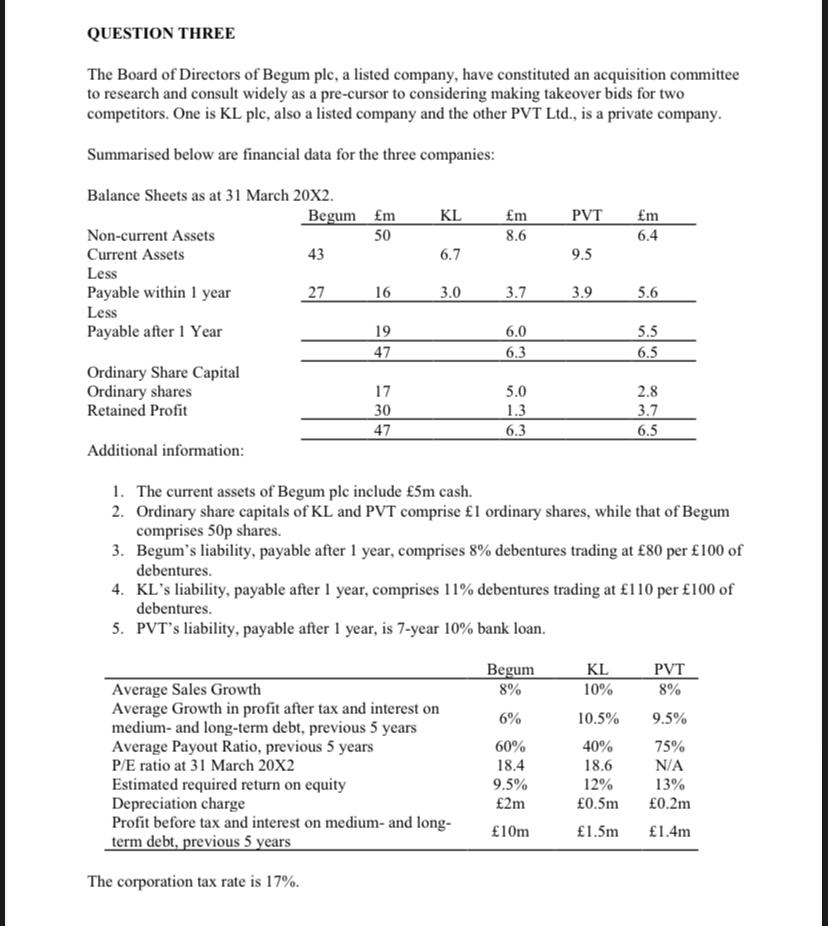

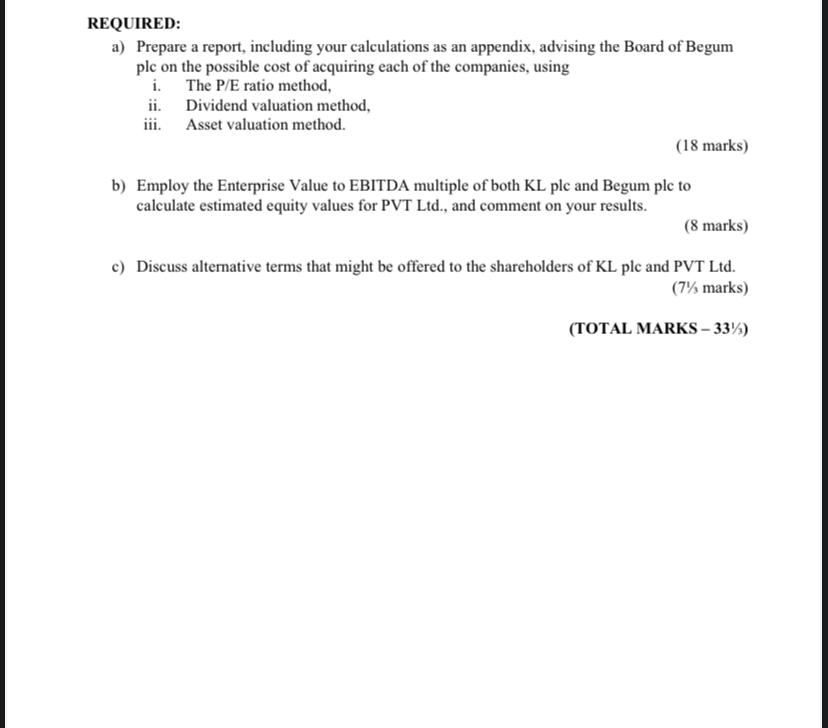

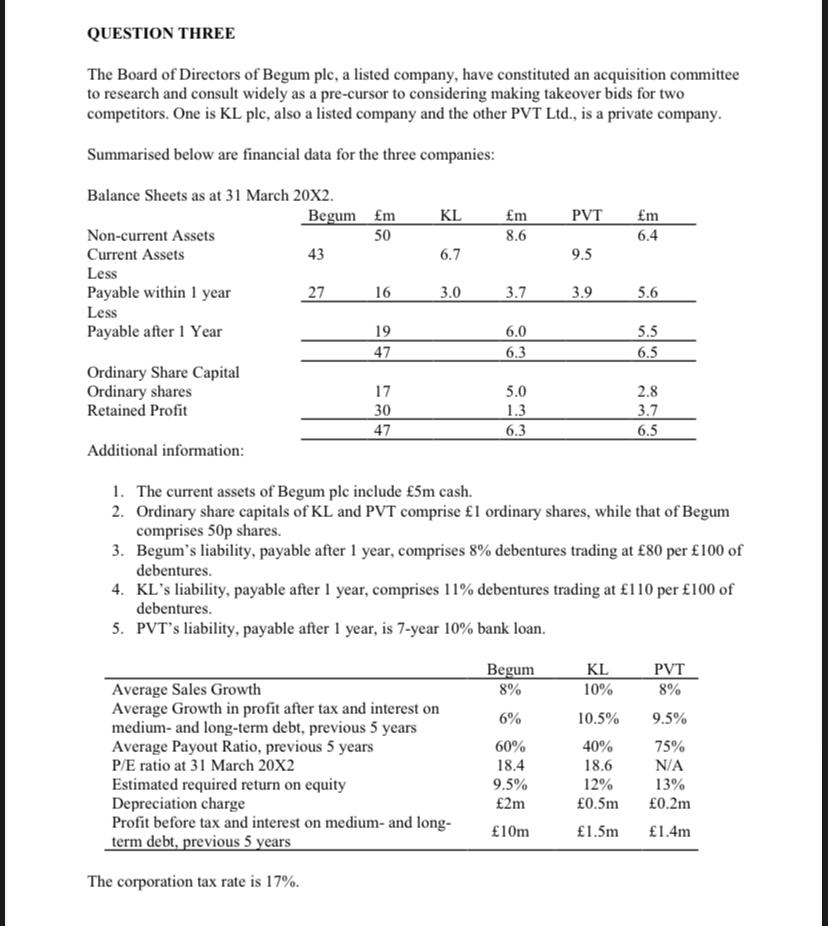

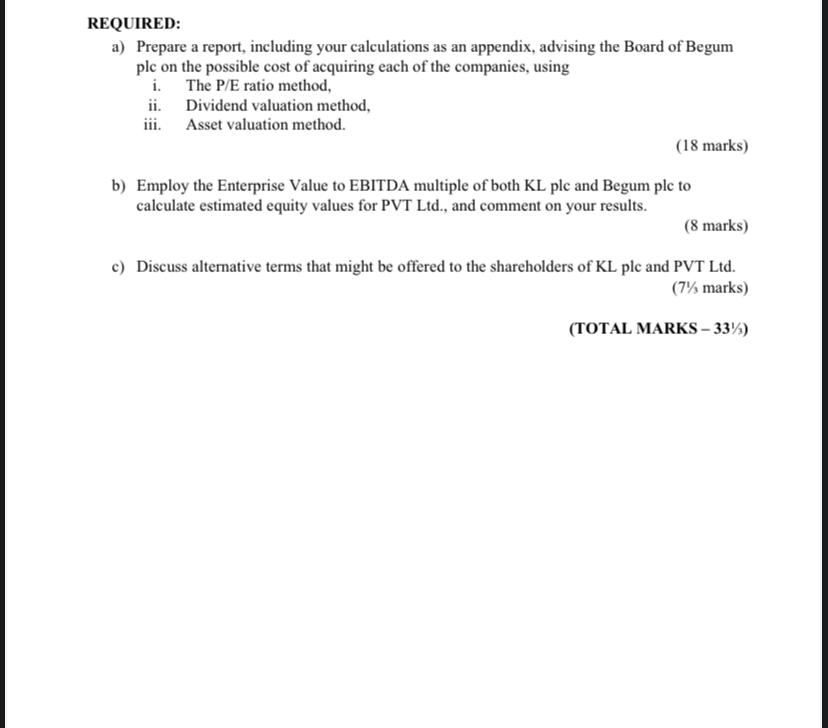

QUESTION THREE The Board of Directors of Begum plc, a listed company, have constituted an acquisition committee to research and consult widely as a pre-cursor to considering making takeover bids for two competitors. One is KL plc, also a listed company and the other PVT Ltd., is a private company. Summarised below are financial data for the three companies: Balance Sheets as at 31 March 20X2. Begum m KL m PVT m Non-current Assets 50 8.6 6.4 Current Assets 43 6.7 9.5 Less Payable within 1 year 27 16 3.0 3.7 3.9 5.6 Less Payable after 1 Year 19 6.0 5.5 47 6.3 6.5 Ordinary Share Capital Ordinary shares 17 5.0 2.8 Retained Profit 30 1.3 3.7 47 6.3 6.5 Additional information: 1. The current assets of Begum plc include 5m cash. 2. Ordinary share capitals of KL and PVT comprise 1 ordinary shares, while that of Begum comprises 50p shares. 3. Begum's liability, payable after 1 year, comprises 8% debentures trading at 80 per 100 of debentures. 4. KL's liability, payable after 1 year, comprises 11% debentures trading at 110 per 100 of debentures. 5. PVT's liability, payable after 1 year, is 7-year 10% bank loan. Begum KL PVT Average Sales Growth 8% 10% 8% Average Growth in profit after tax and interest on medium- and long-term debt, previous 5 years 6% 10.5% 9.5% Average Payout Ratio, previous 5 