Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question: Prepare a statement of changes in equity for MIDNIGHT Ltd in accordance with the requirements of AASB 101? MIDNIGHT Ltd, a manufacturing company, commenced

Question:

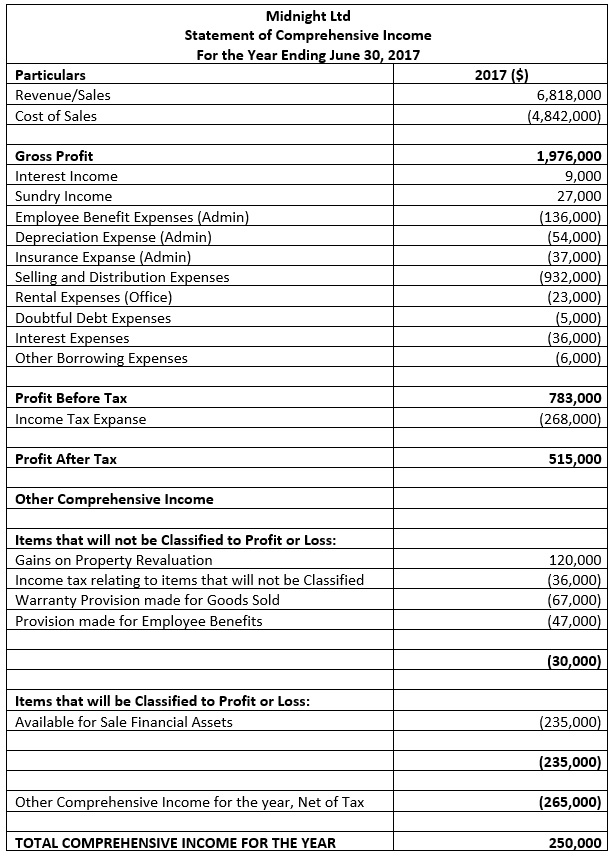

Prepare a statement of changes in equity for MIDNIGHT Ltd in accordance with the requirements of AASB 101?

