Answered step by step

Verified Expert Solution

Question

1 Approved Answer

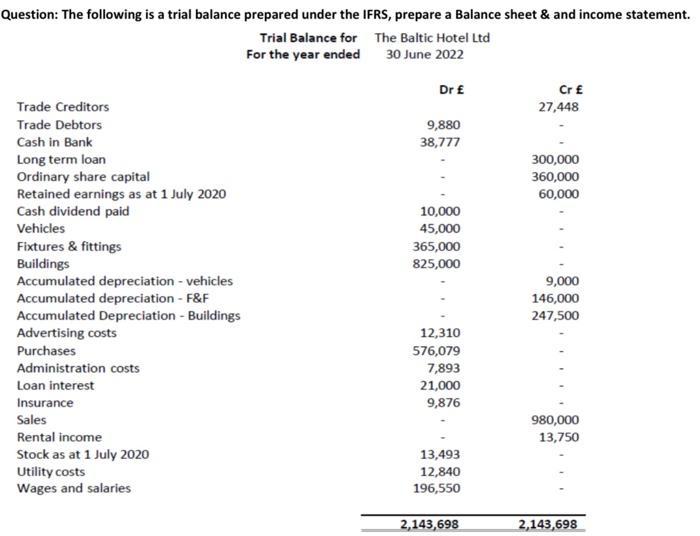

Question: The following is a trial balance prepared under the IFRS, prepare a Balance sheet & and income statement. Trial Balance for For the

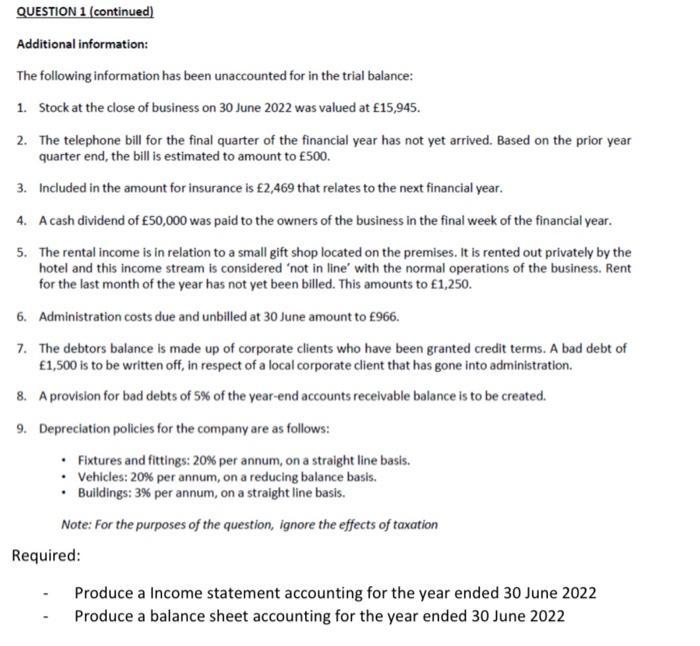

Question: The following is a trial balance prepared under the IFRS, prepare a Balance sheet & and income statement. Trial Balance for For the year ended The Baltic Hotel Ltd 30 June 2022 Trade Creditors Trade Debtors Cash in Bank Long term loan Ordinary share capital Retained earnings as at 1 July 2020 Cash dividend paid Vehicles Fixtures & fittings Buildings Accumulated depreciation - vehicles Accumulated depreciation - F&F Accumulated Depreciation - Buildings Advertising costs Purchases Administration costs Loan interest Insurance Sales Rental income Stock as at 1 July 2020 Utility costs Wages and salaries Dr 9,880 38,777 10,000 45,000 365,000 825,000 12,310 576,079 7,893 21,000 9,876 13,493 12,840 196,550 2,143,698 Cr 27,448 300,000 360,000 60,000 9,000 146,000 247,500 980,000 13,750 2,143,698 QUESTION 1 (continued) Additional information: The following information has been unaccounted for in the trial balance: 1. Stock at the close of business on 30 June 2022 was valued at 15,945. 2. The telephone bill for the final quarter of the financial year has not yet arrived. Based on the prior year quarter end, the bill is estimated to amount to 500. 3. Included in the amount for insurance is 2,469 that relates to the next financial year. 4. A cash dividend of 50,000 was paid to the owners of the business in the final week of the financial year. 5. The rental income is in relation to a small gift shop located on the premises. It is rented out privately by the hotel and this income stream is considered 'not in line with the normal operations of the business. Rent for the last month of the year has not yet been billed. This amounts to 1,250. 6. Administration costs due and unbilled at 30 June amount to 966. 7. The debtors balance is made up of corporate clients who have been granted credit terms. A bad debt of 1,500 is to be written off, in respect of a local corporate client that has gone into administration. 8. A provision for bad debts of 5% of the year-end accounts receivable balance is to be created. 9. Depreciation policies for the company are as follows: Fixtures and fittings: 20% per annum, on a straight line basis. Vehicles: 20% per annum, on a reducing balance basis. Buildings: 3% per annum, on a straight line basis. Note: For the purposes of the question, ignore the effects of taxation Required: Produce a Income statement accounting for the year ended 30 June 2022 Produce a balance sheet accounting for the year ended 30 June 2022

Step by Step Solution

★★★★★

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started