Answered step by step

Verified Expert Solution

Question

1 Approved Answer

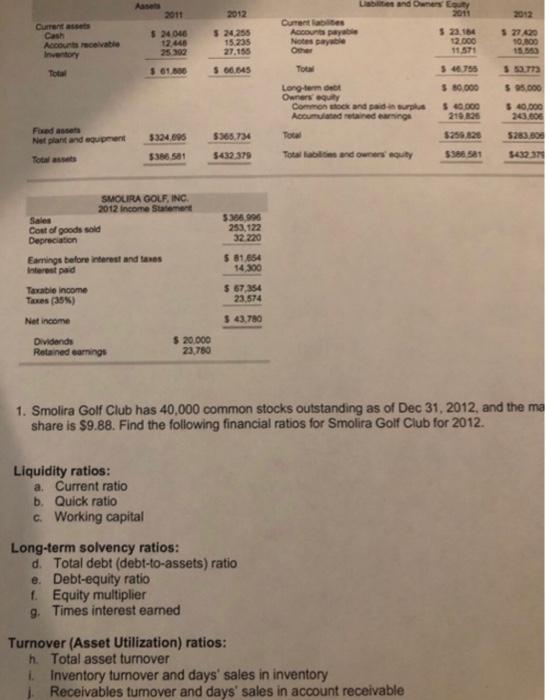

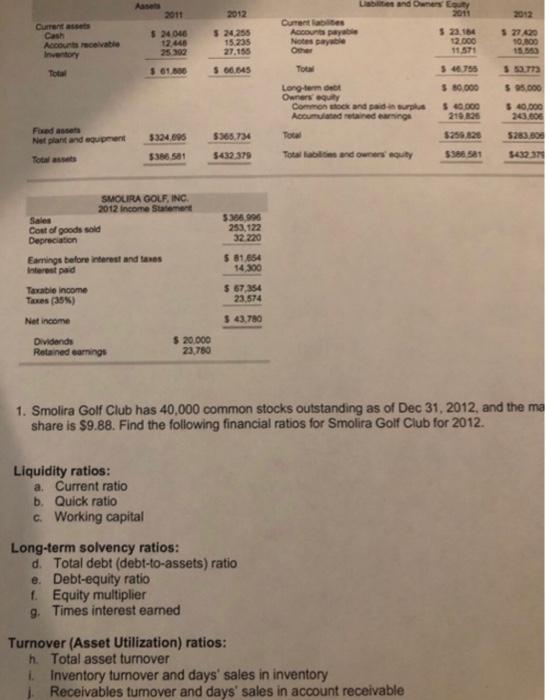

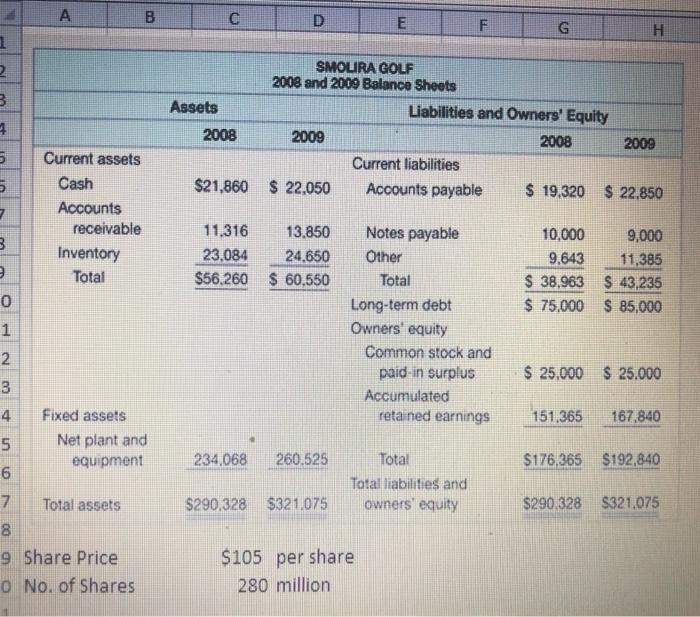

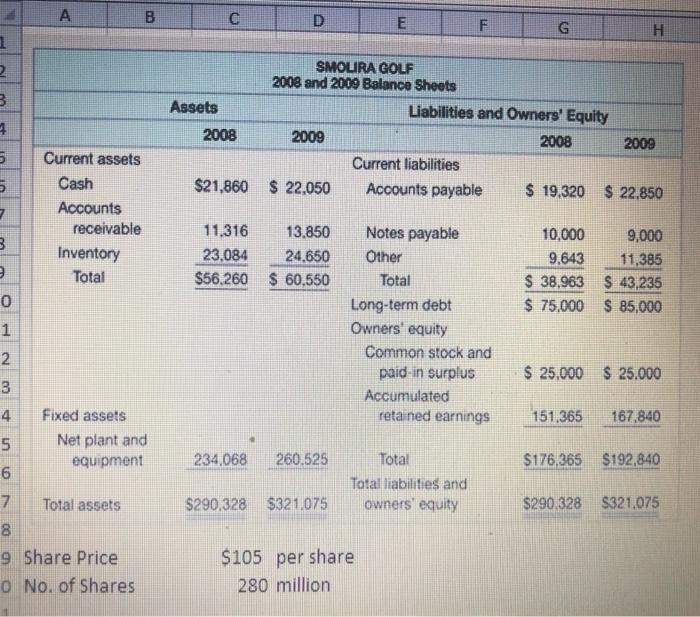

Question: SMOLIRA GOLF 2011 And 2012 Balance Sheets Liabilities And Owners' Equity 2011 Assets calculate financial ratios for 2009 Aase 2011 Les and Own County

Question: SMOLIRA GOLF 2011 And 2012 Balance Sheets Liabilities And Owners' Equity 2011 Assets

