Answered step by step

Verified Expert Solution

Question

1 Approved Answer

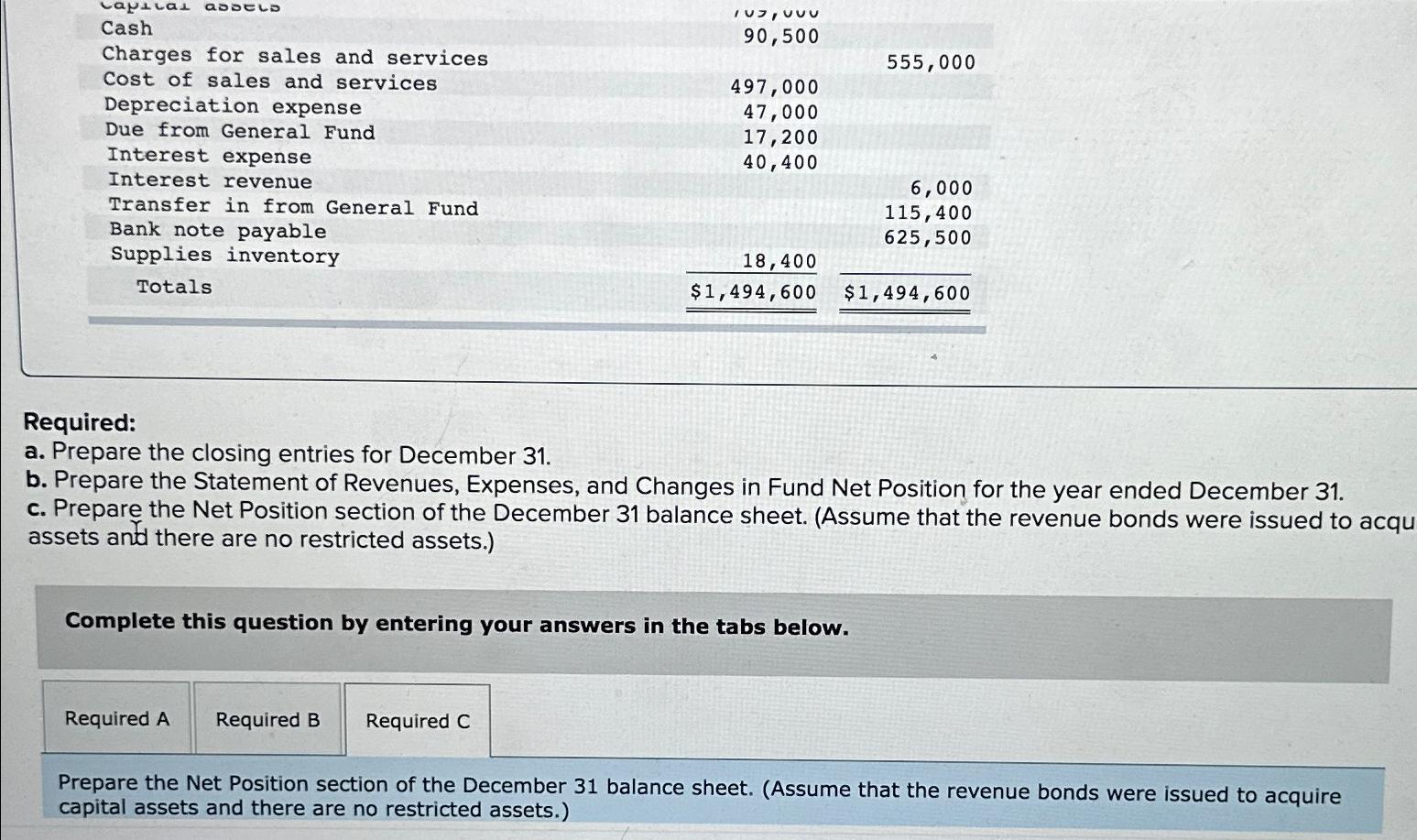

Question: table[[Laptlat aDseld,ivo, vuv,],[Cash,90,500,],[Charges for sales and services,,555,000],[Cost of sales and services,497,000,],[Depreciation expense,47,000,],[Due from General Fund,17,200,],[Interest expense,40,400,],[Interest revenue,,6,000],[Transfer in from General Fund,,115,400],[Bank note payable,,625,500],[Supplies table[[Laptlat

Question: \\\\table[[Laptlat aDseld,ivo, vuv,],[Cash,90,500,],[Charges for sales and services,,555,000],[Cost of sales and services,497,000,],[Depreciation expense,47,000,],[Due from General Fund,17,200,],[Interest expense,40,400,],[Interest revenue,,6,000],[Transfer in from General Fund,,115,400],[Bank note payable,,625,500],[Supplies

\\\\table[[Laptlat aDseld,ivo, vuv,],[Cash,90,500,],[Charges for sales and services,,555,000],[Cost of sales and services,497,000,],[Depreciation expense,47,000,],[Due from General Fund,17,200,],[Interest expense,40,400,],[Interest revenue,,6,000],[Transfer in from General Fund,,115,400],[Bank note payable,,625,500],[Supplies inventory,18,400,],[Totals,

$1,494,600,

$1,494,600

Cash 90,500 Charges for sales and services 555,000 Cost of sales and services 497,000 Depreciation expense 47,000 Due from General Fund 17,200 Interest expense 40,400 Interest revenue 6,000 Transfer in from General Fund 115,400 Bank note payable 625,500 Supplies inventory Totals 18,400 $1,494,600 $1,494,600 Required: a. Prepare the closing entries for December 31. b. Prepare the Statement of Revenues, Expenses, and Changes in Fund Net Position for the year ended December 31. c. Prepare the Net Position section of the December 31 balance sheet. (Assume that the revenue bonds were issued to acqu assets and there are no restricted assets.) Complete this question by entering your answers in the tabs below. Required A Required B Required C Prepare the Net Position section of the December 31 balance sheet. (Assume that the revenue bonds were issued to acquire capital assets and there are no restricted assets.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started