years 60% 40% 75% P/E ratio at 31 March 20X2 18.4 18.6 N/A Estimated required return on equity 9.5% 12% 13% Depreciation charge 2m 0.5m 0.2m Profit before tax and interest on medium- and long- term debt, previous 5 years 10m 1.5m 1.4m The corporation tax rate is 17%. REQUIRED: a) Prepare a report, including your calculations as an appendix, advising the Board of Begum ple on the possible cost of acquiring each of the companies, using i. The P/E ratio method, ii. Dividend valuation method, iii. Asset valuation method. (18 marks) b) Employ the Enterprise Value to EBITDA multiple of both KL ple and Begum plc to calculate estimated equity values for PVT Ltd., and comment on your results. (8 marks) c) Discuss alternative terms that might be offered to the shareholders of KL plc and PVT Ltd. (7% marks) (TOTAL MARKS-33%) QUESTION THREE The Board of Directors of Begum plc, a listed company, have constituted an acquisition committee to research and consult widely as a pre-cursor to considering making takeover bids for two competitors. One is KL plc, also a listed company and the other PVT Ltd., is a private company. Summarised below are financial data for the three companies: Balance Sheets as at 31 March 20X2. Begum m KL m PVT m Non-current Assets 50 8.6 6.4 Current Assets 43 6.7 9.5 Less Payable within 1 year 27 16 3.0 3.7 3.9 5.6 Less Payable after 1 Year 19 6.0 5.5 47 6.3 6.5 Ordinary Share Capital Ordinary shares 17 5.0 2.8 Retained Profit 30 1.3 3.7 47 6.3 6.5 Additional information: 1. The current assets of Begum plc include 5m cash. 2. Ordinary share capitals of KL and PVT comprise 1 ordinary shares, while that of Begum comprises 50p shares. 