Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question Ref. No: 3228 You are considering two investment options. In option A, you have to invest RM2000 now and RM1000 three years from now,

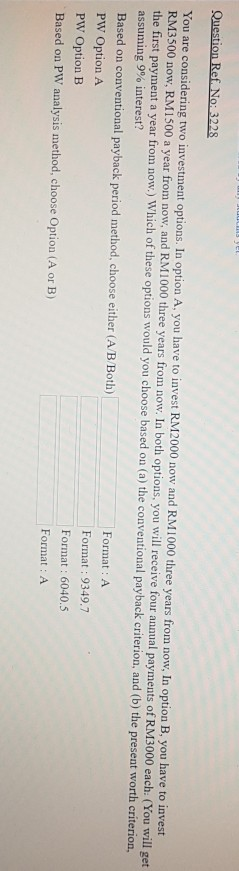

Question Ref. No: 3228 You are considering two investment options. In option A, you have to invest RM2000 now and RM1000 three years from now, In option B, you have to invest RM3500 now, RM1500 a year from now, and RM1000 three years from now. In both options, you will receive four annual payments of RM3000 each: (You will get the first payment a year from now.) Which of these options would you choose based on (a) the conventional payback criterion, and (b) the present worth criterion. assuming 9% interest? Based on conventional payback period method, choose either (A/B Both) Format : A PW Option A Format : 9349.7 PW Option B Format : 6040.5 Based on PW analysis method, choose Option (A or B) Format: A Question Ref. No: 3228 You are considering two investment options. In option A, you have to invest RM2000 now and RM1000 three years from now, In option B, you have to invest RM3500 now, RM1500 a year from now, and RM1000 three years from now. In both options, you will receive four annual payments of RM3000 each: (You will get the first payment a year from now.) Which of these options would you choose based on (a) the conventional payback criterion, and (b) the present worth criterion. assuming 9% interest? Based on conventional payback period method, choose either (A/B Both) Format : A PW Option A Format : 9349.7 PW Option B Format : 6040.5 Based on PW analysis method, choose Option (A or B) Format: A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started