Answered step by step

Verified Expert Solution

Question

1 Approved Answer

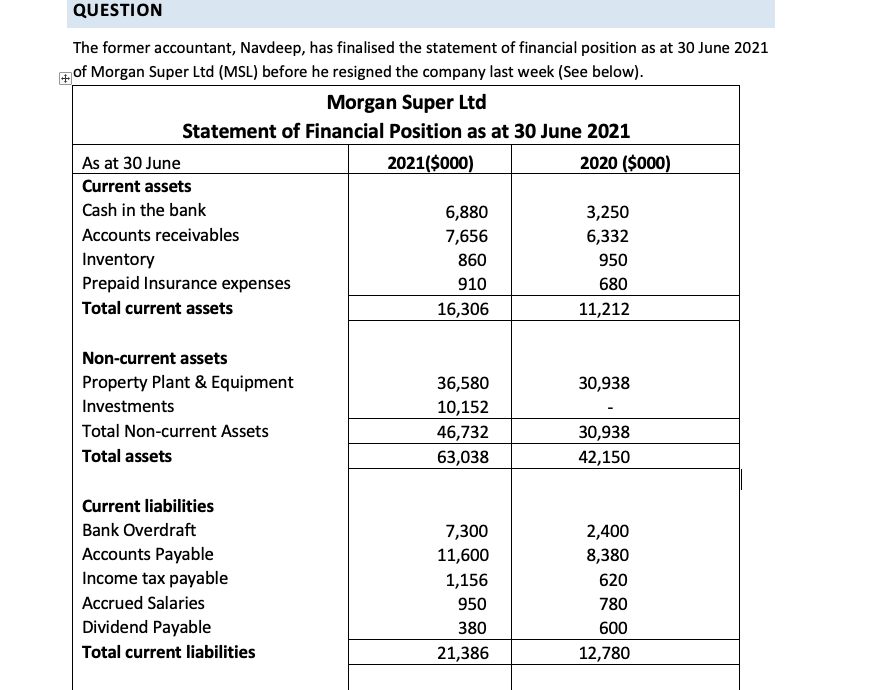

QUESTION The former accountant, Navdeep, has finalised the statement of financial position as at 30 June 2021 #of Morgan Super Ltd (MSL) before he resigned

