2019 BHVAC net sales increased $9 million, or 4 percent, in fiscal 2020 compared with the prior year, primarily due to higher sales in the US, which increased $14 million, partially offset by lower sales in the U.K., which decreased $5 million. The higher sales in the U.S. were primarily driven by the increased sales of ventilation and heating products. The lower sales in the U.K. were primarily due to lower sales of air conditioning and ventilation products and a $3 million unfavorable impact of foreign currency exchange rate changes, partially offset by higher data center sales. BHVAC cost of sales increased $1 million, or less than 1 percent, in fiscal 2020. As a percentage of sales, cost of sales decreased 240 basis points to 67.7 percent, primarily due to favorable sales mix and favorable customer pricing. As a result of the higher sales and lower cost of sales as a percentage of sales, gross profit increased $9 million and gross margin improved 240 basis points to 32.3 percent. BHVAC SG&A expenses remained consistent with the prior year yet decreased 60 basis points as a percentage of sales. During fiscal 2019, we sold our business in South Africa and, as a result, recorded a loss of $2 million. Annual net sales attributable to this disposed business were less than $2 million. Operating income in fiscal 2020 of 36 million increased $9 million, primarily due to higher gross profit. CIS Years ended March 31. 2021 2020 2019 $'s S's S's 532 465 67 W of sales 100.0% $ 87.5% 624 531 93 % of sales 100.0% $ 85.1% 14.9% 708 593 115 W of sales 100.0 83.8% 16.2 12.5% {in millions) Net sales Cost of sales Gross profit Selling, general and administrative expenses Restructuring expenses Impairment charges Operating income 61 53 5 52 2 8.6% 10.0% 1.0% 9.2% 0.3% 0.1% 5.3% 1.5% 0.1% 7.50 Year Ended March 31, 2021 Compared with Year Ended March 31, 2020 CIS net sales decreased $92 million, or 15 percent, in fiscal 2021 compared with the prior year, primarily due to lower sales volume associated with the impacts of the COVID-19 pandemic and lower sales to a significant data center customer, partially offset by a $13 million favorable impact of foreign currency exchange rate changes. Sales to data center cooling and commercial HVAC&R customers decreased $60 million and $43 inillion, respectively, 30 Tohler Contents CIS cost of sales decreased $66 million, or 12 percent, primarily due to lower sales volume, partially offset by an $11 million unfavorable impact of foreign currency exchange rate changes. As a percentage of sales, cost of sales increased 240 basis points to 87.5 percent, primarily due to the impact of lower sales volume and unfavorable sales mix, partially offset by cost-reduction and procurement initiatives. As a result of the lower sales and higher cost of sales as a percentage of sales, gross profit decreased $26 million and gross margin declined 240 basis points to 12.5 percent. CIS SG&A expenses decreased S4 million compared with the prior year. The decrease in SG&A expenses was primarily due to lower compensation- related expenses, which decreased approximately $5 million, partially offset by a $1 million unfavorable impact of foreign currency exchange rate changes. Restructuring expenses during fiscal 2021 increased $3 million, and primarily consisted of severance expenses and equipment transfer costs related to plant consolidation activities in China and targeted headcount reductions in North America. Operating income in fiscal 2021 decreased $25 million to $8 million, primarily due to lower gross profit and higher restructuring expenses, partially offset by lower SG&A expenses. Year Ended March 31, 2020 Compared with Year Ended March 31, 2019 CIS net sales decreased $84 million, or 12 percent, in fiscal 2020 compared with the prior year, primarily due to lower sales volume and a $12 million unfavorable impact of foreign currency exchange rate changes. Sales to commercial HVAC&R and data center cooling customers decreased $43 million and $38 million, respectively, CIS cost of sales decreased $62 million, or 10 percent, primarily due to lower sales volume and an $11 million favorable foreign currency exchange rate impact. As a percentage of sales, cost of sales increased 120 basis points to 85.1 percent, primarily due to the unfavorable impact of lower sales volume and unfavorable sales mix. As a result of the lower sales and higher cost of sales as a percentage of sales, gross profit decreased $22 million and gross margin declined 130 basis points to 14.9 percent. CIS SG&A expenses decreased S4 million compared with the prior year, primarily due to lower compensation-related expenses, which decreased approximately $2 million, and the favorable impact of cost-control initiatives. Restructuring expenses during fiscal 2020 increased $2 million, primarily due to higher equipment transfer and plant consolidation costs. During fiscal 2020, we recorded a $1 million asset impairment charge related to a previously-closed manufacturing facility in Austria. a Operating income in fiscal 2020 decreased $20 million to $33 million, primarily due to lower gross profit, partially offset by lower SG&A expenses. 