3. Begum's liability, payable after 1 year, comprises 8% debentures trading at 80 per 100 of debentures. 4. KL's liability, payable after 1 year, comprises 11% debentures trading at 110 per 100 of debentures. 5. PVT's liability, payable after 1 year, is 7-year 10% bank loan. Begum KL PVT Average Sales Growth 8% 10% 8% Average Growth in profit after tax and interest on medium- and long-term debt, previous 5 years 6% 10.5% 9.5% Average Payout Ratio, previous 5 years 60% 40% 75% P/E ratio at 31 March 20X2 18.4 18.6 N/A Estimated required return on equity 9.5% 12% 13% Depreciation charge 2m 0.5m 0.2m Profit before tax and interest on medium- and long- term debt, previous 5 years 10m 1.5m 1.4m The corporation tax rate is 17%. REQUIRED: a) Prepare a report, including your calculations as an appendix, advising the Board of Begum ple on the possible cost of acquiring each of the companies, using i. The P/E ratio method, ii. Dividend valuation method, iii. Asset valuation method. (18 marks) b) Employ the Enterprise Value to EBITDA multiple of both KL ple and Begum plc to calculate estimated equity values for PVT Ltd., and comment on your results. (8 marks) c) Discuss alternative terms that might be offered to the shareholders of KL plc and PVT Ltd. (7% marks) (TOTAL MARKS-33%)