Answered step by step

Verified Expert Solution

Question

1 Approved Answer

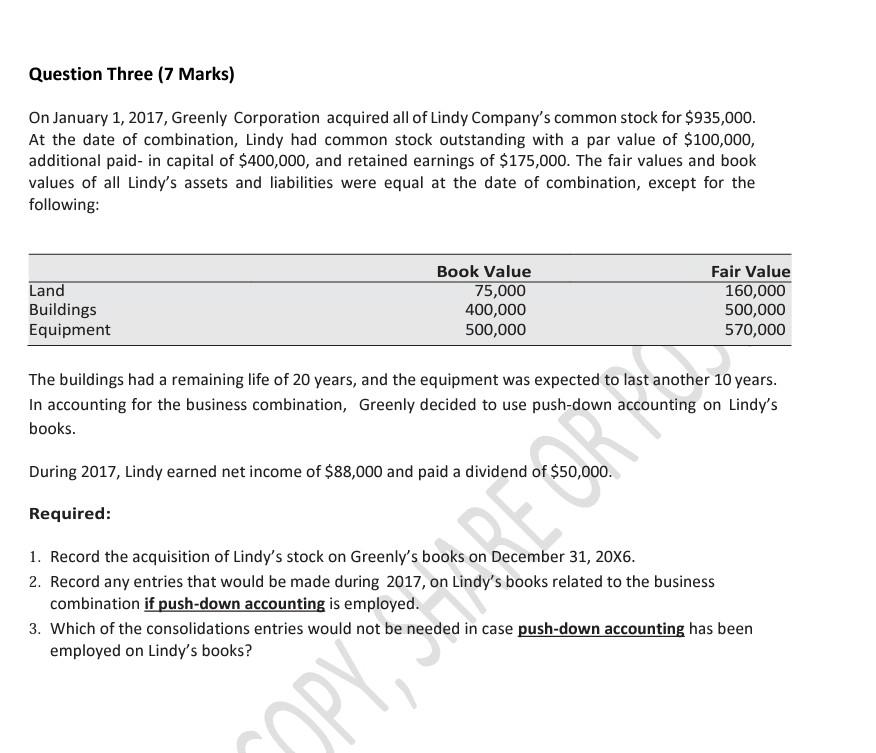

Question Three (7 Marks) On January 1, 2017, Greenly Corporation acquired all of Lindy Company's common stock for $935,000. At the date of combination, Lindy

Question Three (7 Marks) On January 1, 2017, Greenly Corporation acquired all of Lindy Company's common stock for $935,000. At the date of combination, Lindy had common stock outstanding with a par value of $100,000, additional paid- in capital of $400,000, and retained earnings of $175,000. The fair values and book values of all Lindy's assets and liabilities were equal at the date of combination, except for the following: Land Buildings Equipment Book Value 75,000 400,000 500,000 Fair Value 160,000 500,000 570,000 The buildings had a remaining life of 20 years, and the equipment was expected to last another 10 years. In accounting for the business combination, Greenly decided to use push-down accounting on Lindy's books. During 2017, Lindy earned net income of $88,000 and paid a dividend of $50,000. Required: 1. Record the acquisition of Lindy's stock on Greenly's books on December 31, 20x6. 2. Record any entries that would be made during 2017, on Lindy's books related to the business combination if push-down accounting is employed. 3. Which of the consolidations entries would not be needed in case push-down accounting has been employed on Lindy's books? OPY Question Three (7 Marks) On January 1, 2017, Greenly Corporation acquired all of Lindy Company's common stock for $935,000. At the date of combination, Lindy had common stock outstanding with a par value of $100,000, additional paid- in capital of $400,000, and retained earnings of $175,000. The fair values and book values of all Lindy's assets and liabilities were equal at the date of combination, except for the following: Land Buildings Equipment Book Value 75,000 400,000 500,000 Fair Value 160,000 500,000 570,000 The buildings had a remaining life of 20 years, and the equipment was expected to last another 10 years. In accounting for the business combination, Greenly decided to use push-down accounting on Lindy's books. During 2017, Lindy earned net income of $88,000 and paid a dividend of $50,000. Required: 1. Record the acquisition of Lindy's stock on Greenly's books on December 31, 20x6. 2. Record any entries that would be made during 2017, on Lindy's books related to the business combination if push-down accounting is employed. 3. Which of the consolidations entries would not be needed in case push-down accounting has been employed on Lindy's books? OPY

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started