Question

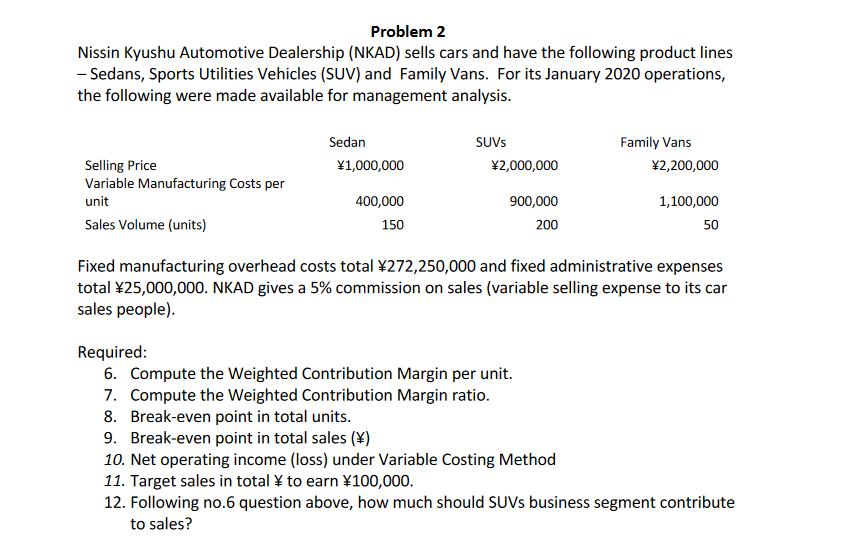

QUESTION: PROBLEM 3 Cost Volume Profit Analysis. Assume that actual sales volume of NKAD (Problem 1) for February 2020 were as follows: Sedan 200; SUVs

QUESTION: PROBLEM 3

Cost Volume Profit Analysis. Assume that actual sales volume of NKAD (Problem 1)

for February 2020 were as follows: Sedan 200; SUVs 140, Family Van 50. Assuming

there is no change in selling price and the cost structure (variable and fixed),

compute the net operating income under variable costing method.

14. The marketing manager believes that financial performance for March 2020 could be

improved with his proposal of 12% selling price increase with a corresponding 10%

decrease in volume across all products lines. Compute the projected net operating

income for March 2020 using figures from February 2020.

15. Following question number 9 , compute the break-even point in units under this

scenario.

3

16. Thinking that customers are price sensitive, management is considering to decrease

the selling price by 10% in the hope of a 10% increase in sales volume. Assume this

scenario is independent of the marketing manager’s proposal and base your March

2020 computations on the February 2020 results (see no. 8).

17. Following question number 11, compute the break-even point in total sales (¥).

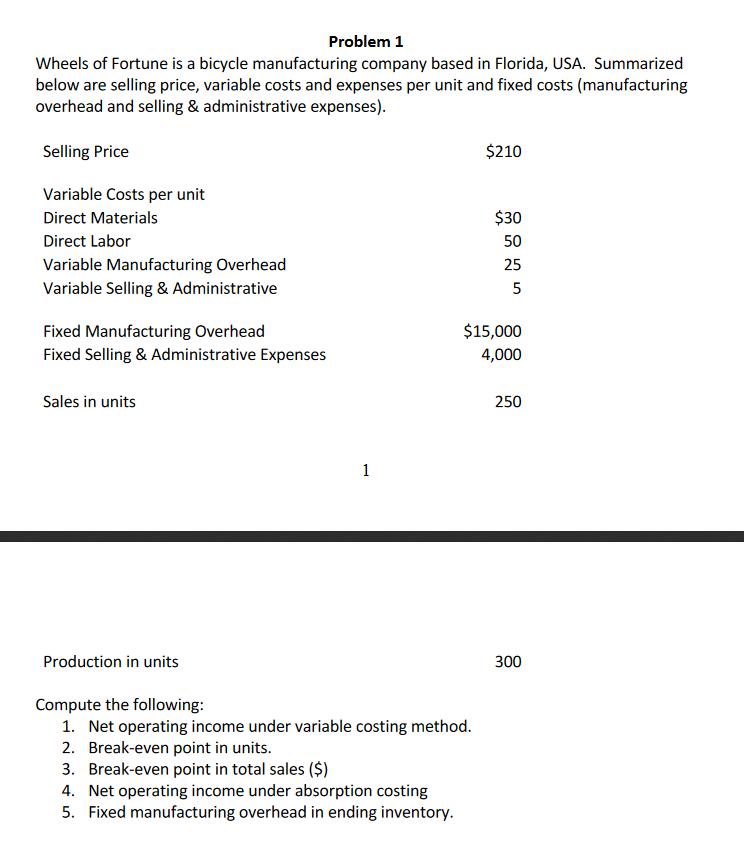

Problem 1 Wheels of Fortune is a bicycle manufacturing company based in Florida, USA. Summarized below are selling price, variable costs and expenses per unit and fixed costs (manufacturing overhead and selling & administrative expenses). Selling Price $210 Variable Costs per unit Direct Materials $30 Direct Labor 50 Variable Manufacturing Overhead 25 Variable Selling & Administrative Fixed Manufacturing Overhead $15,000 Fixed Selling & Administrative Expenses 4,000 Sales in units 250 1 Production in units 300 Compute the following: 1. Net operating income under variable costing method. 2. Break-even point in units. 3. Break-even point in total sales ($) 4. Net operating income under absorption costing 5. Fixed manufacturing overhead in ending inventory.

Step by Step Solution

3.26 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started