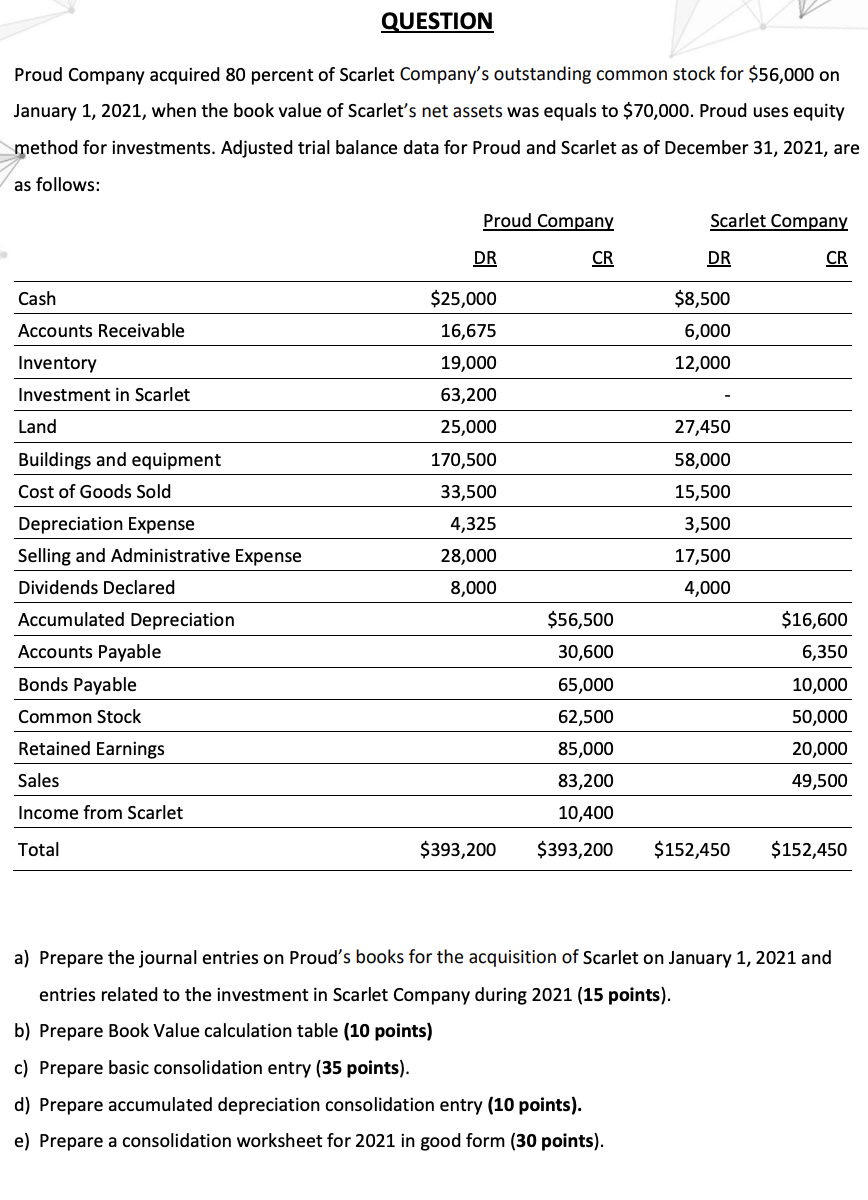

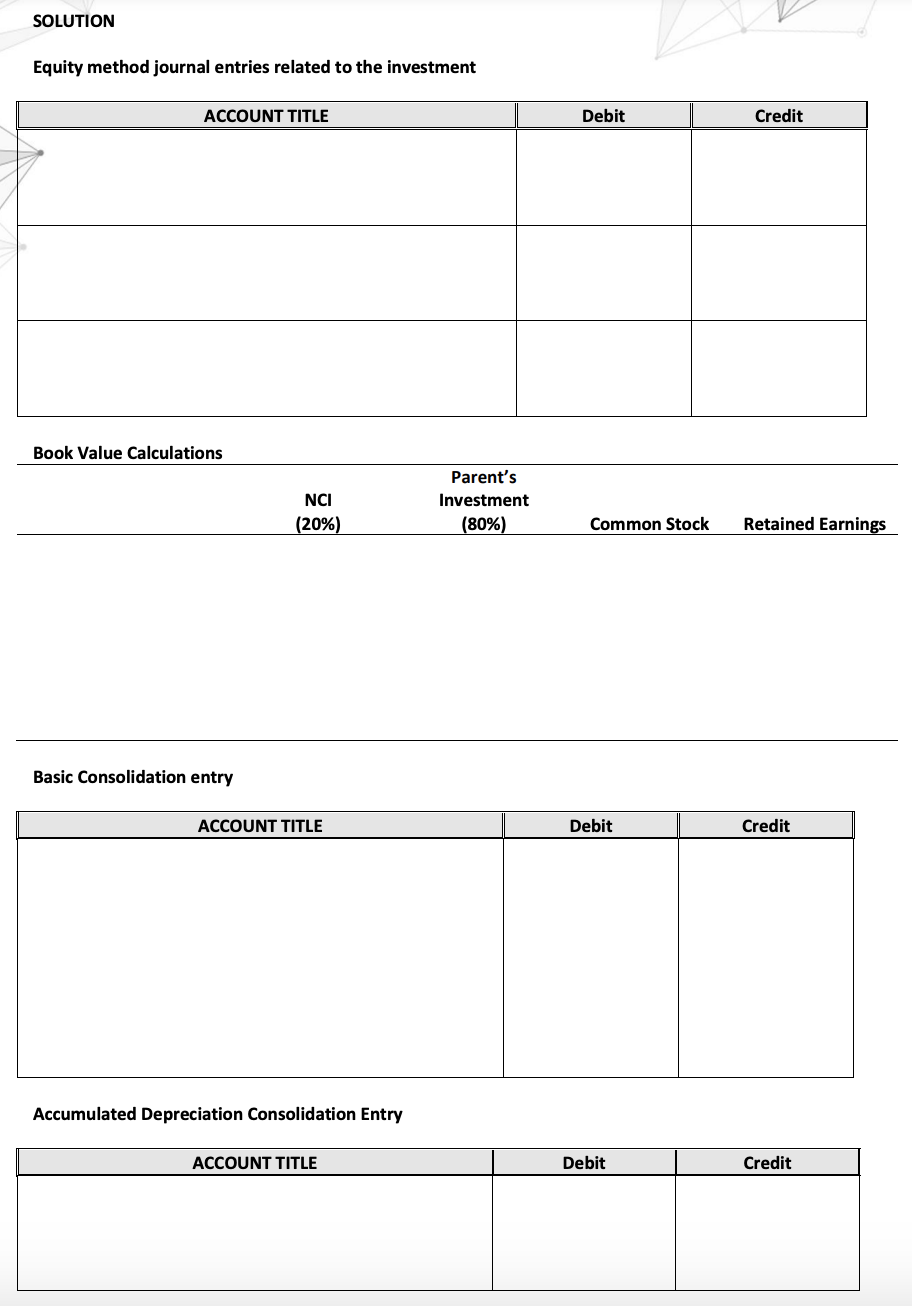

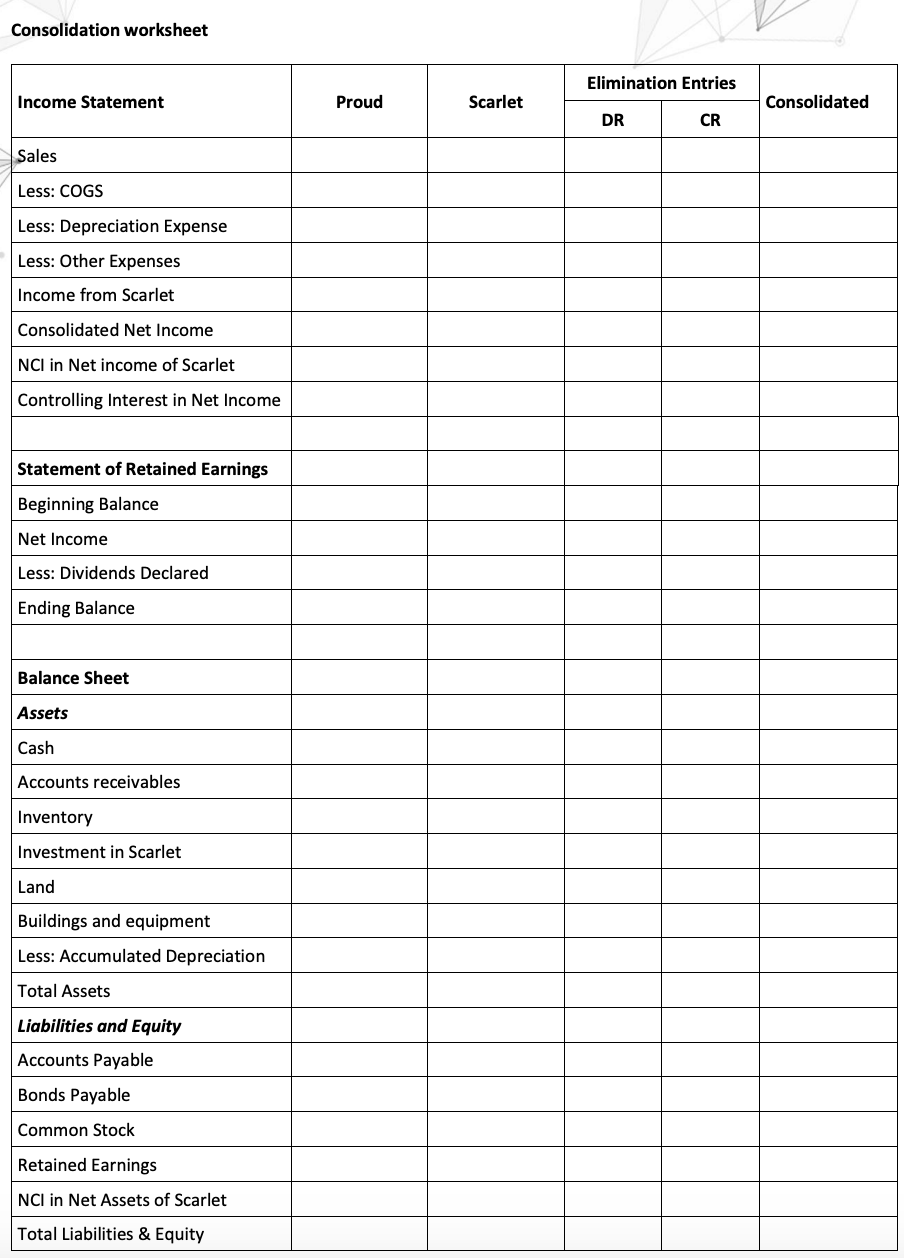

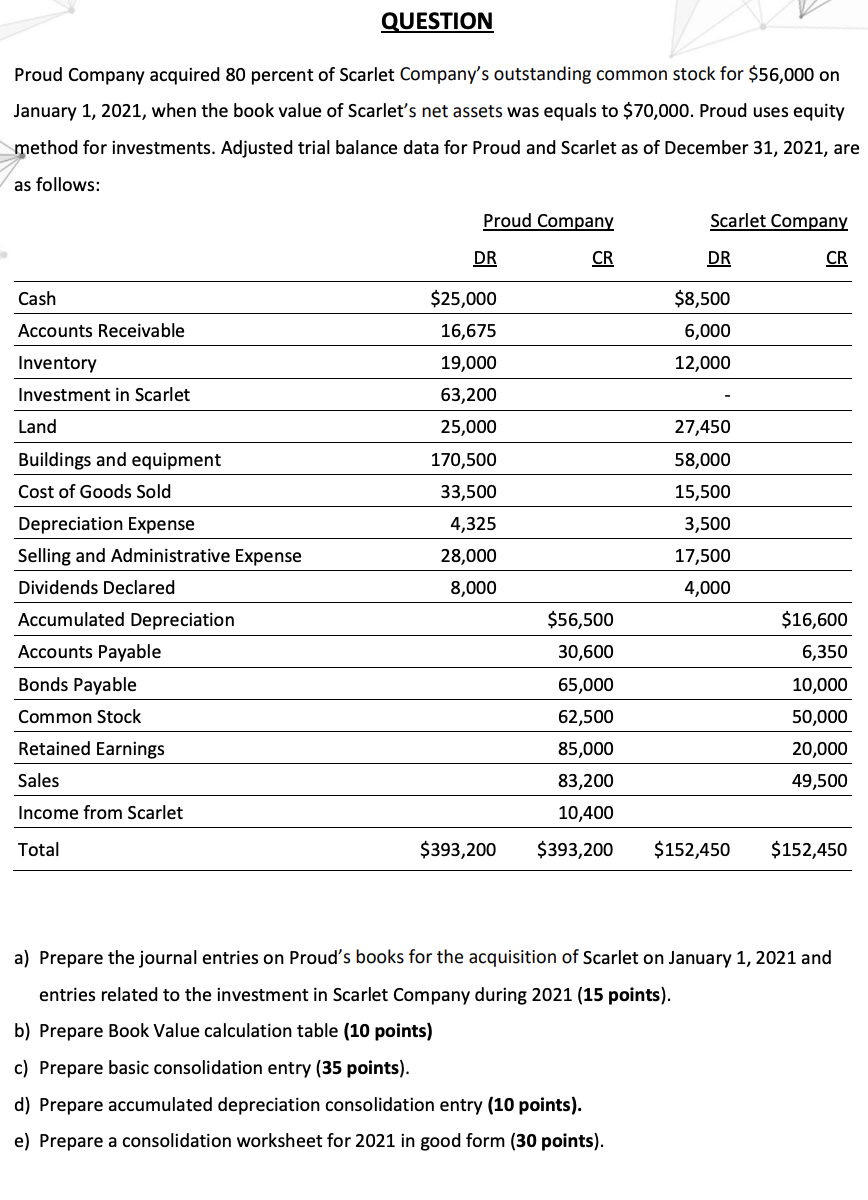

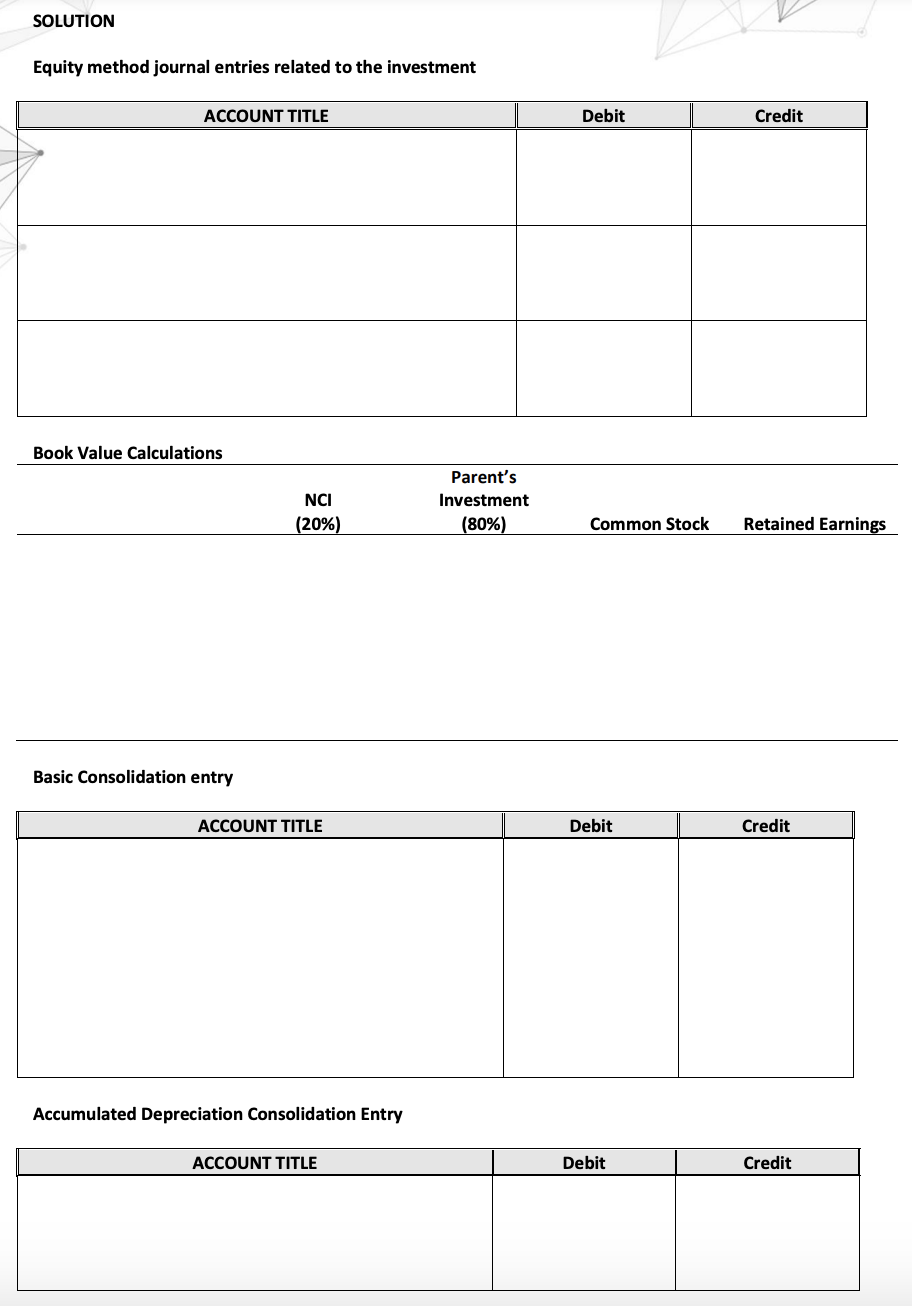

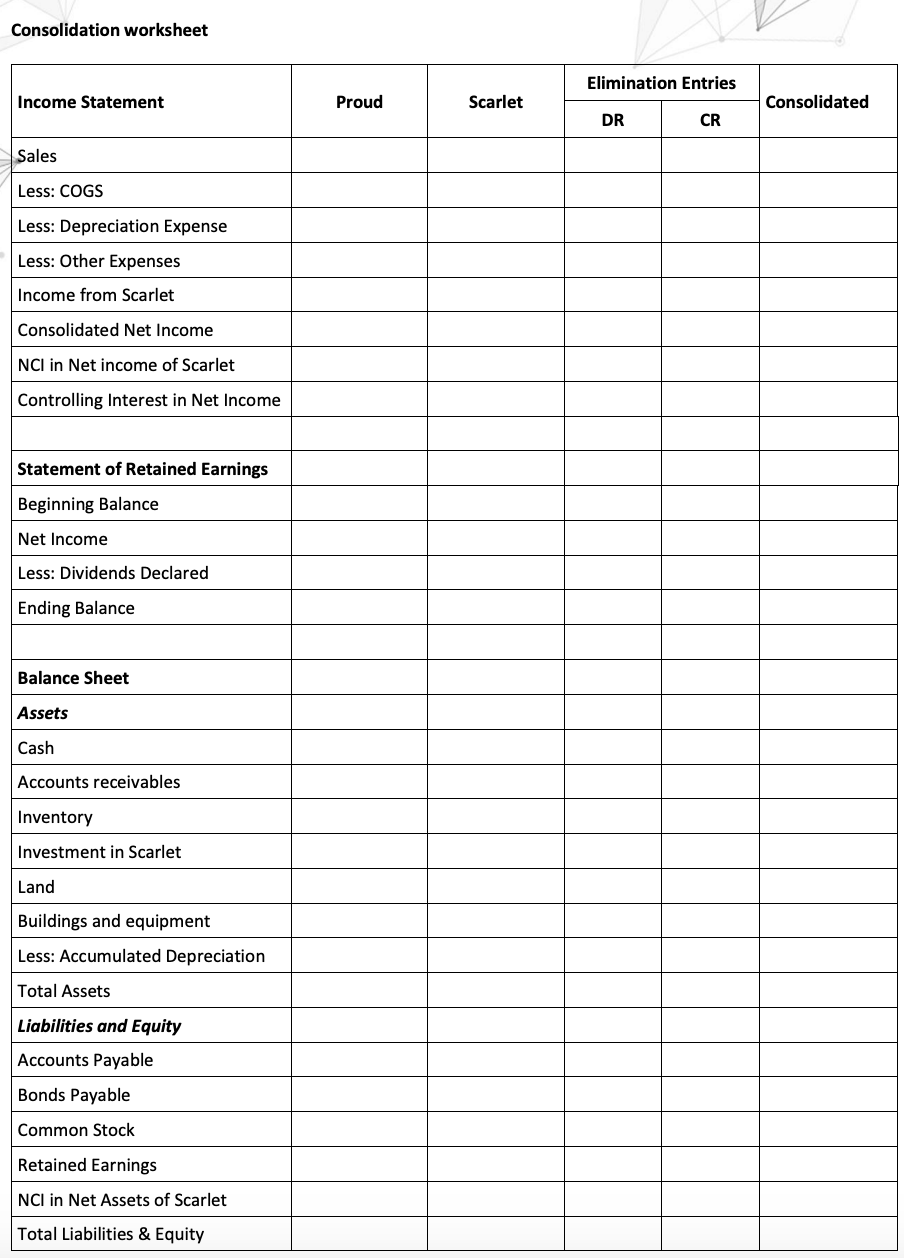

QUESTION Proud Company acquired 80 percent of Scarlet Company's outstanding common stock for $56,000 on January 1, 2021, when the book value of Scarlet's net assets was equals