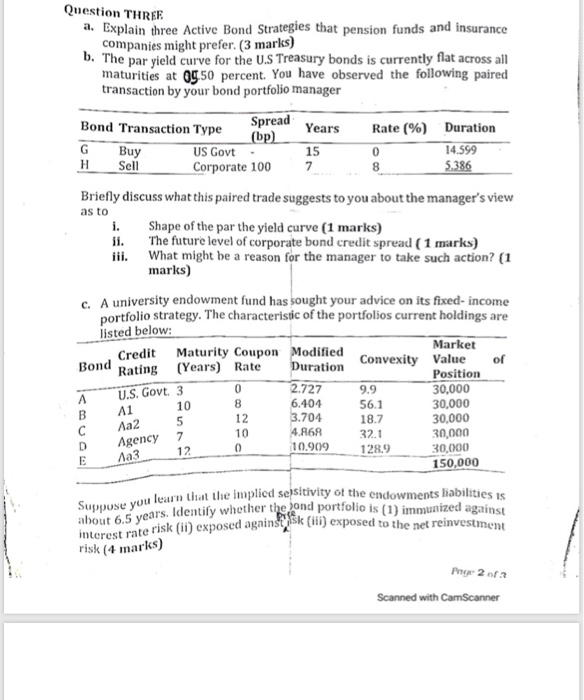

Question THREE Buy a. Explain three Active Bond Strategies that pension funds and insurance companies might prefer. (3 marks) b. The par yield curve for the U.S Treasury bonds is currently flat across all maturities at Og 50 percent. You have observed the following paired transaction by your bond portfolio manager Bond Transaction Type Spread (bp) Years Rate (%) Duration G US Govt 15 0 14.599 H Sell Corporate 100 7 8 5.386 Briefly discuss what this paired trade suggests to you about the manager's view as to Shape of the par the yield curve (1 marks) ii. The future level of corporate bond credit spread (1 marks) iii. What might be a reason for the manager to take such action? (1 marks) c. A university endowment fund has sought your advice on its fixed-income portfolio strategy. The characteristic of the portfolios current holdings are listed below: Market Credit Maturity Coupon Modified Convexity Value Duration Rating (Years) Rate of Position 2.727 9.9 30,000 10 56.1 30,000 12 3.704 18.7 30,000 32.1 10.909 128.9 30,000 150,000 Suppose you learn that the implicd sepsitivity of the endowments liabilities is interest rate risk (i) exposed against p$k (ii) exposed to the net reinvestment about 6.5 years. Identify whether the end portfolio is (1) immunized against risk (4 marks) Bond 0 8 6.404 A B D E U.S. Govt. 3 A1 Aa2 5 Agency 7 12 4.A6A 10 0 30,000 Page 2 of 2 Scanned with CamScanner Question THREE Buy a. Explain three Active Bond Strategies that pension funds and insurance companies might prefer. (3 marks) b. The par yield curve for the U.S Treasury bonds is currently flat across all maturities at Og 50 percent. You have observed the following paired transaction by your bond portfolio manager Bond Transaction Type Spread (bp) Years Rate (%) Duration G US Govt 15 0 14.599 H Sell Corporate 100 7 8 5.386 Briefly discuss what this paired trade suggests to you about the manager's view as to Shape of the par the yield curve (1 marks) ii. The future level of corporate bond credit spread (1 marks) iii. What might be a reason for the manager to take such action? (1 marks) c. A university endowment fund has sought your advice on its fixed-income portfolio strategy. The characteristic of the portfolios current holdings are listed below: Market Credit Maturity Coupon Modified Convexity Value Duration Rating (Years) Rate of Position 2.727 9.9 30,000 10 56.1 30,000 12 3.704 18.7 30,000 32.1 10.909 128.9 30,000 150,000 Suppose you learn that the implicd sepsitivity of the endowments liabilities is interest rate risk (i) exposed against p$k (ii) exposed to the net reinvestment about 6.5 years. Identify whether the end portfolio is (1) immunized against risk (4 marks) Bond 0 8 6.404 A B D E U.S. Govt. 3 A1 Aa2 5 Agency 7 12 4.A6A 10 0 30,000 Page 2 of 2 Scanned with CamScanner