Question

Question: Suppose the firm decides to hedge its foreign exchange risks using futures market hedges. Suppose also the firm opens positions in the futures market

Question: Suppose the firm decides to hedge its foreign exchange risks using futures market hedges. Suppose also the firm opens positions in the futures market on January 2 at the prices quoted at the beginning of the problem (at the Jan. 2 prices shown above).

Question: Suppose the firm decides to hedge its foreign exchange risks using futures market hedges. Suppose also the firm opens positions in the futures market on January 2 at the prices quoted at the beginning of the problem (at the Jan. 2 prices shown above).

1. How would the firm hedge its risk in the futures market? (ie. how many contracts, would it go long or short?)

2. Suppose on July 2 (6 months from Jan.2), the spot exchange rates and the September futures prices are as follows:

| Bid | Ask | |

| Spot: | CAD 1.2682/$ | CAD 1.2690/$ |

| AUD 1.3508/$ | AUD 1.3523/$ |

September futures prices on July 2:

Canadian dollar Sept. futures prices: $0.7835/CAD

Australian dollar Sept. futures prices: $0.7438/AUD

Suppose that the September futures contracts mature on September 15. Assume, however, the firm decides to close out its futures positions on July 2 since its foreign exchange receivables and payables come due on that date. What will the firm pay or receive (number of $) for CAD and AUD six months from now (on July 2) given that it hedged its positions using futures market?

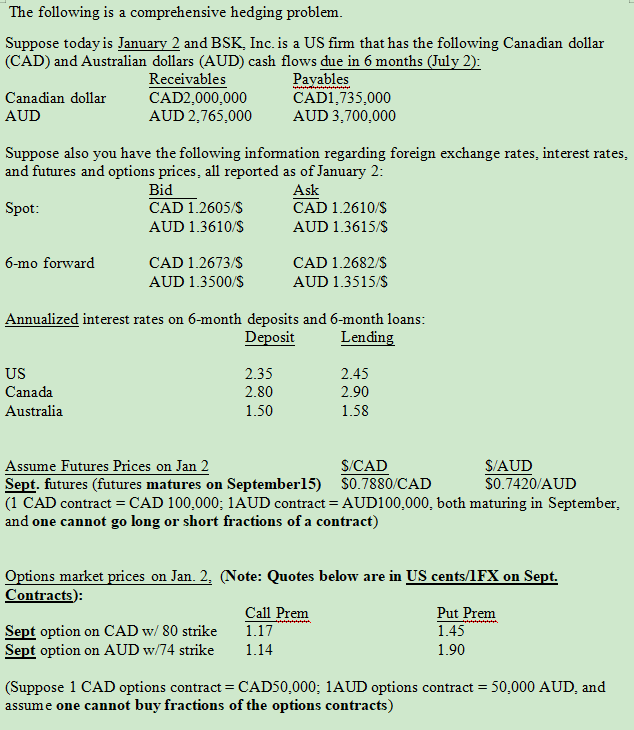

The following is a comprehensive hedging problem. Suppose today is January 2 and BSK, Inc. is a US firm that has the following Canadian dollar (CAD) and Australian dollars (AUD) cash flows due in 6 months (July 2): Receivables Payables Canadian dollar CAD2,000,000 CAD1,735,000 AUD AUD 2,765,000 AUD 3,700,000 Suppose also you have the following information regarding foreign exchange rates, interest rates, and futures and options prices, all reported as of January 2: Bid Ask Spot: CAD 1.2605/$ CAD 1.2610/$ AUD 1.3610/S AUD 1.3615/5 6-mo forward CAD 1.2673/$ CAD 1.2682/5 AUD 1.3500/$ AUD 1.3515/5 Annualized interest rates on 6-month deposits and 6-month loans: Deposit Lending US Canada Australia 2.35 2.80 1.50 2.45 2.90 1.58 Assume Futures Prices on Jan 2 S/CAD S/AUD Sept. futures (futures matures on September15) $0.7880/CAD $0.7420/AUD (1 CAD contract = CAD 100,000: 1AUD contract = AUD100.000, both maturing in September, and one cannot go long or short fractions of a contract) Options market prices on Jan. 2. (Note: Quotes below are in US cents/1FX on Sept. Contracts): Call Prem Put Prem Sept option on CAD w/80 strike 1.17 1.45 Sept option on AUD w/74 strike 1.14 1.90 44 (Suppose 1 CAD options contract = CAD50.000; 1AUD options contract = 50,000 AUD, and assume one cannot buy fractions of the options contracts) The following is a comprehensive hedging problem. Suppose today is January 2 and BSK, Inc. is a US firm that has the following Canadian dollar (CAD) and Australian dollars (AUD) cash flows due in 6 months (July 2): Receivables Payables Canadian dollar CAD2,000,000 CAD1,735,000 AUD AUD 2,765,000 AUD 3,700,000 Suppose also you have the following information regarding foreign exchange rates, interest rates, and futures and options prices, all reported as of January 2: Bid Ask Spot: CAD 1.2605/$ CAD 1.2610/$ AUD 1.3610/S AUD 1.3615/5 6-mo forward CAD 1.2673/$ CAD 1.2682/5 AUD 1.3500/$ AUD 1.3515/5 Annualized interest rates on 6-month deposits and 6-month loans: Deposit Lending US Canada Australia 2.35 2.80 1.50 2.45 2.90 1.58 Assume Futures Prices on Jan 2 S/CAD S/AUD Sept. futures (futures matures on September15) $0.7880/CAD $0.7420/AUD (1 CAD contract = CAD 100,000: 1AUD contract = AUD100.000, both maturing in September, and one cannot go long or short fractions of a contract) Options market prices on Jan. 2. (Note: Quotes below are in US cents/1FX on Sept. Contracts): Call Prem Put Prem Sept option on CAD w/80 strike 1.17 1.45 Sept option on AUD w/74 strike 1.14 1.90 44 (Suppose 1 CAD options contract = CAD50.000; 1AUD options contract = 50,000 AUD, and assume one cannot buy fractions of the options contracts)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started