31 Table of Contents HDE 2019 s's 1.11 2021 % of sales 682 100.0% 594 87.0% 88 13.0% (in millions) Net sales Cost of sales Gross profit Selling, general and administrative expenses Restructuring expenses Operating income f41 Years ended March 31, 2020 S's % of sunles 746 100.0% 649 87.0% 97 13.0% 872 744 128 111 % of sales 100.0% 85.3% 14.7 49 7.4% 62 7.1% 0.4% 5.4% 56 3 38 0.4% 5.1% 7.1% 0.1% 7.5% 65 Year Ended March 31, 2021 Compared with Year Ended March 31, 2020 HDE net sales decreased $64 million or Operrent in fiscal 2021 compared with the prior vear primarily due to lower sales volume resulting from the ITEM 8 FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA. MODINE MANUFACTURING COMPANY CONSOLIDATED STATEMENTS OF OPERATIONS For the years ended March 31, 2021, 2020 and 2019 (In millions, except per share amounts) $ 2021 1.808.4 1.515.0 293.4 210.9 13.4 166.8 Net sales Cost of sales Gross profit Selling, general and administrative expenses Restructuring expenses Impairment charges (Gain) loss on sale of assets Operating (loss) income Interest expense Other expense.net (Loss) earnings before income taxes (Provision) benefit for income taxes Net (loss) earrings Net earnings attributable to noncontrolling interest Net (loss) earnings attributable to Modine Net doss) earnings per share attributable to Modine shareholders: Basic Diluted Weighted average shares outstanding: Basic Diluted 2020 1.975.5 1.668.0 307.5 249.6 12.2. 8.6 (0.8 37.9 (22.7 (4.8) 10.4 (12.4 (2.09 (0.2 2019 2.212.7 1,847.2 365.5 244.1 9.6 0.4 1.7 109.7 (24.8 (4.1 80.8 5.1 85.9 (1.1 84.8 (97.7 (19.4) (2.2) (119.3) (90.2) (209.5) (1.2) (210.7 $ (2.2 $ S (4.11) $ (4.11 $ (0.04) (0.04) 1.67 1.65 S 51.3 51.3 50.8 50.8 50.5 51.3 The notes to consolidated financial statements are an integral part of these statements. 44 43 Table of Contents ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA. MODINE MANUFACTURING COMPANY CONSOLIDATED STATEMENTS OF OPERATIONS For the years ended March 31, 2021, 2020 and 2019 (In millions, except per share amounts) $ $ S 2021 1.808.4 1,515.0 293.4 210.9 13.4 166.8 Net sales Cost of sales Gross profit Selling, general and administrative expenses Restructuring expenses Impairment charges (Gain) loss on sale of assets Operating (loss) income Interest expense Other expense - net (Loss) earnings before income taxes (Provision) benefit for income taxes Net (loss) earnings Net earnings attributable to noncontrolling interest Net (loss) earnings attributable to Modine Net (loss) earnings per share attributable to Modine shareholders: Basic Diluted Weighted-average shares outstanding: Basic Diluted 2020 1,975.5 1,668.0 307.5 249.6 12.2 8.6 (0.8) 37.9 (22.7) (4.8 10.4 (12.4) (2.0 (0.2 (2.2 2019 2.212.7 1,847.2 365.5 244.1 9.6 0.4 1.7 109. (24.8 (4.1 80.8 5.1 85.9 (1.1 84.8 (97.7) (19.4) (2.2) (119.3) (90.2 (209.5) (1.2) (210.7) $ S (4.11) (4.11 $ $ (0.04) (0.04) 1.67 1.65 $ S 51.3 51.3 50.8 50.8 50.5 51.3 The notes to consolidated financial statements are an integral part of these statements. 44 Table of Contents MODINE MANUFACTURING COMPANY CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME For the years ended March 31, 2021, 2020 and 2019 (In millions) 2021 (209.5) $ 2020 (2.0) 2019 85.9 S Net (loss) earnings Other comprehensive income (loss): Foreign currency translation Defined benefit plans, net of income taxes of $10.4, ($8.3) and ($0.3) million Cash flow hedges, net of income taxes of $0.6, (30.5) and $0.1 million Total other comprehensive income (loss) Comprehensive income (loss) Comprehensive (income) loss attributable to noncontrolling interest Comprehensive income (loss) attributable to Modine 30.9 30.1 1.6 62.6 (19.2) (24.6) (1.5 (45.3) (37.6) (1.4 0.4 (38.6 (146.9 (1.7) (148.6) $ (473 0.2 4713 (0.6 46.7 (47.1) S The notes to consolidated financial statements are an integral part of these statements. 