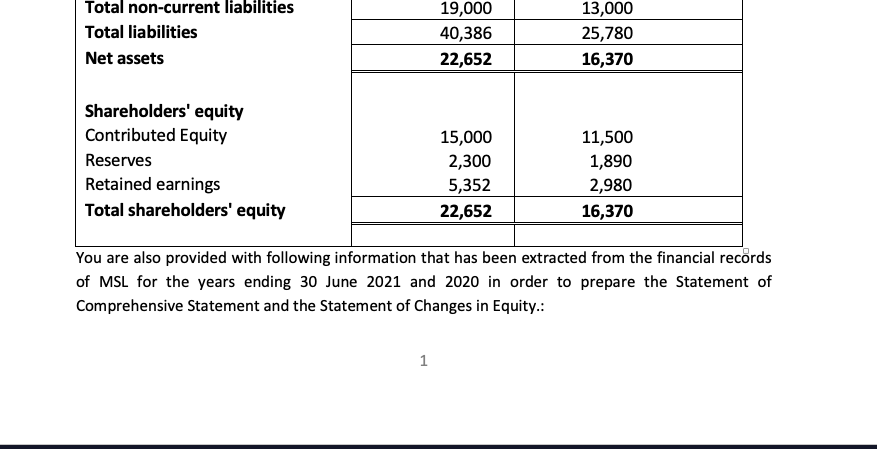

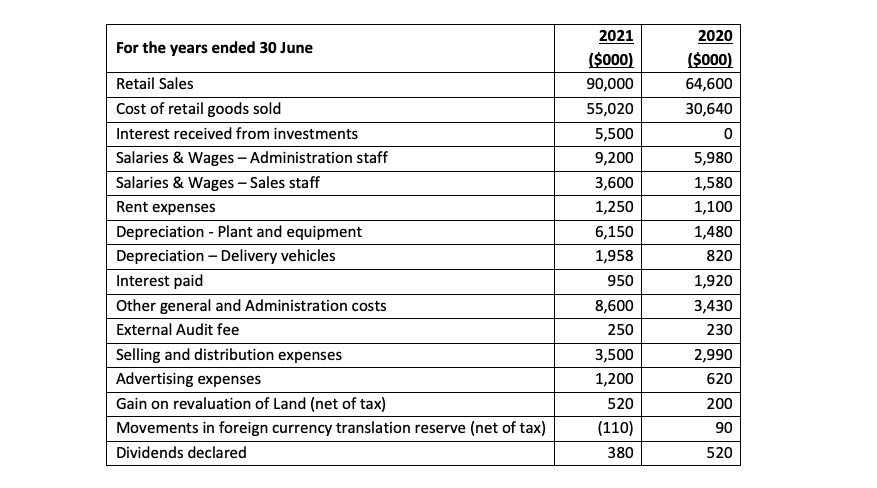

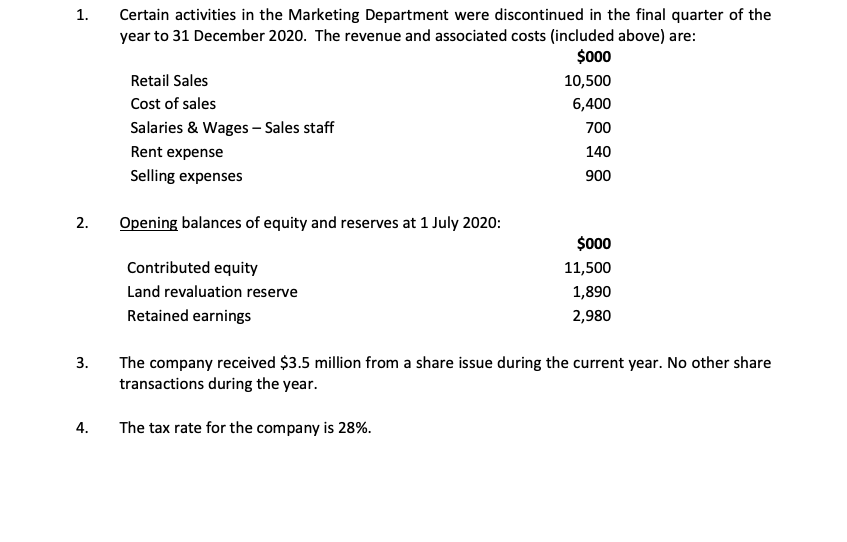

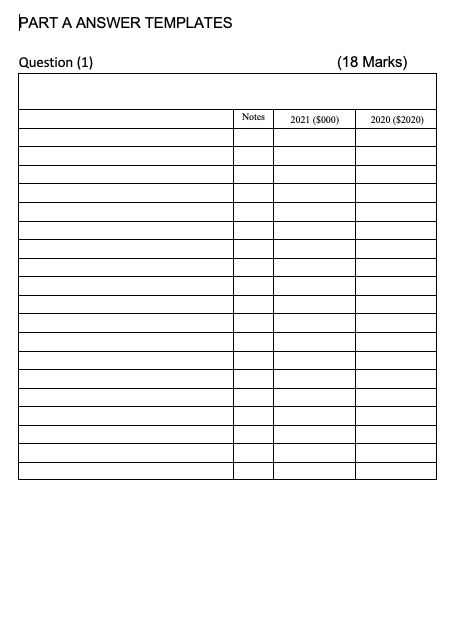

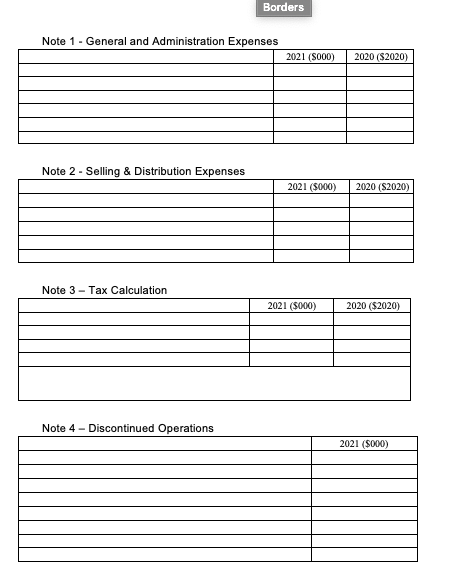

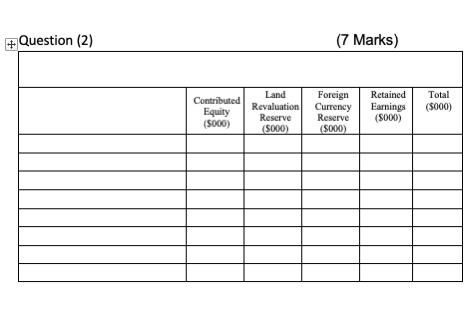

QUESTION The former accountant, Navdeep, has finalised the statement of financial position as at 30 June 2021 #of Morgan Super Ltd (MSL) before he resigned the company last week (See below). Morgan Super Ltd Statement of Financial Position as at 30 June 2021 As at 30 June 2021($000) 2020 ($000) Current assets Cash in the bank 6,880 3,250 Accounts receivables 7,656 6,332 Inventory 860 950 Prepaid Insurance expenses 910 680 Total current assets 16,306 11,212 30,938 Non-current assets Property Plant & Equipment Investments Total Non-current Assets Total assets 36,580 10,152 46,732 63,038 30,938 42,150 Current liabilities Bank Overdraft Accounts Payable Income tax payable Accrued Salaries Dividend Payable Total current liabilities 7,300 11,600 1,156 950 380 21,386 2,400 8,380 620 780 600 12,780 Total non-current liabilities Total liabilities Net assets 19,000 40,386 22,652 13,000 25,780 16,370 Shareholders' equity Contributed Equity Reserves Retained earnings Total shareholders' equity 15,000 2,300 5,352 22,652 11,500 1,890 2,980 16,370 You are also provided with following information that has been extracted from the financial records of MSL for the years ending 30 June 2021 and 2020 in order to prepare the Statement of Comprehensive Statement and the Statement of Changes in Equity.: 1 For the years ended 30 June Retail Sales Cost of retail goods sold Interest received from investments Salaries & Wages - Administration staff Salaries & Wages - Sales staff Rent expenses Depreciation - Plant and equipment Depreciation - Delivery vehicles Interest paid Other general and Administration costs