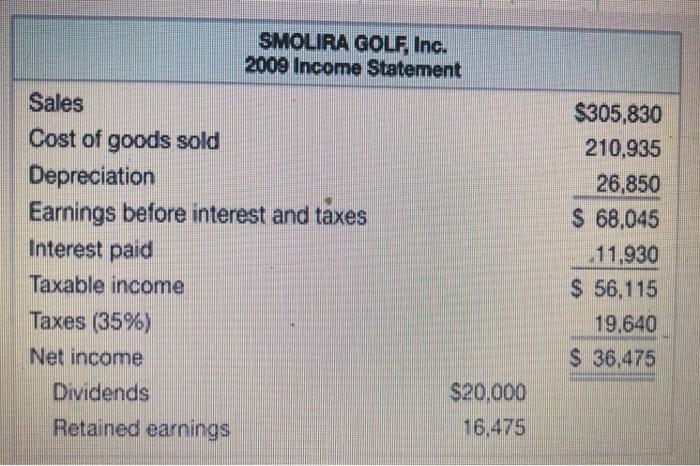

calculate financial ratios for 2009

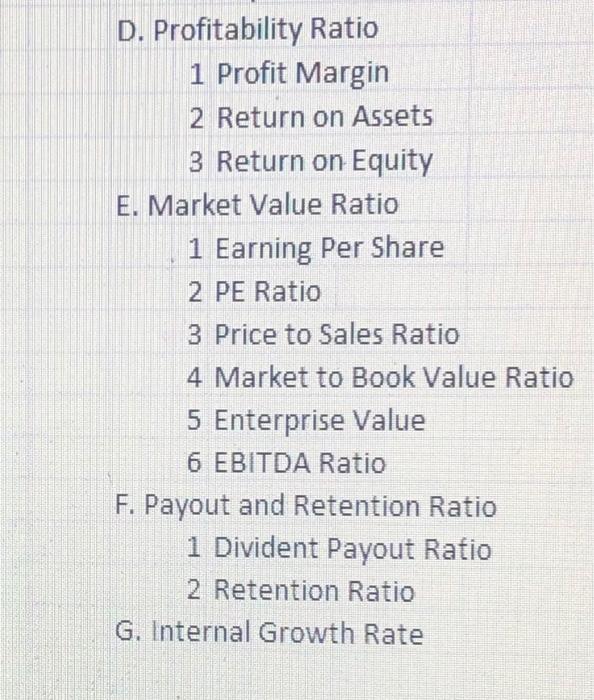

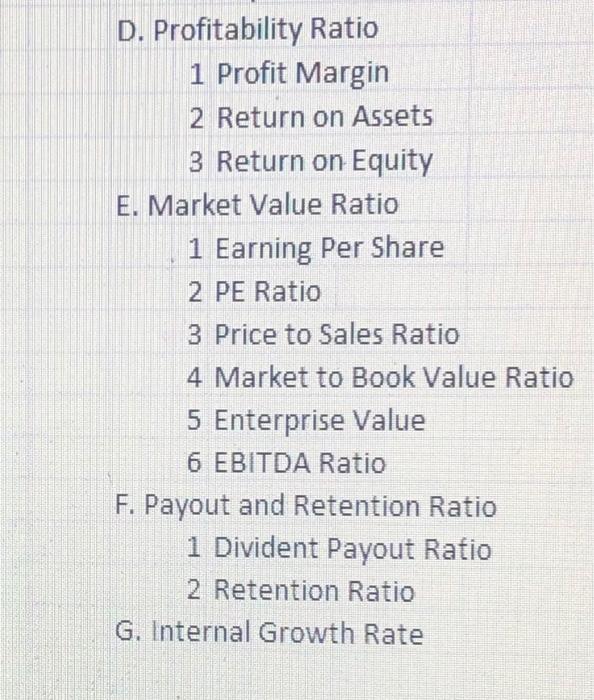

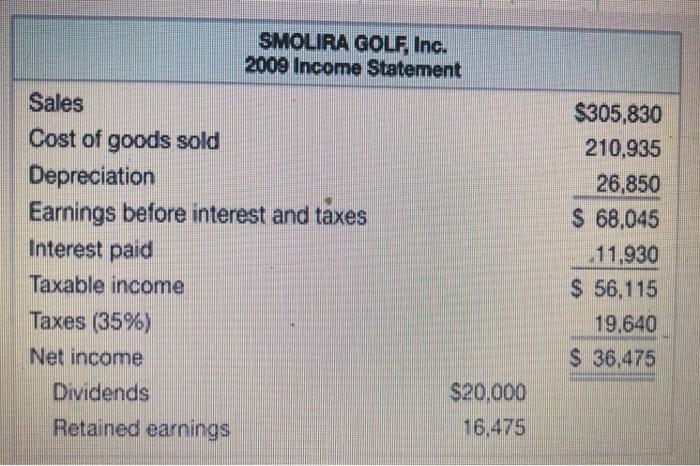

Aase 2011 Les and Own County 2012 2012 Current Cash Account ceva Inventory Total $ 24040 12.446 25.300 5 24.255 15.235 27.155 Ourelan Accounts paya Note pe One $ 23,164 12.000 11.571 S 22.420 10.800 3 61.00 5 66.643 Total 546755 $ 80.000 $95.000 Long-term Owners Common cock and paida ka And retained earnings $40.000 2120 $40.000 Foredan Net plant and equipment $365,734 $250.628 5283.000 5324 095 5386581 5432 379 Total $588 581 Totables and owners outy 548237 SMOLIRA GOLF, INC 2012 Income Statement Sales Cost of goods sold Depreciation Earnings before interest and taxes Interest paid 5368.990 253,122 32 220 $ 81.654 14.300 Table income Toses (35) $ 67,354 23.574 Net income 5.43.780 Dividends Retained earnings $20.000 23,789 1. Smolira Golf Club has 40,000 common stocks outstanding as of Dec 31, 2012, and the ma share is $9.88. Find the following financial ratios for Smolira Golf Club for 2012 Liquidity ratios: a. Current ratio b. Quick ratio c. Working capital Long-term solvency ratios: d. Total debt (debt-to-assets) ratio e. Debt-equity ratio 1. Equity multiplier 9. Times interest eamed Turnover (Asset Utilization) ratios: h. Total asset turnover i Inventory turnover and days' sales in inventory | Receivables turnover