45 Tuhle of Contents MODINE MANUFACTURING COMPANY CONSOLIDATED STATEMENTS OF CASH FLOWS For the years ended March 31, 2021, 2020 and 2019 In millions) 2021 2020 2019 $ (209.5) $ S 85.9 76.9 (4.4 (15.3) (22.0 16.6 (10.1) (11.8 (27.8 103.3 Cash flows from operating activities: Net (loss) earnings Adjustments to reconcile net (loss) earnings to net cash provided by operating activities: Depreciation and amortization Impairment charges (Gain) loss on sale of assets Stock-based compensation expense Deferred income taxes Othernet Changes in operating assets and liabilities: Trade accounts receivable Inventories Accounts payable Accrued compensation and employee benefits Other assets Other liabilities Net cash provided by operating activities Cash flows from investing activities: Expenditures for property, plant and equipment Proceeds from dispositions of assets Proceeds from sale of investment in affiliate Proceeds from maturities of short-term investments Purchases of short-term investments Othernet Net cash used for investing activities Cash flows from financing activities: Borrowings of debt Repayments of debt Borrowings on bank overdraft facilities -net Dividend paid to noncontrolling interest Purchase of treasury stock under share repurchase program Financing fees paid Other - net Net cash (used for) provided by financing activities Effect of exchange rate changes on cash Net (decrease) increase in cash, cash equivalents, restricted cash and cash held for sale Cash, cash equivalents, restricted cash and cash held for sale - beginning of year Cash, cash equivalents, restricted cash and cash held for sale - end of year CEE CEEA 11512@36 Lala, BENG (73.9 EL LCS Blaga. 120 LETNICE 12122, (3.8) (0.3 (72.8 (60.5 (183,6) 672.0 (630.3) 1.2 (1.3 (2.4 (2.8 (3.1) 33.3 221.3 (241.9 (0.1 (1.8) (0.6) (2.8 (25.9 (145.1 1150 (1.6) 29.1 42.2 71.3 (2.7 1.9 40.3 42.2 The notes to consolidated financial statements are an integral part of these statements. MODINE MANUFACTURING COMPANY CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY For the years ended March 31, 2021, 2020 and 2019 (In millions) Additional Treasury Common stock paid-in Retained Accumulated other stock, Non-controlling Shares Amount tapital Total earnings comprehensive loss at cost interest 52.35 32.7 229.9 $ 394.9 $ (140.3) $ 498.5 (27.1) $ 8.4 $ (7.6) 84.8 (7.6 85.9 (38.1) HIER (0.5) 0.5 0.3 0.8 (4.3 7.9 () 52.8 33.0 238.6 (178.4) (31.4) 541.1 472.1 (2.2 (44.9 Balance, March 31, 2018 Adoption of new accounting guidance (Note 1) Net earnings Other comprehensive loss Stock options and awards Purchase of treasury stock Stock-based compensation expense Dividend paid to noncontrolling interest Balance, March 31, 2019 Net (Loss) earnings Other comprehensive loss Stock options and awards Purchase of treasury stock Stock-based compensation expense Dividend paid to noncontrolling interest Balance, March 31, 2020 Net (Loss) earnings Other comprehensive income Stock options and awards Purchase of treasury stock Stock-based compensation expense Balance, March 31, 2021 Tel ................. GIEL IR (0.4) 0.6 0.3 1 (0.1 01 @ le 18 II @ GB 2 @ E E|| (5.7) HERE 6.6 (1.3) 53.4 33.3 245.1 (223.3) (37.1) 469.9 (210,7 BER 493.6 (209.5 62.1 0.9 0.6 3.6 (1.1 6.3 255.0 $ 54.3 $ 33.9 s 259,2 $ (1612) $ (38.2) $ 7.4 $ 356.1 The notes to consolidated financial statements are an integral part of these statements. MODINE MANUFACTURING COMPANY CONSOLIDATED STATEMENTS OF OPERATIONS For the years ended March 31, 2021, 2020 and 2019 (In millions, except per share amounts) $ S 2021 1,808.4 1.515.0 293.4 210.9 13.4 166.8 2020 1.975.5 1,668,0 307.5 249.6 12.2 8.6 (0.8) 37.9 (22.7 2019 2,212.7 1,847.2 365.5 244.1 9.6 0.4 1.7 4.8) Net sales Cost of sales Gross profit Selling, general and administrative expenses Restructuring expenses Impairment charges (Gain) loss on sale of assets Operating (loss) income Interest expense Other expense - net (Loss) earnings before income taxes (Provision) benefit for income taxes Net (loss) earnings Net earnings attributable to noncontrolling interest Net (loss) earnings attributable to Modine Net (loss) earnings per share attributable to Modine shareholders: Basic Diluted Weighted average shares outstanding: Basic Diluted 1977 (19.4) (2.2) (119.3) (90.21 (209.5) (1.2 (210.7) $ 10.4 (12.4) (2.0) (0.2 (2.2 109.7 (24.8) (4.1 80.8 5.1 85.9 (1.1 84.8 $ $ $ (4.11) (4.11) (0.04) (0.04) 1.67 1.65 $ $ S 51.3 51.3 50.8 50.8 50.5 51.3 The notes to consolidated financial statements are an integral part of these statements. Table of Contents Eiscal 2021 Highlights Fiscal 2021 net sales decreased $167 million, or 8 percent, from the prior year, primarily due to lower sales in our CIS, HDE, and Automotive segments, partially offset by higher sales in our BHVAC segment. Foreign currency exchange rate changes favorably impacted sales in fiscal 2021 by $28 million. Cost of sales decreased $153 million, or 9 percent, from last year, primarily