Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question Set 1 > An FI wants to evaluate the credit risk of a $ 2 million loan with a duration of 6 . 3

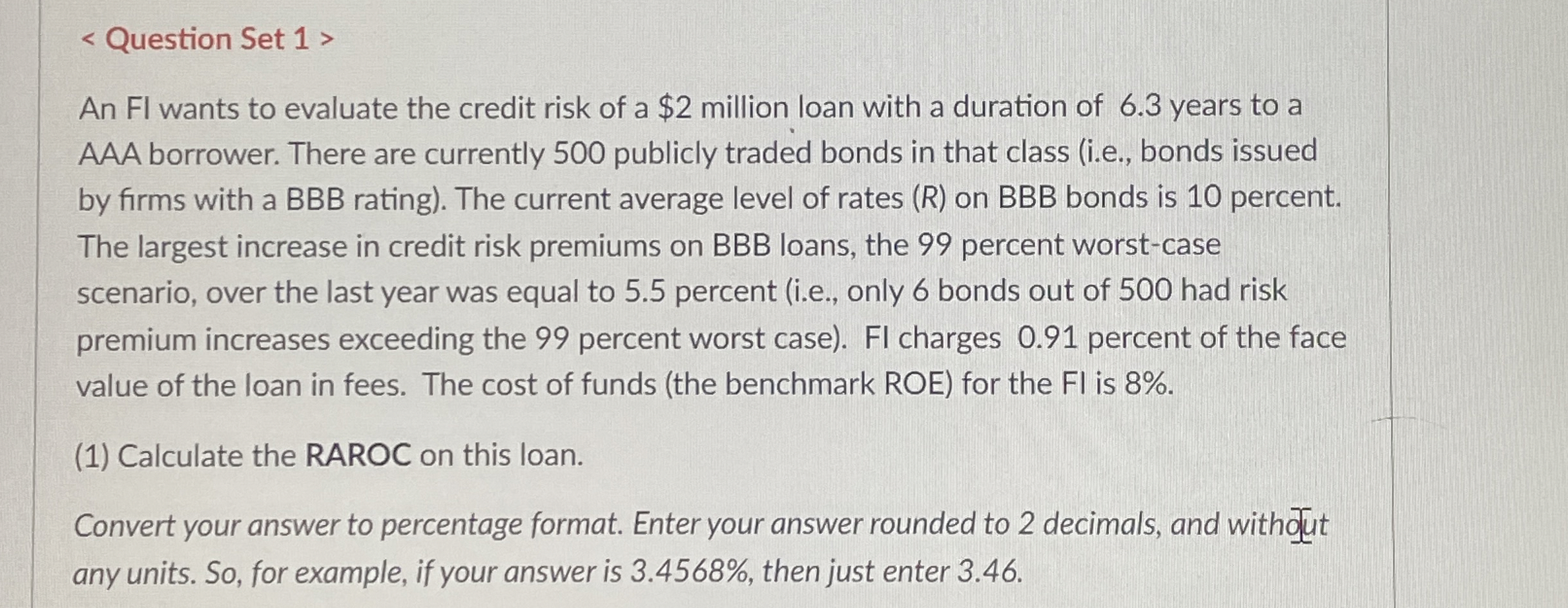

Question Set

An FI wants to evaluate the credit risk of a $ million loan with a duration of years to a AAA borrower. There are currently publicly traded bonds in that class ie bonds issued by firms with a BBB rating The current average level of rates on BBB bonds is percent. The largest increase in credit risk premiums on BBB loans, the percent worstcase scenario, over the last year was equal to percent ie only bonds out of had risk premium increases exceeding the percent worst case FI charges percent of the face value of the loan in fees. The cost of funds the benchmark ROE for the FI is

Calculate the RAROC on this loan.

Convert your answer to percentage format. Enter your answer rounded to decimals, and withut any units. So for example, if your answer is then just enter

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started