and days' sales in account receivable D. Profitability Ratio 1 Profit Margin 2 Return on Assets 3 Return on Equity E. Market Value Ratio 1 Earning Per Share 2 PE Ratio 3 Price to Sales Ratio 4 Market to Book Value Ratio 5 Enterprise Value 6 EBITDA Ratio F. Payout and Retention Ratio 1 Divident Payout Ratio 2 Retention Ratio G. Internal Growth Rate SMOLIRA GOLF, Inc. 2009 Income Statement Sales Cost of goods sold Depreciation Earnings before interest and taxes Interest paid Taxable income Taxes (35%) Net income Dividends Retained earnings $305,830 210,935 26,850 $ 68,045 11,930 $ 56,115 19.640 $ 36,475 $20.000 16,475 A B C D E F G H 1 3 Assets 2008 SMOLIRA GOLF 2008 and 2009 Balance Sheets Liabilities and Owners' Equity 2009 2008 2009 Current liabilities $ 22,050 Accounts payable $ 19.320 $ 22,850 5 5 $21,860 Current assets Cash Accounts receivable Inventory Total 3 11.316 23.084 $56,260 13,850 24.650 $ 60,550 10,000 9,000 9.643 11,385 $ 38,963 $ 43,235 $ 75,000 $ 85,000 0 1 2 3 Notes payable Other Total Long-term debt Owners' equity Common stock and paid-in surplus Accumulated retained earnings $ 25,000 $ 25.000 4 151,365 167.840 5 6 Fixed assets Net plant and equipment 234,068 260.525 $176,365 $192,840 Total Total liabilities and owners' equity 7 Total assets $290,328 $321075 $290.328 $321,075 8 9 Share Price o No. of Shares $105 per share 280 million

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started