due to lower sales volume. Gross profit decreased $14 million and gross margin improved 60 basis points to 16.2 percent. SG&A expenses decreased $39 million, primarily due to lower costs associated with our review of strategic alternatives for our Automotive segment businesses and preparing the liquid and air-cooled automotive businesses for sale. In addition, SG&A expenses decreased due to cost-reduction initiatives implemented early in the fiscal year in response to the negative impacts of COVID-19. The operating loss of S98 million during fiscal 2021 represents a $136 million decline from the prior-year operating income of $38 million and was primarily due to 5167 million of impairment charges recorded primarily for assets of the liquid- and air-cooled automotive businesses, partially offset by lower SG&A expenses. Fiscal 2020 Highlights Fiscal 2020 net sales decreased $237 million, or 11 percent, from the prior year, primarily due to lower sales in our HDE, CIS, and Automotive segments, partially offset by higher sales in our BHVAC segment. Foreign currency exchange rate changes negatively impacted sales in fiscal 2020 by $46 million. Cost of sales decreased $179 million, or 10 percent, from the prior year, primarily due to lower sales volume. Gross profit decreased $58 million and gross margin declined 90 basis points to 15.6 percent. SG&A expenses increased $6 million, primarily due to higher costs associated with the review of strategic alternatives for our Automotive segment businesses, partially offset by lower-compensation related expenses. Operating income during fiscal 2020 decreased $72 million to $38 million, primarily due to lower gross profit and higher SG&A expenses. The following table presents our consolidated financial results on a comparative basis for fiscal years 2021, 2020 and 2019. Years ended March 31, 20211 2020 2019 (in millions) % of sales % of sales $'s of sales Net sales 1,808 100.0% 5 1,976 100.0% 2.213 100.096 Cost of sales 1.515 83.8% 1.668 84.4% 1.847 83.5% Gross profit 293 16.2% 308 15.6% 366 16.5% Selling, general and administrative expenses 211 11.7% 250 12.6% 244 11.0 Restructuring expenses 13 0.7% 0.6% 10 0.4% Impairment charges 167 9.2% 0.4% (Gain) loss on sale of assets (1) 2 0.1% Operating (loss) income (98) -5.4% 1.9% 110 5.0% Interest expense (19) -1.1% (23) -1.1% (25) -1.1% Other expense - net (2) -0.1% -0.2% (4) -0.2% (Loss) earnings before income taxes (119) -6.6% 0.5% 3.7% (Provision) benefit for income taxes (90) -5.0% (12) -0.6% 5 0.2% Net (Loss) earnings (209) - 11.6% S -0.1% 86 3.9% Year Ended March 31, 2021 Compared with Year Ended March 31, 2020 $'s ele alle Fiscal 2021 net sales of $1,808 million were $167 million, or 8 percent, lower than the prior year, primarily due to lower sales volume in the CIS, HDE, and Automotive segments, partially offset by a $28 million favorable impact of foreign currency exchange rate changes and higher sales volume in the BHVAC segment. Sales in the CIS, HDE and Automotive segments decreased $92 million, $64 million and 547 million, respectively, and were significantly impacted by market-driven volume declines and temporary plant closures early in the fiscal year due to the COVID-19 pandemic. Sales increased $20 million in our BHVAC segment. Fiscal 2021 cost of sales of $1,515 million decreased $153 million, or 9 percent, primarily due to lower sales volume. Fiscal 2021 cost of sales was negatively impacted by $24 million from foreign currency exchange rate changes. As a percentage of sales, cost of sales decreased 60 basis points to 83.8 percent. The unfavorable impacts of lower sales volume and, to a lesser extent, higher material costs, which negatively impacted cost of sales as a percentage of sales by approximately 50 basis points, were more than offset by benefits from procurement and other cost-reduction initiatives and an 38 million decrease in depreciation expense in the Automotive segment. We ceased depreciating the long-lived assets within the liquid- and air- cooled automotive businesses once they were classified as held for sale during fiscal 2021. In addition, program and equipment transfer costs to prepare the liquid-cooled automotive business for sale decreased approximately $3 million compared with the prior year. MODINE MANUFACTURING COMPANY CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME For the years ended March 31, 2021, 2020 and 2019 (In millions) 2021 (209.5) 2020 (2.0) 2019 85.9 $ S 30.9 30.1 (19.2) (24.6) (1.5 (45.3) (37.6) (1.4 0.4 1.6 62.6 (38.6) Net (loss) earnings Other comprehensive income (loss): Foreign currency translation Defined benefit plans, net of income taxes of $10.4, ($8.3) and ($0.3) million Cash flow hedges, net of income taxes of $0.6, (30.5) and $0.1 million Total other comprehensive income (loss) Comprehensive income (loss) Comprehensive (income) loss attributable to noncontrolling interest Comprehensive income (loss) attributable to Modine The notes to consolidated financial statements are an integral part of these statements. 