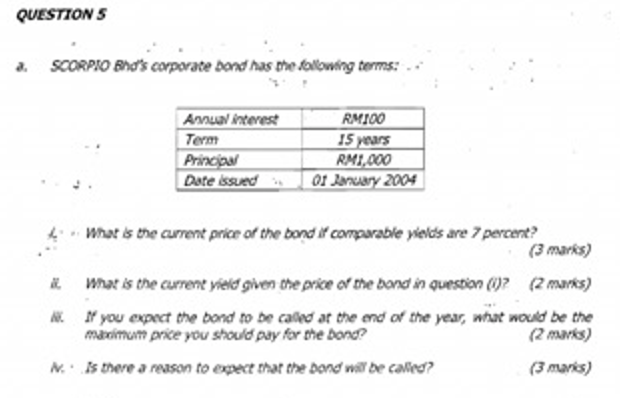

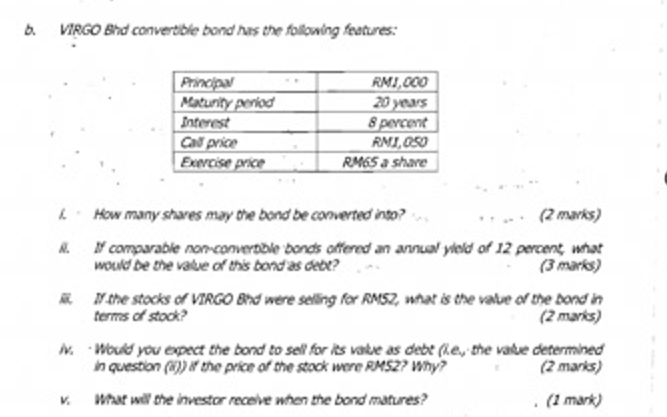

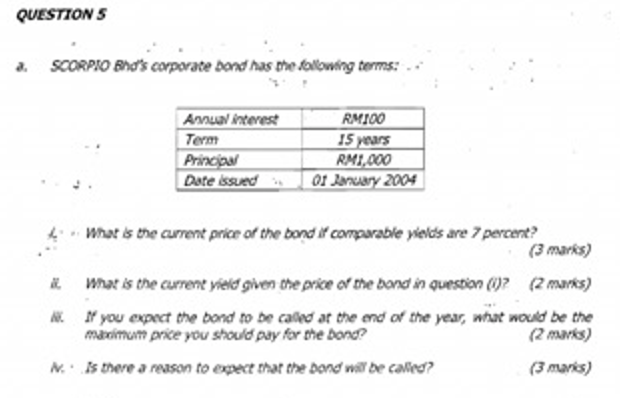

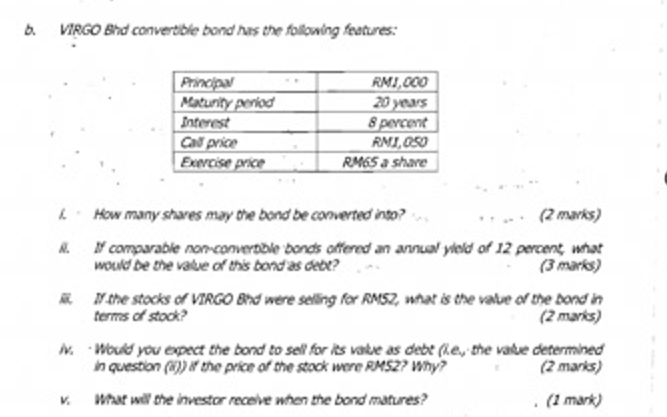

QUESTION S a. SCORPIO Bhd's corporate bond has the following terms: Annual interest Term Principal Date issued & RM100 15 years RM1,000 01 January 2004 What is the current price of the bond if comparable yields are 7 percent? (3 marks) What is the current yield given the price of the bond in question (1)? (2 marks) N. If you expect the bond to be called at the end of the year, what would be the maximum price you should pay for the bond? (2 marks) N. Is there a reason to expect that the bond will be called? (3 marks) b. VIRGO Bhd convertible bond has the following features: 1. R. Principal Maturity period Interest Call price Exercise price RM1,000 20 years 8 percent RM1,050 RM65 a share How many shares may the bond be converted into? (2 marks) If comparable non-convertible bonds offered an annual yield of 12 percent, what would be the value of this bond as debt? (3 marks) If the stocks of VIRGO Bhd were selling for RMS2, what is the value of the bond in terms of stock? (2 marks) iv. Would you expect the bond to sell for its value as debt (ie, the value determined in question () if the price of the stock were RMS2? Why? (2 marks) What will the investor receive when the bond matures? . (1 mark) QUESTION S a. SCORPIO Bhd's corporate bond has the following terms: Annual interest Term Principal Date issued & RM100 15 years RM1,000 01 January 2004 What is the current price of the bond if comparable yields are 7 percent? (3 marks) What is the current yield given the price of the bond in question (1)? (2 marks) N. If you expect the bond to be called at the end of the year, what would be the maximum price you should pay for the bond? (2 marks) N. Is there a reason to expect that the bond will be called? (3 marks) b. VIRGO Bhd convertible bond has the following features: 1. R. Principal Maturity period Interest Call price Exercise price RM1,000 20 years 8 percent RM1,050 RM65 a share How many shares may the bond be converted into? (2 marks) If comparable non-convertible bonds offered an annual yield of 12 percent, what would be the value of this bond as debt? (3 marks) If the stocks of VIRGO Bhd were selling for RMS2, what is the value of the bond in terms of stock? (2 marks) iv. Would you expect the bond to sell for its value as debt (ie, the value determined in question () if the price of the stock were RMS2? Why? (2 marks) What will the investor receive when the bond matures? . (1 mark)