Answered step by step

Verified Expert Solution

Question

1 Approved Answer

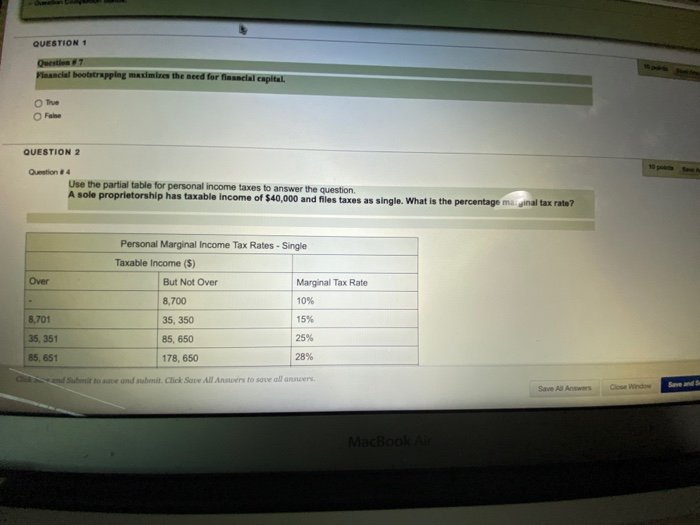

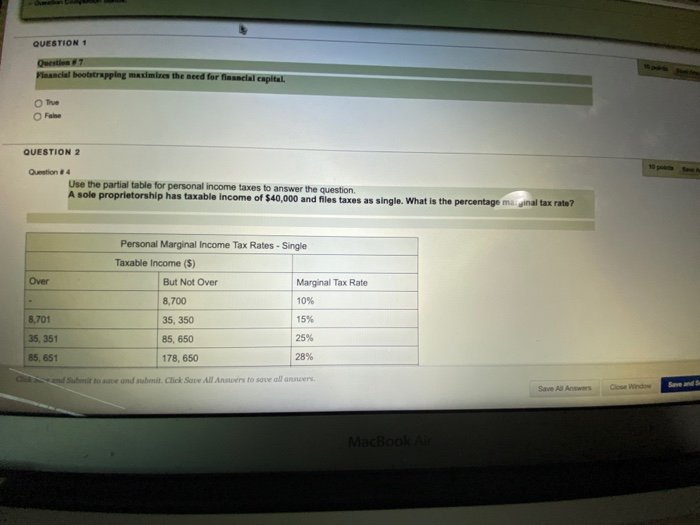

QUESTION Quest#7 Financial bootstrapping maximize the need for financial capital Thue Fale 10 QUESTION 2 Question 4 Use the partial table for personal income taxes

QUESTION Quest#7 Financial bootstrapping maximize the need for financial capital Thue Fale 10 QUESTION 2 Question 4 Use the partial table for personal income taxes to answer the question. A sole proprietorship has taxable income of $40,000 and files taxes as single. What is the percentage mai inal tax rate? Over Personal Marginal Income Tax Rates - Single Taxable income (5) But Not Over Marginal Tax Rate 8,700 10% 35, 350 15% 85, 650 25% 178, 650 28% 8,701 35, 351 85,651 Submit to save and submit. Click Save All Answers to save all answers Save Al Answers MacBook

QUESTION Quest#7 Financial bootstrapping maximize the need for financial capital Thue Fale 10 QUESTION 2 Question 4 Use the partial table for personal income taxes to answer the question. A sole proprietorship has taxable income of $40,000 and files taxes as single. What is the percentage mai inal tax rate? Over Personal Marginal Income Tax Rates - Single Taxable income (5) But Not Over Marginal Tax Rate 8,700 10% 35, 350 15% 85, 650 25% 178, 650 28% 8,701 35, 351 85,651 Submit to save and submit. Click Save All Answers to save all answers Save Al Answers MacBook

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started