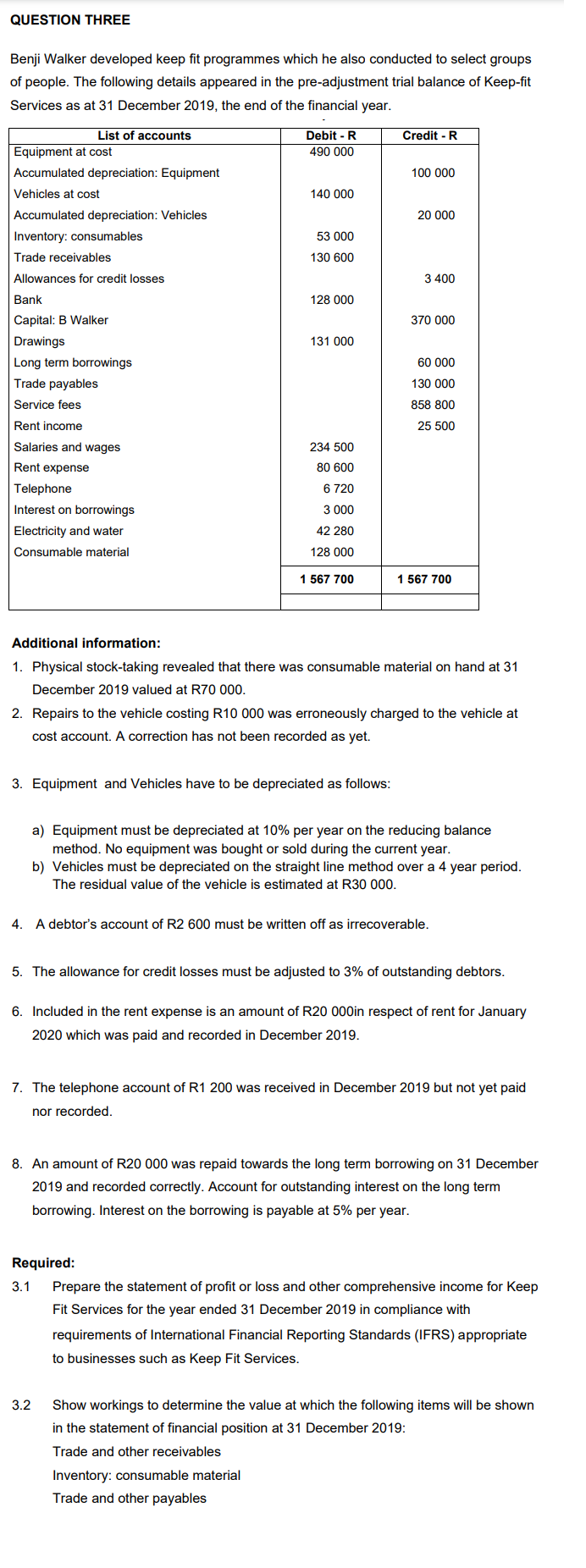

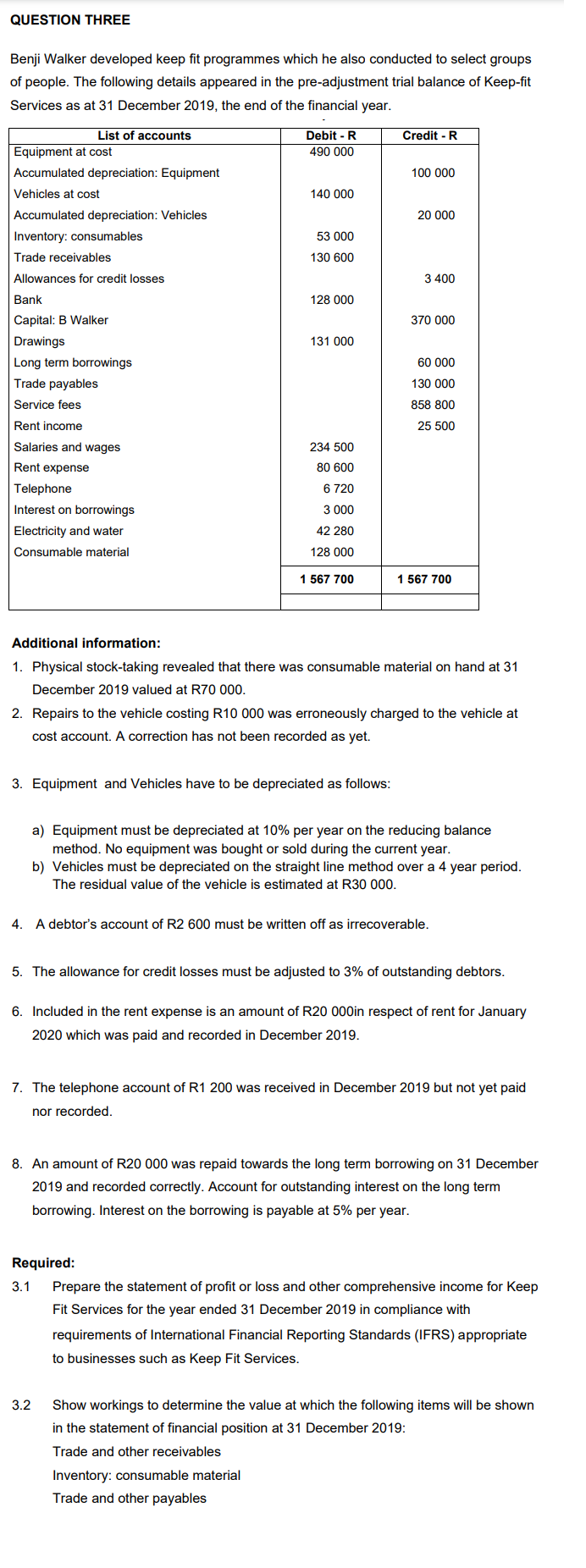

QUESTION THREE Benji Walker developed keep fit programmes which he also conducted to select groups of people. The following details appeared in the pre-adjustment trial balance of Keep-fit Services as at 31 December 2019, the end of the financial year. Credit - R Debit - R 490 000 100 000 140 000 List of accounts Equipment at cost Accumulated depreciation: Equipment Vehicles at cost Accumulated depreciation: Vehicles Inventory: consumables Trade receivables Allowances for credit losses 20 000 53 000 130 600 3 400 Bank 128 000 370 000 131 000 60 000 130 000 858 800 25 500 Capital: Walker Drawings Long term borrowings Trade payables Service fees Rent income Salaries and wages Rent expense Telephone Interest on borrowings Electricity and water Consumable material 234 500 80 600 6 720 3 000 42 280 128 000 1 567 700 1 567 700 Additional information: 1. Physical stock-taking revealed that there was consumable material on hand at 31 December 2019 valued at R70 000. 2. Repairs to the vehicle costing R10 000 was erroneously charged to the vehicle at cost account. A correction has not been recorded as yet. 3. Equipment and Vehicles have to be depreciated as follows: a) Equipment must be depreciated at 10% per year on the reducing balance method. No equipment was bought or sold during the current year. b) Vehicles must be depreciated on the straight line method over a 4 year period. The residual value of the vehicle is estimated at R30 000. 4. A debtor's account of R2 600 must be written off as irrecoverable. 5. The allowance for credit losses must be adjusted to 3% of outstanding debtors. 6. Included in the rent expense is an amount of R20 000in respect of rent for January 2020 which was paid and recorded in December 2019. 7. The telephone account of R1 200 was received in December 2019 but not yet paid nor recorded 8. An amount of R20 000 was repaid towards the long term borrowing on 31 December 2019 and recorded correctly. Account for outstanding interest on the long term borrowing. Interest on the borrowing is payable at 5% per year. Required: 3.1 Prepare the statement of profit or loss and other comprehensive income for Keep Fit Services for the year ended 31 December 2019 in compliance with requirements of International Financial Reporting Standards (IFRS) appropriate to businesses such as Keep Fit Services. 3.2 Show workings to determine the value at which the following items will be shown in the statement of financial position at 31 December 2019: Trade and other receivables Inventory: consumable material Trade and other payables