Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question: Show allocation bases under these two processes (Show all the calculations) A) Product Costs under Simple Costing System B) Unit Product Cost under Job-Order

Question: Show allocation bases under these two processes (Show all the calculations)

A) Product Costs under Simple Costing System

B) Unit Product Cost under Job-Order Costing System

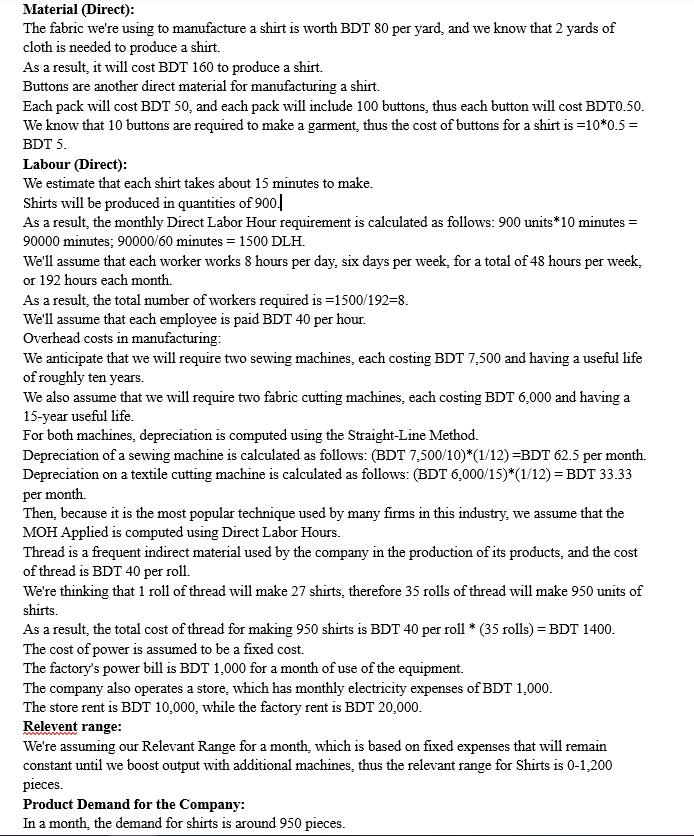

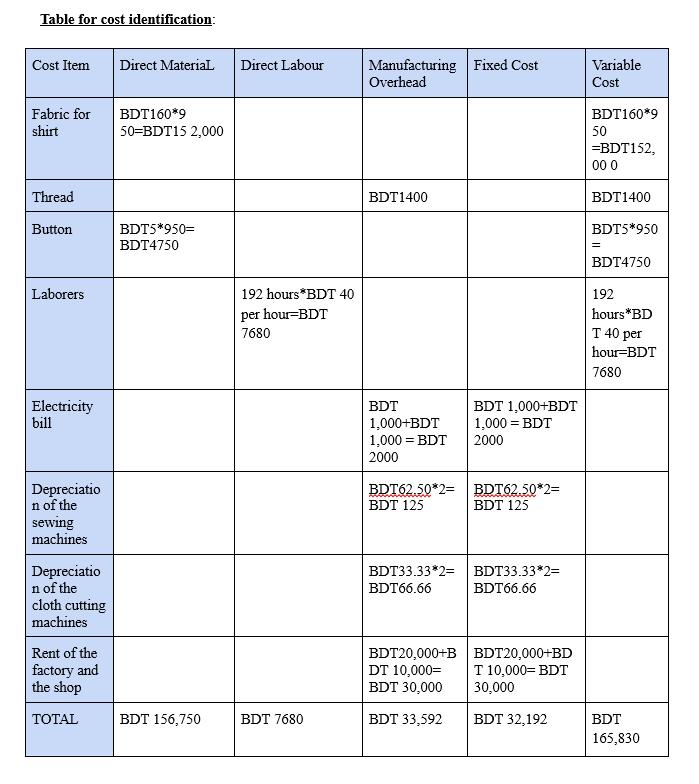

Material (Direct): The fabric we're using to manufacture a shirt is worth BDT 80 per yard, and we know that 2 yards of cloth is needed to produce a shirt. As a result, it will cost BDT 160 to produce a shirt. Buttons are another direct material for manufacturing a shirt. Each pack will cost BDT 50, and each pack will include 100 buttons, thus each button will cost BDTO.50. We know that 10 buttons are required to make a garment, thus the cost of buttons for a shirt is =10*0.5 = BDT 5. Labour (Direct): We estimate that each shirt takes about 15 minutes to make. Shirts will be produced in quantities of 900o] As a result, the monthly Direct Labor Hour requirement is calculated as follows: 900 units*10 minutes = 90000 minutes; 90000/60 minutes = 1500 DLH. We'll assume that each worker works 8 hours per day, six days per week, for a total of 48 hours per week, or 192 hours each month. As a result, the total number of workers required is =1500/192=8. We'll assume that each employee is paid BDT 40 per hour. Overhead costs in manufacturing: We anticipate that we will require two sewing machines, each costing BDT 7,500 and having a useful life of roughly ten years. We also assume that we will require two fabric cutting machines, each costing BDT 6,000 and having a 15-year useful life. For both machines, depreciation is computed using the Straight-Line Method. Depreciation of a sewing machine is calculated as follows: (BDT 7,500/10)*(1/12) =BDT 62.5 per month. Depreciation on a textile cutting machine is calculated as follows: (BDT 6,000/15)*(1/12) = BDT 33.33 per month. Then, because it is the most popular technique used by many firms in this industry, we assume that the MOH Applied is computed using Direct Labor Hours. Thread is a frequent indirect material used by the company in the production of its products, and the cost of thread is BDT 40 per roll. We're thinking that 1 roll of thread will make 27 shirts, therefore 35 rolls of thread will make 950 units of shirts. As a result, the total cost of thread for making 950 shirts is BDT 40 per roll * (35 rolls) = BDT 1400. The cost of power is assumed to be a fixed cost. The factory's power bill is BDT 1,000 for a month of use of the equipment. The company also operates a store, which has monthly electricity expenses of BDT 1,000. The store rent is BDT 10,000, while the factory rent is BDT 20,000. Relevent range: We're assuming our Relevant Range for a month, which is based on fixed expenses that will remain constant until we boost output with additional machines, thus the relevant range for Shirts is 0-1,200 pieces. Product Demand for the Company: In a month, the demand for shirts is around 950 pieces.

Step by Step Solution

★★★★★

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

A Product Costs are the cost which are attributabe to the manufacturing of the products which all ot...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started