to $70,000. Proud uses equity method for investments. Adjusted trial balance data for Proud and Scarlet as of December 31, 2021, are as follows: Proud Company Scarlet Company DR CR DR CR Cash $25,000 $8,500 Accounts Receivable 6,000 12,000 Inventory Investment in Scarlet Land 16,675 19,000 63,200 25,000 170,500 33,500 4,325 28,000 8,000 27,450 58,000 15,500 3,500 17,500 4,000 Buildings and equipment Cost of Goods Sold Depreciation Expense Selling and Administrative Expense Dividends Declared Accumulated Depreciation Accounts Payable Bonds Payable Common Stock Retained Earnings Sales Income from Scarlet $56,500 30,600 65,000 62,500 85,000 83,200 10,400 $16,600 6,350 10,000 50,000 20,000 49,500 Total $393,200 $393,200 $152,450 $152,450 a) Prepare the journal entries on Proud's books for the acquisition of Scarlet on January 1, 2021 and entries related to the investment in Scarlet Company during 2021 (15 points). b) Prepare Book Value calculation table (10 points) c) Prepare basic consolidation entry (35 points). d) Prepare accumulated depreciation consolidation entry (10 points). e) Prepare a consolidation worksheet for 2021 in good form (30 points). SOLUTION Equity method journal entries related to the investment ACCOUNT TITLE Debit Credit Book Value Calculations NCI (20%) Parent's Investment (80%) Common Stock Retained Earnings Basic Consolidation entry ACCOUNT TITLE Debit Credit Accumulated Depreciation Consolidation Entry ACCOUNT TITLE Debit Credit Consolidation worksheet Elimination Entries Income Statement Proud Scarlet Consolidated DR CR Sales Less: COGS Less: Depreciation Expense Less: Other Expenses Income from Scarlet Consolidated Net Income NCI in Net income of Scarlet Controlling Interest in Net Income Statement of Retained Earnings Beginning Balance Net Income Less: Dividends Declared Ending Balance Balance Sheet Assets Cash Accounts receivables Inventory Investment in Scarlet Land Buildings and equipment Less: Accumulated Depreciation Total Assets Liabilities and Equity Accounts Payable Bonds Payable Common Stock Retained Earnings NCI in Net Assets of Scarlet Total Liabilities & Equity