Question

Assuming that you are the chief executive of Excellent Now (EN) plc, which is a company which produces alcohol. EN Plc was exporting some of

Assuming that you are the chief executive of Excellent Now (EN) plc, which is a company which produces alcohol. EN Plc was exporting some of its alcohol to neighbouring countries. Lately, however, due to Covid 19, A Virus which is a respiratory disease, EN plc experienced a significant reduction in the Demand of its alcohol in most countries where the product was exported. The Turnover was negatively affected due to the reduced confirmed orders. The Board of Directors through a teleconference meeting requested you as the Chief Executive officer to consider capital investment in new projects in order to diversify your income base. You engaged an individual consultant following the normal procedures, the consultant was ably selected based on completive bid submissions. The Consultant you selected had extensive knowledge of financial management. The selected consultant, outbid the other bidders due to his technical submission where they scored 90%. The Financial Bid of the Consultant, though higher than the other bidders was subjected to negotiations and an agreed amount was reached.

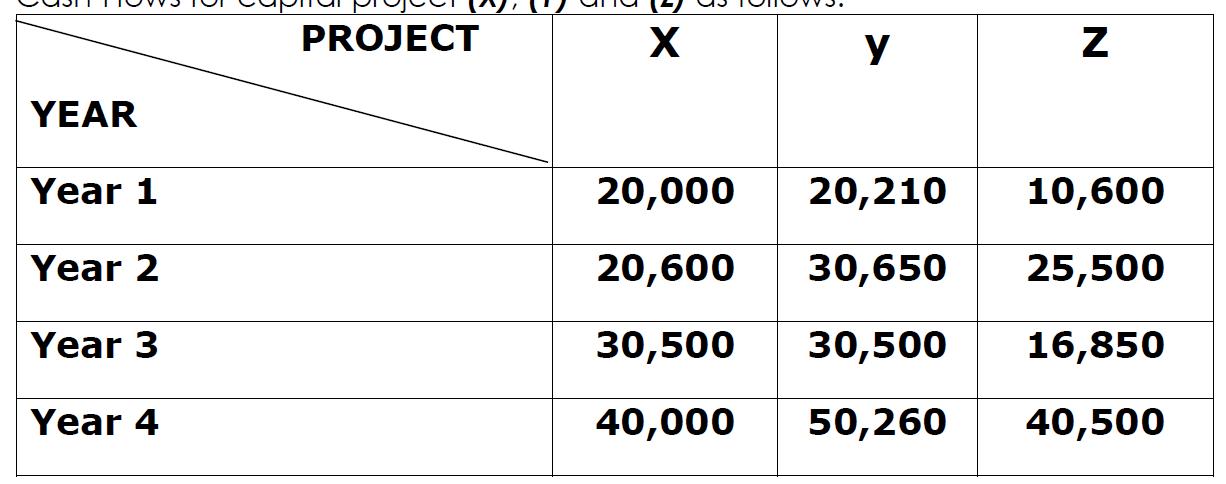

Page | 4 The consultant determined information on two types of projects to undertake i.e. projects (X), (Y) and (Z). Project (X) involved the reconversion of some of the equipment used in the production of alcohol to the production of Hand Sanitizers. However, there was need to purchase an additional fixed asset for this purpose. Product (Y) involved the purchase of a combine harvester which was to be used on the farm that EN Plc owned and Project (Z) involved an investment in a 5-Semi-Detached flat specifically for rental purposes. The Original investment was budgeted at K300, 000 (‘K000) for all the capital projects. The consultant presented the following information to you. He determined Cash flows for each project for a period of 4 years. Cash-Flows for capital project (X), (Y) and (Z) as follows

Required:a). You are required to use the Net Present Value(NPV) method to advise which project EN plc should consider implementing and give reasons as to why you have selected that particular capital project. 15 Marks(For the evaluation of long-term capital projects the Consultants use a discount rate of 10% per annum.)

Required:a). You are required to use the Net Present Value(NPV) method to advise which project EN plc should consider implementing and give reasons as to why you have selected that particular capital project. 15 Marks(For the evaluation of long-term capital projects the Consultants use a discount rate of 10% per annum.)

b). Identify and explain (2) other methods that the consultant of EN plc could have used to determine which project to undertake-

PROJECT y YEAR Year 1 20,000 20,210 10,600 Year 2 20,600 30,650 25,500 Year 3 30,500 30,500 16,850 Year 4 40,000 50,260 40,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Year Cash Flows Present Value of Cash Flows X Y Z PV Factor 10 X Y Z 1 20000 20210 10600 0909 18...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started