Question Three: (30 Marks)

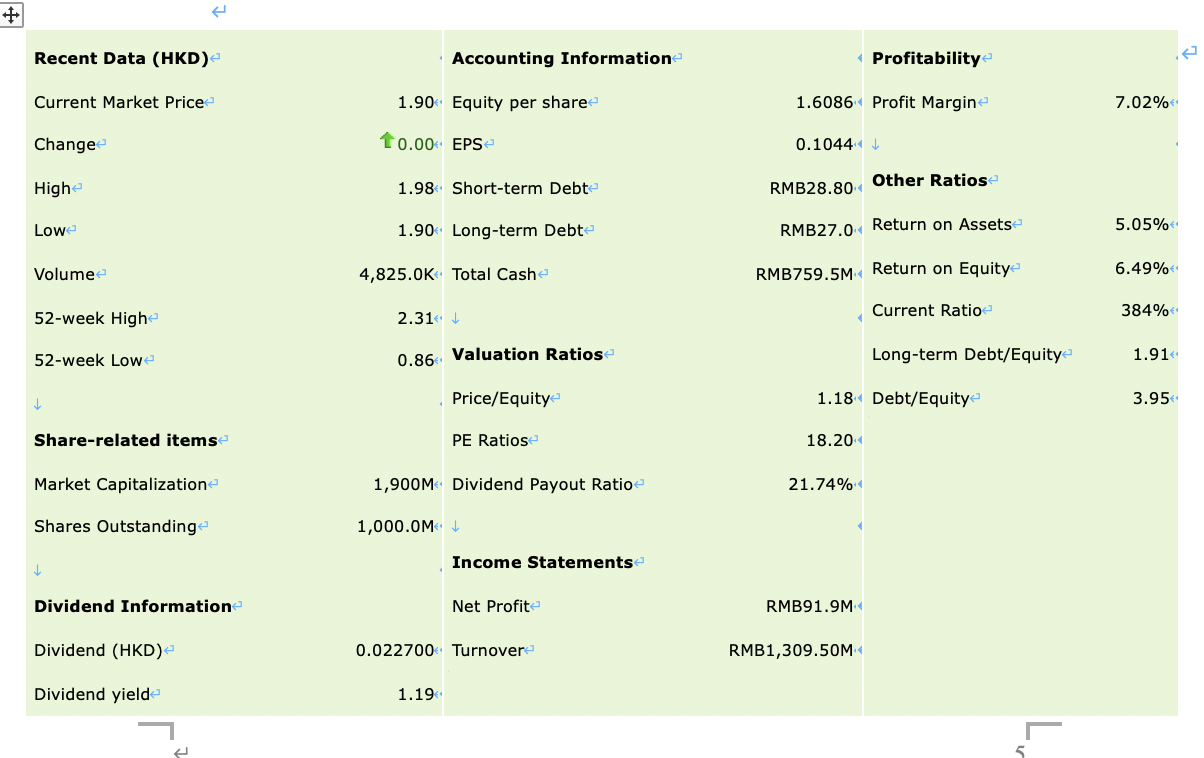

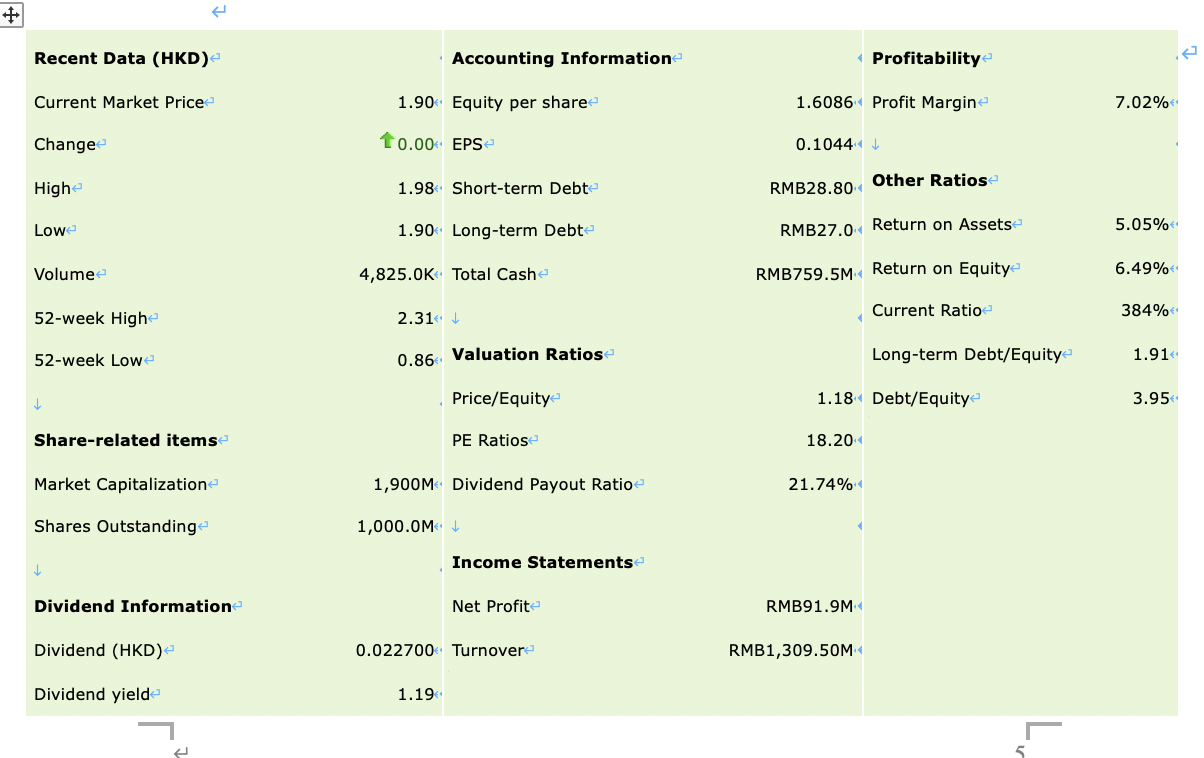

The following financial data is an extract from the website of yahoo.com.hk in respect to the financial ratios of a manufacturing company listed in Hong Kong. The market price for the company in this week was about $1.90.

You are required to:

Comment if this company is a good investment target based on the supplied information with reference to

- Capitalization of Profits Model (10 marks)

- Asset Backing Model (10 marks)

- Dividend Capitalization Model (10 marks)

(Note: You may make some assumptions in applying the above mentioned models, but you only need to makecomments on the investment opportunity of the company based on the data below, and you do not need to make reference to other available information on the websites.)