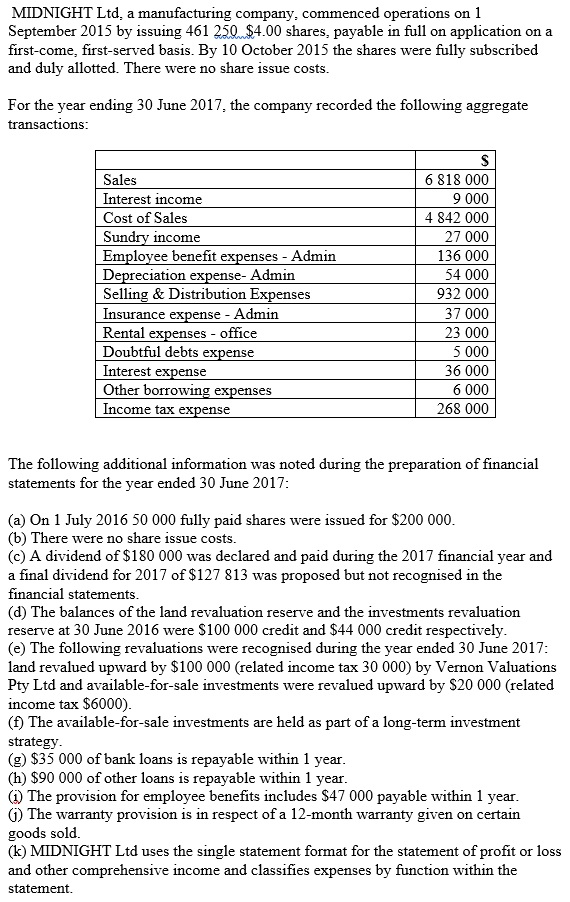

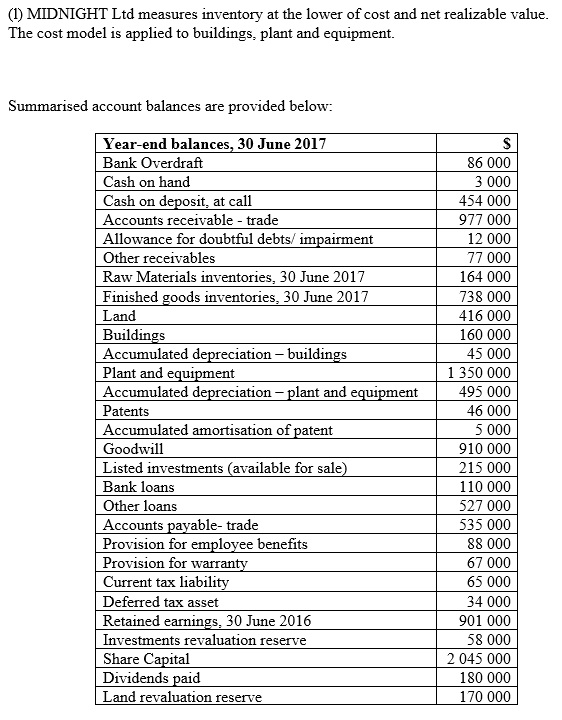

MIDNIGHT Ltd, a manufacturing company, commenced operations on 1 issuing 461 250 $4.00 shares, payable in full on application on a September 2015 by first-come, first-served basis. By 10 October 2015 the shares were fully subscribed and duly allotted. There were no share issue costs For the year ending 30 June 2017, the company recorded the following aggregate transactions Sales 6 818 000 9000 Interest income Cost of Sales 4 842 000 27 000 Sundry income Employee benefit expenses Admin 136 000 54000 Depreciation expense- Admin Selling & Distribution Expenses 932 000 37000 Insurance expense Admin 23 000 Rental expenses office 5000 Doubtful debts expense 36000 Interest expense 6000 Other borrowing expenses 268 000 Income tax expense The following additional information was noted during the preparation of financial statements for the year ended 30 June 2017 1 July 2016 50 000 fully paid shares were issued for $200 000 (a) On b) There were no share issue costs (c) A dividend of $180 000 was declared and paid during the 2017 financial year and a final dividend for 2017 of$127 813 was proposed but not recognised in the financial statements (d) The balances of the land revaluation reserve and the investments revaluation reserve at 30 June 2016 were $100 000 credit and $44 000 credit respectively (e) The following revaluations were recognised during the year ended 30 June 2017 land revalued upward by $100 000 (related income tax 30 000 by Vernon Valuations Pty Ltd and available-for-sale investments were revalued upward by S20 000 (related income tax $6000 (f The available-for-sale investments are held as part of a long-term investment strategy. (g) $35 000 of bank loans is repayable within 1 year (h) $90 000 of other loans is repayable within 1 year The provision for employee benefits includes $47 000 payable within 1 year U) e warranty provision is in respect of a 12-month warranty given on certain goods sold. (k) MIDNIGHT Ltd uses the single statement format for the statement of profit or loss and other comprehensive income and classifies expenses by function within the statement MIDNIGHT Ltd, a manufacturing company, commenced operations on 1 issuing 461 250 $4.00 shares, payable in full on application on a September 2015 by first-come, first-served basis. By 10 October 2015 the shares were fully subscribed and duly allotted. There were no share issue costs For the year ending 30 June 2017, the company recorded the following aggregate transactions Sales 6 818 000 9000 Interest income Cost of Sales 4 842 000 27 000 Sundry income Employee benefit expenses Admin 136 000 54000 Depreciation expense- Admin Selling & Distribution Expenses 932 000 37000 Insurance expense Admin 23 000 Rental expenses office 5000 Doubtful debts expense 36000 Interest expense 6000 Other borrowing expenses 268 000 Income tax expense The following additional information was noted during the preparation of financial statements for the year ended 30 June 2017 1 July 2016 50 000 fully paid shares were issued for $200 000 (a) On b) There were no share issue costs (c) A dividend of $180 000 was declared and paid during the 2017 financial year and a final dividend for 2017 of$127 813 was proposed but not recognised in the financial statements (d) The balances of the land revaluation reserve and the investments revaluation reserve at 30 June 2016 were $100 000 credit and $44 000 credit respectively (e) The following revaluations were recognised during the year ended 30 June 2017 land revalued upward by $100 000 (related income tax 30 000 by Vernon Valuations Pty Ltd and available-for-sale investments were revalued upward by S20 000 (related income tax $6000 (f The available-for-sale investments are held as part of a long-term investment strategy. (g) $35 000 of bank loans is repayable within 1 year (h) $90 000 of other loans is repayable within 1 year The provision for employee benefits includes $47 000 payable within 1 year U) e warranty provision is in respect of a 12-month warranty given on certain goods sold. (k) MIDNIGHT Ltd uses the single statement format for the statement of profit or loss and other comprehensive income and classifies expenses by function within the statementStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started