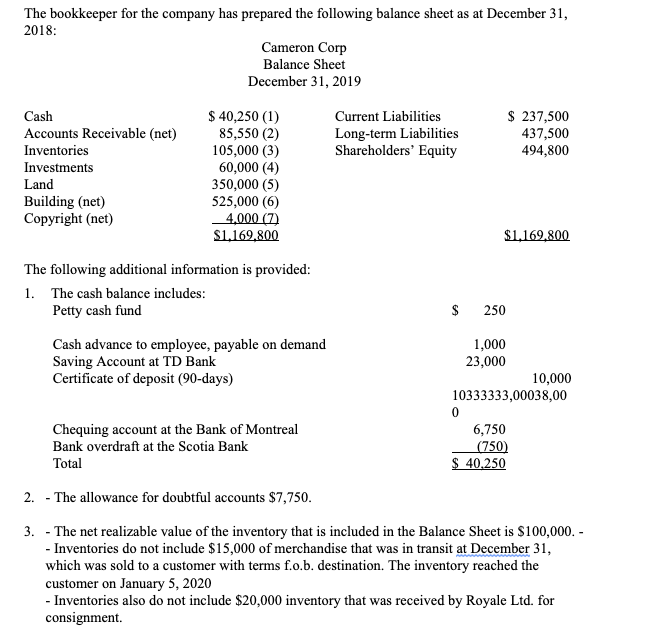

Question: Prepare the December 31, 2019 adjusting entries for notes receivable, inventory and investments.

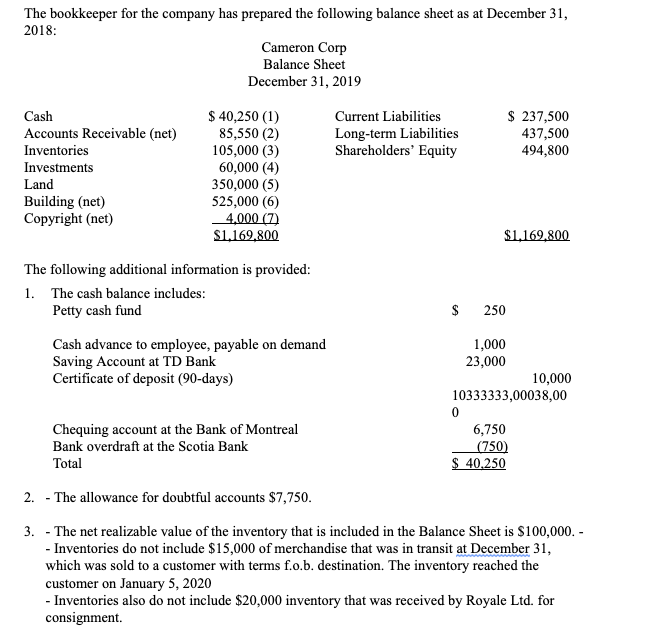

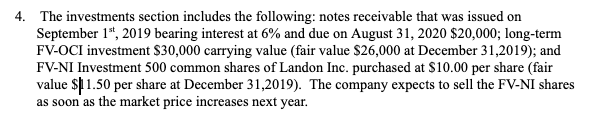

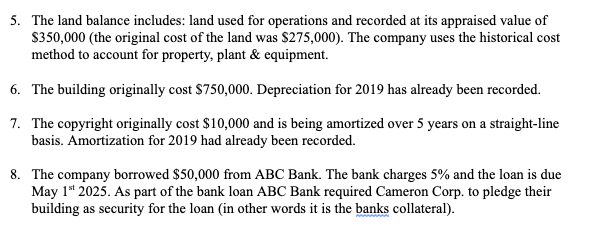

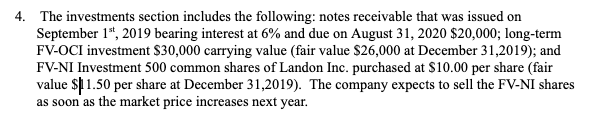

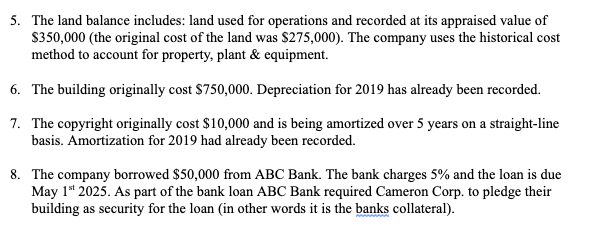

The bookkeeper for the company has prepared the following balance sheet as at December 31, 2018: Cameron Corp Balance Sheet December 31, 2019 Current Liabilities Long-term Liabilities Shareholders' Equity $ 237,500 437,500 494,800 Cash Accounts Receivable (net) Inventories Investments Land Building (net) Copyright (net) $ 40,250 (1) 85,550 (2) 105,000 (3) 60,000 (4) 350,000 (5) 525,000 (6) 4.000 (7) $1.169.800 $1.169.800 The following additional information is provided: 1. The cash balance includes: Petty cash fund $ 250 Cash advance to employee, payable on demand Saving Account at TD Bank Certificate of deposit (90-days) 1,000 23,000 10,000 10333333,00038,00 0 6,750 (750) $ 40,250 Chequing account at the Bank of Montreal Bank overdraft at the Scotia Bank Total 2. - The allowance for doubtful accounts $7,750. 3. - The net realizable value of the inventory that is included in the Balance Sheet is $100,000.- - Inventories do not include $15,000 of merchandise that was in transit at December 31, which was sold to a customer with terms f.o.b. destination. The inventory reached the customer on January 5, 2020 - Inventories also do not include $20,000 inventory that was received by Royale Ltd. for consignment. 4. The investments section includes the following: notes receivable that was issued on September 1", 2019 bearing interest at 6% and due on August 31, 2020 $20,000; long-term FV-OCI investment $30,000 carrying value (fair value $26,000 at December 31,2019); and FV-NI Investment 500 common shares of Landon Inc. purchased at $10.00 per share (fair value $1.50 per share at December 31,2019). The company expects to sell the FV-NI shares as soon as the market price increases next year. 5. The land balance includes: land used for operations and recorded at its appraised value of $350,000 (the original cost of the land was $275,000). The company uses the historical cost method to account for property, plant & equipment. 6. The building originally cost $750,000. Depreciation for 2019 has already been recorded. 7. The copyright originally cost $10,000 and is being amortized over 5 years on a straight-line basis. Amortization for 2019 had already been recorded. 8. The company borrowed $50,000 from ABC Bank. The bank charges 5% and the loan is due May 1* 2025. As part of the bank loan ABC Bank required Cameron Corp. to pledge their building as security for the loan (in other words it is the banks collateral)