Question (S9-4) only

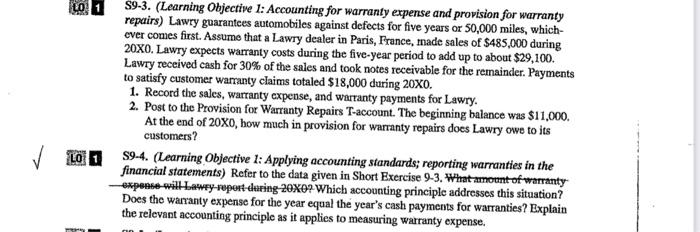

S9-3. (Learning Objective 1: Accounting for warranty expense and provision for warranty repairs) Lawry guarantees automobiles against defects for five years or 50,000 miles, whichever comes first. Assume that a Lawry dealer in Paris, France, made sales of $485,000 during 20X0. Lawry expects warranty costs during the five-year period to add up to about $29,100. Lawry received cash for 30% of the sales and took notes receivable for the remainder. Payments to satisfy customer warranty claims totaled $18,000 during 20X0. 1. Record the sales, warranty expense, and warranty payments for Lawry. 2. Post to the Provision for Warranty Repairs T-account. The beginning balance was $11,000. At the end of 200, how much in provision for warranty repairs does Lawry owe to its customers? S9-4. (Learning Objective 1: Applying accounting standards; reporting warnanties in the financial statements) Refer to the data given in Short Exercise 9-3. What amount of warranty -expens will Lawfy-repert-daring 20X0? Which accounting principle addresses this situation? Does the warranty expense for the year equal the year's cash payments for warranties? Explain the relevant accounting principle as it applies to measuring warranty expense. S9-3. (Learning Objective 1: Accounting for warranty expense and provision for warranty repairs) Lawry guarantees automobiles against defects for five years or 50,000 miles, whichever comes first. Assume that a Lawry dealer in Paris, France, made sales of $485,000 during 20X0. Lawry expects warranty costs during the five-year period to add up to about $29,100. Lawry received cash for 30% of the sales and took notes receivable for the remainder. Payments to satisfy customer warranty claims totaled $18,000 during 20X0. 1. Record the sales, warranty expense, and warranty payments for Lawry. 2. Post to the Provision for Warranty Repairs T-account. The beginning balance was $11,000. At the end of 200, how much in provision for warranty repairs does Lawry owe to its customers? S9-4. (Learning Objective 1: Applying accounting standards; reporting warnanties in the financial statements) Refer to the data given in Short Exercise 9-3. What amount of warranty -expens will Lawfy-repert-daring 20X0? Which accounting principle addresses this situation? Does the warranty expense for the year equal the year's cash payments for warranties? Explain the relevant accounting principle as it applies to measuring warranty expense