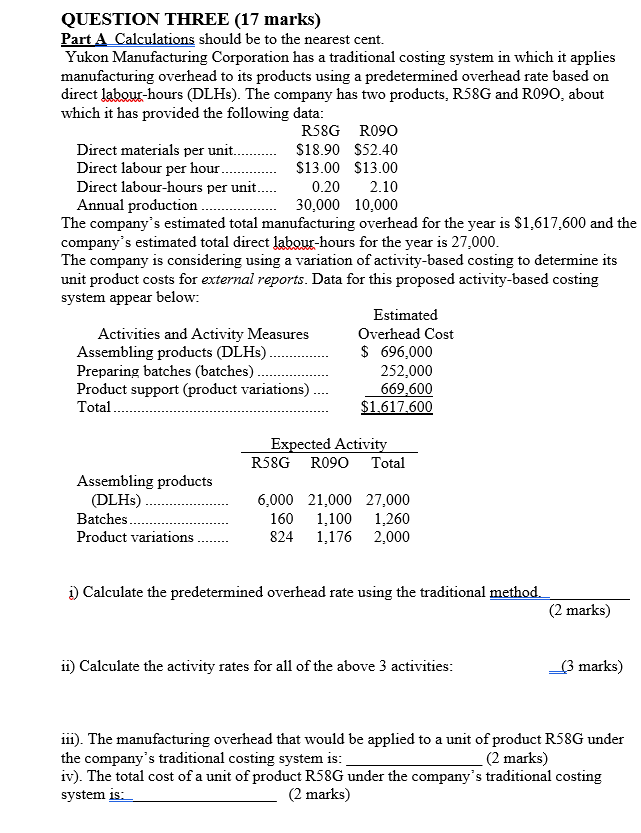

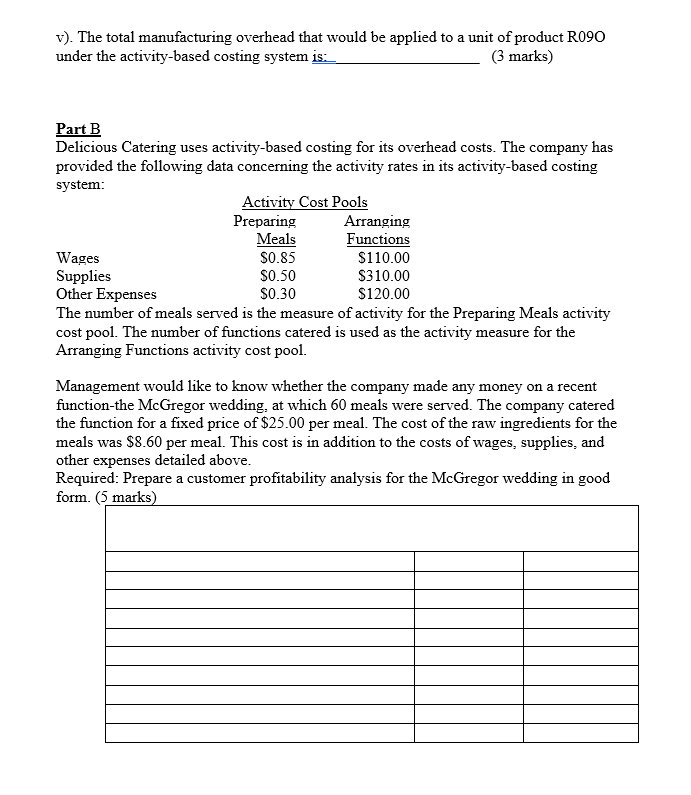

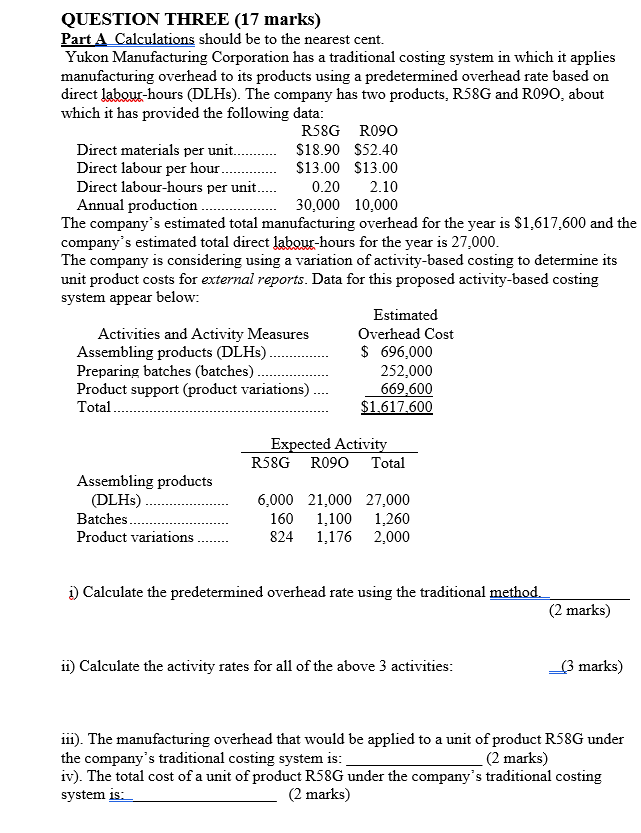

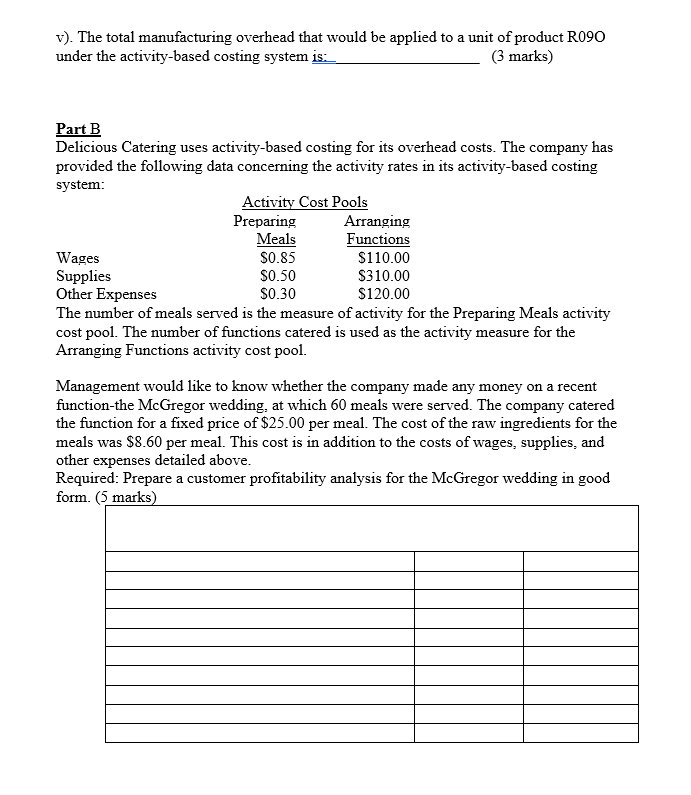

QUESTION THREE (17 marks) Part A Calculations should be to the nearest cent. Yukon Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labour-hours (DLHS). The company has two products, R58G and R090, about which it has provided the following data: R58G R090 Direct materials per unit... $18.90 $52.40 Direct labour per hour... $13.00 $13.00 Direct labour-hours per unit. 0.20 2.10 Annual production ..... 30,000 10,000 The company's estimated total manufacturing overhead for the year is $1,617,600 and the company's estimated total direct labouc-hours for the year is 27,000. The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below: Estimated Activities and Activity Measures Overhead Cost Assembling products (DLHS). $ 696,000 Preparing batches (batches). 252,000 Product support (product variations). 669.600 Total $1.617,600 Expected Activity R58G R090 Total Assembling products (DLHs) Batches..... Product Variations 6,000 21.000 27,000 160 1.100 1.260 824 1,176 2,000 1) Calculate the predetermined overhead rate using the traditional method (2 marks) 11) Calculate the activity rates for all of the above 3 activities: (3 marks) 111). The manufacturing overhead that would be applied to a unit of product R58G under the company's traditional costing system is: (2 marks) iv). The total cost of a unit of product R58G under the company's traditional costing system is: (2 marks) v). The total manufacturing overhead that would be applied to a unit of product R090 under the activity-based costing system is: (3 marks) Part B Delicious Catering uses activity-based costing for its overhead costs. The company has provided the following data concerning the activity rates in its activity-based costing system: Activity Cost Pools Preparing Arranging Meals Functions Wages $0.85 $110.00 Supplies $0.50 $310.00 Other Expenses $0.30 $120.00 The number of meals served is the measure of activity for the Preparing Meals activity cost pool. The number of functions catered is used as the activity measure for the Arranging Functions activity cost pool. Management would like to know whether the company made any money on a recent function-the McGregor wedding, at which 60 meals were served. The company catered the function for a fixed price of $25.00 per meal. The cost of the raw ingredients for the meals was $8.60 per meal. This cost is in addition to the costs of wages, supplies, and other expenses detailed above. Required: Prepare a customer profitability analysis for the McGregor wedding in good form