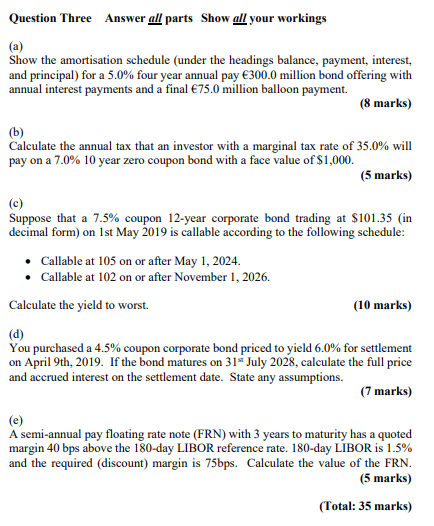

Question Three Answer all parts Show all your workings (a) Show the amortisation schedule (under the headings balance, payment interest, and principal) for a 5.0% four year annual pay 300.0 million bond offering with annual interest payments and a final 75.0 million balloon payment (8 marks) (b) Calculate the annual tax that an investor with a marginal tax rate of 35.0% will pay on a 7.0% 10 year zero coupon bond with a face value of $1,000. (5 marks) () Suppose that a 7.5% coupon 12-year corporate bond trading at $101.35 (in decimal form) on 1st May 2019 is callable according to the following schedule: Callable at 105 on or after May 1, 2024. Callable at 102 on or after November 1, 2026. Calculate the yield to worst. (10 marks) (d) You purchased a 4.5% coupon corporate bond priced to yield 6.0% for settlement on April 9th, 2019. If the bond matures on 31 July 2028, calculate the full price and accrued interest on the settlement date. State any assumptions. (7 marks) (e) A semi-annual pay floating rate note (FRN) with 3 years to maturity has a quoted margin 40 bps above the 180-day LIBOR reference rate. 180-day LIBOR is 1.5% and the required (discount) margin is 75bps. Calculate the value of the FRN. (5 marks) (Total: 35 marks) Question Three Answer all parts Show all your workings (a) Show the amortisation schedule (under the headings balance, payment interest, and principal) for a 5.0% four year annual pay 300.0 million bond offering with annual interest payments and a final 75.0 million balloon payment (8 marks) (b) Calculate the annual tax that an investor with a marginal tax rate of 35.0% will pay on a 7.0% 10 year zero coupon bond with a face value of $1,000. (5 marks) () Suppose that a 7.5% coupon 12-year corporate bond trading at $101.35 (in decimal form) on 1st May 2019 is callable according to the following schedule: Callable at 105 on or after May 1, 2024. Callable at 102 on or after November 1, 2026. Calculate the yield to worst. (10 marks) (d) You purchased a 4.5% coupon corporate bond priced to yield 6.0% for settlement on April 9th, 2019. If the bond matures on 31 July 2028, calculate the full price and accrued interest on the settlement date. State any assumptions. (7 marks) (e) A semi-annual pay floating rate note (FRN) with 3 years to maturity has a quoted margin 40 bps above the 180-day LIBOR reference rate. 180-day LIBOR is 1.5% and the required (discount) margin is 75bps. Calculate the value of the FRN. (5 marks) (Total: 35 marks)