1971 (146.9) (1.7) (148,6) $ (47.3 0.2 (47.1) 47.3 (0.6 46.7 45 Tohle of Contents MODINE MANUFACTURING COMPANY CONSOLIDATED BALANCE SHEETS March 31, 2021 and 2020 (In millions, except per share amounts) 2021 2020 S 70.9 292.5 207.4 62.5 ASSETS Cash and cash equivalents Trade accounts receivable -net Inventories Assets held for sale Other current assets Total current assets Property, plant and equipment - net Intangible assets-net Goodwill Deferred income taxes Other noncurrent assets Total assets 37.8 267.9 195.6 107.6 35.9 644.8 269.9 100.6 170.7 24.5 66.2 1,276.7 633.3 448,0 106.3 166.1 104.8 77.6 1,536.1 $ $ 14.8 15.6 227.4 65.0 49.2 LIABILITIES AND SHAREHOLDERS' EQUITY Short-term debt Long-term debt-current portion Accounts payable Accrued compensation and employee benefits Liabilities held for sale Other current linbilities Total current liabilities Long-term debt Deferred income taxes Pensions Other noncurrent liabilities Total liabilities Commitments and contingencies (see Note 20) Shareholders' equity Preferred stock, $0.025 par value, authorized 16.0 million shares, issued - none Common stock, $0.625 par value, authorized 80.0 million shares, issued 54.3 million and 53.4 million shares Additional paid-in capital Retained earnings Accumulated other comprehensive loss Treasury stock, at cost, 2.7 million and 2.5 million shares Total Modine shareholders' equity Noncontrolling interest Total equity Total liabilities and equity 1.4 21.9 233.9 66.5 103.3 42.2 469.2 311.2 5.9 58.6 75.7 920.6 372.0 452.0 8.1 130.9 79.5 1,042.5 33.9 255.0 259.2 (161.2 (38.2) 348.7 7.4 356.1 1,276,7 33.3 245.1 469.9 (223.3 (37.1 487.9 5.7 493.6 1,536.1 $ S The notes to consolidated financial statements are an integral part of these statements. Table of Contents MODINE MANUFACTURING COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (In millions, except per share amounts) The Company classified the assets and liabilities of the liquid- and air-cooled automotive businesses as held for sale on the March 31, 2021 consolidated balance sheet. The major classes of assets and liabilities held for sale were as follows: March 31, 2021 ASSETS Cash and cash equivalents 8.0 Trade accounts receivables - net 54.4 Inventories 24.7 Other current assets 12.8 Property, plant and equipment - net 164.0 Other noncurrent assets 8.8 Impairment of carrying value (165.1) Total assets held for sale 107.6 LIABILITIES Short-term debt 5.0 Accounts payable 46.3 Accrued compensation and employee benefits 15.5 Other current liabilities 12.2 Pensions 17.8 Other noncurrent liabilities 6.5 Total liabilities held for sale 103.3 The Company will reassess the liquid-cooled disposal group's fair value less costs to sell at each reporting period that it is held for sale until the transaction is completed. The Company expects to record a loss on sale of approximately $20.0 million to $30.0 million upon transaction completion. The loss on sale recorded will be impacted by changes in working capital, costs to sell, net actuarial losses in accumulated other comprehensive loss related to the disposal group's pension plans, and cumulative translation adjustments. It is possible that the loss on sale recorded could differ materially from the Company's estimate Note 11: Inventories Inventories consisted of the following: $ Raw materials Work in process Finished goods Total inventories March 31. 2021 2020 117.1 123.6 38.5 34.6 40.0 49.2 195.65 207.4 At March 31, 2021, inventories excluded amounts classified as held for sale. See Note 2 for additional information. March 31, 2021 $ 8.0 54.4 24.7 12.8 164.0 8.8 (165.1) 107.6 ASSETS Cash and cash equivalents Trade accounts receivables - net Inventories Other current assets Property, plant and equipment-net Other noncurrent assets Impairment of carrying value Total assets held for sale LIABILITIES Short-term debt Accounts payable Accrued compensation and employee benefits Other current liabilities Pensions Other noncurrent liabilities Total liabilities held for sale 5.0 46.3 15.5 12.2 17.8 6.5 103.3 The Company will reassess the liquid-cooled disposal group's fair value less costs to sell at each reporting period that it is held for sale until the transaction is completed. The Company expects to record a loss on sale of approximately $20.0 