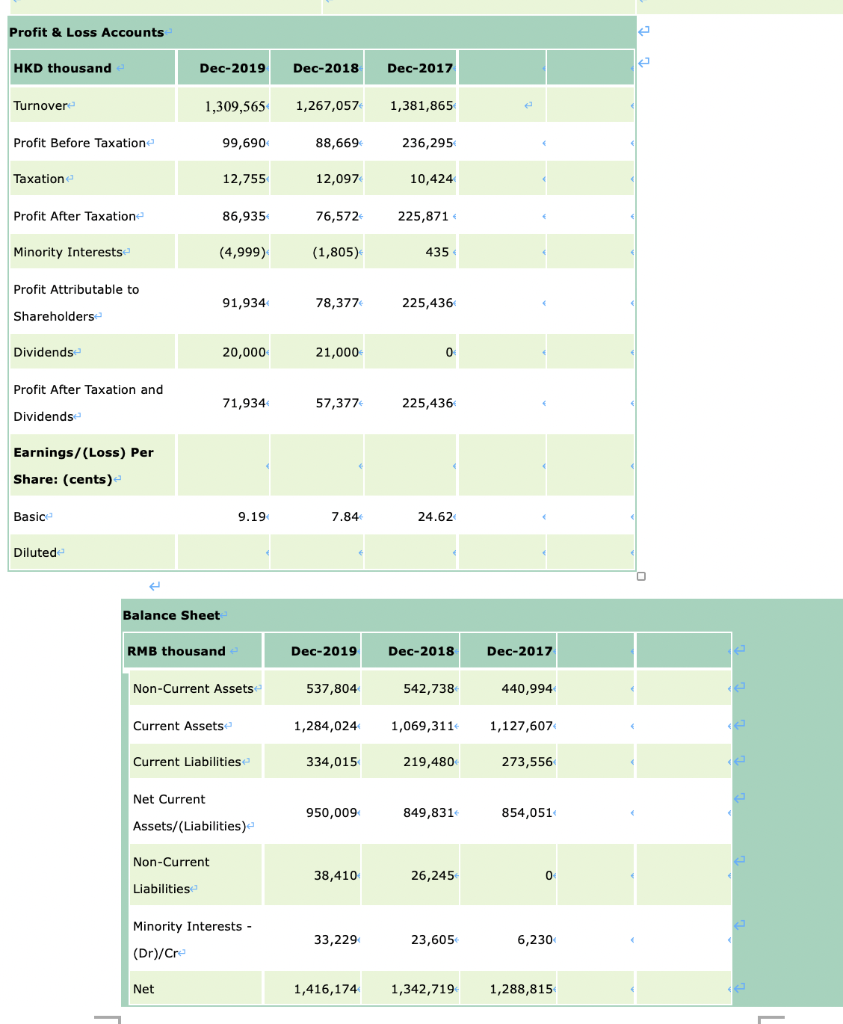

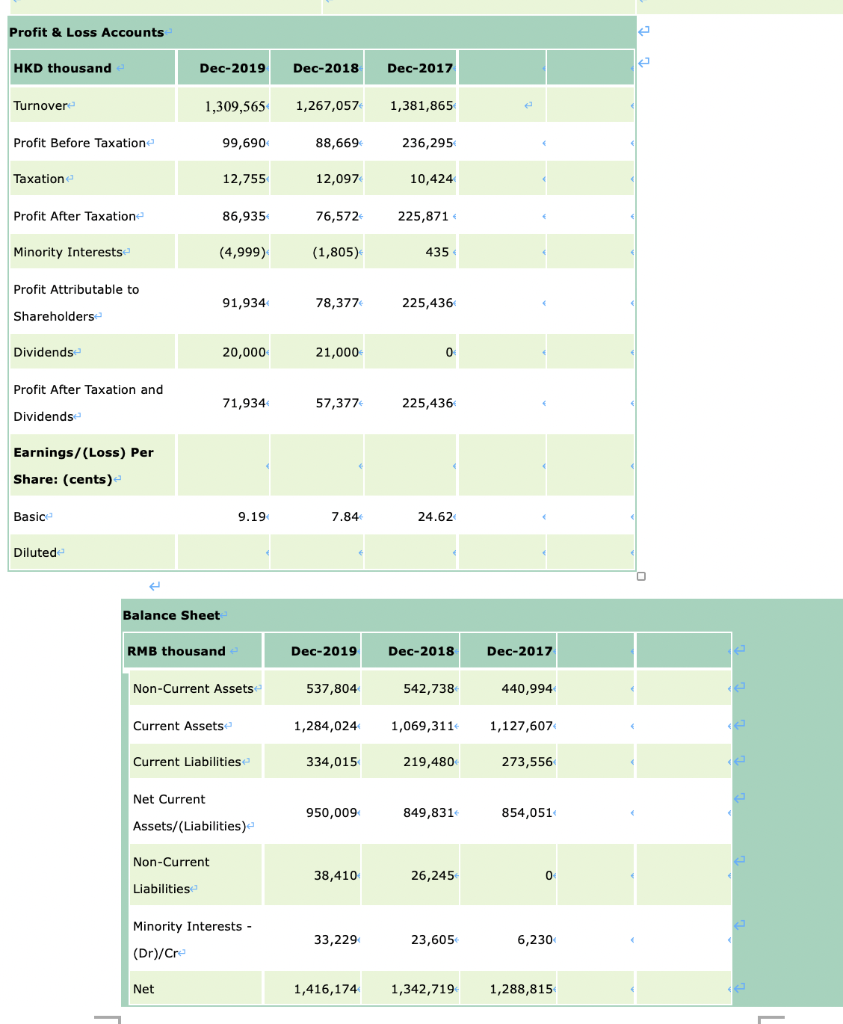

Recent Data (HKD) Accounting Information Profitability Current Market Price 1.90 Equity per share- 1.6086 Profit Margin 7.02% Change 10.00 EPS 0.1044 Other Ratios High 1.98 Short-term Debt RMB28.80 Low 1.90Long-term Debt RMB27.0 Return on Assets 5.05% Volume 4,825.0K Total Cash RMB759.5M Return on Equity 6.49% Current Ratio 52-week High 384% 2.31 52-week Lowe 0.86 Valuation Ratios Long-term Debt/Equity 1.91 Price/Equity 1.18 Debt/Equity 3.95 Share-related items PE Ratios 18.20 Market Capitalization 1,900M Dividend Payout Ratio 21.74% Shares Outstanding 1,000.OM Income Statements Dividend Information Net Profit RMB91.9M Dividend (HKD) 0.0227004 Turnover RMB1,309.50M Dividend yield 1.19 Profit & Loss Accounts le HKD thousand Dec-2019 Dec-2018 Dec-2017 Turnover 1,309,565 1,267,057 1,381,865 Profit Before Taxatione 99,690 88,669 236,295 Taxation 12,755 12,097 10,424 Profit After Taxation 86,935 76,572 225,871 Minority Interests (4,999) (1,805) 435 Profit Attributable to 91,934 78,377 225,436 Shareholders Dividends 20,000 21,000 0 Profit After Taxation and 71,934 57,377 225,436 Dividends Earnings/(Loss) Per Share: (cents) Basic 9.19 7.84 24.62 Diluted Balance Sheet RMB thousand Dec-2019 Dec-2018 Dec-2017 Non-Current Assets 537,804 542,738 440,994 Current Assets 1,284,024 1,069,311 1,127,607 Current Liabilities 334,015 219,480 273,556 Net Current 950,009 849,831 854,051 Assets/(Liabilities) Non-Current 38,410 26,245 0 Liabilities Minority Interests - 33,229 23,605 6,230 (Dr)/Cr Net 1,416,174 1,342,719 1,288,815 Recent Data (HKD) Accounting Information Profitability Current Market Price 1.90 Equity per share- 1.6086 Profit Margin 7.02% Change 10.00 EPS 0.1044 Other Ratios High 1.98 Short-term Debt RMB28.80 Low 1.90Long-term Debt RMB27.0 Return on Assets 5.05% Volume 4,825.0K Total Cash RMB759.5M Return on Equity 6.49% Current Ratio 52-week High 384% 2.31 52-week Lowe 0.86 Valuation Ratios Long-term Debt/Equity 1.91 Price/Equity 1.18 Debt/Equity 3.95 Share-related items PE Ratios 18.20 Market Capitalization 1,900M Dividend Payout Ratio 21.74% Shares Outstanding 1,000.OM Income Statements Dividend Information Net Profit RMB91.9M Dividend (HKD) 0.0227004 Turnover RMB1,309.50M Dividend yield 1.19 Profit & Loss Accounts le HKD thousand Dec-2019 Dec-2018 Dec-2017 Turnover 1,309,565 1,267,057 1,381,865 Profit Before Taxatione 99,690 88,669 236,295 Taxation 12,755 12,097 10,424 Profit After Taxation 86,935 76,572 225,871 Minority Interests (4,999) (1,805) 435 Profit Attributable to 91,934 78,377 225,436 Shareholders Dividends 20,000 21,000 0 Profit After Taxation and 71,934 57,377 225,436 Dividends Earnings/(Loss) Per Share: (cents) Basic 9.19 7.84 24.62 Diluted Balance Sheet RMB thousand Dec-2019 Dec-2018 Dec-2017 Non-Current Assets 537,804 542,738 440,994 Current Assets 1,284,024 1,069,311 1,127,607 Current Liabilities 334,015 219,480 273,556 Net Current 950,009 849,831 854,051 Assets/(Liabilities) Non-Current 38,410 26,245 0 Liabilities Minority Interests - 33,229 23,605 6,230 (Dr)/Cr Net 1,416,174 1,342,719 1,288,815