Question

QUESTION: Prepare a statement of profit or loss and other comprehensive income for the year ended 31 December 2021 The following information is relevant. 1.

QUESTION: Prepare a statement of profit or loss and other comprehensive income for the year ended 31 December 2021

The following information is relevant.

1. Closing inventory at 31 December 2021 is 45,000

On further investigation of the suspense account in the trial balance above, it was discovered that:

An expense of 8,250 for legal services had been posted to the suspense account and a cash receipt of 15,750 had been posted to the suspense account. This represented the disposal proceeds from selling equipment, which had been purchased on 1 March 2017 at a cost of 48,000.

Tonson depreciates non-current assets as follows:

-buildings at 1 per cent on a straight-line basis

-plant and equipment at 10 per cent on a straight-line basis

-motor vehicles at 20 per cent on a reducing balance basis.

4 5

6 7

8

9

10

Non-current assets have no residual value. No depreciation for the year ended 2021 has been entered into the accounting records. A full years depreciation is charged in the year of acquisition and none in the year of disposal. Depreciation expense for the year is included in administration expenses.

At 31 December 2021, Tonsons directors decided to revalue the buildings to 1,350,000. No entries have been made in the nominal ledger accounts.

Post-trial balance reconciliations showed that an invoice for 54,000 for insurance for the period from 1 October 2021 to 30 September 2022 had been paid and debited to the insurance account. Insurance costs are included in administration expenses.

A full years debenture interest is to be accrued.

At 31 December 2021, Tonson decided to write off a trade receivable of 2,400 and to make an allowance for irrecoverable receivables of 10 per cent of the outstanding receivables at that date. No entries have been made in the nominal ledger accounts.

No heat and lighting costs for the months of November and December 2021 have been recorded in the accounting records. The next quarters invoice for heat and lighting is expected to be 36,000. Heat and lighting costs are included in administration expenses.

For the financial year ended 31 December 2021, corporation tax is estimated to be 222,000 and the audit fee is estimated to be 180,000. These estimates have not been entered in the nominal ledger accounts.

Tonson is proposing a final dividend of 2 pence per share.

QUESTION: Prepare a statement of profit or loss and other comprehensive income for the year ended 31 December 2021

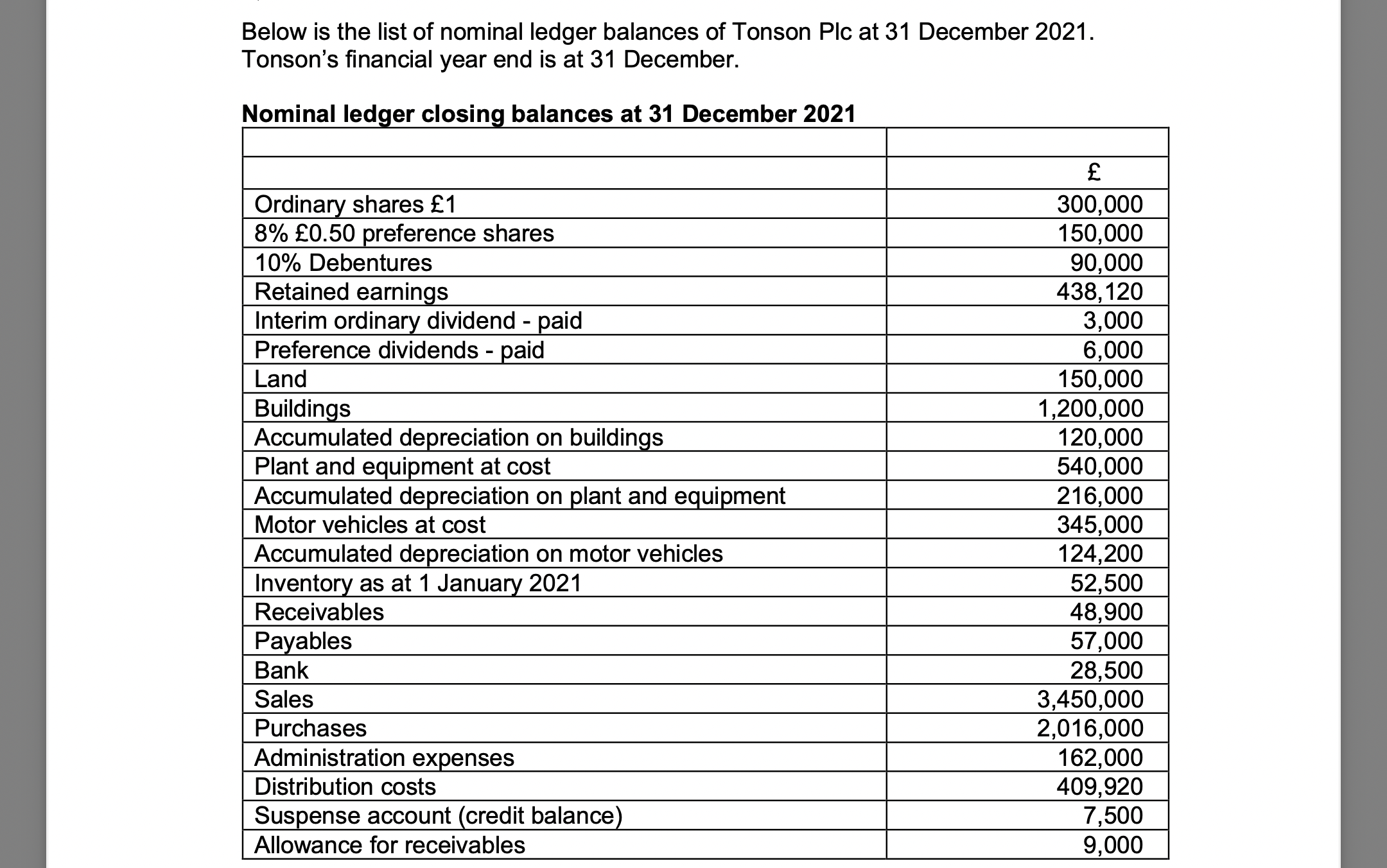

Below is the list of nominal ledger balances of Tonson Plc at 31 December 2021. Tonson's financial year end is at 31 DecemberStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started