million to $30.0 million upon transaction completion. The loss on sale recorded will be impacted by changes in working capital, costs to sell, net actuarial losses in accumulated other comprehensive loss related to the disposal group's pension plans, and cumulative translation adjustments. It is possible that the loss on sale recorded could differ materially from the Company's estimate Table of Contents Credit Risk . and Credit risk represents the possibility of loss from a customer failing to make payment according to contract terms. Our principal credit risk consists of outstanding trade accounts receivable. At March 31, 2021,35 percent of our trade accounts receivable was concentrated with our top ten customers. These customers operate primarily in the commercial vehicle, off-highway, automotive and light vehicle, commercial air conditioning, and refrigeration markets and are influenced by similar market and general economic factors. In the past, credit losses from our customers have not been significant, nor have we experienced a significant increase in credit losses in connection with the COVID-19 pandemic. We manage credit risk through a focus on the following: Cash and investments - We review cash deposits and short-term investments to ensure banks have acceptable credit ratings, and short-term investments are maintained in secured or guaranteed instruments. We consider our holdings in cash and investments to be stable and secure at March 31, 2021; Trade accounts receivable - Prior to granting credit, we evaluate each customer, taking into consideration the customer's financial condition, payment experience and credit information. After credit is granted, we actively monitor the customer's financial condition and applicable business news: Pension assets - We have retained outside advisors to assist in the management of the assets in our pension plans. In making investment decisions, we utilize an established risk management protocol that focuses on protection of the plan assets against downside risk. We ensure that investments within these plans provide appropriate diversification, the investments are monitored by investment teams, and portfolio managers adhere to the established investment policies. We believe the plan assets are subject to appropriate investment policies and controls; Insurance - We monitor our insurance providers to ensure they maintain financial ratings that are acceptable to us. We have not identified any concerns in this regard based upon our reviews. In addition, we are also exposed to risks associated with demands by our customers for decreases in the price of our products. We attempt to offset this risk with firm agreements with our customers whenever possible, but these agreements sometimes contain provisions for future price reductions. Economic and Market Risk Economic risk represents the possibility of loss resulting from economic instability in certain areas of the world or downturns in markets in which we operate. We sell a broad range of products that provide thermal solutions to customers operating in diverse markets, including the commercial, industrial, and building HVAC&R and commercial vehicle, off-highway, and automotive and light vehicle markets. The COVID-19 pandemic has negatively impacted many of these markets. While conditions in these markets have been steadily improving, future impacts of the COVID-19 pandemic are uncertain. Considering our global presence, we also encounter risks imposed by potential trade restrictions, including tariffs, embargoes, and the like. We continue to pursue non-speculative opportunities to mitigate these economic risks, and capitalize, when possible, on changing market conditions. We pursue new market opportunities after careful consideration of the potential associated risks and benefits. Successes in new markets are dependent upon our ability to commercialize our investments. Current examples of new and emerging markets for us include those related to electric vehicles, coils and coolers in certain markets, and coatings. Our investment in these areas is subject to the risks associated with technological success, customer and market acceptance, and our ability to meet the demands of our customers as these markets grow. Table of Contents Hedging and Foreign Currency Forward Contracts We use derivative financial instruments as a tool to manage certain financial risks. We prohibit the use of leveraged derivatives. Commodity Derivatives From time to time, we enter into over-the-counter forward contracts related to forecasted purchases of aluminum and copper. Our strategy is to reduce our exposure to changing market