External Audit fee Selling and distribution expenses Advertising expenses Gain on revaluation of Land (net of tax) Movements in foreign currency translation reserve (net of tax) Dividends declared 2021 ($000) 90,000 55,020 5,500 9,200 3,600 1,250 6,150 1,958 950 8,600 250 3,500 1,200 520 (110) 380 2020 ($000) 64,600 30,640 0 5,980 1,580 1,100 1,480 820 1,920 3,430 230 2,990 620 200 90 520 1. Certain activities in the Marketing Department were discontinued in the final quarter of the year to 31 December 2020. The revenue and associated costs (included above) are: $000 Retail Sales 10,500 Cost of sales 6,400 Salaries & Wages Sales staff 700 Rent expense 140 Selling expenses 900 2. Opening balances of equity and reserves at 1 July 2020: Contributed equity Land revaluation reserve Retained earnings $000 11,500 1,890 2,980 3. The company received $3.5 million from a share issue during the current year. No other share transactions during the year. 4. The tax rate for the company is 28%. Required: 2. (a) Using the template provided, prepare the Statement of Comprehensive Income for the year ended 30 June 2021 and Prepare necessary disclosures in separate notes. Comparative figures are required. (18 marks) (b) Using the template provided, prepare the Statement of Changes in Equity for the year ended 30 June 2021 (7 marks) PART A ANSWER TEMPLATES Question (1) (18 Marks) Notes 2021 (5000) 2020 ($2020) Borders Note 1 - General and Administration Expenses 2021 (5000) 2020 (S2020) Note 2 - Selling & Distribution Expenses 2021 (5000) 2020 (S2020) Note 3 - Tax Calculation 2021 (5000) 2020 ($2020) Note 4 - Discontinued Operations 2021 (5000) + Question (2) (7 Marks) Land Revaluation Reserve 5000) Contributed Equity (5000) Foreign Currency Reserve (5000) Retained Earnings (5000) Total (5000)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started