prices of these commodities. In fiscal 2021 and 2020, we designated certain commodity forward contracts as cash flow hedges for accounting purposes. Accordingly, for these designated hedges, we record unrealized gains and losses related to the change in the fair value of the contracts in other comprehensive income (loss) within shareholders' equity and subsequently recognize the gains and losses within cost of sales as the underlying inventory is sold. In fiscal 2021, 2020 and 2019, net gains and losses recognized in cost of sales related to commodity forward contracts were less than $1 million in each year. Foreign Currency Forward Contracts We use derivative financial instruments in a limited way to mitigate foreign currency exchange risk. We periodically enter into foreign currency forward contracts to hedge specific foreign currency-denominated assets and liabilities as well as forecasted transactions. We have designated certain hedges of forecasted transactions as cash flow hedges for accounting purposes. Accordingly, for these designated hedges, we record unrealized gains and losses related to the change in the fair value of the contracts in other comprehensive income (loss) within shareholders' equity and subsequently recognize the gains and losses as a component of earnings at the same time and in the same financial statement line that the underlying transactions impact earnings. In fiscal 2021, 2020, and 2019, net gains and losses recognized in sales and cost of sales related to foreign currency forward contracts were less than $1 million in each year. We have not designated forward contracts related to foreign currency- denominated assets and liabilities as hedges. Accordingly, for these non-designated contracts, we record unrealized gains and losses related to the change in the fair value of the contracts in other income and expense. Gains and losses on these non-designated foreign currency forward contracts are offset by foreign currency gains and losses associated with the related assets and liabilities. We manage counterparty risks by ensuring that counterparties to derivative instruments maintain credit ratings acceptable to us. At March 31, 2021, all counterparties had a sufficient long-term credit rating. Tohle of Contents ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA. MODINE MANUFACTURING COMPANY CONSOLIDATED STATEMENTS OF OPERATIONS For the years ended March 31, 2021, 2020 and 2019 (In millions, except per share amounts) $ 2021 1.808.4 1.515.0 293.4 210.9 13.4 166.8 2020 1.975.5 1.668.0 307.5 249.6 12.2. 8.6 (0.8 37.9 (22.7 (4.8) 10.4 (12.4 (2.09 (0.2 2019 2.212.7 1,847.2 365.5 244.1 9.6 0.4 1.7 109.7 (24.8) Net sales Cost of sales Gross profit Selling, general and administrative expenses Restructuring expenses Impairment charges (Gain) loss on sale of assets Operating (loss) income Interest expense Other expense - net (Loss) earnings before income taxes (Provision) benefit for income taxes Net (loss) earnings Net earnings attributable to noncontrolling interest Net (loss) earnings attributable to Modine Net doss) earnings per share attributable to Modine shareholders: Basic Diluted Weighted average shares outstanding: Basic Diluted (977) (19.4) (2.23 (119.3) (90.2) (209.5) (1.2 (210.7 80.8 5.1 85.9 (1.1 84.8 $ (2.2 $ (4.11) $ (4.11 $ (0.04) (0.04) S S 1.67 1.65 51.3 51.3 50.8 50.8 50.5 51.3 The notes to consolidated financial statements are an integral part of these statements. 44 Table of Contents 2020 2019 85.9 (2.0 MODINE MANUFACTURING COMPANY CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME For the years ended March 31, 2021, 2020 and 2019 (In millions) 2021 Net (loss) earnings (209.5) Other comprehensive income (loss): Foreign currency translation 30.9 Defined benefit plans, net of income taxes of $10.4. ($8.3) and ($0.3) million 30.1 Cash flow hedges, net of income taxes of $0.6, (30.5) and $0.1 million 1.6 Total other comprehensive income (loss) 62.6 Comprehensive income (loss) (146.9) Comprehensive (income) loss attributable to noncontrolling interest (1.7 Comprehensive income (loss) attributable to Modine (148.6) (37.6 (1.4 (19.2) (24.5) (1.5 (45.3) 19194 (38.6 (47.3 0.2 (47.1) s 47.3 (0.6 46.7 $ The notes to consolidated financial statements are an integral part of these statements. 45 Table of contents Tablea.contents MODINE MANUFACTURING COMPANY CONSOLIDATED BALANCE SHEETS March 31, 2021 and 2020 (In millions, except per share amounts) 2021 2020 70.9 292.5 207.4 ASSETS Cash and cash equivalents Trade accounts receivable-net Inventories Assets held for sale Other current assets Total current assets Property, plant and equipment - net Intangible assets - net Goodwill Deferred income taxes Other noncurrent assets Total assets 37.8 267.9 195,6 107.6 35.9 644.8 269.9 100.6 170.7 24.5 66.2 1,276,7 62.5 633.3 448.0 106.3 166.1 104.8 77.6 1,536.1 $ S s 14.8 15.6 227.4 65.0 LIABILITIES AND SHAREHOLDERS' EQUITY Short-term debt Long-term debt - current portion Accounts payable Accrued compensation and employee benefits Liabilities held for sale Other current liabilities Total current liabilities Long-term debt Deferred income taxes Pensions Other noncurrent liabilities Total liabilities Commitments and contingencies (see Note 20) Shareholders' equity Preferred stock, $0.025 par value, authorized 16.0 million shares, issued - none Common stock, $0.625 par value, authorized 80.0 million shares, issued 54.3 million and 53.4 million shares Additional paid-in capital Retained earnings Accumulated other comprehensive loss Treasury stock, at cost, 2.7 million and 2.5 million shares Total Modine shareholders' equity Noncontrolling interest Total equity Total liabilities and equity 1.4 21.9 233.9 66.5 103.3 42.2 469.2 311.2 5.9 58.6 75.7 920.6 Here 49.2 372.0 452.0 8.1 130.9 79.5 1,042.5 33.9 255.0 259,2 (161.2 (38.2 348.7 7.4 356.1 1.276.7 33.3 245.1 469.9 (223.3 (371) 487.9 5.7 493.6 1,536.1 $ S The notes to consolidated financial statements are an integral part of these statements. 46 Inbie.of.contents MODINE MANUFACTURING COMPANY CONSOLIDATED STATEMENTS OF CASH FLOWS For the years ended March 31, 2021, 2020 and 2019 (In millions) 2021 2020 2019 (209.5) $ S Cash flows from operating activities: Net (Loss) earnings Adjustments to reconcile net (loss) earnings to net cash provided by operating activities: Depreciation and amortization Impairment charges (Gain) loss on sale of assets Stock-based compensation expense Deferred income taxes Othernet Changes in operating assets and liabilities: Trade accounts receivable Inventories Accounts payable Accrued compensation and employee benefits Other assets Other liabilities Net cash provided by operating activities Cash flows from investing activities: Expenditures for property, plant and equipment Proceeds from dispositions of assets Proceeds from sale of investment in affiliate Proceeds from maturities of short-term investments Purchases of short-term investments Othernet Net cash used for investing activities Cash flows from financing activities: Borrowings of debt Repayments of debt Borrowings on bank overdraft facilities - net Dividend paid to noncontrolling interest Purchase of treasury stock under share repurchase program Financing fees paid Othernet Net cash (used for) provided by financing activities Effect of exchange rate changes on cash Net (decrease) increase in cash, cash equivalents, restricted cash and cash held for sale Cash, cash equivalents, restricted cash and cash held for sale - beginning of year Cash, cash equivalents, restricted cash and cash held for sale - end of year The notes to consolidated financial statements are an integral part of these statements. ... s la la. PG ES171 g El la. El IS SIBI:13: libel: SISIRIS Hazle be Bezbegal , el CECECE CIID 13 (60.5 (183.6 DE-B33E | (0.8) 3.0 (145.1) 1.4 (25.2) 71.3 46.1 (1.6) 29.1 42.2 71.3 $ ### ... LITER MODINE MANUFACTURING COMPANY CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY For the years ended March 31, 2021, 2020 and 2019 (In millions) Additional Treasury Common stock paid-in Retained Accumulated other stock, Non-controlling Shares Amount tapital earnings comprehensive loss at cost interest Total Balance, March 31, 2018 52.3 $ 32.7 S 229.9 $ 394.9 $ (140.3) $ (27.1) $ 8.4 $ 498.5 Adoption of new accounting guidance (Note 1) (7.6 (7.6 Net earnings 84.8 1.1 85.9 Other comprehensive loss (38.1 (0.5) (38.6 Stock options and awards 0.5 0.3 0.8 Purchase of treasury stock (4.3 Stock-based compensation expense 7.9 Dividend paid to noncontrolling interest (1.8) Balance, March 31, 2019 52.8 33.0 238,6 472.1 (178.4) (31.4) 7.2 Net (loss) earnings (2.2 0.2 (2.0) Other comprehensive loss (44.9 (0.4) Stock options and 0.6 0.3 awards (0.1 Purchase of treasury stock (5.7 Stock-based 6.6 compensation expense Dividend paid to (1.3) noncontrolling interest Balance, March 31, 2020 53.4 33.3 245.1 469.9 (223.3) (37.1) 5.7 493.6 Net (loss) earnings (210.7) 1.2 (209.5 Other comprehensive 62.1 0.5 income Stock options and awards 0.9 0.6 3.6 Purchase of treasury stock (1.1 Stock-based 6.3 compensation expense Balance, March 31, 2021 54.3 $ 33.9 $ 255.0 $ 259.2 $ (161.2) $ (382) $ 74 $ 356.1 The notes to consolidated financial statements are an integral part of these statements. TERRITORI HIER al El la la la la @ GE ET @ LC 2.. BER !! 48 Table of contents